[ad_1]

Large Dividends PLUS, Blue Harbinger imagedepotpro/iStock by way of Getty Photos

The BlackRock Well being Sciences Time period Belief (NYSE:BMEZ) is a closed-end fund (“CEF”) that not too long ago introduced a distribution reduce, and now trades at an normally massive low cost to Web Asset Worth (“NAV”). We evaluate the fund and provide our opinion on investing on this big-yield contrarian alternative.

BlackRock

Overview (BMEZ):

For starters, right here is the BMEZ funding method, based on the BlackRock web site:

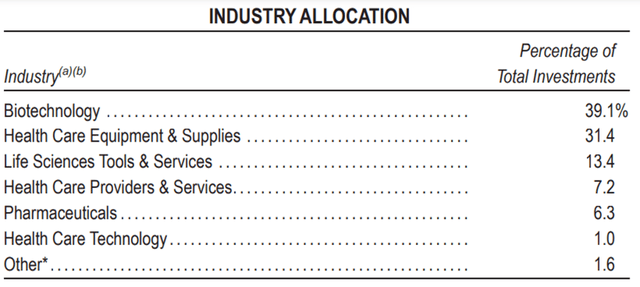

BlackRock Well being Sciences Time period Belief’s (BMEZ) (the “Belief”) funding goal is to offer whole return and revenue by means of a mixture of present revenue, present beneficial properties and long-term capital appreciation. Underneath regular market circumstances, the Belief will make investments at the least 80% of its whole property in fairness securities of firms principally engaged within the well being sciences group of industries and fairness derivatives with publicity to the well being sciences group of industries. The Belief makes use of an possibility writing (promoting) technique in an effort to generate present beneficial properties from choices premiums and to reinforce the Belief’s risk-adjusted returns.

That’s loads to soak up, so let’s break it down into the next key factors:

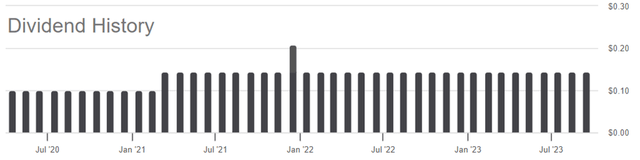

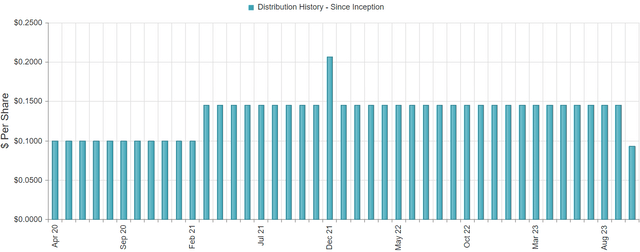

1. BMEZ seeks present revenue and long-term capital appreciation. To this point, the present revenue half has arguably labored out (extra on this later) because the fund’s inception in 2020, as you’ll be able to see within the following chart (word these are literally distributions, not dividends). Nonetheless, a latest distribution reduce announcement was made (extra on this momentarily).

Searching for Alpha

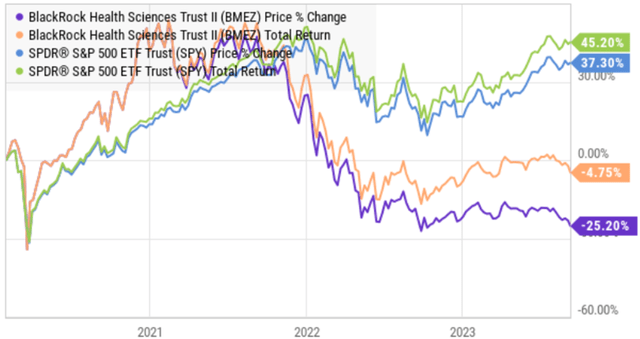

Additional, the long-term capital appreciation half hasn’t labored out to date, as you’ll be able to see the weak efficiency since inception on this subsequent chart (whole return is the worth return plus distributions reinvested).

YCharts

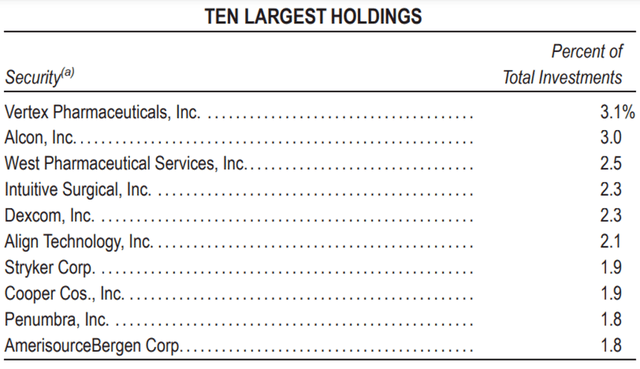

2. BMEZ usually invests in well being sciences firms. For reference, the fund not too long ago held 179 positions, and here’s a take a look at the highest 10 (you possible acknowledge at the least of few of those healthcare firms).

BlackRock

(DXCM) (VRTX) (ISRG) (SYK) (ALC)

BlackRock

3. BMEZ makes use of an choices writing technique to reinforce present beneficial properties. To implement this technique, BMEZ writes (sells) name and put choices in an effort to gather premium revenue and improve risk-adjusted return. The principle caveat with an possibility promoting technique is that whereas it will probably improve revenue and alter the volatility profile of the fund, it will probably additionally restrict long-term beneficial properties. That is the trade-off (risk-versus-reward).

4. BMEZ is a “Time period” Belief. This implies the fund intends to dissolve on or about January 29, 2032, whereby buyers obtain their a refund (i.e. a liquidity occasion) at NAV. There are a number of stipulations whereby the liquidity occasion could happen barely earlier than or after the date, however it is a Time period fund nonetheless. Right here is how BlackRock describes it on its web site:

BMEZ has a contingent restricted time period construction and can provide buyers a liquidity occasion at internet asset worth both on the Dissolution Date (as indicated under) or in connection an Eligible Tender Supply (as mentioned under). The Belief intends to dissolve on or about January 29, 2032 (the “Dissolution Date”) in accordance with its Settlement and Declaration of Belief; supplied that the Board of Trustees of the Belief (the “Board”) could vote to increase the Dissolution Date: (i) as soon as for as much as one yr, and (ii) as soon as for as much as a further six months, to a date as much as and together with eighteen months after the preliminary Dissolution Date (which date shall then grow to be the Dissolution Date). Every holder of frequent shares could be paid a professional rata portion of the Belief’s internet property upon dissolution of the Belief. The Board can also vote to trigger the Belief to conduct a young provide, as of a date inside twelve months previous the Dissolution Date (as could also be prolonged as described above), to all frequent shareholders to buy 100% of the then excellent frequent shares of the Belief at a worth equal to the NAV per frequent share on the expiration date of the tender provide (an “Eligible Tender Supply”).

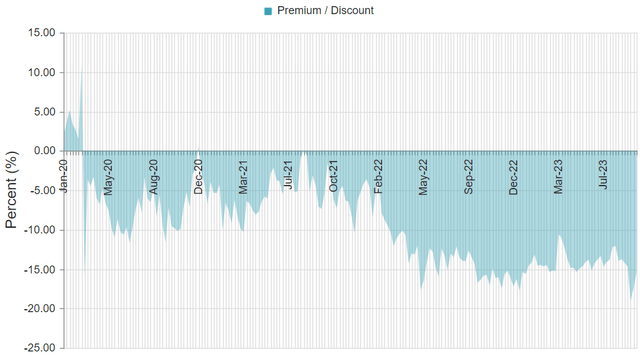

This can be a huge deal as a result of, not like most different CEFs, this fund has an finish date whereby the low cost to NAV goes away (i.e. when you purchase at a reduction, you may be made complete at “maturity”). That is considerably distinctive in comparison with most CEFs.

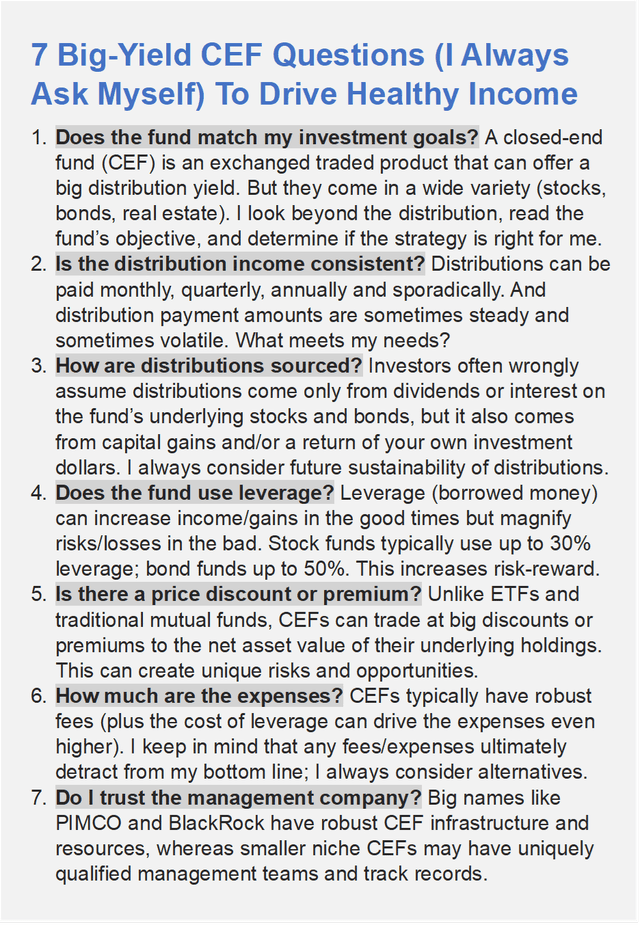

7 “Should Ask” Large-Yield CEF Questions:

So with that backdrop in thoughts, let’s take into account BMEZ by means of our “7 Query” CEF framework, as described under.

Blue Harbinger

1. Your Funding Objectives: Earlier than you take into account investing in BMEZ, be sure you are snug with an allocation to healthcare shares, as described above. The returns of this fund will possible “zig and zag” with a excessive correlation to the efficiency of the healthcare sector (well being sciences, particularly).

2. Distribution Consistency: We noticed earlier that BMEZ does have a historical past of regular rising month-to-month distribution funds since its inception (that is the principle cause numerous buyers make investments). Nonetheless, the “supply” of those distributions has been an issue (as we focus on subsequent). Moreover, BMEZ simply introduced a distribution discount going ahead, as per this press launch. Particularly, on a go ahead foundation, BMEZ “can pay month-to-month distributions to shareholders at an annual charge of 6% of the Fund’s 12-month rolling common each day internet asset worth to be calculated 5 enterprise days previous to declaration date.” The BMEZ share worth is down since this announcement was made on September eighth. (BIGZ) (BSTZ)

CEF Join

It is also vital to notice right here, that as a result of the fund trades at such a big low cost to NAV (extra on the low cost later), the precise yield on worth will likely be roughly 8% (although it is just 6% of NAV). So when you purchase, you get an 8% yield on value.

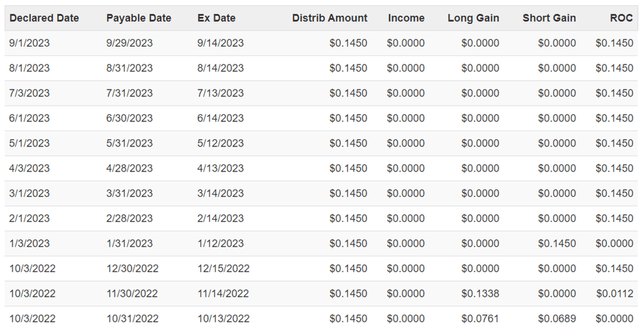

3. How are the distributions sourced? As you’ll be able to see on this subsequent chart, 100% of the distribution on BMEZ has not too long ago been sourced from a return of your individual capital. This may be very unfavorable because it reduces the fund’s NAV and thereby reduces its future earnings energy. Return of Capital will be acceptable occasionally (to assist hold the distributions regular), however an excessive amount of ROC is usually a trigger for concern.

CEF Join

Within the case of BMEZ, it’s a comparatively new fund, so it didn’t have numerous capital beneficial properties saved up through the years (that it may use to supply the distributions) like different funds do. Reasonably, BMEZ was launched pretty not too long ago in 2020, and instantly confronted challenges of steep pandemic worth declines, thereby giving the fund some virtually instantly capital losses (and thereby forcing it to make use of some ROC to assist the distribution). On a go-forward foundation, this fund is in a significantly better place (because the market—and the fund’s underlying holdings—have been rising), and contemplating the go-forward distribution charge has been decreased.

4. Does the fund use leverage? BMEZ usually does NOT use leverage (aside from a small 1-2% quantity because of accounting flows). This reduces upside potential relative to another funds, but additionally reduces dangers too. And contemplating the upper volatility of many life sciences firms, we like this technique.

5. Is there a worth low cost? BMEZ at the moment trades at a big and engaging 17.0% low cost as in comparison with its NAV (the low cost simply received wider after the brand new distribution discount announcement). This low cost is massive even by BMEZ historic requirements, and it’s just like shopping for the entire underlying holdings on sale. After all the low cost can get bigger or smaller over time, however when this fund reaches its time period in (or round) 2032, buyers will likely be cashed out on the full NAV.

BMEZ Premium-Low cost Since Inception (CEF Join)

6. How a lot are the bills? The administration charges and bills on this fund are pretty typical for a CEF, however important nonetheless. Particularly, the entire administration price was not too long ago 1.25% and while you add in bills, the entire expense ratio was not too long ago 1.32%. Usually, we’d attempt to keep away from any fund with an expense ratio this excessive (as a result of it detracts out of your efficiency), however as a result of this fund trades at such a big low cost to NAV, we imagine the entire expense ratio could also be acceptable (relying in your private targets and scenario).

7. Do You Belief the Administration Firm? BlackRock is a world-class fund firm with deep sources out there to assist the administration of this fund. Relative to some smaller lessor recognized fund firms, BlackRock is far much less of a trigger for concern (though some buyers have completely different opinions on this).

The Backside Line:

Contemplating the massive worth low cost to NAV (following the decreased distribution announcement), and the truth that the distribution is loads more healthy (extra sustainable) going ahead, an funding in BMEZ comes all the way down to your curiosity within the well being sciences sector and your want for month-to-month revenue. We view this fund as engaging on a go-forward foundation (particularly contemplating the predetermined liquidity occasion at NAV in 2032), and have ranked BMEZ in our new report “Prime 10 Large-Yield Contrarian CEFs.” In case you are an income-focused investor that likes to purchase issues on sale, BMEZ is totally price contemplating.

[ad_2]

Source link