[ad_1]

designer491/iStock through Getty Photos

Thesis

My funding analysis follows the under quote from Benjamin Graham:

“Bond choice is primarily a detrimental artwork. It’s a technique of exclusion and rejection, reasonably than search and acceptance.”

Nevertheless, I exploit exclusion not just for bonds however for fairness, too. In right this moment’s article, I’ll apply that psychological mannequin to TriplePoint Enterprise Progress (NYSE:TPVG). At first look, the corporate had a stable final quarter with rising web funding earnings, rising belongings, and paying beneficiant dividends. Wanting on the particulars, loads of questions come up. Neither the earlier quarter was so successful, nor dividends supported by sturdy monetary outcomes, thus TPVG is undervalued for a purpose.

Firm Overview

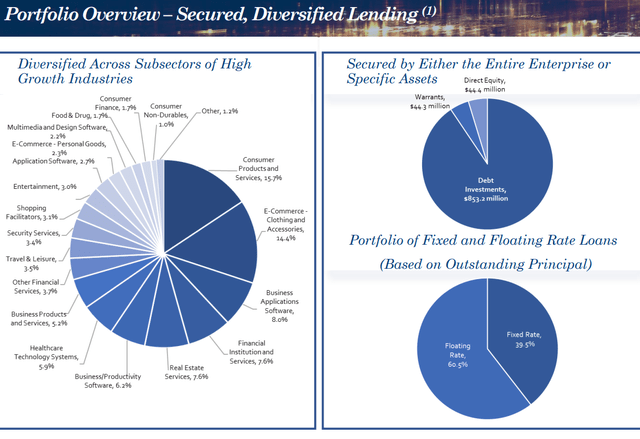

TriplePoint Enterprise Progress (TPVG) is an externally managed BDC targeted on direct fairness and mortgage investments in venture-stage corporations within the IT and different progress industries. Software program, e-commerce, and shopper providers are its three important allocation areas. The graph under from the final firm presentation exhibits its portfolio construction.

TPVG presentation

The heavyweights are shopper services and E-commerce. They represent 30 % of the portfolio. I discussed that analyzing PennantPark’s (PNNT) grocery store portfolios is a purple flag for me. Aside from these two industries, the remainder of the TPVG`s investments are scattered throughout numerous industries like PNNT.

TPVG prioritizes debt investments, representing greater than 85 % of the full. 39.5 % of the debt is issued with a hard and fast charge and 60.5 % with a floating charge. In an setting with increased for longer rates of interest, such a excessive share of fixed-interest debt commitments has twofold penalties. First, TPVG`s price of funding will develop, and its web funding earnings will decline. Second, the margin between the price of funds and curiosity cost would possibly develop into insignificant and even dangerous. Therefore, TPVG liquidity might be adversely affected too.

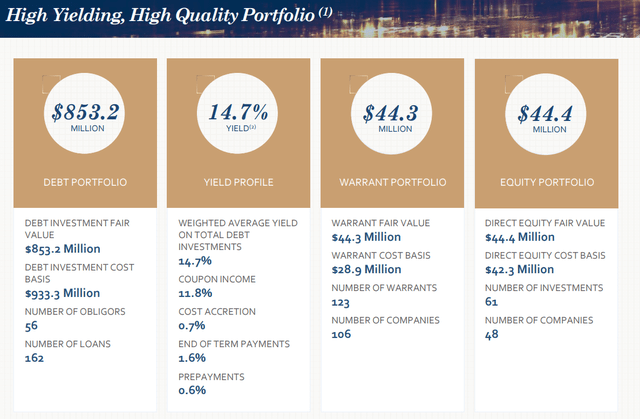

One factor I like about TPVG is the emphasis on debt investments. The desk under exhibits their parameters.

TPVG presentation

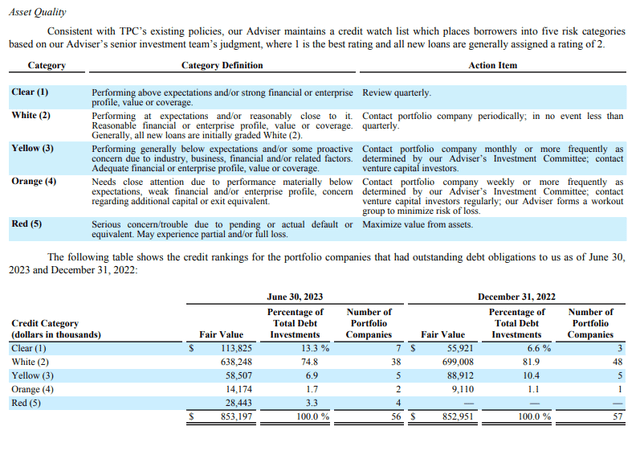

A yield of 14.7 % is a good achievement. Nevertheless, we should take into account the context of coupon earnings, which is 11.8 %. That stated, a part of the corporate’s debt investments are priced under their face worth. The picture under from the final report exhibits the corporate’s portfolio construction by borrower high quality.

TPVG presentation

The commitments are divided into classes by shade. Yellow, orange, and purple are thrilling, adversely affecting the corporate’s portfolio. All three collectively signify 11.7 % of the full. Final quarter, within the purple bucket, we had 4 firms in comparison with zero in December 2022. The variety of firms declined, too, from 57 to 56.

Q2 2023 Outcomes

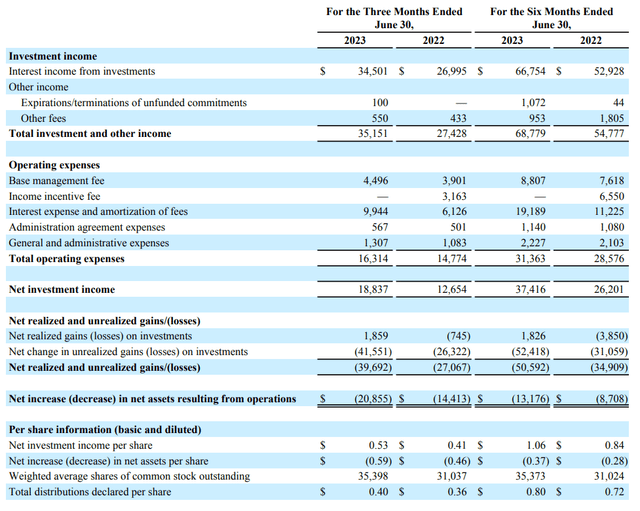

The final quarters have been tough for TPVG. Regardless of rising curiosity earnings, its web realized positive aspects are deeply underwater. As famous above, a few of TPVG`s investments have to be written off, thus inflicting unrealized losses affecting the corporate’s backside line.

Let’s dig deeper into the corporate’s final earnings assertion. The picture under compares TPVG efficiency for 3 and 6 months in 2022 and 2023.

TPVG Q2 2023 report

Curiosity earnings from investments grew together with the corporate’s bills however later at a slower charge. Thus, web funding earnings elevated from $ 12.65 million to $ 18.83 million final quarter. The troubles are arising attributable to rising unrealized positive aspects (losses). As talked about above, the distressed companies are an excessive amount of for my style in TPVG`s portfolio.

Firm Financials

TPVG’s steadiness sheet high quality is satisfactory, other than its investments. The corporate has ample liquidity measured with fast and present ratios. The desk under exhibits some metrics I exploit to estimate the corporate’s steadiness sheet well being. The information is from the final monetary report.

Fast ratio

3.5

Present ratio

4.08

Lengthy-term debt/Fairness

166 %

Complete debt/Fairness

166 %

Complete liabilities/Complete belongings

36 %

Click on to enlarge

The extent of debt isn’t excessive in comparison with its friends, nor the liabilities as a share of whole belongings. That stated, let’s look intimately at TPVG`s funding sources.

TPVG presentation

As seen within the picture above, TPVG issued senior unsecured notes due yearly from 2025 until 2027. The nice factor is the mounted rate of interest gives a cushion in opposition to liquidity troubles. At first look, the dimensions of the debt isn’t overwhelming, and it doesn’t signify a hazard to the corporate’s solvency. Nevertheless, TPVG`s poor efficiency questions its capacity to pay its money owed with out promoting belongings.

TPVG’s profitability metrics give a blended impression.

In search of Alpha

The corporate’s margins are nonetheless good and above TPVG`s five-year common values. Return on Fairness has declined significantly within the final 12 months attributable to unrealized losses.

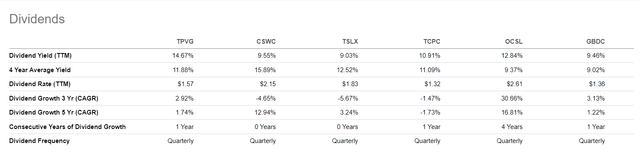

TPVG has been paying dividends. Nevertheless, given the corporate’s outcomes, I hesitate about how sustainable that’s. The picture under exhibits TPVG dividend metrics.

In search of Alpha

Internet funding earnings has been rising within the final quarter. It will cowl the dividend funds for some time, however within the long-term, the corporate’s capacity to distribute dividends stays disputable.

Valuation

To calculate TPVG worth with the Dividend Low cost Mannequin, I’ve to measure the value of the corporate’s fairness and levered beta.

To acquire these numbers, I exploit the next steps and assumptions:

Danger-free charge equals the 5Y common of USA long-term Authorities bond Fee, 2.2%. Progress charge, g, equals the 5Y common of the USA long-term Authorities bond Fee, 2.2%. US’s fairness danger premium is 5.00 %. TPVG’s unlevered Beta 0.96 TPVG Debt/Fairness ratio 100 %. The US’ efficient tax charge is 25 %. TPVG dividend (TTM) $ 1.59 Calculate Levered Beta with the components under:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the low cost charge (low cost charge as the price of fairness) utilizing the ensuing worth for leveraged beta. The components I exploit is:

Value of Fairness = Danger-Free Fee + (Levered Beta * Fairness Danger Premium).

3. Calculate the Terminal Worth of dividends contemplating the Value of Fairness and Anticipated dividend progress:

Terminal Worth = Dividend per share * (1 + anticipated dividend progress) / (Value of Fairness – Anticipated Dividend Progress)

4. Calculate the Current Worth of Terminal Worth assuming a continuing low cost charge for ten years.

For TPVG, I get the next outcomes:

Intrinsic worth per share = $ 21.92

Present Market worth = $ 10.7 on Sept 19, 2023

As seen above, TPVG distributes beneficiant dividends; thus, the corporate is deeply undervalued primarily based on the dividend low cost mannequin. On the present market worth, it gives greater than a 50 % margin of security.

Dangers

Enterprise growth firms are banks for the enterprise capital business. As such, they carry the identical dangers: credit score, liquidity, operational and market danger. TPVG’s steadiness sheet is wholesome, with ample liquidity. However, TPVG’s liquidity danger depends upon its capacity to pay its money owed. As proven, from 2025 until 2026, TPVG senior unsecured notes will mature yearly. TPVG’s deteriorating efficiency will problem its capability to settle its money owed. If the efficiency downtrend persists, TPVG has to chop dividends and new investments or liquidate belongings to satisfy its obligations.

The financial danger within the face of inflation and rates of interest is at all times current. Larger for longer is optimistic for lending companies typically. TPVG’s debt portfolio has nearly 40 % debt with a hard and fast charge. Therefore, increased charges in such instances will dwindle web curiosity margins and the corporate’s backside line.

Market danger is expounded to broad fairness market efficiency. Final 12 months has been profitable for fairness traders regardless of regional banks’ turmoil and rising world uncertainty. The tide lifts all boats, as is the case with TPVG. Its share worth didn’t soar parabolically, however given the corporate’s uncertainties, it ascended by 10% given right this moment’s worth.

Conclusion

TPVG is a below-average BDC firm with a grocery store steadiness sheet, a rising share of distressed investments, and a too-large portion of its debt portfolio that carries mounted curiosity. Rising web funding earnings, beneficiant dividend yield, and 50 % margin of security are usually not sufficient to contemplate TPVG investable. In conclusion, I give TPVG a promote ranking.

[ad_2]

Source link