[ad_1]

Up to date on October thirteenth, 2023

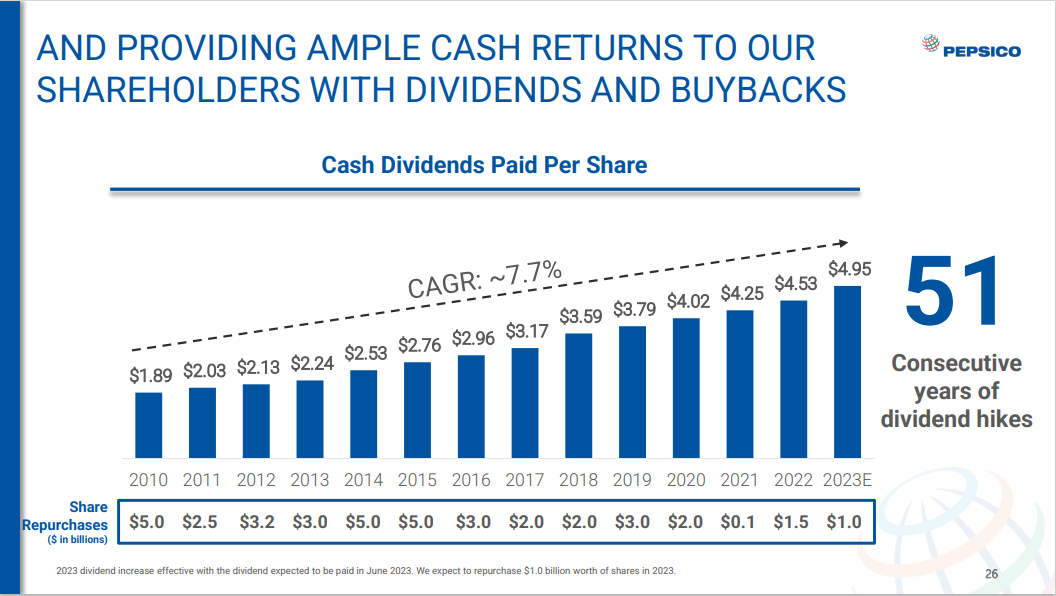

PepsiCo (PEP) lately elevated its dividend by 10%. This marks the corporate’s 51st consecutive 12 months of elevated dividends paid to shareholders.

Consequently, it’s on the checklist of Dividend Kings.

The Dividend Kings are a bunch of simply 50 shares which have elevated their dividends for not less than 50 years in a row. We imagine the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all 50 Dividend Kings. You possibly can obtain the total checklist, together with vital monetary metrics resembling dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

PepsiCo is a recession-proof Dividend King with a management place within the meals and beverage trade. It’s a dependable dividend development inventory that may enhance its dividend, even throughout recessions.

On the identical time, the inventory has a market-beating 3.2% dividend yield. Attributable to its above-average yield and lengthy historical past of constant annual dividend will increase, PepsiCo stays a high-quality holding for revenue traders.

Enterprise Overview

PepsiCo is a significant client staples inventory. It has a big portfolio of high quality manufacturers, together with greater than 20 particular person manufacturers that generate annual gross sales of $1 billion or extra. Only a few of its core manufacturers embody Pepsi, Frito-Lay, Quaker, Gatorade, and lots of extra.

Supply: Investor Presentation

Its enterprise is sort of equally cut up between its meals and beverage segments. It is usually balanced geographically between the U.S. and the remainder of the world.

On October tenth, 2023, PepsiCo introduced third quarter outcomes. Income elevated 6.7% to $23.45 billion whereas adjusted earnings-per-share of $2.25 elevated 14% year-over-year. Natural gross sales elevated 8.8% for the third quarter. For the quarter, beverage quantity was flat whereas handy meals have been down 2%.

PepsiCo Drinks North America’s income grew 9% organically as increased costs greater than offset a 4.5% decline in quantity. Frito-Lay North America elevated 12%, once more as a result of worth will increase, whereas quantity was flat. Quaker Meals North America grew natural gross sales 6% regardless of a 3% decline in quantity.

PepsiCo offered an up to date outlook for 2023 as properly, with the corporate anticipating adjusted earnings-per-share of $7.54 for the 12 months, up from $7.47, $7.27, and $6.93 beforehand. Natural gross sales are nonetheless projected to be increased by 10% for the 12 months.

Development Prospects

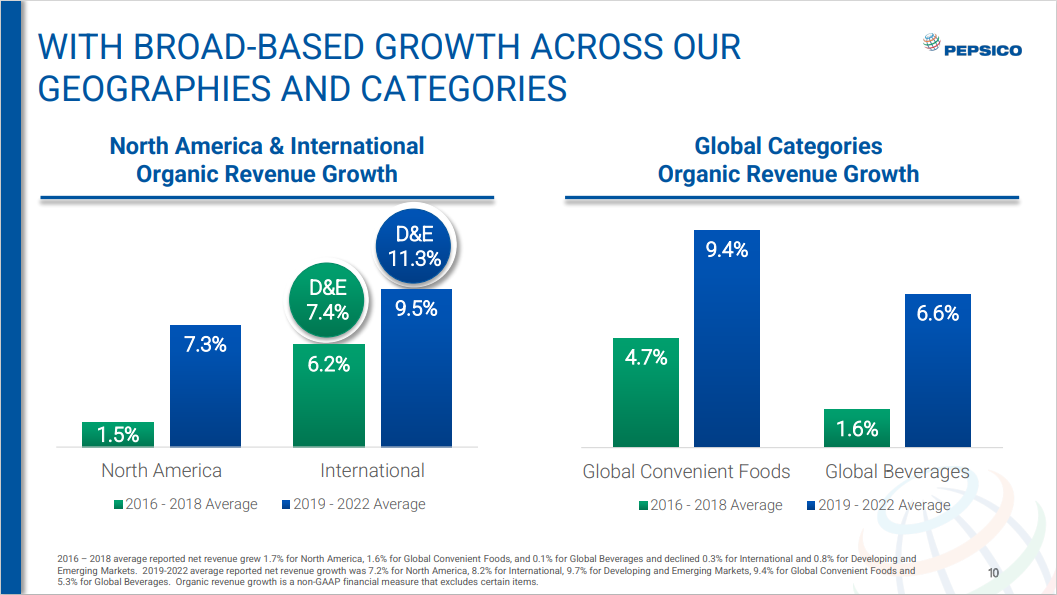

PepsiCo has an extended historical past of regular development. Even in a difficult atmosphere for soda, PepsiCo has continued its constant development. An illustration of the corporate’s efficiency over the previous a number of years might be seen within the under picture.

Supply: Investor Presentation

We imagine PepsiCo will generate round 5%-6% adjusted earnings-per-share development per 12 months over the subsequent 5 years. Going ahead, two of PepsiCo’s most promising catalysts are development in more healthy meals and drinks, and in rising markets.

Gross sales of soda are slowing down in developed markets just like the U.S., the place soda consumption has steadily declined for over a decade.

Consequently, massive soda corporations like PepsiCo have needed to adapt to a extra health-conscious client. To do that, PepsiCo has shifted its portfolio towards more healthy meals which can be resonating extra strongly with altering client preferences.

As well as, PepsiCo has an enormous development alternative in rising markets like China, Africa, India, and Latin America. These are under-developed areas of the world with massive client populations and excessive financial development charges.

Rising markets have been a development driver as soon as once more final quarter. Latin America income elevated 12%, Asia Pacific/Australia/New Zealand/China area improved 7%, and Africa/Center East/South Asia was up 20%. Every area noticed an uptick in quantity.

Aggressive Benefits & Recession Efficiency

PepsiCo has quite a few aggressive benefits. Amongst them are robust manufacturers and a worldwide scale. In all, PepsiCo has over 20 particular person manufacturers that every acquire not less than $1 billion in annual income. Robust manufacturers give PepsiCo optimum shelf area at retailers and provides the corporate pricing energy.

PepsiCo’s monetary power additionally permits the corporate to put money into analysis and growth, in addition to promoting, to retain its aggressive benefits.

For instance, PepsiCo invests billions every year in analysis and growth to innovate new merchandise and packaging designs. As well as, PepsiCo often spends greater than $2 billion every year on promoting to keep up market share and construct model fairness with customers.

PepsiCo’s aggressive benefits and robust manufacturers make the corporate extremely worthwhile, even throughout recessions. Meals and drinks all the time retain a sure degree of demand, which is why the corporate held up so properly in the course of the Nice Recession.

Supply: Investor Presentation

PepsiCo’s aggressive benefits and profitability have enabled the corporate to extend its dividend for 50 years straight. Since 2010, PepsiCo has elevated its dividend by 8% per 12 months on common.

PepsiCo’s earnings-per-share all through the Nice Recession of 2007-2009 are listed under:

2007 earnings-per-share of $3.34

2008 earnings-per-share of $3.21 (3.9% decline)

2009 earnings-per-share of $3.77 (17% enhance)

2010 earnings-per-share of $3.91 (3.7% enhance)

As you may see, PepsiCo’s earnings-per-share declined solely modestly in 2008. The corporate proceeded to develop earnings by almost 20% in 2009, which could be very spectacular. Earnings continued to develop as soon as the recession ended.

The corporate reported robust development in 2020 and 2021 when the coronavirus pandemic despatched the U.S. financial system right into a recession. Subsequently, PepsiCo is a recession-resistant enterprise.

Valuation & Anticipated Returns

PepsiCo is predicted to generate earnings-per-share of $7.54 for 2023. Based mostly on this, the inventory trades for a price-to-earnings ratio of 21.2. Our honest worth estimate is a price-to-earnings ratio of 21.0. Consequently, the inventory is simply barely overvalued. A declining price-to-earnings ratio may scale back annual returns by 0.2% every year over the subsequent 5 years.

Consequently, future returns will possible be comprised of earnings-per-share development and dividends. We count on PepsiCo to develop earnings-per-share every year by 5.5%, consisting of natural income development, acquisitions, and share repurchases.

As well as, PepsiCo additionally has a 3.2% present dividend yield. The mixture of valuation modifications, earnings development, and dividends leads to whole anticipated returns of 8.5% per 12 months over the subsequent 5 years.

We at present price PepsiCo inventory a maintain.

PepsiCo has a safe dividend, with a projected dividend payout ratio of 67% for 2023. This provides PepsiCo sufficient room to proceed rising the dividend at a price in-line with the expansion price of its adjusted EPS.

Remaining Ideas

PepsiCo is a high-quality firm with a various portfolio of robust manufacturers. Its long-term development will probably be fueled by its snacks enterprise and by advancing in creating markets.

The corporate has elevated its dividend for 50 years in a row, and the inventory at present yields 3.2%. Subsequently, it meets our definition of a blue-chip inventory, and it ought to proceed to ship regular dividend will increase every year.

In case you are inquisitive about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link