[ad_1]

Up to date on September eleventh, 2023 by Felix Martinez

ABM Industries (ABM) has a tremendous monitor document on the subject of paying dividends to shareholders. The corporate is a part of the Dividend Kings, a bunch of shares which have raised their payouts for at the very least 50 consecutive years. You’ll be able to see all 50 Dividend Kings right here.

We created a full record of all 50 Dividend Kings and vital monetary metrics equivalent to dividend yields, payout ratios, and price-to-earnings ratios. You’ll be able to obtain the complete record by clicking on the hyperlink under:

Dividend Kings are the best-of-the-best on the subject of rewarding shareholders with money returns. This text will talk about ABM’s dividend security, in addition to its valuation and outlook.

Enterprise Overview

ABM was based again in 1909, and since that point, it has grown into an trade powerhouse. ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, vitality options, services engineering, HVAC & mechanical, panorama & turf, and parking. The corporate produces $7.8 billion in annual income and trades right this moment with a market cap of $2.5 billion.

ABM counts hospitals, universities, public colleges, knowledge facilities, manufacturing vegetation, and airports amongst its lengthy and spectacular consumer record. The corporate’s experience and plenty of many years of expertise in facility administration have earned it a terrific popularity, and thus it’s a true trade chief.

ABM’s technique is to compete in industries the place it might probably win moderately than competing all over the place. ABM has realized via the many years the place it might probably compete efficiently and the place it can not and has targeted its efforts accordingly.

In 2007 ABM’s annual income was about $3 billion, but it surely has practically tripled since then, at present standing at practically $8 billion. ABM has grown organically partially, however the overwhelming majority of its progress has been acquired. And given strategic route from ABM when it comes to future money utilization, we are able to count on extra acquisitions because the years go on.

ABM additionally has an distinctive dividend progress document. The corporate has paid greater than 223 consecutive quarterly dividends and has elevated its dividend for 55 consecutive years.

Supply: Investor Presentation

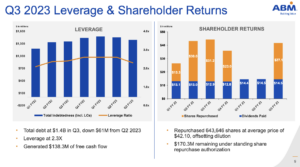

Given the remarkably low payout ratio of ~25% projected for 2023, its long-term progress prospects, and its resilience to recessions, ABM is more likely to maintain elevating its dividend for a few years to return. As well as, the corporate has purchased again practically 600 thousand shares in latest quarters, serving to to drive increased earnings-per-share. It is a change from prior habits, the place capital returns have been nearly completely via money dividends.

One supply of potential earnings progress going ahead is worldwide enlargement, as ABM entered the U.Okay. market with the GBM and Westway acquisitions previously few years. Going ahead, proceed searching for plenty of transactions from ABM when it comes to acquisitions and divestitures because it shifts its combine round additional.

ABM is cut up into six segments that present its clients a big selection of facility options: Enterprise & Trade, Training, Aviation, Expertise & Manufacturing, Healthcare, and Technical Options. The corporate’s income streams are extremely diversified, with janitorial providers comprising ABM’s greatest single piece of the pie.

Progress Prospects

As we noticed above, ABM’s said technique is to develop by acquisition. Nonetheless, that’s to not say that it’s ignoring its capability to develop organically. When it has free money circulation to spend, it appears to be like first at natural progress. The corporate has deep experience and an important popularity right here within the US for services administration and appears to take advantage of that the place attainable. Which means going after nationwide accounts first, the place it might probably acquire a major quantity of enterprise unexpectedly in addition to centralizing assist providers to enhance margins.

ABM additionally particularly calls out acquisitions in its technique, though it’s behind natural investments and the dividends. Nonetheless, ABM’s latest historical past means that acquisitions are an important a part of its total technique and thus, we are able to count on ABM will proceed to develop by way of acquisitions in addition to organically.

ABM remains to be extraordinarily targeted on the US market, which presents potential alternatives for additional worldwide enlargement. ABM might use its important experience in services administration to realize entry to international purchasers worldwide. The strikes into the U.Okay. lately show ABM is prepared to take an opportunity; this can be probably the most important progress avenue ABM has going ahead.

Supply: Investor presentation

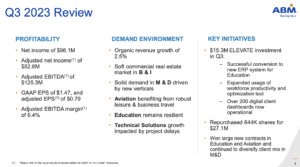

ABM Industries is predicted to be extremely worthwhile once more this 12 months, and following third-quarter earnings, we now count on $3.50 in earnings-per-share for the 12 months. The corporate’s Q3 outcomes confirmed income progress of three.4% year-over-year, hitting $2.0 billion. That was additionally $20 million higher than expectations. Adjusted earnings-per-share got here to 79 cents in Q3, which was ten cents decrease than anticipated.

As famous above, the corporate acquired RavenVolt, an electrical microgrid firm that’s targeted on serving to companies and governments obtain sustainability objectives. This acquisition is a bit outdoors ABM’s typical acquisition as a result of it isn’t a service supplier.

General, ABM’s progress is more likely to be average because the financial system normalizes. We count on 5% annual earnings-per-share progress over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

ABM’s aggressive benefit is its measurement and the resultant economies of scale it enjoys. It has a 100+ 12 months historical past of offering facility options for a big selection of consumers, and that experience is what units ABM aside. It’s a true trade chief within the services administration area, and that affords it not solely the flexibility to extra simply appeal to new purchasers, but additionally to increase relationships with those it already has.

As well as, since ABM operates in low-margin companies, smaller rivals are at a drawback when it comes to leveraging down again workplace and assist prices. ABM could also be in some aggressive traces of labor, however it’s actually higher positioned than its rivals to beat a few of these obstacles.

ABM Industries is among the greatest firms in its trade, and its historical past of constructing acquisitions has enhanced its scale benefits additional. ABM Industries will possible proceed to make acquisitions to extend its measurement additional.

Recessions are painful for ABM similar to another firm, however its efficiency in the course of the Nice Recession was exceptional. ABM’s earnings-per-share in the course of the Nice Recession are under:

2007 earnings-per-share of $0.99

2008 earnings-per-share of $1.10 (11% improve)

2009 earnings-per-share of $1.33 (21% improve)

2010 earnings-per-share of $1.34 (0.7% improve)

Impressively, ABM grew earnings-per-share in annually of the Nice Recession. Only a few firms have been capable of accomplish this. Furthermore, ABM has proved as soon as once more its resilient nature within the coronavirus pandemic.

Due to a rise in high-margin work orders from resilient clients, ABM has simply offset the impact of the pandemic on its clients within the aviation trade and schooling. Because of this, it’s poised to develop its earnings per share to an all-time excessive degree this 12 months.

General, ABM enjoys skinny working margins and lackluster progress charges throughout regular financial occasions, however it’s exceptionally resilient throughout tough financial intervals.

This resilience is essential, because it helps the inventory’s long-term returns and makes it simpler for the shareholders to retain the inventory throughout broad market sell-offs.

Valuation & Anticipated Returns

ABM is predicted to generate earnings-per-share of $3.50 in its fiscal 2023. Because of this, the inventory is at present buying and selling at a price-to-earnings ratio of simply 11.2. That is considerably decrease than the common price-to-earnings ratio of ~17.5 for the inventory previously 10 years. We contemplate 16 occasions earnings to be an affordable estimate of honest worth for this inventory.

ABM’s valuation has plummeted all through 2023, and the inventory is as low-cost because it has been at any level previously decade. If the inventory trades at our assumed honest valuation degree in 5 years, it should generate 8% annualized returns due to the enlargement of its earnings a number of.

Furthermore, the inventory is providing a 2.2% dividend yield. This yield is considerably increased than the yield of the S&P 500, however it’s nonetheless a comparatively low yield.

As well as, latest dividend raises have been very small, with typical will increase within the 2% or 3% vary. Whereas ABM has a powerful historical past of paying dividends, it lacks a excessive present yield and dividend progress charge.

Lastly, we count on annual EPS progress of 5.0% over the subsequent 5 years. Mixed with a 2.2% dividend and an 8% annualized enlargement of the price-to-earnings ratio, complete annual returns might method 15.2% per 12 months.

Ultimate Ideas

ABM is actually not a high-yield revenue inventory or a excessive dividend progress inventory. However what it lacks in pleasure, it makes up for with consistency. ABM’s lengthy and spectacular historical past of paying a dividend needs to be revered, because the Dividend Kings are uncommon compared to the 1000’s of publicly traded shares available in the market.

ABM’s natural progress is undamaged, and acquisitions add to progress. Progress from right here relies upon upon potential worldwide enlargement in addition to continued margin features. As well as, the corporate has a comparatively new tailwind of share repurchases.

With a really low-cost valuation and cheap progress forward, complete annual returns could possibly be robust at 15.2% yearly via the subsequent 5 years. ABM is a purchase as a consequence of its excessive anticipated return and lengthy historical past of dividend will increase.

Extra Studying

The next databases of shares include shares with very lengthy dividend or company histories, ripe for choice for dividend progress traders.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link