[ad_1]

AndreyPopov

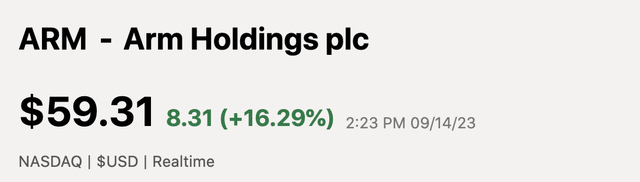

The IPO market has been shut for some time, but Arm Holdings plc (NASDAQ:ARM) got here out with a sizzling public providing as we speak. The semiconductor inventory priced on the excessive finish of the vary and jumped in preliminary buying and selling. My funding thesis is extremely Bearish on the inventory, although realizing some sizzling IPOs can run to excessive valuations.

Supply: In search of Alpha

IPO Particulars

Arm Holdings offered 95.5 million shares at $51.00 per share to lift over $4.9 billion for promoting shareholder SoftBank Group (OTCPK:SFTBY). The corporate priced on the high finish of a advised vary between $47 to $51.

The promoting shareholder has granted underwriters a further 7.0 million shares to cowl over-allotments. With the inventory buying and selling above the providing worth, Arm Holdings will promote a complete of 102.5 million shares to lift $5.2 billion for SoftBank.

The IPO is the biggest since Rivian Automotive (RIVN) raised $12 billion again in late 2021 – in an ominous signal for preliminary traders.

The corporate will has over 1x billion shares excellent. The largest query for shareholders is how SoftBank handles the 90% possession of the corporate, although no indications exist that the corporate has any intent to promote further shares.

Plenty of firms concerned in designing chips invested $735 million within the cope with the next concerned: Taiwan Semiconductor Manufacturing Firm Restricted (TSM), Intel (INTC), Superior Micro Gadgets (AMD), Nvidia (NVDA), Alphabet’s Google (GOOG), Apple (AAPL) and Samsung Electronics Co., Ltd. (OTCPK:SSNLF). These giant traders reduces the float to solely $4 billion value of inventory, or nearer to 88 million shares really out there to the general public.

The inventory rapidly jumped to $60 in preliminary buying and selling pushing the valuation all the best way as much as $60 billion. The small public float could cause the inventory to squeeze increased till one in all these large shareholders finally unload shares following the top of any IPO lockups.

Far Too Sizzling

Arm Holdings has traded as much as $60 out of the gate, however the inventory is way too sizzling right here. The corporate is a frontrunner in CPUs and licenses high-performance, low-cost, energy-efficient merchandise to the main semiconductor firms on the earth with a big give attention to the smartphone market.

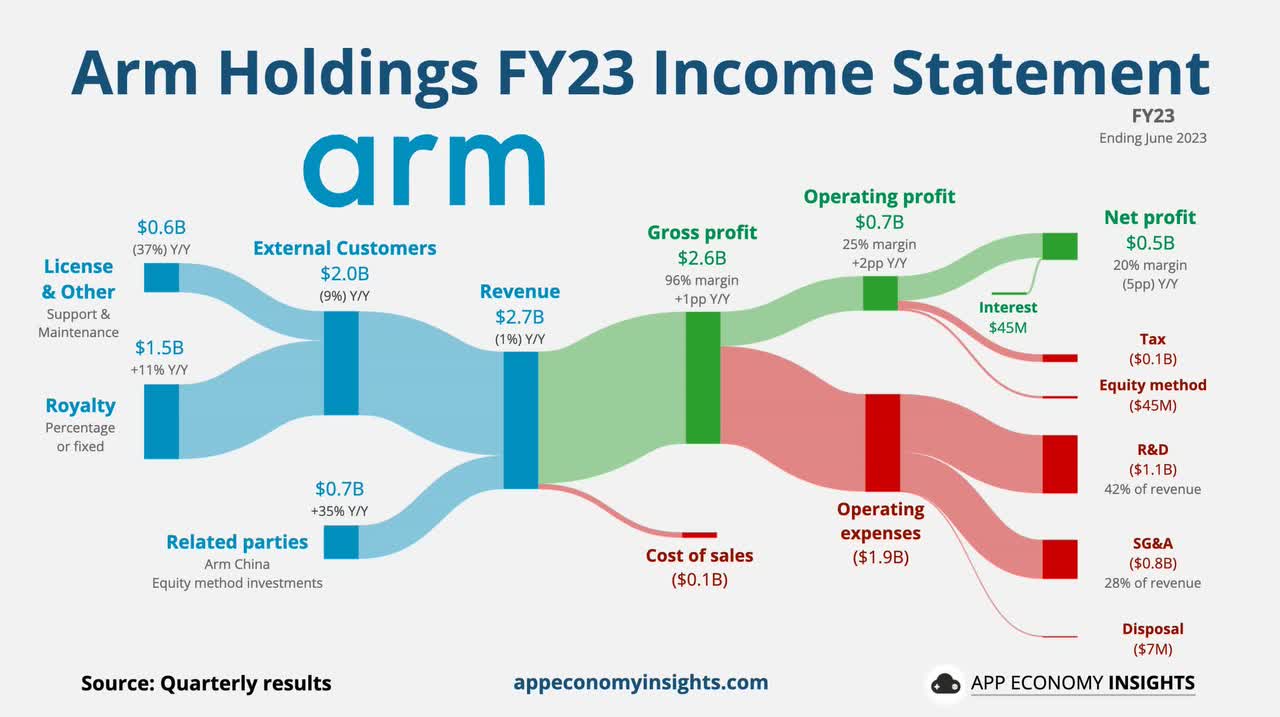

The issue is that FY23 revenues had been right down to $2.7 billion. Arm is extremely worthwhile with a 25% working margin producing $524 million in earnings from operations final FY, however the inventory trades at over 100x earnings.

Arm generated nearly all of revenues from license and royalty agreements. For FY23, the exterior buyer revenues had been $2.0 billion, down 9% YoY.

Supply: App Economic system Insights

The opposite revenues come from associated events in China. The corporate has an fairness funding in Arm China.

The large query is how traders need to worth the inventory. In whole, Arm Holdings has $2.7 billion in revenues with simply $2.0 billion from exterior clients.

As mentioned above, the inventory valuation is already up at $60 billion as a consequence of some pleasure over AI chips, but Arm Holdings is not producing any development proper now, in contrast to new shareholder Nvidia.

The IPO reminds us a variety of Rivian that topped $150 for a valuation far in extra of $100 billion. The EV producer raised practically $12 billion of their sizzling IPO, however the inventory now trades down simply above $20 with a valuation nearer to solely $20 billion. Rivian even simply reported 1 / 4 the place gross sales surged over 200% in an indication of how dwelling as much as lofty expectations following a sizzling IPO is almost inconceivable.

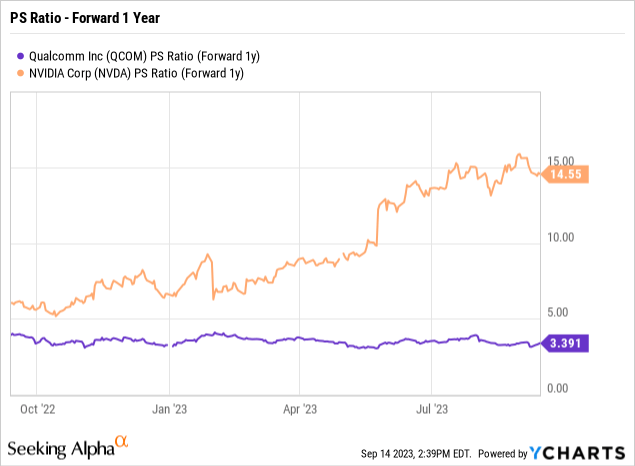

Arm Holdings hasn’t surged to the identical diploma at this level, however the inventory valuation is insane at over 20x whole gross sales and 30x gross sales to exterior clients. The enterprise seems much more associated to Qualcomm (QCOM) targeted on smartphone chips with hopes of getting into the AI chip race buying and selling at 3x ahead gross sales, than a Nvidia buying and selling at over 14x ahead gross sales targets.

Takeaway

The important thing investor takeaway is that any sizzling IPO can rally to unfathomed heights, however the shares usually find yourself again at regular valuation multiples, with Rivian being a main current instance. Arm Holdings already trades at P/S multiples that exceeds Nvidia, and traders ought to see this as a serious warning signal the inventory worth is way too lofty right here. Anybody fortunate sufficient to obtain shares within the IPO should not overstay their welcome.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link