[ad_1]

DieterMeyrl

Thesis

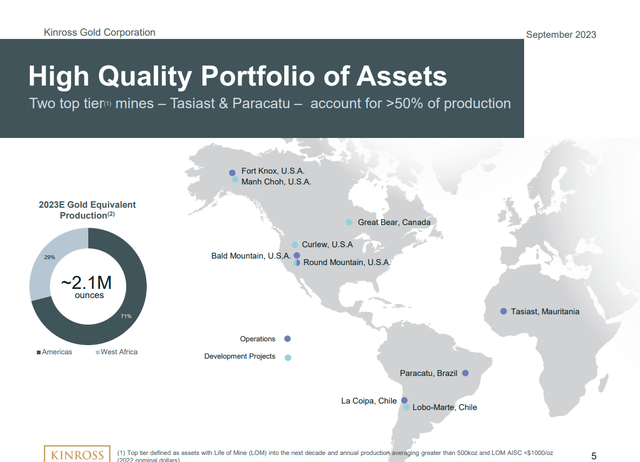

Kinross Gold Company (NYSE:KGC) is a serious gold miner with property in america, Canada, Brazil, Chile, and Mauritania. KGC produces 2 million ouncesof gold yearly from its flagship mines, Tasiast, Paracatu, and La Coipa. Kinross’s venture pipeline has a Manh Choh venture anticipated to return into manufacturing in 1H24 and Nice Bear, which is on the PFS stage.

The corporate has a strong stability sheet with enough liquidity to cowl its debt obligations. In 2025, a big portion of its debt is due, and I don’t anticipate any points given KGC’s improved profitability and enough liquidity. I consider Mr. Market misprices KGS, thus offering a margin of security of 17% even in a conservative state of affairs with the gold spot value at $1500/oz. One pink flag is the excessive acquisition value of the Nice Bear venture. Kinross paid $360/ouncesfor reserves. I hope the Pre-Feasibility Research will validate the venture’s potential, thus justifying the excessive value. Given all of the info, I give Kinross a purchase score.

Firm Overview

Kinross owns a portfolio of high quality property in Brazil, Mauritania, Chile, USA, and Canada. The map beneath from the final firm presentation exhibits the KGS mine areas.

Kinross presentation

The Nice Bear venture in Nice Lake, Canada, is anticipated to enter manufacturing in 2029. I hope the Nice Bear venture will justify its excessive value. The venture has an preliminary indicated useful resource of two.7 million ounces and an inferred useful resource of two.3 million ounces. Kinross paid an early-stage venture value of $1.8 billion or $360/oz. The plans are to succeed in an annual manufacturing of 5 million ounces and broaden its useful resource base to 10 million ounces. Moreover, it’s nonetheless being decided how a lot it can value to place Nice Bear into manufacturing. For a mine of this scale, prices may most likely attain the $2–3 billion degree (maybe larger if inflation stays excessive).

The Manh Choh Challenge in Alaska is 70% owned. All through its roughly 5-year mine life, the mine is predicted to supply 640,000 attributable gold equal ounces. The Fort Knox mill, upgraded to deal with the brand new ore, will course of the Manh Choh ore. Kinross continues to be on the right track to start manufacturing within the second half of 2024 after acquiring essential operational licenses in Could.

Kinross’s flagship producing mines are La Coipa in Chile, Tasiast in Mauretania, and Paracatu in Brazil. The corporate owns three producing mines within the US. Their whole output is 15% of KGC’s annual manufacturing. Tasiast mine is the main asset, with an output of 610 thousand ounces yearly. Respectively, La Coipa brings 240k ounces, and Paracatu 580k ounces.

Q2 Evaluate

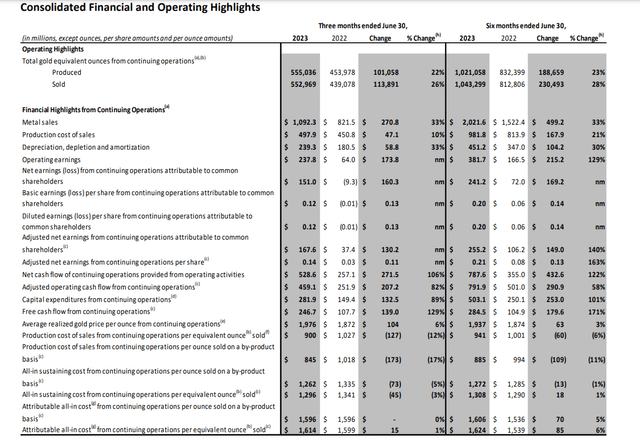

Revenues got here to $1,092.3 million for the second quarter of 2023, and internet earnings got here to $151.0 million. The desk beneath from the 2Q23 monetary report exhibits monetary and operational highlights.

Kinross 2Q23 report

Kinross exceeded expectations, helped by a $100 enhance in common realized gold costs in comparison with the earlier 12 months. Apart from that, a 22% enhance in manufacturing from the prior 12 months and All-in-sustaining prices of $1,296 per ounce contributed to that consequence.

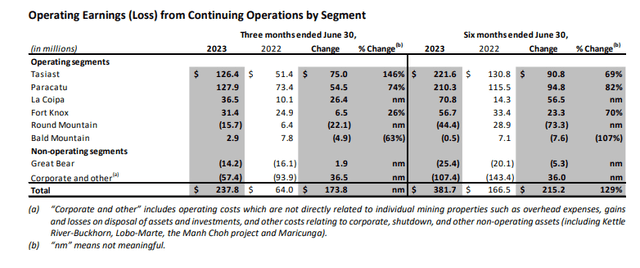

Wanting on the outcomes by mine, Tasiast realized sizable development of operational earnings. The desk beneath exhibits working earnings by mining property.

Kinross 2Q23 report

US mines Bald Mountain and Spherical Mountain have been a drag, with declining earnings at 63% and realized losses, respectively.

Firm Financials

KGC has a neat and clear stability sheet. Its rising manufacturing figures and better gold costs notably improved the corporate’s liquidity and solvency. The desk beneath exhibits the Kinross stability sheet metrics I take advantage of to judge its high quality. The info is taken from the final monetary report.

EBITDA/Curiosity bills

22

EBITDA – CPX/Curiosity bills

5.4

Fast ratio

0.51

Present ratio

1.57

Internet debt/EBITDA

1.38

Internet debt/EBITDA – CPX

4.65

Lengthy-term debt/Fairness

31.0%

Whole debt/Fairness

41%

Whole liabilities/Whole property

73.1%

Click on to enlarge

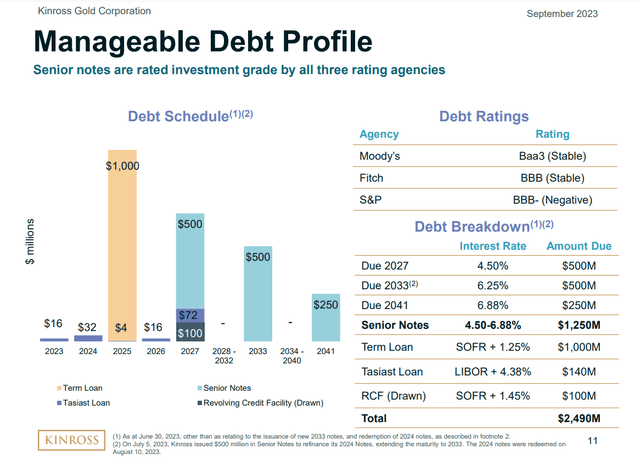

It is price mentioning the corporate’s debt profile. The picture beneath exhibits debt parameters.

Kinross presentation

In 2025, a big portion of the corporate’s debt will mature. I don’t anticipate points repaying that debt as a result of regular manufacturing, steady AISC, and better gold costs for longer. The remaining debt is properly distributed by maturity: $672 million is due in 2027, $500 million in 2023, and $250 million in 2041.

The previous few years have been nice for gold majors regardless of rising inflation, COVID-19, and geological turmoil. Kinross is among the many prime performers among the many massive gamers. The desk beneath exhibits the corporate’s profitability. The info is taken from the 2Q23 monetary report.

FCF/EV

3.6

Gross sales/EV

4.8

FCF Margin

7.5%

Gross Margin

47.4%

ROI

3.84%

ROE

3.22%

Internet earnings per Worker

$21,431

Click on to enlarge

All figures are larger than the business common and KGC’s five-year common. The exception is Internet earnings per worker. In 2022, Kinross realized losses of $642 million because of the divestiture of its Kupol mine. The losses carried over and impacted TTM internet earnings, thus considerably decreasing internet earnings per worker.

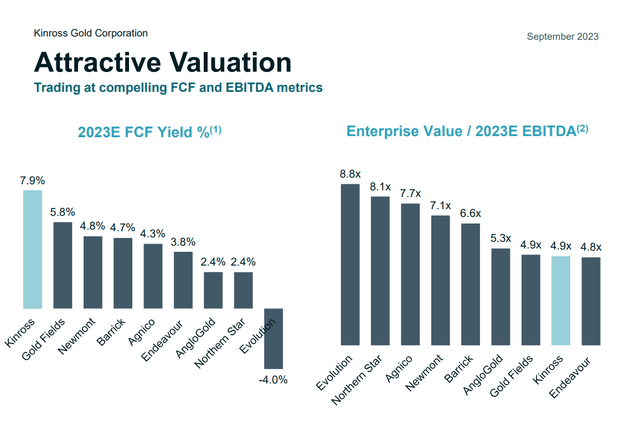

KGC’s FCF yield is larger in contrast with different majors. The picture beneath weighs up KGC’s FCF yield and EV/EBITDA.

Kinross presentation

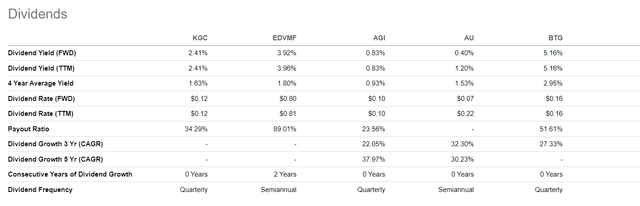

The corporate generates stable cashflows in comparison with different miners and, within the meantime, is cheaper. On prime of that, Kinross pays dividends with enough yield, as seen within the desk beneath.

Looking for Alpha

Valuation

Kinross is a gold miner, and as such, I take advantage of three valuation strategies:

Internet asset worth primarily based on the corporate’s believable reserves, present property, and whole liabilities. Typical comparability primarily based on EV/Gross sales and Value/Money Circulation. Miners particular evaluation weighting up EV to Annual manufacturing, EV to Believable reserves, Believable reserves to Totally diluted shares.

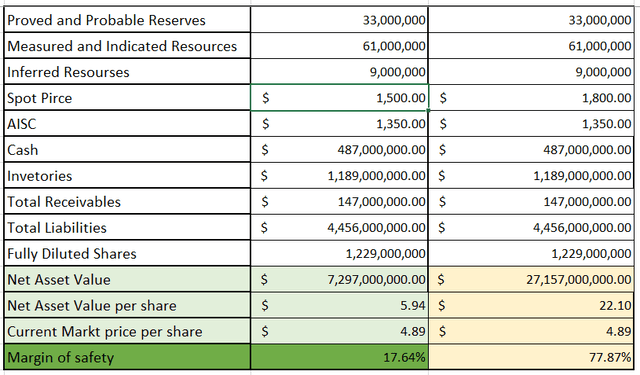

I calculate internet property as follows:

NAV = PR*(SP-AISC) + money + inventories + whole receivables – whole liabilities

PR (believable reserves) = 100% * P&P Reserves + 50%*M&I Sources + 30%*Inferred Sources

Writer`s database

I examined two situations. One conservative with spot gold $1500/oz. The opposite is the bottom state of affairs utilizing the $1800/ouncesvalue.

Conservative NAV per share = $ 5.94

Base NAV per share = $ 22.10

Present Market Value = $ 4.89

Even utilizing $1500/ouncesgives an enough margin of security at 17.6%. Nevertheless, utilizing base case figures, KGC’s margin of security strikes to 80%.

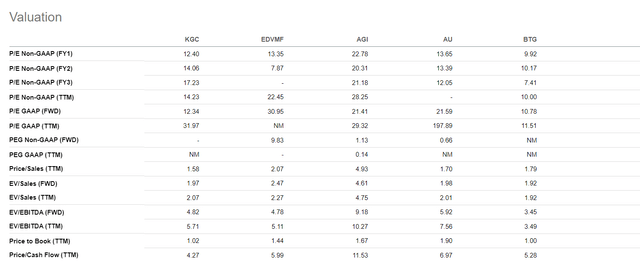

The picture beneath compares Kinross with the next firms:

Endeavour Mining (OTCQX:EDVMF) Alamos Gold (AGI) AngloGold Ashanti (AU) B2Gold (BTG)

Looking for Alpha

Evaluating KGC to different main miners utilizing EV/Gross sales and Value/Money Circulation it seems cheaper, too. Even missed miners with property concentrated within the Sahel area, like Endeavour, command excessive multiples.

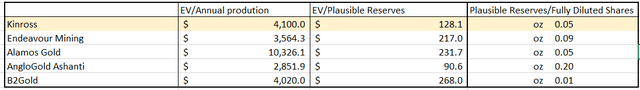

Final however not least is to check Kinross primarily based on EV/annual manufacturing, EV/Believable reserves, and Believable reserves/Totally diluted shares.

Writer`s database

EV/Annual manufacturing illustrates how a lot we pay per ounce of annual output. Kinross, with $4100/oz, holds the center floor. Nevertheless, measured by EV/Believable reserves, KGC is the second least expensive to AngloGold. Shopping for KGC and masking its debt obligations, we pay $128/oz. For AGI, EDV, and BTG, we’ve got greater than $200/oz.

Sensitivity to the gold value is measured with Reserves to shares a number of. The upper the ratio, the higher. Proudly owning one KGC share means holding 0.05 ounces of gold. In comparison with its friends, it’s beneath the imply worth.

Threat

The mining enterprise carries monumental dangers. On prime of that, they differ considerably by the measures required to mitigate them. Kinross had a high-risk profile with its Russian and Mauritanian property. The divestiture of Kupol Mine considerably diminished the political threat. Tasiast mine is the asset with the best nation threat as a result of its location in West Africa. Mauritania is without doubt one of the international locations within the Sahel area with the bottom financial, political, and social metrics. Apart from that, Tasiast brings greater than 25% of KGC’s annual manufacturing. KGC’s different property are properly distributed throughout mining-friendly jurisdictions similar to Brazil, USA, and Chile.

Financially, Kinross has stable standing. Whatever the difficulties in 2022, the corporate maintains a strong stability sheet. In 2025, KGC should pay a $1 billion time period mortgage. Contemplating KGC’s enhancing profitability, I don’t anticipate any problems.

The metallurgical and geological dangers are all the time current however tough to evaluate. The corporate’s producing property are well-known parameters. Nevertheless, the Manh Choh and Nice Bear carry some dangers. The previous is predicted to enter manufacturing 1H24, although the latter is within the early validation stage as a viable venture.

The market threat was an element impacting gold miners’ share costs negatively. Regardless of that, Kinross has been a standout performer amongst its friends this 12 months. Its shares have elevated by about 18%, considerably outpacing the VanEck Junior Miners Index (GDXJ) and the VanEck Gold Miners Index (GDX).

Conclusion

Kinross is a high quality mining firm with a well-diversified portfolio and sturdy stability sheet. KGC has two tasks in its pipeline. The Nice Bear venture has to show it’s price its steep value at $360/oz. I hope the Pre-Feasibility Research will validate the venture’s potential, thus justifying the excessive value. Mahn Choh in Alaska is predicted to return into manufacturing subsequent 12 months. Mr. Market misprices KGS, thus offering a margin of security at 17% even in a conservative state of affairs with the gold spot value at $1500/oz. Given all of the info, I give Kinross a purchase score.

[ad_2]

Source link