[ad_1]

ptasha/iStock through Getty Photographs

The COST Funding Thesis Could By no means Come Low-cost

We beforehand lined Costco Wholesale Corp. (NASDAQ:COST) in June 2023, discussing its wonderful prospects as inflation abated and comparable gross sales expanded.

Because of the elevated rate of interest setting, extra shoppers additionally flocked to COST attributable to its attractively priced choices, triggering its all-time excessive annual membership renewal domestically and internationally.

For now, COST has reported wonderful YoY progress in its first 52 weeks of FY2023 gross sales to $232.95B (+4.6% YoY), largely attributed to the Canada section at +8% YoY and the worldwide section at +7.9% YoY.

Whereas additional monetary particulars haven’t been launched previous to its upcoming earnings name in September 26, 2023, it seems that the corporate could accomplish one other stellar FQ4’23 earnings name forward.

It’s because the Canada section has beforehand reported wonderful working margins of 4.1% (-0.1 factors YoY) and Worldwide section at 3.9% (-0.2 factors YoY), in comparison with the US at 2.9% (-0.2 factors YoY) and general firm at 3.2% (-0.2 factors YoY) for the 36 Weeks ended Could 7, 2023.

We consider these developments could ultimately contribute to COST’s increasing profitability, constructing upon the expansion that we’ve seen within the first three quarters of FY2023, with growing working incomes of $5.62B (+3.8% YoY) and regular working margins of three.4% (inline YoY).

Since most COST buyers are seemingly additionally its loyal shoppers, its membership payment technique requires no introduction as properly. Its rising membership revenues of $3.07B (+6.2% YoY) within the first three quarters of FY2023 have straight flowed into its backside line as properly, comprising 65.8% of its profitability (+6.3 factors YoY).

This alone justifies the inventory’s premium valuations and bellwether standing, because it has carried out extraordinarily properly in each normalized and elevated rate of interest setting, because of the sturdy help base from each the members and long-term shareholders.

Market Sentiments Proceed To Help COST’s Premium Valuations, Comparable To AAPL

COST’s cadence surprisingly reminds us of Apple (AAPL), a inventory that equally defies peak recessionary fears, with its merchandise’ “put in base reaching an all-time excessive throughout all geographic segments” by the newest quarter.

Most significantly, its most costly iPhone 14 Professional Max priced at $1,099 can also be “the one hottest of the brand new telephones,” making up 35% of the general gross sales throughout launch in September 2022.

Regardless of AAPL’s supposed hike of the iPhone 15 Professional Max value to $1,299 (+18.1%), we don’t doubt its superior branding energy and constant fan base as properly, with the Cupertino big already guiding “iPhone and Companies YoY efficiency (to) speed up from the June quarter.”

By the way, each COST and AAPL selected to outsource a lot of their manufacturing to lower-cost areas, resembling Africa/ Vietnam for the previous and China for the latter.

Whereas COST has chosen to move on the financial savings to its shoppers, because of its membership payment technique, the surplus Free Money Move has additionally been used to aggressively broaden its presence to 861 international warehouses by August 2023 (+2 warehouses MoM/ +23 YoY/ +78 from FY2019 ranges).

The growing footprint has naturally grown its loyal member base to 69.1M paid family members (+1M QoQ/ +4.7M YoY) and 31.3M paid government members (+0.7M QoQ/ +3.4M YoY) by the Could 2023 quarter.

AAPL has additionally made nice use of its wonderful Free Money Move era by retiring 2.63B of shares over the previous 4 years, naturally validating its long-term shareholders’ conviction purchase.

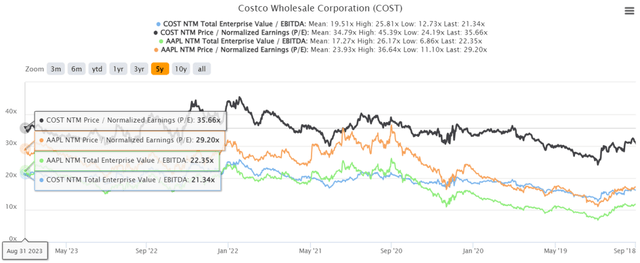

COST 5Y EV/EBITDA and P/E Valuations

S&P Capital IQ

Mixed with Warren Buffett’s 5.8% stake in AAPL, we’re not shocked by the premium embedded in each of their inventory valuations, with COST buying and selling at NTM EV/ EBITDA of 21.34x/ NTM P/E of 35.66x and AAPL at 22.35x/ 29.20x, respectively.

That is in comparison with the Meals And Staples Retailing sector median of 9.63x/ 14.15x and Tech {Hardware}/ Software program sector median of 13.23x/ 20.46x, respectively.

Then once more, buyers have to be conscious that Mr. Market continues to award these two firms their premium valuations, regardless of the projected deceleration in AAPL’s high and backside line progress at a CAGR of +3.4%/ +5.7% by FY2025, just like COST at +6.1%/ +9.3%, respectively.

That is in comparison with AAPL’s normalized CAGR of +10.6%/ +19.7% between FY2016 and FY2022, and COST’s at +11.4%/ +16.4%, respectively.

Nevertheless, for thus lengthy that COST continues to execute properly, because of its membership payment technique, increasing international footprint, and stellar stability sheet with a internet money stage of $7.21B (+35.2% YoY), we preserve our perception that the inventory could by no means come low cost in any case.

With its 5/ six 12 months anniversary coming quickly, buyers may look ahead to its eventual membership payment hike, additional boosting its backside line.

So, Is COST Inventory A Purchase, Promote, or Maintain?

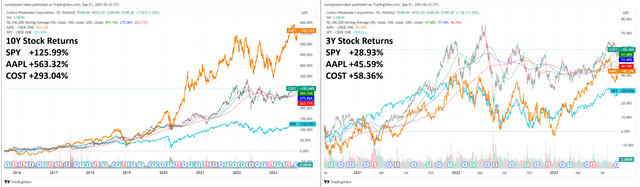

COST 3Y/ 10Y Inventory Worth

Buying and selling View

Because of their long-term shareholders’ sustained help, the identical outperformance by COST has additionally been noticed over the previous three years of hyper-pandemic interval and ten years, additional strengthening our long-term funding thesis.

Naturally, since previous efficiency isn’t any assure of future outcomes, it stays to be seen how COST will carry out over the following decade, particularly attributable to its premium valuations.

On the one hand, COST’s valuations have steadily climbed over the previous 20 years, demonstrating its sturdy place as one of many bellwether shares available in the market.

However, there might be a ceiling to this climb in any case, since it’s unsure if we might even see its valuations additional double as to how its EV/ EBITDA valuation has, from 10.91x in September 2013 to 21.34x in September 2023, and P/E valuation from 23.05x to 35.20x, respectively.

Primarily based on its present valuations and the consensus FY2025 adj EPS of $17.32, we’re a long-term value goal of $617.63, suggesting that the majority of its upside potential is already pulled ahead as properly.

On account of the baked-in premium, it’s naturally not simple to suggest a Purchase for the COST inventory, because it actually depends upon particular person buyers’ price averages and investing model.

Subsequently, since we is not going to be including to our portfolio, because of our full place from our earlier 4 purchase ranking articles, we will be ranking the COST inventory as a Maintain (Impartial) right here. If any, buyers could need to add at any pullbacks for an improved margin of security.

[ad_2]

Source link