[ad_1]

MicroStockHub

Following the summer time rally, the market has been on a gradual decline in current weeks. Good points are displaying indicators of fast unwinding after Fed Chair Jerome Powell reiterated policymakers’ help for “larger for longer” charges to tame inflation. The tempo of value will increase have remained stubbornly above the two% goal vary regardless of the current development decrease. And there are nonetheless a myriad of things – significantly the resilient labour market – on the market that stay an lively menace to holding inflation in test.

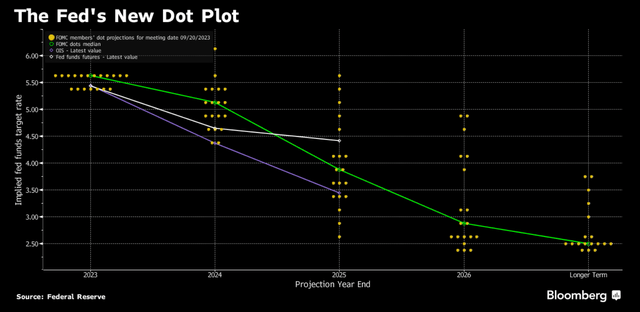

The newest Fed dot plot exhibits help for the Fed Funds price to hit the 5.50% to five.75% vary by year-end, implying one other 25 bps enhance at both the upcoming November or December coverage assembly. Price reduce expectations for 2024 have additionally tempered, with policymakers’ newest projection implying a benchmark price at 5.1% by the top of subsequent 12 months, which is about 50 bps larger than the 4.6% final projected in June.

Bloomberg Information

In the meantime, the economic system has withstood essentially the most aggressive cycle of price hikes in a long time higher than anticipated – each client spending and the labour market have been resilient, incentivizing an upward revision to the 2023 financial development projection from 1% in June to 2.1%, with the anticipated unemployment price tweaked decrease from 4.5% to 4.1%. Though information suggests a soft-landing is feasible, Chair Powell has denied such a situation because the “baseline” and reiterated the Fed’s stance to maintain financial coverage in restrictive territory for longer.

The remarks have taken the long-end Treasury yield above a 16-year excessive in current weeks, whereas fairness efficiency has additionally been shedding floor. Though bonds have been pricing within the new regular of restrictive financial coverage for some time now, fairness valuations seem to solely now be catching up. We see a number of dangers which are quickly brewing into actuality, which may counsel a sustained downtrend within the S&P (SP500/NYSEARCA:SPY) and Nasdaq (NDX/QQQ) valuations from present ranges.

2% Inflation Goal At Danger of Derailment

Inflation has proven indicators of softening over the summer time, however dangers of a reacceleration are nonetheless working excessive. That is corroborated by August figures that got here in stronger than anticipated, with each core and headline inflation working scorching on the resurgence of vitality prices and stubbornly excessive shelter prices.

Particularly, oil costs have “climbed almost $25 from their summer time lows”, representing 30% beneficial properties over the previous quarter and buying and selling comfortably above the $90 vary. Whereas oil costs have largely been pushed by weak sentiment through the first half of the 12 months, primarily influenced by fears of weakening demand as a consequence of China’s deteriorating economic system which have overshadowed OPEC+ provide curbs, the fact of tightening provides is settling in. And that is mirrored within the current surge in gasoline costs, which contributed to greater than half of August’s month-to-month value enhance. In the meantime, the outlook on meals costs additionally stays blended, as the mix of rising vitality and labour prices alongside shortages in American cattle and varied crops as a consequence of excessive climate stay headwinds. Taken collectively, each core and non-core costs proceed to face distinguished dangers of resurgence, underscoring August’s figures could also be a warning signal.

With inflation nonetheless working scorching, the upper for longer narrative is more likely to settle in as the brand new regular. We concern that this set-up could also be ushering in essentially the most opposed implication attainable – the Fed might cease pursuing a goldilocks soft-landing situation and go for a compelled correction of the economic system, because the scenario turns into more and more politically-driven. And Chair Powell’s current rejection of the financial gentle touchdown as a baseline situation is corroborative of this danger. The upper for longer price atmosphere has pushed Treasury yields towards an all-time excessive. 10-year Treasury yields have quickly surged past the 4.6% vary, whereas the five-year is approaching 4.7%. In the meantime, the rate-sensitive two-year yield has skilled a comparatively gradual uptrend, reaching about 5.1%.

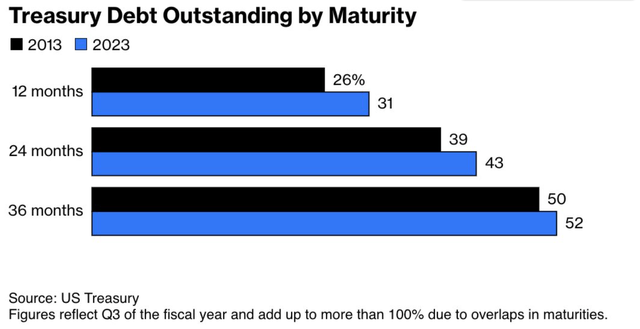

At these ranges, the federal government faces acute monetary stress to funding operations. For context, almost a 3rd of whole U.S. authorities debt excellent is ready to hit maturity inside the subsequent 12 months, with greater than a half set to mature over the subsequent three years.

U.S. Treasury

This underscores the huge refinancing wanted over the foreseeable future, and extra importantly, the federal government’s publicity to influence from an opposed price atmosphere. The fee on associated debt has already surged from 1.5% from when it was final financed, to now 3.0%. And the doubling price is poised to climb additional in tandem with rising rates of interest, underscoring quarterly curiosity expense funds past the present all-time excessive of $1 trillion very quickly.

The ever-increasing federal debt burden, coupled with rising debt service prices implies the potential for tax will increase, which may adversely influence the economic system additional as still-hot inflation and tightening monetary circumstances run concurrently within the background. Extra importantly, the mix might be opposed to the Biden administration’s outlook on extending its time period heading into the 2024 re-election. To stop this unfavourable combine, Chair Powell and Co. might must tighten credit score circumstances additional to manually orchestrate the slowdown wanted to place the economic system into correction, placing circumstances for a gentle touchdown additional out of attain.

Including stress to this dire set-up is the mechanics of leveraged price funds which have been growing their brief wagers on Treasury main as much as the September FOMC assembly. The web-short positions on Treasuries futures held by leveraged funds reached their highest ranges in additional than a decade in August, incentivized by persistent financial challenges spanning “inflation, tight labour market and the hawkish Fed”. The web keep it up money Treasury and futures costs might have additionally incentivized the build-up of bearish bets. Nonetheless, the current surge in yields may doubtlessly result in an unwind of this net-short positioning, and stress bonds’ efficiency additional by creating shock waves that can ripple all through the market. The unpredictably elevated nature of long-end Treasury yields is corroborated by the normalization of the five- and 30-year Treasury yield curve final week – a 12 months after the curve’s inversion reached its highest in additional than a decade.

…a big however orderly unwinding of hedge funds’ positions in Treasuries may push yields larger relative to different fixed-income devices…

Supply: Reuters

Lofty Fairness Valuation Premiums

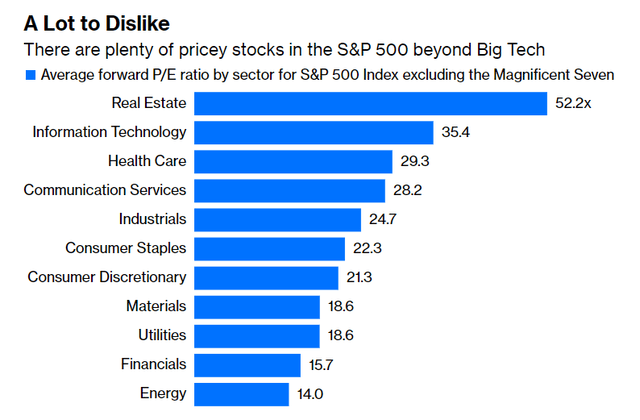

Along with persistent inflation and tightening monetary circumstances, the overvalued nature of fairness valuations at present ranges is what greenlights the approaching danger of a broader market crash. Previous to the onset of the late September market droop, the S&P 500 had been buying and selling at a file excessive of virtually 30x ahead earnings, representing a wealthy valuation premium to 10-year common of about 23x. A lot of this uptrend had been buoyed by the market’s frenzy for AI, with the Magnificent Seven shares – specifically, Apple (AAPL), Amazon (AMZN), Google (GOOG / GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA) – buying and selling at a median ahead P/E of greater than 40x and accounting for a few third of the S&P 500 index’s efficiency. However the S&P 500, ex-Magnificent Seven, shouldn’t be low cost both – it presently trades at about 24x estimated earnings, and nonetheless exceeds the 10-year common of about 21x on the normalized gauge. The resurgence of tech valuations is corroborated by the Nasdaq 100’s lofty premium built-up this 12 months – the tech-heavy index is presently buying and selling at greater than 30x estimated earnings, far exceeding its historic common of about 23x.

Bloomberg Information

Though long-end Treasury yields have lengthy been pushing new highs for the reason that onset of the most recent price hike cycle, which have been opposed to development valuations underpinned by money flows additional out sooner or later, the market’s rally this 12 months has largely defied these challenges most prominently noticed throughout 2022. Markets had possible been pricing in expectations for an eventual normalization within the price atmosphere through the first half of the 12 months, as enhancing inflationary pressures harbinger the approaching unwinding of financial coverage tightening. That is supported by observations of traditionally low fairness danger premium priced into market valuations.

Recall that the ERP measures the distinction between returns on equities versus the risk-free price of return on Treasury. The yield on short-end Treasury payments had persistently exceeded the typical return on fairness as measured by the inverse of the S&P 500 P/E ratio through the first half of the 12 months – a primary since 2000 – possible on the again of expectations for elevated visibility on an eventual trajectory again in direction of financial coverage easing. Even with the current droop in inventory valuations, the shut to five.5% yield on three-month T-bills nonetheless exceeds the typical 4.2% return on equities computed on the inverse of S&P 500 ex-Magnificent Seven P/E ratio of about 24x, regardless of the latter’s larger danger publicity.

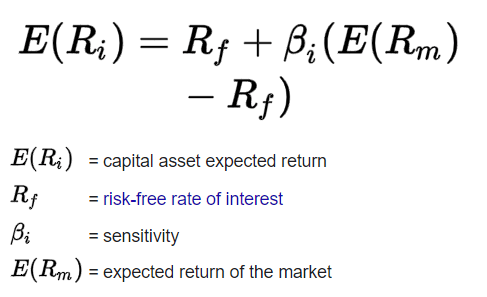

This means that the market’s newest declines following the Fed’s reaffirmation on a better for longer price actuality is a mirrored image of swift changes to the ERP. Whereas valuations haven’t budged within the face of continued price hikes through the first half of 2023, they may very effectively begin to because the potential of a gentle touchdown and eventual coverage easing are pushed again till additional discover. Recall the CAPM mannequin, which dictates the price of fairness primarily based on each the inventory and broader market’s danger profile. The price of fairness is computed because the risk-free price plus the fairness beta multiplied by the ERP.

CAPM Mannequin

The price of fairness is usually extra delicate to modifications within the ERP than the risk-free price itself. As markets are more likely to upwardly alter the ERP in response to the brand new regular of upper for longer rates of interest, the low cost issue on future money flows accordingly will increase, risking an additional decline in fairness valuations from present ranges.

Presently lofty market valuations additionally face brewing weak point amongst monetary names. Whereas market sentiment has normalized for the reason that slew of regional financial institution failures in March, it doesn’t materially change the fact that an elevated price atmosphere doesn’t bode effectively for the monetary sector. Increased charges basically imply larger borrowing prices, and narrowing web curiosity margins for the banks. Clients will proceed to be incentivized to rotate their deposits into higher-yielding merchandise and accounts, impacting the provision of low-cost funding for banks to service its lending operations and, inadvertently, pressuring web curiosity earnings. In the meantime, borrowing will possible stay weak within the face of an elevated price atmosphere as dwelling consumers and traders keep danger averse, which can hamper banks’ earnings additional.

Whereas each regulators and banks have bolstered capital buffer necessities to raised “deal with a extreme financial shock”, particularly following the slew of financial institution failures earlier this 12 months, the sector’s publicity to weak point persists amid the elevated price atmosphere. As Treasury yields proceed to rise, the worth of long-term notes held by banks diminishes. Whereas a lot of those losses keep unreported on P&L, as banks stash the holdings away as “obtainable on the market securities” with their unrealized beneficial properties / losses flowing by AOCI, the diminishing worth of bond belongings impacts banks’ degree of fairness on the stability sheet. The common capital requirement – or CET1 ratio – for big banks presently common 8.95%, which means that for each $10 the financial institution lends, it should have no less than $0.895 of capital in reserve. This additionally signifies that banks usually function at about 10x leverage, which exposes them to dangers of a major fairness worth correction within the occasion of fabric depreciation to asset worth – a case confirmed within the failures of Silvergate Financial institution, Silicon Valley Financial institution, Signature Financial institution, and First Republic Financial institution.

Taken collectively, the window of weak point on equities is quickly increasing at present ranges. The sturdiness of present valuation premiums have gotten more and more in danger, given weak point in underlying fundamentals amid the elevated price atmosphere.

Different Danger Concerns

Along with persistent inflation, larger for longer rates of interest, and lofty fairness valuations, there’s additionally a broadening portfolio of different shifting items indicative of additional market weak point to come back:

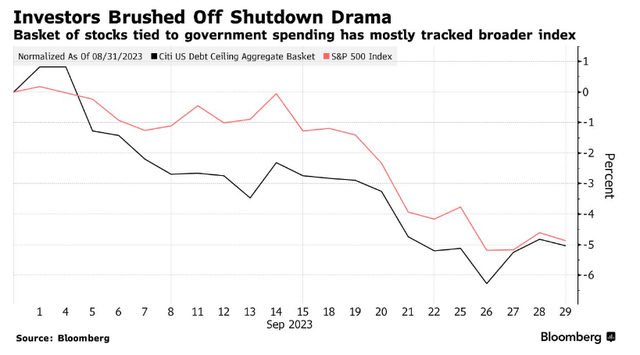

Authorities shutdown: The U.S. authorities has narrowly dodged a shutdown this weekend with the settlement on a 45-day extension for ongoing negotiations concerning long-term funding. However this doesn’t eradicate the approaching danger of a possible no-deal, which may deliver on opposed implications for fairness valuations.

The market has traditionally rallied upon the top of a authorities shutdown/averted shutdown. This was additionally the case earlier this 12 months, when the federal government had averted a shutdown (and potential monetary disaster) after an settlement to droop the U.S. debt ceiling. Nonetheless, the growing frequency of presidency shutdown dangers (two occasions this 12 months) amidst an inflationary atmosphere and tightening monetary circumstances is unprecedented. That is in keeping with the market’s modest response to the most recent danger of a authorities shutdown – a lot of the current market draw back realized have been possible attributable to the fact of a better rate of interest atmosphere settling in, which signifies that the averted shutdown is unlikely to be a “large supply of upside” within the near-term.

Bloomberg Information

However the mire of political drama is more likely to additional dampen confidence within the U.S. authorities’s skill to navigate the economic system again to well being. Present fashions estimate a 0.2 proportion level headwind to annualized GDP development for every week of presidency shutdown that would doubtlessly happen within the fourth quarter if the 45-day deadlock ends with no-deal. An additional extension may additionally “impede the Fed’s efforts to quell inflation”, risking a reversal of current progress made.

De-risking VIX: The VIX, which measures inventory market volatility expectations, additionally stays dampened at sub-20 ranges contemplating the present market danger profile. Underneath the Rule of 16, which divides the present VIX by 16 to gauge the implied inventory market motion, present choices pricing suggests a ~1% day by day motion within the S&P 500. We don’t suppose this has sufficiently de-risked for impending market dangers.

As an alternative, the modest VIX is probably going underpriced for the present market danger profile set-up as a result of provide and demand mechanics in choices markets, influenced primarily by structured product funds. Particularly, choices promoting for passive earnings at a few of these funds could also be weighing on the VIX, ensuing within the gauge’s insufficient reflection of pent-up inventory market volatility, which dangers changing into an ignored issue.

One other implied danger to think about is the historic hyperlink between month-end choices expiry (“mopex”) that occurs on the third Friday of every month, and an fairness market collapse. The onset of the fairness market collapse noticed in February 2020 had coincided with mopex on February 21. This eerily resembles the most recent inventory droop, which started the third Friday of September, in keeping with the most recent mopex.

Weakening client spending backdrop: The narrative on weakening consumption amid inflationary pressures and an elevated borrowing price atmosphere has been brewing for greater than a 12 months. But company earnings have largely stayed resilient, main markets to ponder if related dangers have already been priced into present market valuations.

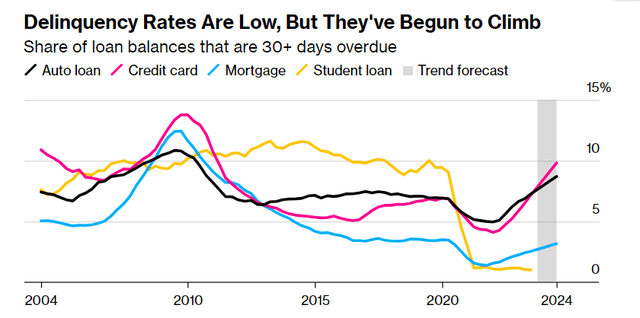

The resilient labour market amid the most recent cycle of financial coverage tightening has been a major counteractive drive to the opposed mixture of dwindling pandemic-era financial savings and protracted inflation. However this final lever is probably going going to provide quickly. Bank card delinquencies are surging above pre-pandemic ranges, whereas the resumption of pupil mortgage repayments this month is more likely to weigh on family budgets additional. Particularly, reducing out room in budgets for pupil mortgage repayments is anticipated to displace $100 billion in annual discretionary spending and influence GDP development by 0.1% this 12 months and 0.3% subsequent 12 months.

Bloomberg Information

Sadly, the added burden on client budgets additionally coincides with the timeline of which the lagging financial coverage impact on labour markets is because of materialize. Totally different elements of the economic system have totally different sensitivities to financial coverage tightening. And for the labour markets, which has been resilient by all of it to date, usually begins to really feel the influence of financial tightening on the 18- to 24-month mark. Which means the “full drive” of the 0% to five.5% price hikes applied since March 2022 are about to be felt by the labour market from right here on out, doubtlessly eradicating a key supply of energy that has been holding the economic system afloat to date. With no less than another price hike within the books, the influence of weakening client spending would possibly lastly be beginning to hit the underlying fundamentals crucial to supporting the market’s lofty valuation premiums at present ranges.

The Backside Line

Whereas 2023 has largely defied the market’s pessimism and turned out to be a great 12 months for equities to date, vulnerabilities to a violent downturn stay shut. The mix of Fed hawkishness, political motives, weakening financial fundamentals and a possible earnings recession may danger sending new shock waves to the broader markets, placing the case for a gentle touchdown additional out of attain. The set-up is changing into more and more unfavourable to the sturdiness of fairness valuation premiums at present ranges, driving up dangers that the most recent uptrend is likely to be lastly working out of steam.

[ad_2]

Source link