[ad_1]

jetcityimage

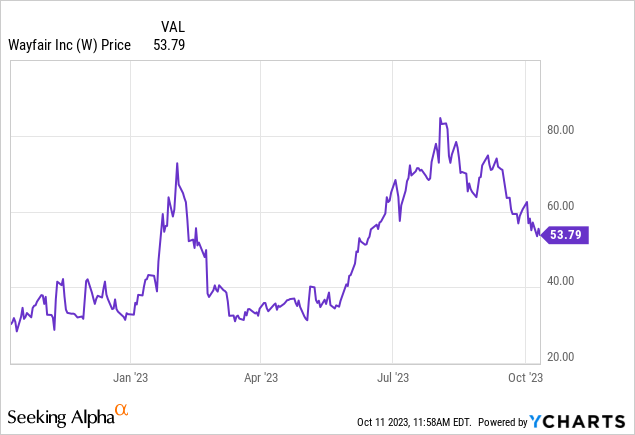

It has been a tricky yr essentially for Wayfair (NYSE:W), the net furnishings firm that skilled its greatest heyday in the course of the pandemic when folks had been dashing out of cities and wanting to fill new properties. Wayfair inventory stays up greater than 60% yr to this point, however is properly off highs because the markets digest each the affect of upper rates of interest in addition to the overhang of income declines. All of the whereas, Wayfair – which is presently sitting at north of a $6 billion market cap – continues to be barely worthwhile (and solely on an adjusted foundation), and struggling to justify why it ought to be price that a lot.

Earlier this yr, I wrote a bearish opinion on Wayfair when the inventory was sitting within the mid-$60s. Since then, the inventory has each launched Q2 outcomes (which I interpreted as a substantial sequential enchancment from Q1) and suffered a ~20% worth drop to the low $50s. So whereas I acknowledge that there’s nonetheless appreciable danger on this identify, I’m now extra sanguine on Wayfair’s prospects and I’m upgrading my viewpoint on Wayfair to impartial.

I now see an equally balanced bull and bear case for Wayfair. On the optimistic facet of the coin:

Although pandemic-era lifts had been non permanent, the enterprise has scaled dramatically since pre-COVID. Previous to the pandemic, Wayfair generated roughly ~$9 billion in annual income; now, it’s doing nearer to $12-$13 billion in income. In a enterprise that depends a lot on economies of scale, this added income scale helps Wayfair push nearer to profitability. Number of manufacturers to seize all market segments. Wayfair’s eponymous model could also be recognized for its accessibly-priced furnishings, however on the different finish of the spectrum, the corporate’s different manufacturers like Perigold and Joss & Foremost seize extra upscale clients. For my part, Wayfair’s range of manufacturers and its solidified class management have given the corporate a defensible area of interest that Amazon (AMZN) has struggled to interrupt into.

On the similar time, nevertheless, now we have to watch out of the next dangers:

Substitute cycles might elongate. Prospects are holding onto every thing for longer: vehicles, expertise, furnishings. As the present recession prompts increasingly households to rein of their budgets, gross sales at Wayfair might proceed to gradual. Barely worthwhile. Proper now, Wayfair is barely at single-digit adjusted EBITDA revenue margins, whereas on the similar time coping with damaging income compares. In a enterprise with such low gross margins, it is obscure what catalysts Wayfair has underneath its sleeve to propel it to significant profitability to justify its valuation. Debt load. Wayfair has ~$2 billion of internet debt on its books. The excellent news is that the corporate is now barely FCF optimistic, however in a high-interest setting, Wayfair’s debt will dampen its earnings potential.

The underside line right here: whereas I’m not advocating for an all-in place on Wayfair, I do suppose that the inventory’s current ~20% dip from YTD highs compensates for the added basic dangers that we have seen this yr with slowing income development. Within the low $50s, I do not see considerably extra near-term draw back for this inventory, however neither would I like to recommend shifting off the sidelines simply but.

Q2 obtain

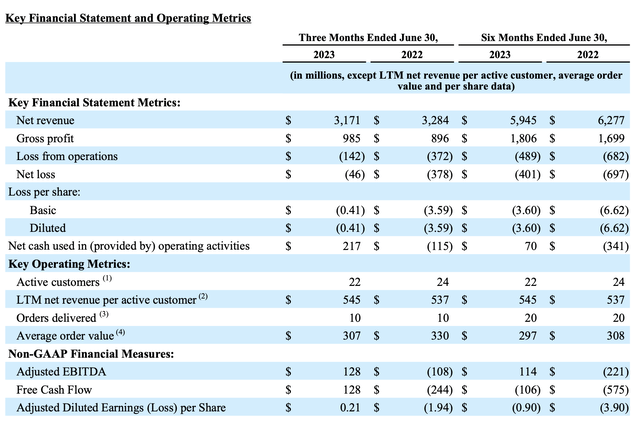

Let’s now undergo Wayfair’s newest quarterly leads to larger element. The Q2 earnings abstract is proven beneath:

Wayfair Q2 outcomes (Wayfair Q2 earnings launch)

Wayfair’s income declined -3% y/y to $3.17 billion within the quarter, because it continues to face powerful compares from the top of pandemic-era demand final yr. On the brighter facet, nevertheless, outcomes did beat Wall Avenue’s expectations of $3.10 billion (-6% y/y), and likewise accelerated from a -7% y/y decline in Q1.

Even higher information: Wayfair estimates that it has taken market share within the furnishings house, primarily based on knowledge on bank card spending. Per CEO Niraj Shah’s remarks on the Q2 earnings name:

Q2 proved to be 1 / 4 of two persevering with themes for Wayfair, share seize and value effectivity. I will begin with the share seize piece and the outcomes actually converse for themselves. Wayfair meaningfully outperformed the competitors this spring with internet income down 3% year-over-year in Q2 in comparison with a class that continues to be down 10% to twenty% for broadly tracked estimates in bank card and e-mail receipt knowledge.

Our group spent important time at numerous commerce exhibits over the previous few months, and now we have heard resounding suggestions from our suppliers that the platform they wish to lean into is Wayfair. Advantages of our huge advertising and marketing attain, appreciable merchandising investments and proprietary logistics capabilities, make Wayfair an unparalleled accomplice to our suppliers.

Since final fall, now we have seen robust market share seize on the again of our core recipe. The mix of broad availability, quick supply and sharp pricing continues to be a strong flywheel to drive each buyer and provider engagement. And throughout the Board, we’re setting new benchmarks on these metrics. Availability and velocity badging proceed to climb in Q2. And with additional wholesale value normalization in addition to our operational value financial savings efforts, we now persistently see ourselves as a worth chief throughout our hottest objects. Our recipe is again intact.”

One other optimistic level to notice: Wayfair had deliberate for a denser promotional calendar together with for Method Day 2023 (Wayfair’s procuring occasion, which sits on the finish of April and is included in Q2 outcomes), which is partially liable for the acceleration in income development. Regardless of this, nevertheless, gross margins rose sequentially to 31.1% in Q2, from a 29.6% margin in Q1.

It is key to notice that the one different time Wayfair has seen gross margins exceed 30% is in the course of the pandemic – however what’s driving margin features this time is sustainable efficiencies labored into Wayfair’s operations and provide chain.

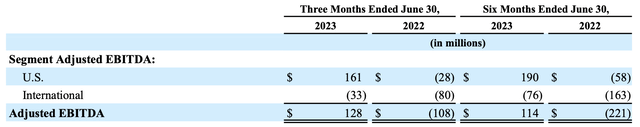

Adjusted EBITDA, in the meantime, swung to optimistic $128 million, or a 4.0% margin – versus the corporate’s preliminary expectations for a 0.5-1.5% margin on this second quarter.

Wayfair adjusted EBITDA (Wayfair Q2 earnings launch)

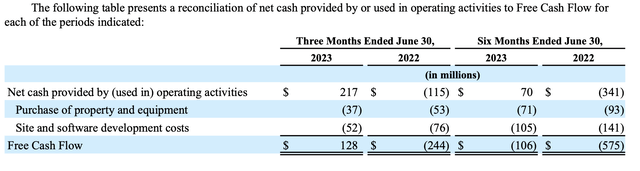

Free money stream additionally swung to optimistic $128 million within the quarter, matching adjusted EBITDA:

Wayfair FCF (Wayfair Q2 earnings launch)

Key takeaways

With bettering gross margins and adjusted EBITDA, and a path towards beginning to reverse income declines and return to development regardless of powerful macro situations, there’s extra hope for Wayfair now, particularly at a extra muted share worth. Nonetheless, nevertheless, I would train warning and wait from the sidelines for the inventory to drop to the mid-$40s earlier than contemplating a purchase.

[ad_2]

Source link