[ad_1]

Geopolitical tensions roil international markets as focus shifts to Center East.

Oil costs surge amidst escalating dangers.

Gold, greenback additionally rebound amidst rising protected haven demand

World markets are kicking off the week with heightened volatility, fueled by escalating tensions between Israel and Palestine, which have now reached a degree of official conflict.

Ought to tensions within the Center East proceed to escalate, it is probably that markets will consider geopolitical danger all through the week. This might quickly overshadow the week’s vital financial developments.

These geopolitical challenges add to an already eventful week for international markets. Notably, the knowledge launch has gained much more significance following final week’s shocking .

Moreover, this week will see the discharge of the newest . Nonetheless, the influence could also be restricted in the event that they comprise no new info past the beforehand acknowledged rhetoric.

In distinction, the interaction of inflation knowledge and geopolitical tensions is predicted to exert vital affect on the Federal Reserve’s forthcoming rate of interest resolution.Wanting on the newest outlook of the , it was seen that DXY moved indecisively on the final day of final week.

Greenback Index Fights Again on Elevated Protected Haven Demand

The initiated the brand new week with an upswing, and from a technical standpoint, it is evident that the 106.6 resistance degree is as soon as once more in focus. A breakthrough past this level, particularly if bolstered by constructive financial knowledge, might doubtlessly set the stage for the subsequent peak within the 108 vary.

On the draw back, the 106.4 degree stands as the closest assist, with the 105.8 degree serving as a extra substantial assist earlier than reaching the essential 105 assist degree.

Conversely, there’s a risk of a waning bullish momentum for the DXY, which has just lately centered round a median of 106.5, contingent upon a resurgence in demand for gold within the upcoming days.

Oil Additionally on the Rise Because of Geopolitical Tensions

Shifting our focus, prevailing dangers have spurred a big uptick in costs. This improvement has the potential to stoke considerations about rising vitality prices, a pivotal consider inflationary worries. A sustained upward trajectory in oil costs might immediate fears of a much less optimistic inflation outlook within the coming months. Consequently, the Federal Reserve is prone to keep a vigilant stance, carefully monitoring components that might drive up vitality bills, along with this week’s inflation knowledge.

Following final week’s combined employment knowledge, there’s a rising probability that expectations of a 25 foundation level rate of interest hike by year-end might achieve additional momentum.

After a number of assessments of its Q2 lows of round $72, Brent crude oil gathered momentum in direction of $95 by late September, pushed by provide lower choices by Russia and the Arab Emirates.

Regardless of a notable correction in October, oil costs closed at $83 final week. However after beginning this week with a big 5% hole as a result of Israel-Palestine clashes over the weekend, Brent oil is now testing the $88 resistance degree, beforehand encountered in Q1 of this yr.

The escalating tensions within the area are prone to act as a catalyst for additional oil value will increase, doubtlessly propelling it into the $90 vary initially. Subsequently, the upward momentum might persist, aiming for the $100 threshold.

Market sentiment favoring ongoing financial tightening will probably proceed to push U.S. bond yields upward, sustaining the energy of the greenback within the last quarter of the yr. An offsetting issue that might mitigate this influence is a possible resurgence in demand for gold.

Gold Tries Oversold Bounce

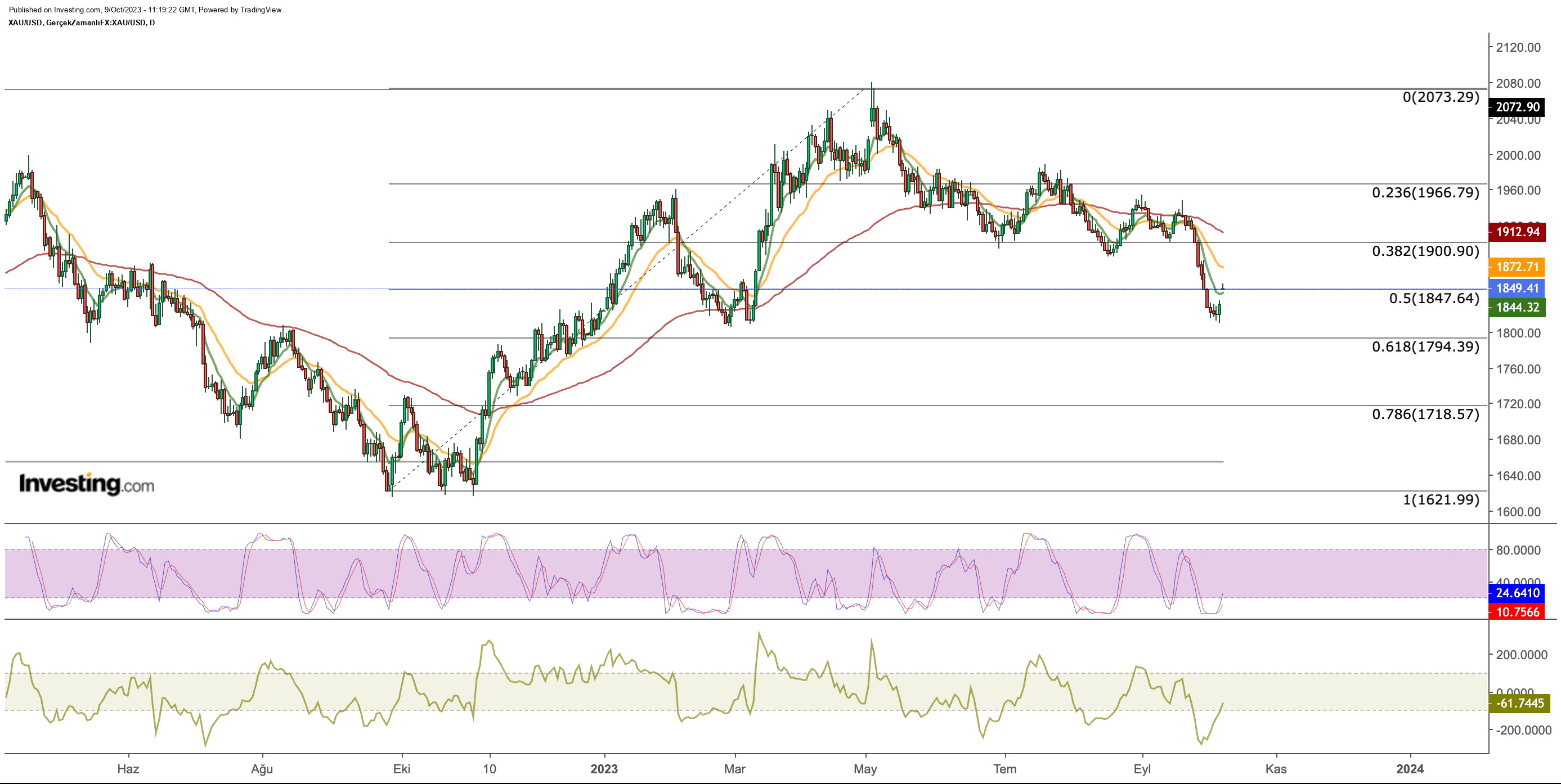

After breaking via the $1,900 assist degree within the latter half of the yr, accelerated its descent, reaching a really perfect correction degree at roughly $1,810, as per the Fibonacci 0.618 retracement.

In tandem with the rise in danger notion resulting in elevated demand for commodities, the gold market witnessed a gap-up opening. The value per ounce of gold commenced the week with a 1% achieve, hovering across the $1,850 mark. Ought to this demand persist, the $1,870 vary will emerge because the preliminary resistance zone, adopted by the essential juncture on the $1,900 mark, which is able to decide the development for gold.

The gold market has confronted strain in current months attributable to heightened demand for the greenback in a local weather of worldwide uncertainty. Nonetheless, the resurgence of geopolitical dangers might doubtlessly reverse this development. Such a improvement may rekindle demand for gold within the last quarter, diminishing the attract of the presently overbought greenback.

Consequently, it is conceivable that the pricing dynamics of this week could also be pushed extra by geopolitical danger than financial knowledge, which might exert a extra pronounced affect within the forthcoming intervals.

***

Signal Up for a Free Week Now!

Disclosure: The creator holds no positions within the securities talked about on this report.

[ad_2]

Source link