[ad_1]

Preliminary indicators from earnings counsel that EPS progress bottomed final quarter

Going forward, it appears to be like just like the rebound might proceed into subsequent 12 months

In the meantime, majority of the shares in S&P 500 stay undervalued

Quarterly earnings reviews have begun to pour in on a constructive be aware, particularly for the large banks. In reality, primarily based on the efficiency of the businesses which have already reported to date, the present pattern signifies that now we have already bottomed out within the earlier quarter.

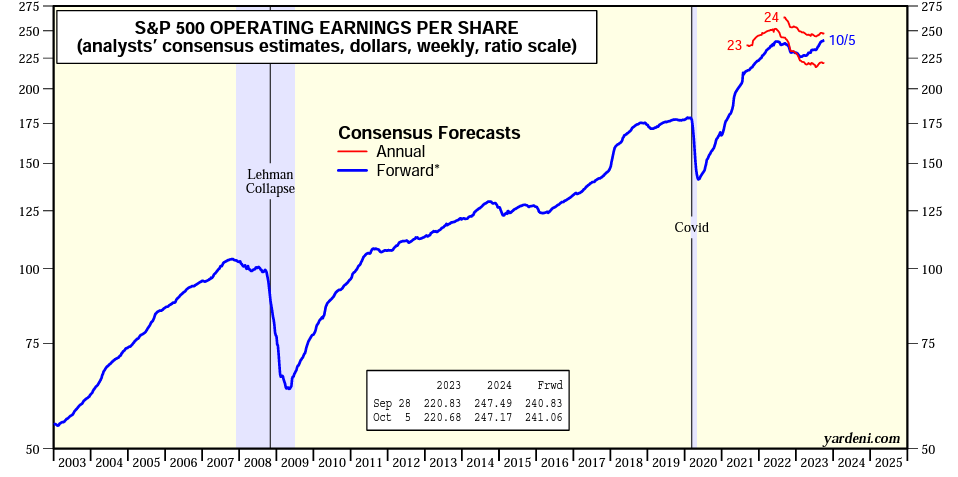

Accordingly, Ed Yardeni’s projections counsel that earnings per share (EPS) for 2023 are prone to attain roughly $221 per share, with an anticipated improve to $247 per share in 2024.

Supply: Ed Yardeni

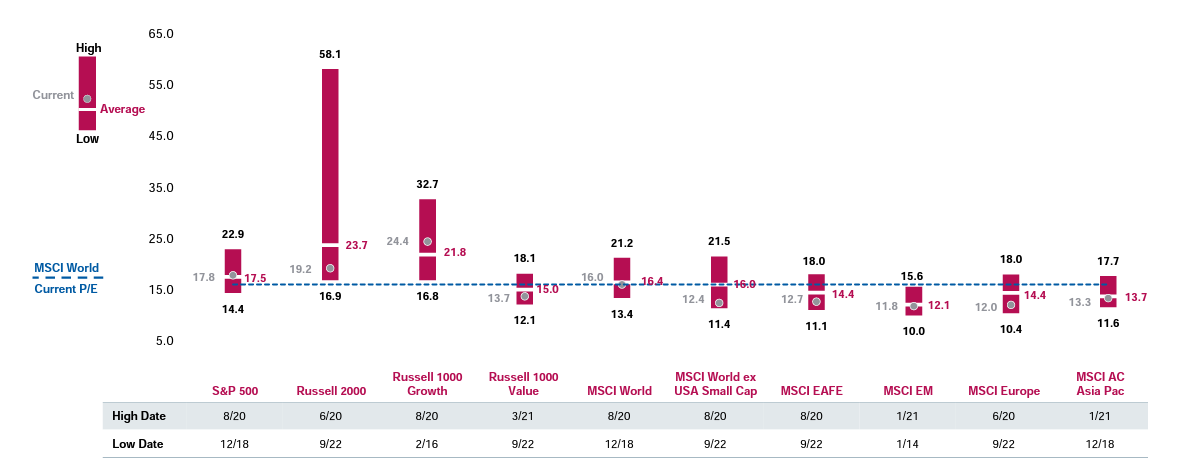

A P/E ratio of roughly 17.5 for the index implies that the truthful worth for the index must be at round 3,900 factors.

Nevertheless, looking forward to 2024’s anticipated EPS progress, we are able to anticipate the truthful worth for the index to be within the neighborhood of 4,331 factors, which is roughly in step with the present value.

Supply: Eaton Vance

The aforementioned determine must be considered with two important issues:

The affect of the Large 7 on pushing the index to increased ranges.

The inherent nature of markets, which are usually both above or beneath the common.

Most S&P 500 Shares Undervalued Regardless of Index’s Positive factors This Yr

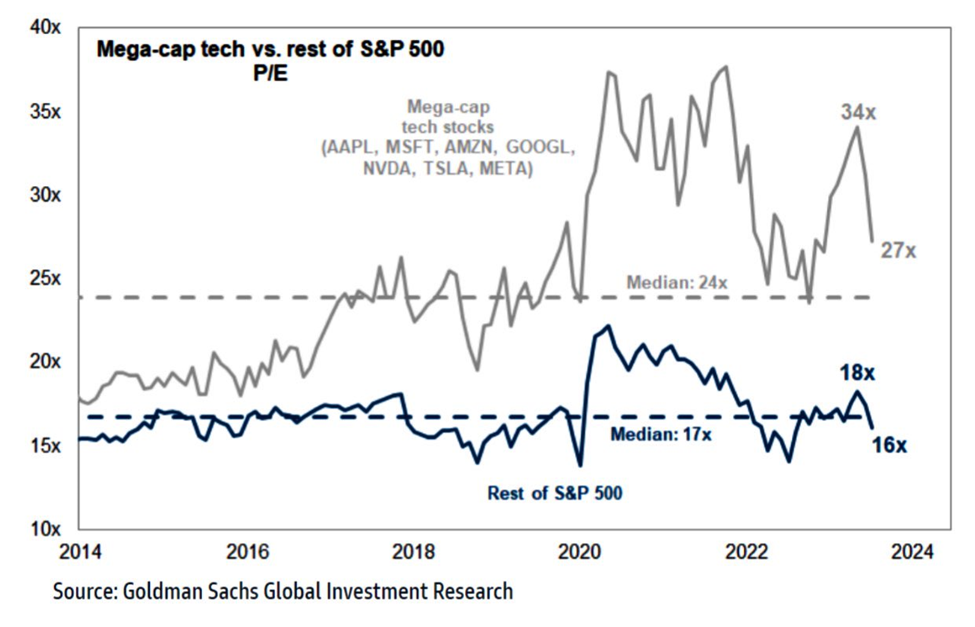

Concerning the Large 7, these large-cap U.S. tech shares commerce at significantly increased valuations in comparison with the opposite 493 shares within the index.

Supply: Goldman Sachs

This dynamic actually skews the general index valuations in direction of the upper finish, nevertheless it’s necessary to notice that almost all shares nonetheless commerce at decrease valuations.

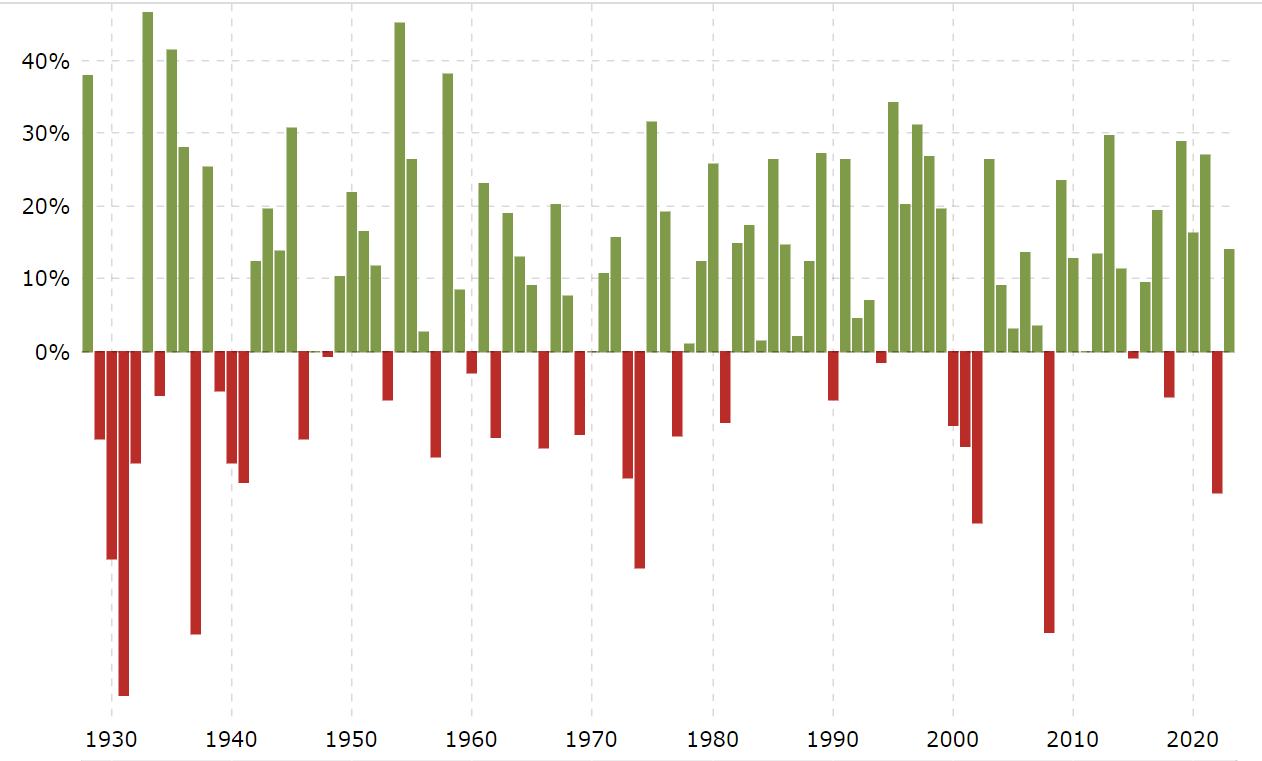

As for the second level, here is a sensible instance: It’s normal information that, on common and over the long run, the U.S. inventory market delivers an annual return of roughly 9 to 10%.

Supply: Macrotrends

Nevertheless, upon nearer examination of yearly efficiency, you may discover that the index hardly ever delivers a constant 9 or 10% return annually. As a substitute, returns typically differ considerably. This similar precept could be utilized to P/E ratios.

What drives these huge short-term variations?

The reply is straightforward: investor psychology and sentiment.

That is why, as traders, it is necessary to deal with valuations, notably once they deviate from truthful worth (an idea often known as the “margin of security”). This method ensures that our investments are poised for long-term success.

***

Tesla Earnings: What to Anticipate?

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling or advice to take a position as such it isn’t meant to incentivize the acquisition of belongings in any approach. I want to remind you that any sort of belongings, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related danger stays with the investor.

[ad_2]

Source link