[ad_1]

Mohammed Haneefa Nizamudeen

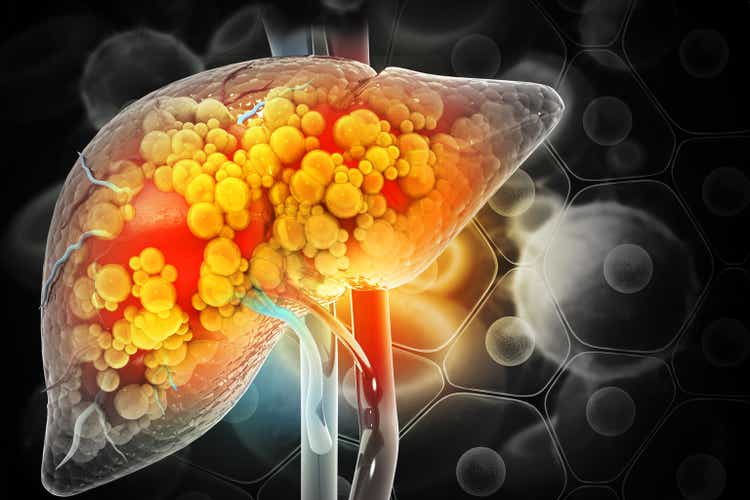

After the

failure of Intercept Prescribed drugs’ (ICPT) Ocaliva (obeticolic acid) for nonalcoholic steatohepatitis (NASH) in June, the corporate was destined to be acquired.

GlobalData argues that with out some other late-stage candidates in its pipeline and with its share value dropping precipitously, an acquisition was the most effective — and maybe solely — possibility for Intercept (NASDAQ:ICPT).

Whereas Ocaliva is authorised for main biliary cholangitis, that market is tiny in comparison with the one for NASH. GlobalData initiatives 600K complete instances of PBC in main markets in 2027.

The information and evaluation agency mentioned that the market measurement for NASH is projected to surpass $25B by 2029. “In consequence, Intercept’s future was predicated on its potential in NASH,” mentioned GlobalData Pharma Analyst Jay Patel.

He added that Intercept’s (ICPT) incapacity to develop into a pacesetter in NASH prevented it from changing into a bigger pharma firm. The Ocaliva failure in NASH led to a plunge within the firm’s inventory value, making it fund different packages.

Patel famous that Intercept’s (ICPT) pipeline, resembling INT-787, a Section IIa asset for for extreme alcohol-associated hepatitis, enhances Alfasigma’s concentrate on metabolic and gastroenterological ailments.

The Italian pharma markets Xifaxan (rifaximin) for decreasing the chance of overt hepatic encephalopathy and irritable bowel syndrome with diarrhea, in addition to Carnitene (L-carnitine) for carnitine deficiency in sufferers with finish stage renal illness.

[ad_2]

Source link