[ad_1]

izusek

The COVID-19 Funding Thesis Could Already Be Over

We beforehand lined Moderna (NASDAQ:MRNA) in December 2022, discussing its blended prospects because the demand for its COVID choices decelerated from the hyper-pandemic peak.

Whereas the biotech firm would possibly report a strong steadiness sheet and nil debt then, we additionally believed that the inventory is perhaps over-valued with a minimal margin of security for next-decade portfolio development.

For now, MRNA has recorded underwhelming COVID-19 vaccine gross sales of $293M in FQ2’23 (-83.9% QoQ/ -93.5% YoY), naturally impacting its gross margins to -212.5% (-269.9 factors QoQ/ -283.4 YoY) and working margins to -542.7% (-523 factors QoQ/ -594.2 YoY).

Whereas the corporate has but to depend on debt, its money/ short-term investments of $8.45B (-5.2% QoQ/ +7% YoY) seem like inadequate to help the administration’s steering of annual R&D bills at roughly $2.5B by 2027, as a result of impacted profitability so far.

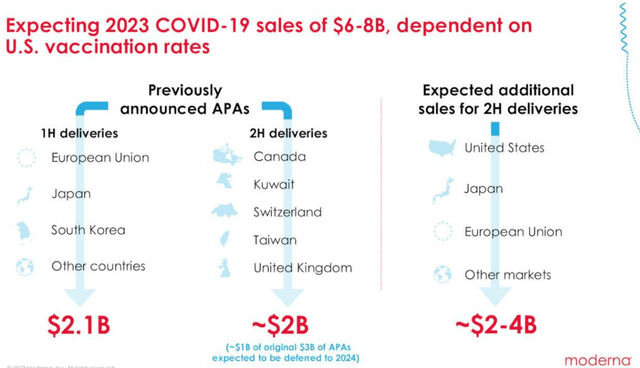

MRNA’s H2’23 Steering

Searching for Alpha

Whereas the MRNA administration has been hopeful of the COVID-pipeline commercialization in H2’23, we desire to order judgement till we really see the beforehand introduced APAs of $2B and as much as $4B in extra gross sales recorded.

The feelings surrounding COVID-19 vaccines seem like pessimistic as properly, primarily based on Pfizer’s (PFE) commentary within the latest JPMorgan US All Stars Convention.

PFE has estimated that solely 24% of the US inhabitants might select to be vaccinated in 2023. This share appears to be overly optimistic, in our view, since solely 17% have opted for booster photographs final yr.

Mixed with MRNA’s alternative of winding down its manufacturing in Switzerland, it seems that the tip of the hyper-pandemic windfall is right here.

MRNA’s Pipeline Is Unlikely To Exchange The COVID-19 Pipeline Anytime Quickly

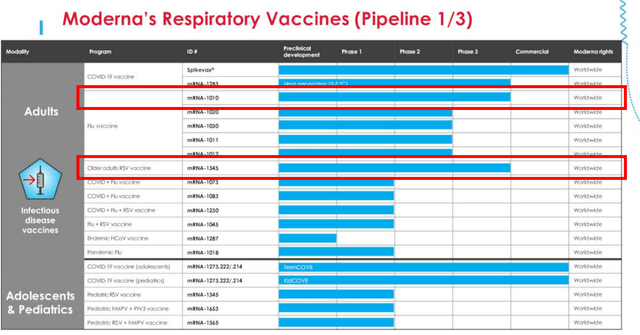

MRNA’s Pipeline Dialogue

Searching for Alpha

If we’re to have a look at MRNA’s first web page of pipeline from the FQ2’23 earnings name, there are two packages already within the Section 3 medical trials, particularly the Flu vaccine and RSV vaccines.

These two packages are a part of the administration’s near-term pipeline projected for FDA approval by 2025, together with the flu-COVID combo vaccine and the following gen COVID vaccine, with a projected respiratory revenues of as much as $15B yearly by 2027.

These numbers appear to be quite aggressive for now, because it suggests MRNA’s market main share within the world respiratory market.

That is primarily based on the administration’s steering of FY2023 COVID pipeline gross sales of as much as $8B, the worldwide flu vaccine market dimension of $7.28B in 2022 (with the potential to develop to $12.4B by 2030, increasing at a CAGR of +6.83%), and the RSV world market dimension of $942.9M in 2022 (increasing to $1.97B by 2030, at a CAGR of +9.7%.)

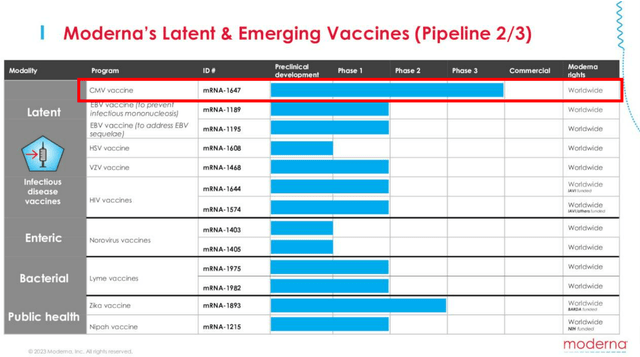

MRNA’s Pipeline Dialogue

Searching for Alpha

If we’re to have a look at its second web page in pipeline, the opposite program at Section 2 is MRNA’s CMV vaccine.

Based mostly on the administration’s commentary within the newest earnings name, they wish to full Section 3 enrollment by the tip of 2023, with medical research more likely to take at the very least one other yr, if lower than 4 years, primarily based on the AbbVie Medical Trials.

Even then, the worldwide CMV remedy is barely value $228.8M in 2022, whereas solely anticipated to develop at a CAGR of +6.1% to $326M by 2028. In consequence, we imagine the CMV vaccine is unlikely to have a big impression on MRNA’s long-term monetary efficiency.

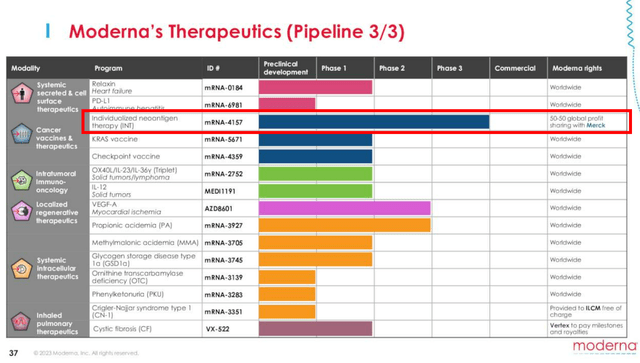

MRNA’s Pipeline Dialogue

Searching for Alpha

If we’re to have a look at its third web page in pipeline, MRNA has partnered with Merck’s Keytruda (MRK) on the mRNA-4157, as an Investigational Personalised mRNA Most cancers Vaccine.

Traders might need to be aware that Keytruda is MRK’s blockbuster most cancers drug with $25.08B in annualized FQ2’23 revenues (+8.2% QoQ/ +19.4% YoY), comprising 41.7% of the top-line (+1.8 factors QoQ/ +5.8 YoY).

With MRNA anticipated to share 50% of the eventual world income with MRK, we may even see its prime and backside strains drastically boosted transferring ahead, doubtlessly exceeding the COVID-19 vaccine windfall.

Sadly, MRNA traders might need to mood their intermediate time period expectations, since newest experiences counsel that the present stage 3 medical trials might solely be accomplished by October 2029.

The identical has been instructed by the administration, with these pipelines more likely to be launched between 2026 and 2028, projected to contribute one other $15B in revenues by then.

Due to this fact, even when profitable FDA commercializations happen, it’s unlikely that we may even see any contribution on its prime and backside strains over the following few years.

Due to this fact, whereas the MRNA administration imagine that they might “launch as much as 15 merchandise within the subsequent 5 years,” within the MRNA R&D Day on September 14, 2023, it’s obvious that its top-line will proceed to undergo by 2024, if not H1’25, with out the advantage of the US FDA Quick Monitor Designation that the earlier COVID vaccine has loved in 2020.

So, Is MRNA Inventory A Purchase, Promote, or Maintain?

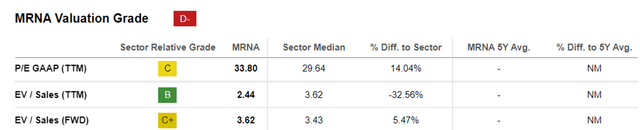

MRNA EV/Gross sales and P/E Valuations

Searching for Alpha

For now, MRNA trades at FWD EV/ Gross sales of three.62x and FWD P/E of -17.42x, in comparison with its TTM valuations of two.44x and 10.66x, respectively.

Then once more, traders might need to be aware that these numbers are topic to vary, each time the biotech firm introduces new pipelines/ obtains new FDA authorizations/ when an M&A occasion happens, particularly since MRNA solely has a profitable commercialized pipeline for COVID-19.

Even so, the trade’s precise success price from medical trials to the eventual approval is barely ~8%, implying {that a} pipeline stays a pipeline till efficacy has been confirmed and FDA authorization has been obtained.

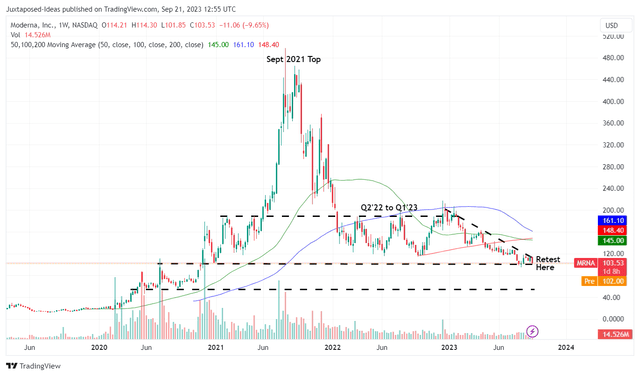

MRNA 5Y Inventory Worth

Buying and selling View

On account of MRNA’s blended prospects over the following few years, we’re not sure whether it is sensible so as to add the inventory right here, particularly with it at present retesting the essential help ranges of $100s.

With the inventory already recording decrease highs and decrease bottoms because the December 2022 prime, we may even see one other retracement to its subsequent help stage of $80s, implying one other draw back of -20% from present ranges.

On account of the potential volatility, we desire to price the MRNA inventory as a Maintain (Impartial) right here. traders might need to observe the state of affairs for somewhat longer.

[ad_2]

Source link