[ad_1]

peepo/E+ through Getty Photos

A few of the finest investments within the inventory market present buyers with a number of alternatives to purchase on main dips earlier than making giant runs. Joby Aviation, Inc. (NYSE:JOBY) is a type of eventualities, with the inventory of the electrical vertical take-off and touchdown (eVTOL) producer collapsing practically 50% because the June surge regardless of a number of optimistic developments. My funding thesis stays extremely Bullish on JOBY inventory, particularly down right here at $6.

Supply: Finviz

Constructive Developments

Simply yesterday, Joby Aviation introduced the corporate has began flight exams with pilots on board. The corporate is making step after step in the direction of final FAA certification.

Joby now has pilots testing plane at each their manufacturing facility in California and at Edwards Air Power Base. Each Joby pilots and U.S. Air Power pilots are testing the plane after the corporate delivered the primary eVTOL to the U.S. Air Power about 6 months forward of plans for a supply in early 2024, as a part of the $131 million contract.

Supply: Joby Aviation Twitter/X

One other main improvement was introduced a number of weeks again, the plans to develop a manufacturing facility in Dayton, Ohio able to producing 500 plane per yr. Joby will make investments as much as $500 million within the facility, with plans for plane from the power to be a part of the aerial ride-sharing community to be launched in 2025.

One other Dip

Joby continues to make nice progress in the direction of the plan for plane certification in 2024. Regardless of the optimistic information within the final couple of months, the inventory has fallen practically 50% from the highs again to $6.

All of the optimistic developments in the previous couple of weeks ought to solely reinforce the trail to commercialization. Lots may nonetheless go unsuitable with FAA certification, however Joby Aviation seems far nearer to the query of “when” and now not “if” it involves certifying an eVTOL.

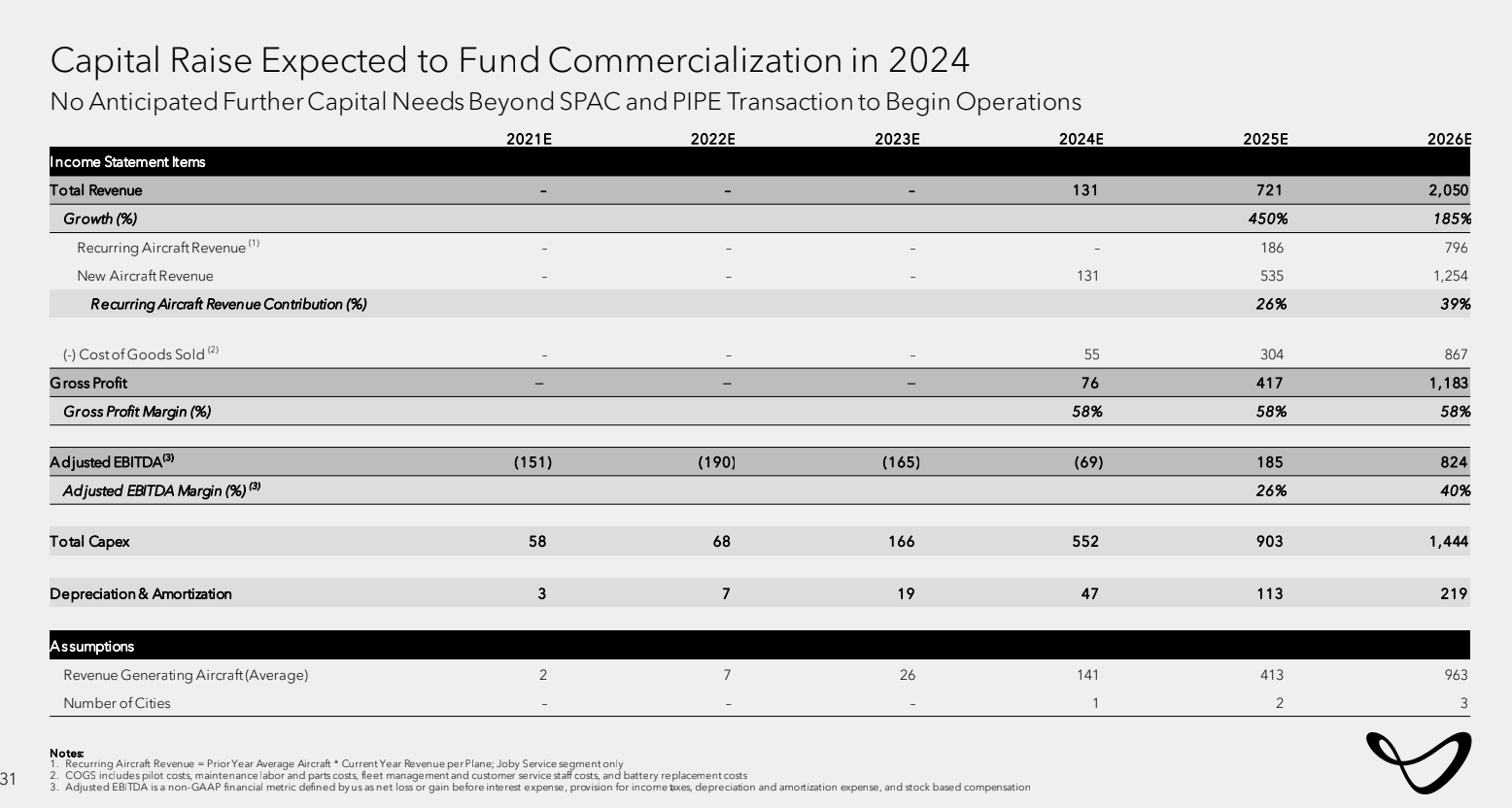

Lots remains to be unknown in regards to the expectations for the income stream, with no main updates because the SPAC deal announcement. The consensus income targets have dipped to minimal expectations, most likely not in step with the progress Joby has made throughout 2023 to stay near the unique targets.

Supply: In search of Alpha

Analysts now solely forecast Joby to ship $84 million in revenues throughout 2025, whereas the corporate is constructing a manufacturing facility able to 500 plane following certification in 2024. The corporate would seem able to far increased gross sales within the subsequent couple of years, particularly contemplating the U.S. Air Power contract has a worth of $131 million.

The inventory doubtless makes one other run, because the administration staff will more and more begin shifting in the direction of discussing the income upside from plane certification and manufacturing in Dayton. Joby Aviation solely seems barely behind its unique targets of getting revenue-generating plane in 2024 through 1 metropolis for a ride-sharing service. The corporate did not forecast materials revenues till 2025, with nearly all of the revenues truly coming from producing over $500 million from promoting new plane.

Supply: Joby Aviation SPAC presentation

The unique plan is barely complicated because the great amount of revenue-generating plane listed for 2024 do not truly generate revenues. Joby Aviation nonetheless seems on the trail to launching the ride-share service in 2025 when the corporate initially forecasted, producing $186 million in revenues from this service with simply 2 cities launched.

Joby Aviation has introduced plans to function air taxi companies for Delta Air Strains (DAL) after an funding by the massive airline. The eVTOL producer seems extra targeted on working a ride-sharing service over promoting plane now.

The inventory has a market cap of simply $4.3 billion. The odd half right here is that Joby has fallen practically 40% because the SPAC deal, but the corporate already has a working eVTOL with the U.S. Air Power and several other years of stable progress have handed since going public through the SPAC.

The corporate ended the final quarter with over $1.2 billion in funds to construct the enterprise making Joby Aviation one of many higher capitalized gamers within the eVTOL house. The eVTOL producer produced an adjusted EBITDA loss again in Q2 2023 of $83 million whereas remaining on the trail to spending $360 to $380 million this yr on working actions and gear purchases.

Takeaway

The important thing investor takeaway is that the income timeline nonetheless stays cloudy, however the enterprise stays one the place Joby Aviation, Inc. probably begins producing billions of {dollars} in annual revenues at scale. The inventory valuation stays engaging right here on dips as the corporate builds a world plane manufacturing and ride-sharing service.

[ad_2]

Source link