[ad_1]

marrio31

Small caps have continued to endure below the load of elevated rates of interest and comparatively weak fundamentals, as seen within the inventory represented within the Russell 2000 Index (RTY). Given its familiarity with buyers, buyers eager on small-caps investing can think about using iShares Russell 2000 ETF (NYSEARCA:IWM) as a conduit.

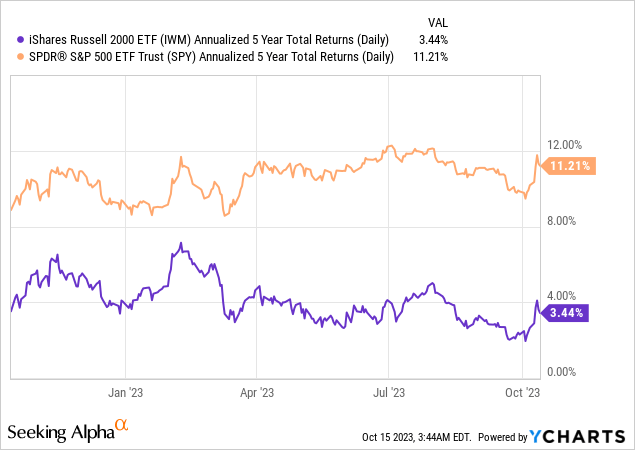

IWM is an ETF designed to “observe the funding outcomes of an index composed of small-capitalization US equities.” Based mostly on the fund supervisor’s newest replace, it has an expense ratio of 0.19%. IWM additionally scored a 5Y complete return CAGR of three.44%.

Firm Title Proportion Tremendous Micro Laptop, Inc. (SMCI) 0.64% Chart Industries, Inc. (GTLS) 0.32% Onto Innovation Inc. (ONTO) 0.31% ChampionX Corp. (CHX) 0.31% Chord Vitality Corp. (CHRD) 0.31% Click on to enlarge

IWM prime 5 holdings. Information supply: In search of Alpha

Indicated above are the top-five holdings of the IWM, as they accounted for lower than 1.9% of IWM’s publicity. As such, IWM is a comparatively well-diversified ETF of small-cap holdings.

On this article, I share my evaluation of IWM and the important thing components buyers ought to take into account. I additionally present my evaluation of the directional bias for the Russell 2000 within the present context, serving to buyers to determine whether or not so as to add publicity.

Sector Allocation (%) Know-how 16.10 Industrials 15.66 Well being Care 14.36 Financials 14.09 Client Cyclical 10.27 Vitality 8.14 Actual Property 7.31 Primary Materials 4.68 Client Defensive 4.25 Utilities 2.94 Communication 2.21 Money & Equivalents 0.20 Click on to enlarge

Russell 2000 sector weightings %. Information supply: In search of Alpha

As seen above, the Russell 2000 is weighted towards 4 sectors: Know-how, Industrials, Well being Care, and Financials. Nonetheless, it is vital to not confuse IWM’s tech sector weightings with a broad-based tech ETF just like the Know-how Choose Sector SPDR ETF (XLK).

Accordingly, The Russell 2000 has a weighted common market cap of $2.85B (as of September 30). Nonetheless, the XLK, a market-cap-weighted ETF, has a weighted common market cap of about $1.36T as of October 12. As such, I consider small-caps investing is a comparatively higher-risk endeavor into much less essentially sound firms that could possibly be trade leaders sooner or later.

Nonetheless, that thesis hasn’t labored out over the previous 5 years, as small-caps investing by IWM have underperformed the S&P 500 (SPX) (SPY) in complete return phrases.

Whereas IWM outperformed SPY popping out of the COVID lows in March/April 2020, the worth motion of IWM/SPY reached a big prime in March 2021 as astute buyers rotated out of small caps. The valuation surges within the essentially weaker small caps weren’t anticipated to be sustained, because the pandemic increase and bust unveiled the underlying deficiencies of the small caps.

ETF Extensive-moat % Slender-moat % SPY 61.5% 29.4% IWM 0.09% 3.79% Click on to enlarge

Moat classifications. Information supply: Morningstar

Based on Morningstar’s knowledge, almost 91% of firms in SPY are both categorised as having wide- or narrow-moat, ascertaining sustainable aggressive benefits. In distinction, lower than 4% of IWM’s constituents are assessed to have comparable moat rankings.

As such, it corroborates my view that IWM’s important underperformance is probably going a mirrored image of the market’s evaluation of upper execution dangers in an unsure macroeconomic local weather. Compounded by the dangers of upper rates of interest that benefited the bigger firms with stronger stability sheets, I consider small-caps might proceed to underperform.

Furthermore, I consider the latest geopolitical dangers emanating from the Israeli-Hamas battle might maintain buyers away from the Russell 2000 within the close to time period. Why? I feel it is nonetheless too early for us to establish the dimensions of the battle. If it have been to accentuate and broaden, it might tip us into a tough touchdown, probably hitting the small caps tougher.

Whereas IWM bulls might argue that the market might have priced in these headwinds, I urge warning.

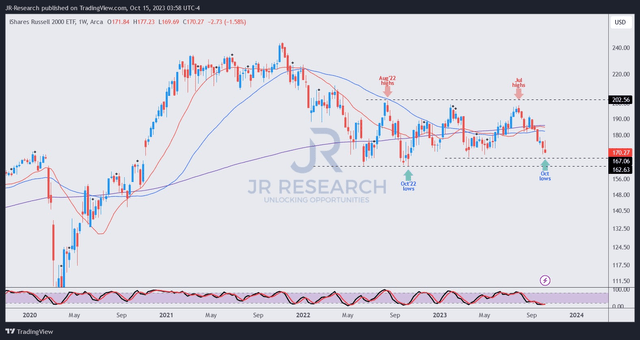

IWM value chart (weekly) (TradingView)

IWM’s value motion has struggled for traction because it bottomed out in October 2022. As seen above, whereas patrons have defended important pullbacks to the low $160s zones, they weren’t eager to carry it past the $200 resistance stage established in August 2022.

Moreover, the steep collapse from IWM’s July 2023 highs has almost re-tested its March 2023 lows (regional banking disaster backside). As such, I consider market operators have probably baked within the growing dangers of a recession or onerous touchdown that would batter IWM tougher than its large-cap friends. In different phrases, IWM might additionally backside out on the present ranges if macroeconomic situations aren’t as dangerous as buyers anticipated.

Regardless of that, I anticipate the market to proceed reflecting heightened dangers on IWM within the close to time period. As such, with out strong shopping for sentiments supporting a sustained reversal in IWM, the Russell 2000 might stay mired in a consolidation zone for a while, underperforming the S&P 500.

With that in thoughts, I consider a extra cautious stance on the Russell 2000 must be embraced. Buyers are urged to search out alternatives in essentially stronger firms to drive outperformance.

Score: Provoke Maintain.

Vital notice: Buyers are reminded to do their due diligence and never depend on the data supplied as monetary recommendation. Please at all times apply impartial considering and notice that the score just isn’t meant to time a selected entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a essential hole in our view? Noticed one thing vital that we did not? Agree or disagree? Remark beneath with the purpose of serving to everybody in the neighborhood to be taught higher!

[ad_2]

Source link