[ad_1]

Marco VDM/E+ by way of Getty Photos

Floor-mounting monitoring methods are produced by Array Applied sciences (NASDAQ:ARRY) to be used in photo voltaic power installations. ARRY introduced strong Q2 FY23 outcomes. The corporate’s monetary and elementary scenario has improved loads. On this report, I’ll assessment its Q2 FY23 outcomes. I imagine the setup of ARRY is kind of favorable, and it might probably present strong returns to the traders. Therefore, I assign a purchase score on ARRY.

Monetary Evaluation

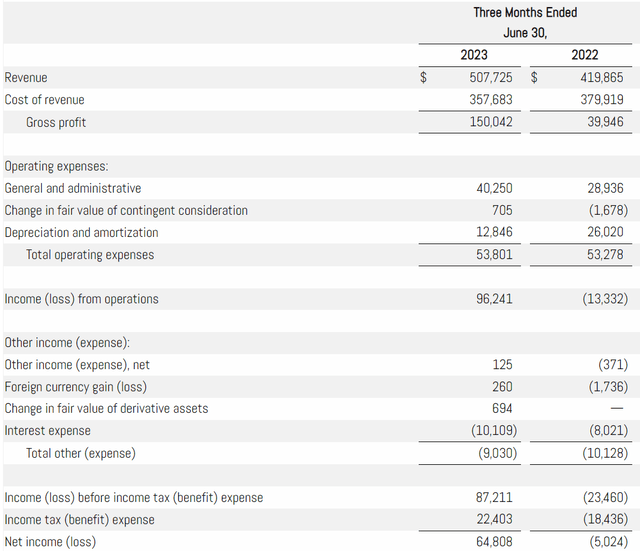

ARRY posted its Q2 FY23 outcomes. The income for Q2 FY23 was $507.7 million, an increase of 21% in comparison with Q2 FY22. I feel a 16% rise within the general quantity of megawatts shipped was the key purpose for the income improve. Its gross revenue margin for Q2 FY23 was 29.5%, which was 9.5% in Q2 FY22. I feel the numerous enchancment in gross margins was attributable to decrease freight and materials prices and increased pass-through pricing.

ARRY’s Investor Relations

The adjusted EBITDA for Q2 FY23 was $115.6 million, which was $20.9 million in Q2 FY22. Because of the vital enchancment within the gross revenue and EBITDA, its web earnings reached $64.8 million in Q2 FY23, in comparison with a web lack of $5 million in Q2 FY22. As well as, if we take a look at its steadiness sheet, its money & money equivalents by the tip of June 2023 was $155.9 million, which is 16.4% increased in comparison with December 2022. The debt has additionally declined by 2.5%. This quarter has been fairly strong, for the corporate reported robust numbers. The end result ticked each field with robust income progress, vital enchancment within the gross margins, robust rise in EBITDA and web earnings, and strong enchancment within the firm’s steadiness sheet. The corporate’s share value remains to be beneath its IPO value ranges, and the corporate has struggled with IRA points and delays previously. However trying on the strong outcomes and fundamentals, I imagine we would see appreciation within the share value quickly.

Technical Evaluation

Buying and selling View

ARRY is buying and selling on the $24.8 degree. The inventory has recovered fairly effectively after making a backside at $5.5. The inventory was buying and selling in a spread of $17-$24 for the previous one yr. However just lately, the inventory broke out of the one-year consolidation, which signifies energy within the inventory. After being in a downtrend for about three years, the inventory is exhibiting robust indicators of pattern reversal. I imagine there’s a excessive probability that the inventory may go into an uptrend quickly. As a result of the breakout has come after an extended consolidation within the inventory value, which will increase the probabilities of the breakout being profitable. I don’t see any main resistance which may cease the inventory value. The following main resistance zone that I see is $35, so I feel it has the potential to succeed in $35.

Ought to One Make investments In ARRY?

The corporate posted strong Q2 FY23 outcomes, and because of this, the share value of the corporate has began to understand. With robust outcomes, improved fundamentals, and the inventory value giving a breakout on the similar time, it’s a strong setup. The setup being inbuilt ARRY is kind of optimistic and is among the most most popular setups I wish to commerce. As well as, if we take a look at ARRY’s valuation, we will see that ARRY is undervalued with a strong upside potential. The five-year common P/E of ARRY is round 53x, and it’s presently buying and selling at a P/E [FWD] ratio of 23.71x. ARRY has a PEG [FWD] ratio of 0.7x, in comparison with the sector ratio of 1.76x. So, it exhibits that ARRY is presently buying and selling beneath the historic common, and taking a look at their robust income progress in Q2 FY23, I feel they’re buying and selling at a reduced value. Therefore, after contemplating all of the components, I feel it’s a nice shopping for alternative. Therefore, I assign a purchase score on ARRY.

Danger

Many finish customers depend on financing for the preliminary capital funding to construct a photo voltaic power plant. Due to this, an increase in rates of interest or a decline within the availability of undertaking debt or tax fairness financing might scale back the variety of photo voltaic tasks that obtain funding or in any other case make it difficult for purchasers or purchasers of purchasers to acquire the financing required to construct a photo voltaic power undertaking on favorable phrases, and even in any respect, which can scale back demand for his or her merchandise and prohibit their means to develop or decrease their web gross sales. Moreover, I feel {that a} sizeable portion of finish customers construct photo voltaic power installations as investments, financing a sizeable chunk of the preliminary capital expenditure with funds from exterior sources. Additional will increase in rates of interest might scale back the return on funding for traders in photo voltaic power tasks, increase the quantity of fairness wanted, or make various investments extra alluring than photo voltaic power tasks, all of which can lead these end-users to search for various investments.

Backside Line

The corporate’s monetary scenario has dramatically improved, and its steadiness sheet has additionally improved. After being in a downtrend for therefore lengthy, its share value has given a breakout, which may signify a pattern reversal. The corporate is ticking all of the bins which might be required for an funding, with strong financials and fundamentals, low valuation, and inventory giving a breakout. I feel it may be an awesome shopping for alternative, and I assign a purchase score on ARRY.

[ad_2]

Source link