[ad_1]

cemagraphics

One other inside week traded within the S&P 500 (SPY) because the sideways vary continued and contracted. That is irritating motion however cannot proceed indefinitely and we must always see vary enlargement this week. The query is, which means will it break?

Final week’s article highlighted the bias for a break decrease previous 4430. Clearly, this hasn’t occurred but, however Friday’s transfer appeared to assist the decision with a robust drop and weak shut. A big transfer might be establishing so this week’s preparation is targeted on how this might develop and the place it might goal.

A wide range of tried and examined technical evaluation methods might be utilized to the S&P 500 in a number of timeframes. The goal is to offer an actionable information with directional bias, necessary ranges, and expectations for value motion. The proof will then be compiled and used to make a name for the week(s) forward.

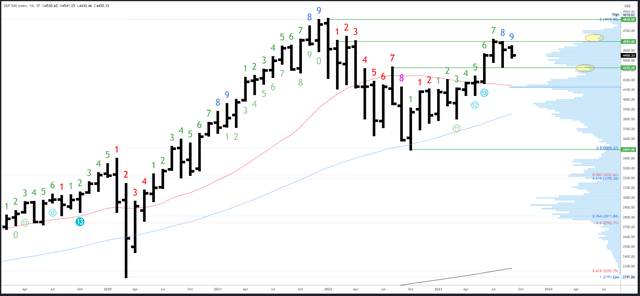

S&P 500 Month-to-month

With over half the month gone, September continues to be contained in a small vary inside the vary of the August bar (which itself was practically inside the vary of July). The quantity profile on the fitting of the chart now exhibits a bell curve between 4325 and 4607 indicating stability.

A very powerful takeaway from the month-to-month chart at this juncture is its bullish bias because of the lack of a reversal sample on the 4607 excessive. New highs ought to be made in some unspecified time in the future.

SPX Month-to-month (Tradingview)

Month-to-month resistance is 4593-4607. 4637 is the subsequent stage above, then the all-time excessive of 4818.

4325-35 is important assist adopted by 4195-4200.

The September bar is quantity 9 (of a potential 9) in a Demark upside exhaustion depend so will full the sign. The dip in August was in all probability an early response, however I would count on a extra extended impact and longer pause as rallies battle to carry beneficial properties.

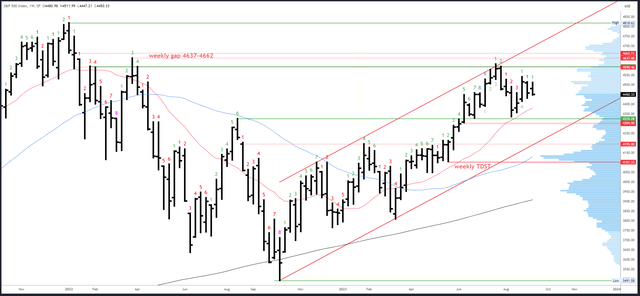

S&P 500 Weekly

A second weekly ‘inside bar’ has been created by the uneven, sideways situations. Its small vary of 4447-4511 seems to be virtually sure to interrupt subsequent week so this could result in enlargement and a push by means of the extremes of the ‘mom’ bar at 4415-4541.

This week’s weak shut at 4450 offers a bearish bias to not less than undercut the 4447 low. It could not sound like a lot, however this may be helpful if Monday’s session opens greater and rallies; chasing the rally would have low odds. Moreover, a transfer beneath 4447 is the minimal expectation and barring a reversal, decrease helps ought to quickly be in play.

SPX Weekly (Tradingview)

4541 is the primary resistance, then 4594-4607. A break of 4607 ought to result in the weekly hole at 4637-4662.

A small weekly hole at 4405-4415 is the primary potential assist space, with 4356 beneath. 4325-35 stays the important thing stage, with a small hole at 4298-4304 ought to this space be flushed.

An upside (Demark) exhaustion depend accomplished in July and has already had an impact with the August drop. New counts are getting interrupted by the uneven situations and a clear development is required to progress in direction of the subsequent exhaustion sign.

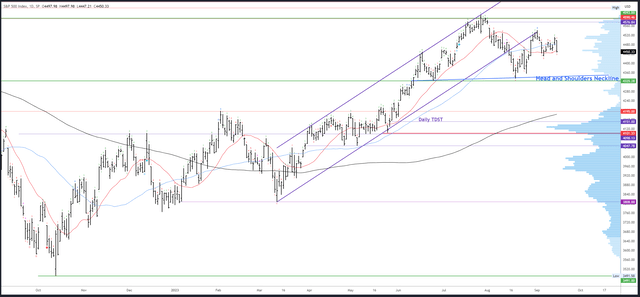

S&P 500 Every day

There’s a creating head and shoulders sample on the day by day chart with the neckline within the 4335 space. Count on this to get much more consideration ought to value get nearer to the neckline. What higher option to shake up the present stasis and generate quantity? If it does set off, it could be a possible entice to get bears brief within the gap. I would truly prefer to see this occur as I might then be rather more assured the underside is in.

Final week’s name for a transfer down by means of 4430 continues to be legitimate and Friday’s robust decline helps this name. The difficulty subsequent week is the place precisely the decline will goal. A measured transfer now tasks 4401, and 4397-4401 is an space of assist. Nevertheless, a transfer by means of 4415 would break a 3-week contracting vary and sufficient power has constructed up for a bigger transfer. Decrease helps might simply come into play.

SPX Every day (Tradingview)

4511 is the primary resistance, then 4541.

Potential helps are 4415 and 4356, then 4325-35.

Situations have been too uneven for any Demark exhaustion indicators to develop.

Occasions Subsequent Week

The FOMC assembly on Wednesday is the principle occasion of the week. A pause is nearly assured, as is a hawkish stance given this week’s robust inflation and retail gross sales information. There might be a nod to additional hikes in November or December and the Fed will not need to make the identical mistake because the ECB who this week signalled they have been possible completed mountaineering.

Yields and the greenback look robust and will make additional beneficial properties into tops in early This autumn.

PMI information is due out on Friday.

Possible Strikes Subsequent Week(s)

Greater image, the S&P 500 is working off month-to-month upside exhaustion. There may be nonetheless a bias for eventual new highs however the common expectation is for vary buying and selling and any strikes outdoors 4325-4607 are prone to be unsustained.

Close to-term, there’s a bearish bias for a swing decrease by means of 4430. This follows on from final week’s name and now has additional proof from the robust decline on Friday and the weak shut. Additionally, the vary contraction during the last 3 weeks seems to be set to interrupt. This might set off a burst of volatility (FOMC assembly induced?) and if the decline breaks 4415-30 in the identical method as Friday’s transfer, look out beneath.

4335-56 is potential assist, however a robust transfer into this space can be bearish and I doubt it will maintain once more. Certainly, the perfect situation would shake out bulls and entice bears with a capitulation adopted by a reversal. I’ve mentioned this earlier than and it did not occur, however it’s very true now there may be the neckline of a big head and shoulders sample in the identical place. The primary take a look at of 4335 ought to result in a bounce, however a quick one to arrange a closing drop (the bear entice) to 4298-4301, which is hole fill and the 38.2% Fib retrace of the March-July rally. A subsequent reversal again over 4325-35 can be a strong bullish sign and virtually definitely cement a robust backside.

Whereas I’ve a short-term bearish bias, I’m ready to be confirmed mistaken. The very best odds come from robust tendencies when the month-to-month, weekly and day by day charts are all saying the identical factor. That is clearly not the case in the intervening time, and the S&P 500 is buying and selling a uneven vary with a number of potentialities. I am unable to listing each chance right here forward of time, however I’ll try to go away a remark below this text ought to the day by day chart shift again bullish.

[ad_2]

Source link