[ad_1]

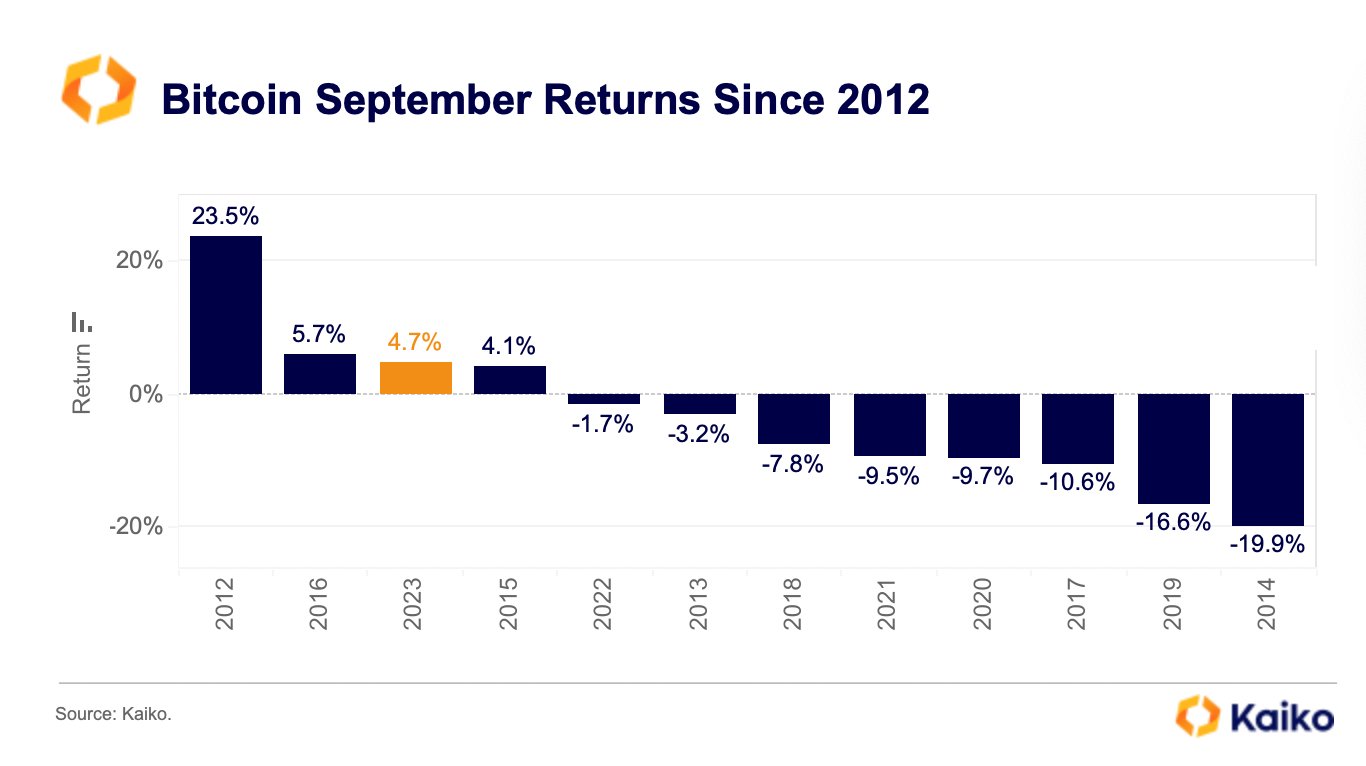

Regardless of falling record-high rates of interest in the USA, Europe, and the U.Okay., Bitcoin was comparatively regular in September and added 4.7%. At this tempo, the coin posted one of many strongest performances since 2012 and 2016, when BTC rose 23.5% and 5.7%, respectively.

Bitcoin Rose In September Regardless of Enticing Curiosity Charges

Buying and selling at across the $27,300 zone when writing on October 3, Bitcoin is up roughly 10% from September lows, and merchants are assured that the following leg of upper highs has simply begun, contemplating the robust upswing in late September, which was confirmed in early October, translating to a robust begin for This fall 2023.

In response to Kaiko, Bitcoin is “agency” regardless that fund charges are comparatively excessive and conservative traders, together with establishments, are drawn by governments providing what the analytics platform says is a “risk-free” yield. For perspective, the USA authorities raised charges quickly all through 2022 and the primary half of 2023 to curb surging inflation.

With each foundation level elevated, regional banks had been strained, with some submitting for chapter in Q1 2023. Furthermore, capital, which might in any other case circulation to crypto, is re-directed to the bond and treasuries market due to the commonly excessive however secure rates of interest.

As of October 3, the U.S. Federal Reserve maintained rates of interest between 5% and 5.25%. Then again, inflation rose to three.7% in August after falling steadily after peaking at 8.2% in September 2022–the very best in roughly 30 years.

Ideally, the Federal Reserve plans to take care of inflation at across the 2% benchmark. As such, with rising inflation, the chances of Jerome Powell, the chair of the Federal Reserve, growing charges within the subsequent assembly stay excessive, a transfer that may considerably affect crypto liquidity and costs of prime cash, together with Bitcoin.

In 2022, when the Federal Reserve raised charges, Bitcoin costs tumbled from 2021 highs, sinking under $16,000 in November 2022. Dropping crypto costs adversely affected crypto platforms as prime exchanges, together with FTX, filed for chapter.

Fitch Downgrades U.S. Treasuries

U.S. treasuries are sometimes thought of risk-free and secure as a result of the federal government’s credit score backs them. Because of this the federal government is dedicated to paying again the debt and its yield well timed and in full. The U.S. authorities has not didn’t repay its debt to date.

Final August, Fitch Scores lowered the credit standing of the U.S. authorities from AAA to AA+. The rankings company predicted that the scenario would worsen over the following three years. Fitch additionally expressed concern concerning the deteriorating governance associated to fiscal and debt issues over the previous few many years.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link