[ad_1]

5./15 WEST

Amid a market that continues to be skittish over rates of interest and the likelihood of the present recession extending all through 2024 and past, it has been more and more tough to justify investing in shares, significantly progress shares with no earnings, when risk-free money is yielding such a beneficiant quantity. A part of remaining invested, nevertheless, is regularly monitoring single-stock positions as valuations and quarterly earnings change.

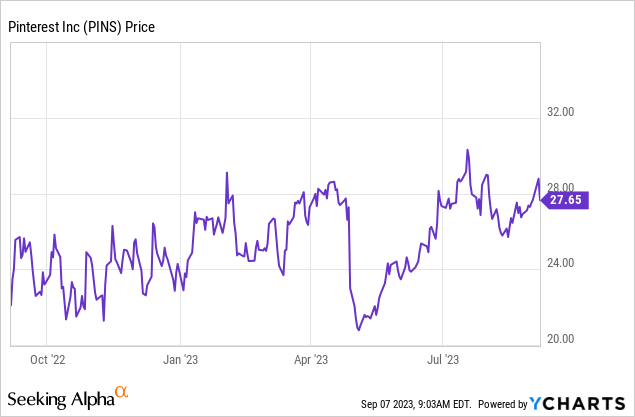

Pinterest (NYSE:PINS) is an organization that has utilized the recession to construct up its backside line, and the market has rewarded that prudence. Yr-to-date, the inventory is up greater than 20% (barely edging out over the S&P 500), with beneficial properties choosing up steam in August after the corporate’s latest earnings launch.

To stage set right here: I had been a longtime Pinterest bear, however after parsing by way of the corporate’s newest Q2 outcomes and seeing its means to spice up adjusted EBITDA by way of expense reductions – significantly in G&A spending – I am extra sanguine on Pinterest’s prospects. Some core points with Pinterest nonetheless stay that forestall me from being absolutely bullish on the corporate, however I’m now impartial on the corporate’s trajectory by way of the remainder of the yr – I do not assume there shall be a lot both draw back or upside from right here.

I view the Pinterest bull and bear circumstances to be comparatively balanced. Listed here are a few of the constructive drivers to concentrate on:

Intentional, purpose-driven consumer base results in a really simply monetized platform. As a result of Pinterest customers are already scrolling by way of gadgets that they’re focused on, amongst social media platforms, Pinterest is among the most instantly interesting to advertisers. The corporate has been constructing out its advertiser options and has succeeded at retaining giant model companions. Excessive gross margins. Pinterest’s high-70s gross margins results in loads of scalability for the corporate, if it could possibly handle to each herald a gentle recurring promoting income base plus preserve spending in examine.

On the flipside, listed here are the important thing pink flags on the bearish facet to be careful for:

Pinterest’s core consumer base just isn’t seeing progress. Pinterest generates the vast majority of its income (similar to another social media firm) within the U.S. Sadly, consumer progress domestically has been stagnant for a number of quarters, which is a mirrored image of Pinterest’s excessive penetration inside its audience plus the rampant competitors amongst social media apps within the U.S. ARPU is not a income tailwind. Social media firms which have run out of the consumer progress lever sometimes can lean on elevated advert load to chase income progress. However on this local weather, with advertisers pulling again, Pinterest’s probabilities of meaningfully resuscitating its advert income stream are additionally beneath hearth.

Pinterest’s valuation, in the meantime, positions it neither as a worth inventory nor as overvalued for its fundamentals (and therefore another excuse for my impartial score). At present share costs close to $28, Pinterest trades at a $18.53 billion market cap. After we internet off the $2.30 billion of money on the corporate’s most up-to-date stability sheet (towards no debt, which is one other minor bull driver in Pinterest’s favor), the corporate’s ensuing enterprise worth is $16.23 billion.

In the meantime, for FY24, Wall Road analysts predict Pinterest to generate $3.46 billion in income (+14% y/y) and $1.14 in professional forma EPS (+19% y/y). This positions Pinterest’s multiples at:

4.7x EV/FY24 income 24.3x FY24 P/E

For my part, the very best transfer right here stays to “watch and wait” from the sidelines. Contemplating the newer value cuts that Pinterest has enacted to allow progress in adjusted EBITDA and professional forma EPS, I feel the corporate has offsets to its weaker consumer progress story – however I would watch for a extra affordable value within the low $20s earlier than leaping in.

Q2 obtain

Let’s now undergo Pinterest’s newest quarterly ends in larger element, first going by way of the newest consumer traits.

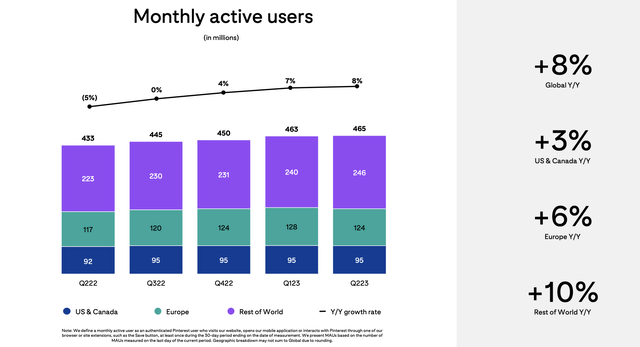

Pinterest MAUs (Pinterest Q2 earnings deck)

Pinterest’s MAUs did develop 8% y/y, however as I’ve identified in prior analyses on Pinterest (in addition to Snap, which shares a standard concern), the focus of this progress lies within the “Remainder of World” house. Within the U.S. and Canada, in the meantime, y/y progress was solely 3%, and sequentially stayed flat at 95 million MAUs.

This shift away from the U.S. and Canada, in the meantime, is inflicting a drop in ARPUs. Whereas ARPU in each area individually is rising, the combination shift towards the “Remainder of World” consumer base, which generated solely 2% of the ARPU ranges of a U.S. consumer in Q2, precipitated a -1% y/y decline in ARPU.

Pinterest ARPU (Pinterest Q2 earnings deck)

General income did nonetheless develop 6% y/y to $708.0 million, accelerating barely over Q1’s 5% y/y income progress tempo and beating Wall Road’s $695.6 million (+4% y/y) expectations.

Do observe that Pinterest has grown its advert load over the previous yr, which means the density of adverts it serves on the platform (and even so right here, the geographic mixture of customers just isn’t offering a carry to ARPUs). I view ARPUs as a really restricted cannon that the corporate can hearth for income progress, as an excessive amount of advert load can finally drive customers off the platform. To this point, administration has famous that consumer engagement ranges have remained regular.

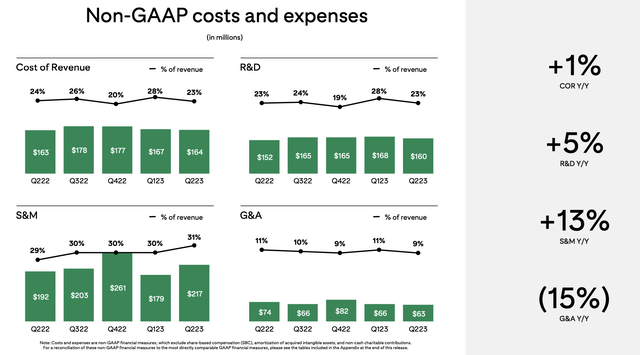

It is on value, nevertheless, that Pinterest shines in Q2 – and the place it did not in prior quarters. Notice significantly within the chart beneath the G&A spending line, which declined -15% y/y and dropped to only 9% of income, versus 11% in Q1 and within the prior-year Q2. Notice as effectively that R&D spend declined sequentially from Q1 as effectively, although this was offset by increased gross sales and advertising and marketing spend pushed by a shift in promoting timing from Q1 to Q2.

Pinterest expense traits (Pinterest Q2 earnings deck)

A piece of the corporate’s financial savings additionally come from actual property rationalization. Per CEO Invoice Prepared’s remarks on value takedowns throughout the Q2 earnings name:

As we have mentioned previously, we’re instilling a tradition the place we’re extra centered on what drives outcomes for customers and advertisers and being extra rigorous with our bills, finally making us a extra sturdy firm. We have been capable of speed up our tempo of innovation whereas additionally being disciplined on expense administration, leading to constructive outcomes for our customers, advertisers and shareholders.

In Q1, we took steps to cut back our bills and drive larger efficiencies in our enterprise, together with rightsizing our workforce to align expertise to our strategic priorities and restructuring our actual property portfolio. In Q2, we recognized additional value efficiencies, resulting in working bills that had been decrease than we guided to. Later within the ready remarks, Julia will share our newest outlook on bills and margin enlargement for the yr.”

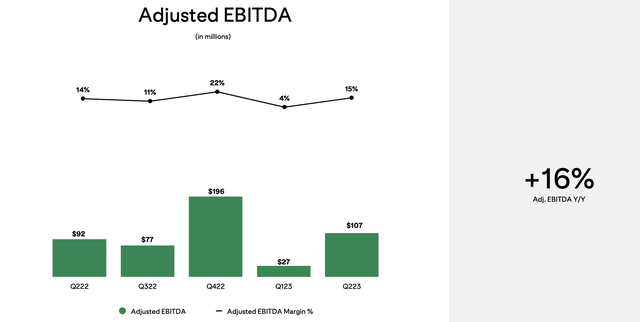

These actions have pushed an incredible carry in adjusted EBITDA, up 16% y/y in nominal phrases to $107 million, and a 15% margin – up one level y/y and a considerable enchancment sequentially.

Pinterest adjusted EBITDA (Pinterest Q2 earnings deck)

Professional forma EPS of $0.21, in the meantime, almost doubled y/y and got here in effectively forward of Wall Road’s $0.12 expectations.

Key takeaways

Now that Pinterest is producing an actual backside line, it is tough to be too bearish on the corporate at a mid-20s P/E stage, particularly if the corporate is continuous to develop. Whether or not Pinterest can proceed to construct a consumer base within the U.S. and Canada will stay considered one of its greatest challenges, and whether or not it could possibly increase monetization exterior of this area is the opposite core concern.

Hold an eye fixed out on this inventory, however do not rush in too rapidly.

[ad_2]

Source link