[ad_1]

Sashkinw/iStock by way of Getty Pictures

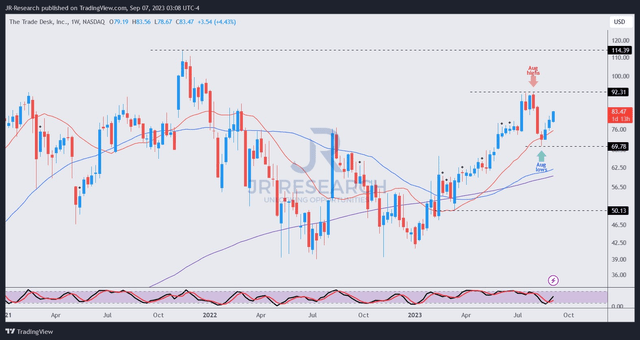

Traders in The Commerce Desk, Inc. (NASDAQ:TTD) celebrated a exceptional market-beating efficiency in 2023 as TTD surged to its early August highs. Nevertheless, sellers denied additional upside on the $92 degree earlier than a post-earnings selloff adopted as TTD bottomed out in mid-August on the $70 degree. As such, TTD briefly entered a bear market, which brought about patrons to return aggressively, lifting its current restoration over the previous three weeks.

The Commerce Desk posted a exceptional second-quarter or FQ2 earnings launch. It demonstrates the secular tailwinds from Related TV or CTV whereas leveraging the expansion drivers in retail media adverts. The corporate additionally careworn that it grew quicker than the general digital advert business in Q2, corroborating market share features within the business.

CEO Jeff Inexperienced and his group have delivered spectacular performances over the previous 12 months regardless of the cyclical downturn that affected the business. Notably, The Commerce Desk delivered income development of greater than 20% over the previous three quarters, benefiting from its well-diversified portfolio of consumers. CTV stays a key development driver for The Commerce Desk and can possible proceed to underpin its ahead projections.

Moreover, the challenges engulfing the Linear TV business may present a stronger impetus for streaming corporations to increase their CTV promoting efforts. As such, TTD’s share features continued powering by way of the current dispute between Disney (DIS) and Constitution (CHTR), which may have ramifications on the near-term prospects of Linear TV amid the continued strikes.

Regardless of the market optimism, warning should nonetheless be emphasised, given TTD’s implied development premium. Accordingly, TTD final traded at a ahead EBITDA a number of of practically 48x because it surged, and a ahead free money circulate or FCF yield of 1.6%.

As such, the market has priced in vital optimism towards its valuation, regardless that the corporate is predicted to proceed producing strong profitability development. Analysts’ estimates recommend that The Commerce Desk is predicted to put up an adjusted EBITDA CAGR of greater than 22% from FY22-25. It is also mirrored within the “A-” development and profitability grades assigned by In search of Alpha’s Quant, reflecting its sturdy enterprise mannequin.

I assessed that the main unbiased demand-side platform, or DSP, is well-positioned to navigate the continued development within the digital advert business as retailers search to monetize their first-party information. Moreover, its publicity to CTV development must also underpin sturdy shopping for sentiment concerning the firm’s prospects.

Whereas I do not anticipate purple flags on its value motion suggesting promote indicators, shopping for its steep development premium may affect the chance/reward efficiency buyers expertise, as seen in TTD’s current steep volatility.

TTD value chart (weekly) (TradingView)

TTD fashioned its lows in August because it briefly entered a bear market after collapsing from its early August highs. Nevertheless, it has recovered remarkably because it inches nearer to re-testing these highs.

TTD’s value motion has but to display a promote sign for buyers to contemplate slicing publicity, in my view. Moreover, the sturdy restoration of its uptrend bias corroborates my commentary that purchasing sentiment stays constructive.

That stated, new buyers who missed including its current backside ought to take into account ready patiently for the following steep pullback earlier than including, given its excessive valuation and up to date surge.

Score: Keep Maintain. Please notice {that a} Maintain score is equal to a Impartial or Market Carry out score.

Vital notice: Traders are reminded to do their due diligence and never depend on the data supplied as monetary recommendation. Please at all times apply unbiased considering and notice that the score will not be supposed to time a particular entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a important hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark beneath with the intention of serving to everybody in the neighborhood to be taught higher!

[ad_2]

Source link