[ad_1]

Joe Raedle

T-Cellular US, Inc. (NASDAQ:TMUS) is among the main telco operators within the US market, along with AT&T (T) and Verizon (VZ). Notably, the corporate is thought for its 5G prowess, because it moved forward of its eager opponents, taking the 5G management mantle towards AT&T and Verizon. The corporate prides itself on its “un-carrier” strategy, aiming to disrupt the standard provider mannequin.

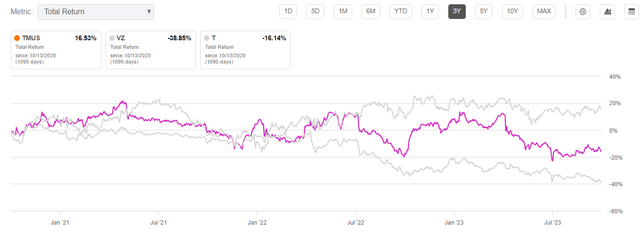

TMUS Vs. Friends (3Y whole return %) (Searching for Alpha)

As such, I am not stunned that the market has rewarded TMUS holders effectively over the previous three years, as TMUS considerably outperformed its main telco friends.

Moreover, the corporate’s second-quarter or FQ2 earnings launch in late July 2023 confirmed that its postpaid internet provides and churn metrics have continued to outperform. As such, T-Cellular has fended off the aggressive menace from cable operators similar to Constitution (CHTR) and Comcast (CMCSA), who’ve been encroaching on the turf of the telco gamers.

Administration stays steadfast in its dedication to attain its $16B to $18B in free money movement or FCF outlook. The corporate’s just lately introduced $19B shareholder return authorization (shares repurchase and dividends) has possible assured traders that the corporate’s development profile stays on observe. Furthermore, its adjusted EBITDA leverage ratio is predicted to stay under its 2.5x goal ratio over the following two years. Therefore, I imagine it units up the corporate effectively to pursue development alternatives, however the high-interest charge regime that has battered rate-sensitive firms.

T-Cellular is scheduled to report its FQ3 earnings launch on October 25. With TMUS holding near its September 2023 highs on the $146 degree, I assessed that traders have remained assured. Administration’s strong capital allocation framework means that its shares are undervalued, underpinning traders’ confidence. The market has possible assessed that T-Cellular is predicted to proceed posting robust net-adds development by means of the second half of 2023, persevering with its strong efficiency within the first half.

Analysts’ estimates counsel that T-Cellular’s adjusted EBITDA margin is predicted to proceed bettering by means of FY25, reaching 40% from this yr’s estimated 37.4%. As such, the bullish thesis on TMUS ought to proceed to see strong shopping for help on steep pullbacks if the corporate continues to execute effectively.

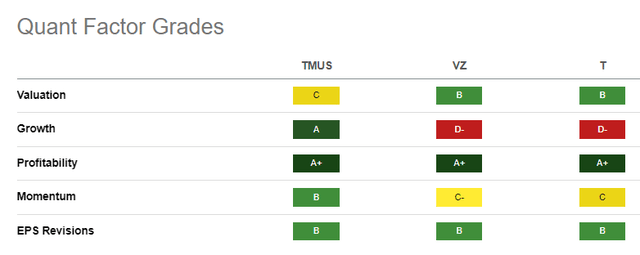

TMUS Vs. Friends Quant Grades (Searching for Alpha)

Given its outperformance, I am not stunned that TMUS is priced at a premium towards its main telco rivals. Nonetheless, with a best-in-class “A” development grade, I gleaned that its “C” valuation grade suggests it is not aggressively valued. Although Verizon and AT&T additionally boast sector-leading “A+” profitability grades, it is clear that T-Cellular’s strong development potential has stored traders onside, which will be assessed by its strong long-term uptrend.

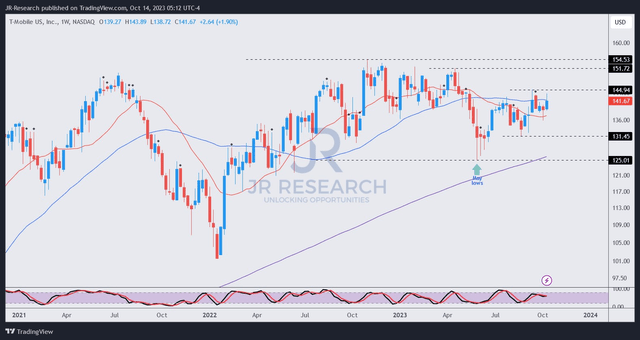

TMUS worth chart (weekly) (TradingView)

I additionally gleaned that TMUS consumers returned with conviction at its Might 2023 lows ($125 degree) and helped stem an additional slide. It has helped TMUS get well constructively towards its September highs on the $145 degree.

Nonetheless, that resistance zone has proved irritating for consumers anticipating additional upward momentum, which has since stalled.

Regardless of that, I do not anticipate TMUS falling again towards its Might lows, given the corporate’s strong execution and strong working efficiency on its 5G management. As such, traders ought to take into account the strong uptrend bias in TMUS to purchase on steep pullbacks confidently.

Ranking: Provoke Purchase.

Essential notice: Traders are reminded to do their due diligence and never depend on the knowledge offered as monetary recommendation. Please all the time apply unbiased considering and notice that the score is just not meant to time a selected entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a vital hole in our view? Noticed one thing necessary that we didn’t? Agree or disagree? Remark under with the goal of serving to everybody locally to be taught higher!

[ad_2]

Source link