[ad_1]

Up to date on October nineteenth, 2023 by Bob CiuraSpreadsheet information up to date each day

Blue-chip shares are established, financially robust, and persistently worthwhile publicly traded corporations.

Their power makes them interesting investments for comparatively secure, dependable dividends and capital appreciation versus much less established shares.

This analysis report has the next sources that will help you put money into blue chip shares:

Useful resource #1: The Blue Chip Shares Spreadsheet Checklist

This checklist comprises essential metrics, together with: dividend yields, payout ratios, dividend development charges, 52-week highs and lows, betas, and extra. There are presently greater than 350 securities in our blue chip shares checklist.

We categorize blue chip shares as corporations which might be members of 1 or extra of the next 3 lists:

Useful resource #2: The 7 Finest Blue Chip Shares To Purchase NowSee the highest 7 greatest blue-chip inventory buys now utilizing anticipated complete returns from the Certain Evaluation Analysis Database. We use the next standards for our rankings:

Dividend Danger Rating of “C” or higher

Rank highest to lowest by anticipated complete returns

Useful resource #3: Different Blue Chip Inventory ResearchFind extra compelling blue chip inventory analysis from Certain Dividend.

The 7 Finest Blue Chip Shares To Purchase Now

The 7 greatest blue chip shares as ranked utilizing information from the Certain Evaluation Analysis Database (excluding REITs and MLPs) are analyzed intimately under.

We use the next standards for our rankings:

Dividend Danger Rating of “C” or higher

Rank by anticipated complete returns

The desk of contents under permits for straightforward navigation.

Blue-Chip Inventory #7: Verizon Communications (VZ)

Dividend Historical past: 19 years of consecutive will increase

Dividend Yield: 8.6%

Anticipated Whole Return: 18.6%

Verizon is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

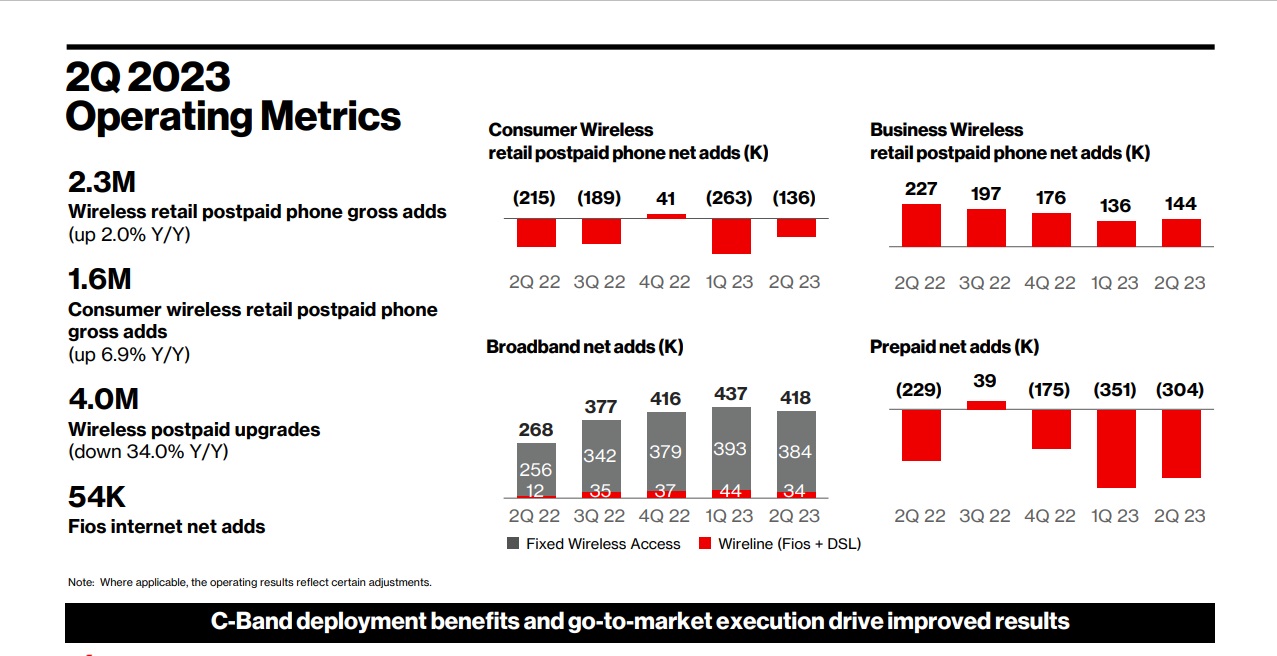

On July twenty seventh, 2023, Verizon introduced earnings outcomes for the second quarter for the interval ending June thirtieth, 2023. For the quarter, income decreased 3.6% to $32.6 billion, which was $720 million under estimates. Adjusted earnings per-share of $1.21 in contrast unfavorably to $1.31 within the prior yr, however was $0.04 increased than anticipated.

Supply: Investor Presentation

Verizon had postpaid telephone internet additions of 8,000, however retail postpaid internet additions totaled 612K. Income for the Shopper section elevated 3.8% to $19.1 billion. Broadband continues to behave properly as the corporate added 418K internet new clients throughout the interval. This included 384K fastened wi-fi internet additions, up from 256K additions within the prior yr. First half free money move improved to $8 billion from $7.2 billion within the prior yr.

Verizon reaffirmed steering for 2023 as properly with the corporate nonetheless anticipating adjusted earnings-per-share of $4.55 to $4.85 for the yr. Wi-fi service income continues to be projected to develop 2.5% to 4.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

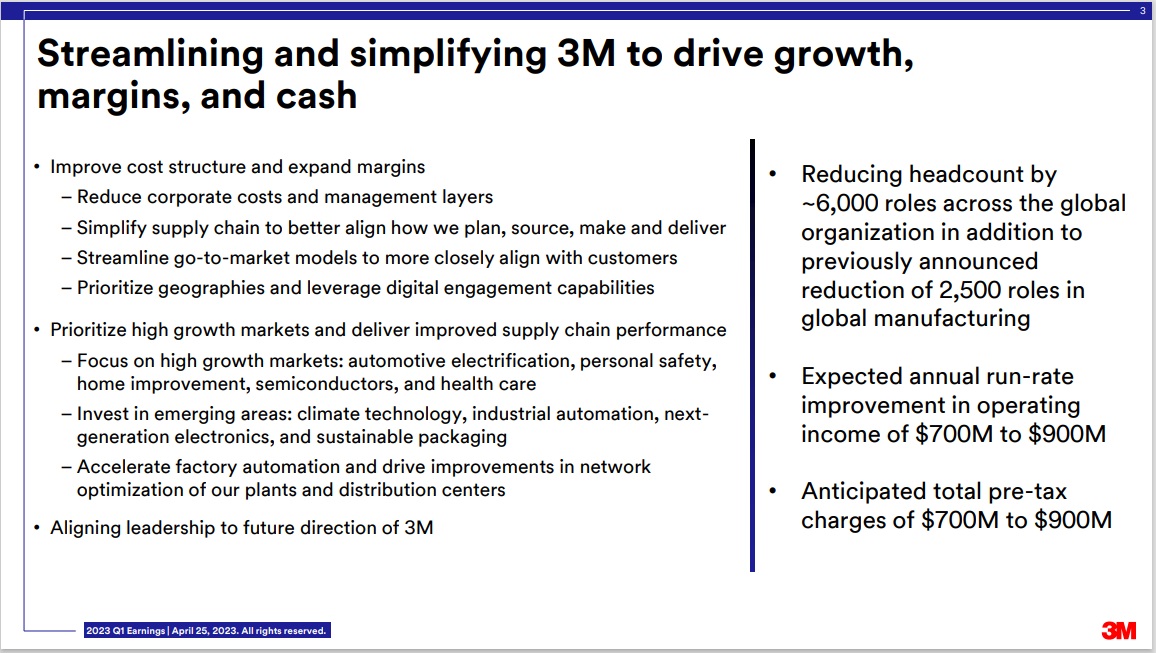

Blue-Chip Inventory #6: Amdocs Ltd. (DOX)

Dividend Historical past: 10 years of consecutive will increase

Dividend Yield: 2.1%

Anticipated Whole Return: 18.6%

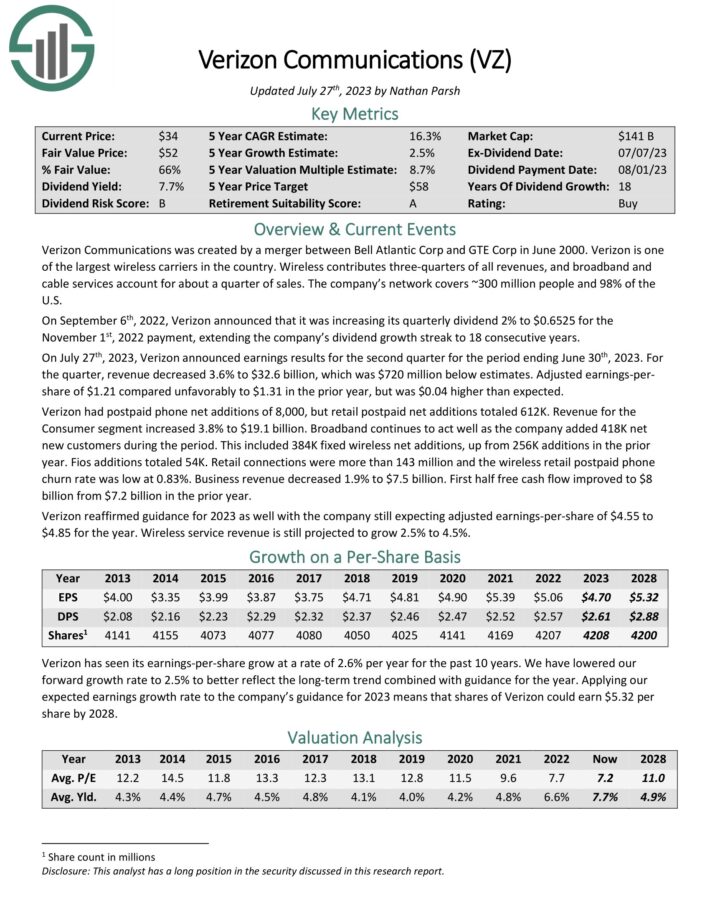

Amdocs Restricted is a B2B software program firm that serves communications service suppliers (CSPs). The enterprise has software program options that assist CSPs to transition from working within the conventional information heart setting to working successfully within the cloud.

Amdocs is about to capitalize on 5G, Cloud, and digitalization, and administration expects that these mega-trends will assist their serviceable addressable market proceed to broaden.

The enterprise serves communications service suppliers internationally with its 29,000 staff and has ~75% recurring income. The robust resiliency from its recurring income enterprise mannequin and robust operations have led to extraordinarily steady working margins over the previous 10 years, the place margins have steadily elevated from 18.6% in 2013 to 21.0% in 2022.

Administration sees room for long run development within the enterprise by retaining and constructing new platforms for the present buyer base, increasing the footprint inside underpenetrated Tier 1 clients, like Verizon and Constitution Communications, and including new companies to the present companies.

On August 2nd, 2023, Amdocs Restricted reported third quarter fiscal yr 2023 outcomes for the interval ending June thirtieth, 2023. The corporate earned $1.32 in GAAP diluted earnings-per-share for the quarter, up 26.9% from the year-ago quarter’s earnings of $1.04 per share and above administration’s steering vary of $1.16 to $1.26.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOX (preview of web page 1 of three proven under):

Blue-Chip Inventory #5: 3M Firm (MMM)

Dividend Historical past: 65 years of consecutive will increase

Dividend Yield: 6.8%

Anticipated Whole Return: 20.4%

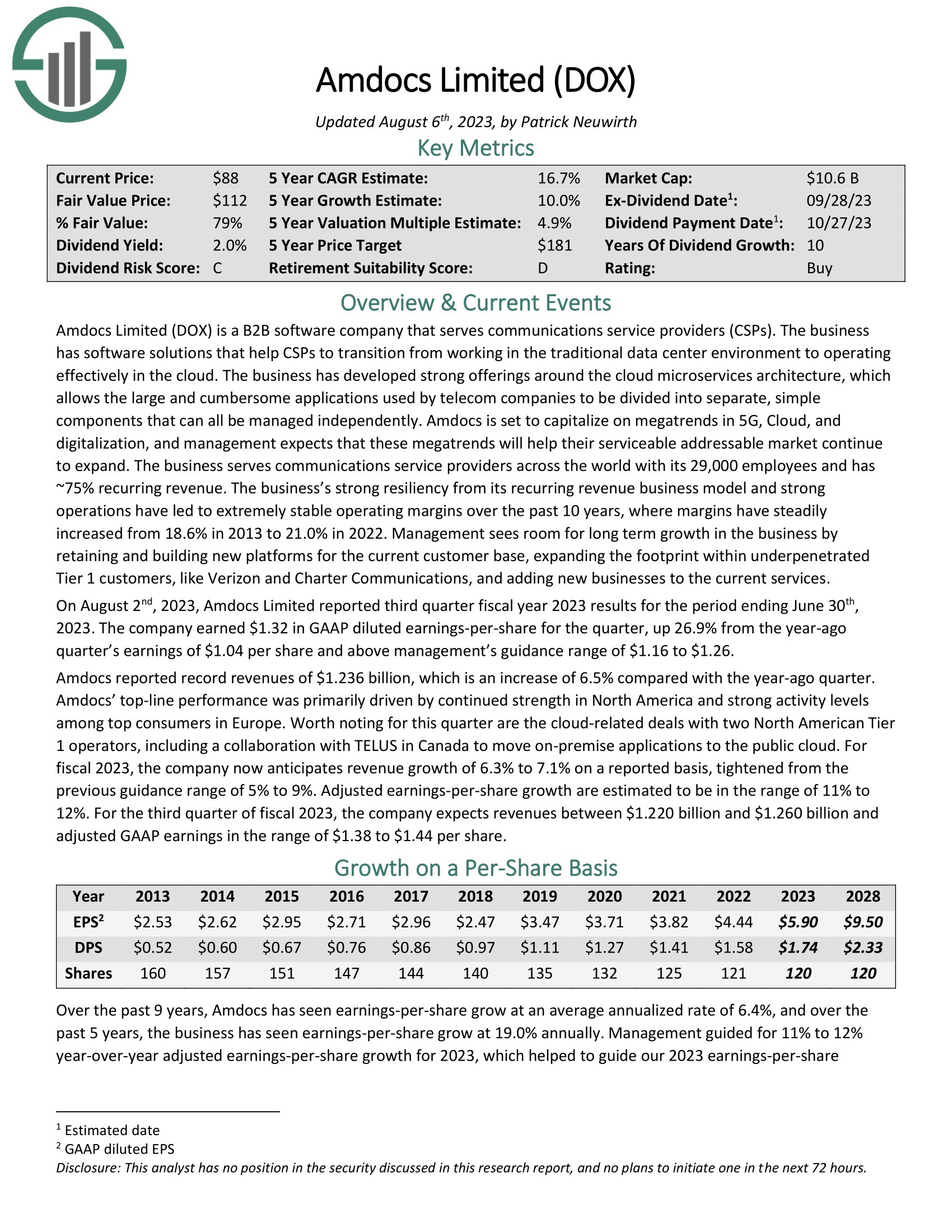

3M sells greater than 60,000 merchandise which might be used day-after-day in houses, hospitals, workplace buildings and colleges across the world. It has about 95,000 staff and serves clients in additional than 200 international locations.

3M is now composed of 4 separate divisions: Security & Industrial, Healthcare, Transportation & Electronics, and Shopper. The corporate additionally introduced that it might be spinning off its Well being Care section right into a standalone entity, which might have had $8.6 billion of income in 2021.

Supply: Investor Presentation

3M’s innovation is among the firm’s best aggressive benefits. The corporate targets R&D spending equal to six% of gross sales (~$2 billion yearly) with a view to create new merchandise to fulfill shopper demand.

This spending has confirmed to be very useful to the corporate as 30% of gross sales over the past fiscal yr had been from merchandise that didn’t exist 5 years in the past. 3M’s dedication to growing progressive merchandise has led to a portfolio of greater than 100,000 patents.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven under):

Blue-Chip Inventory #4: Eversource Vitality (ES)

Dividend Historical past: 25 years of consecutive will increase

Dividend Yield: 5.0%

Anticipated Whole Return: 20.4%

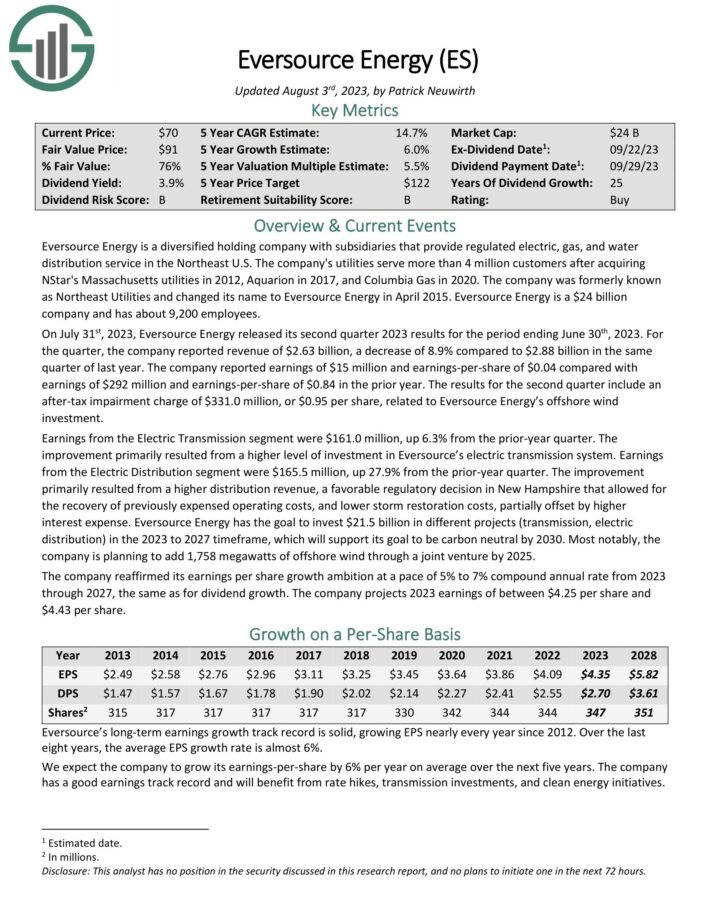

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S. The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

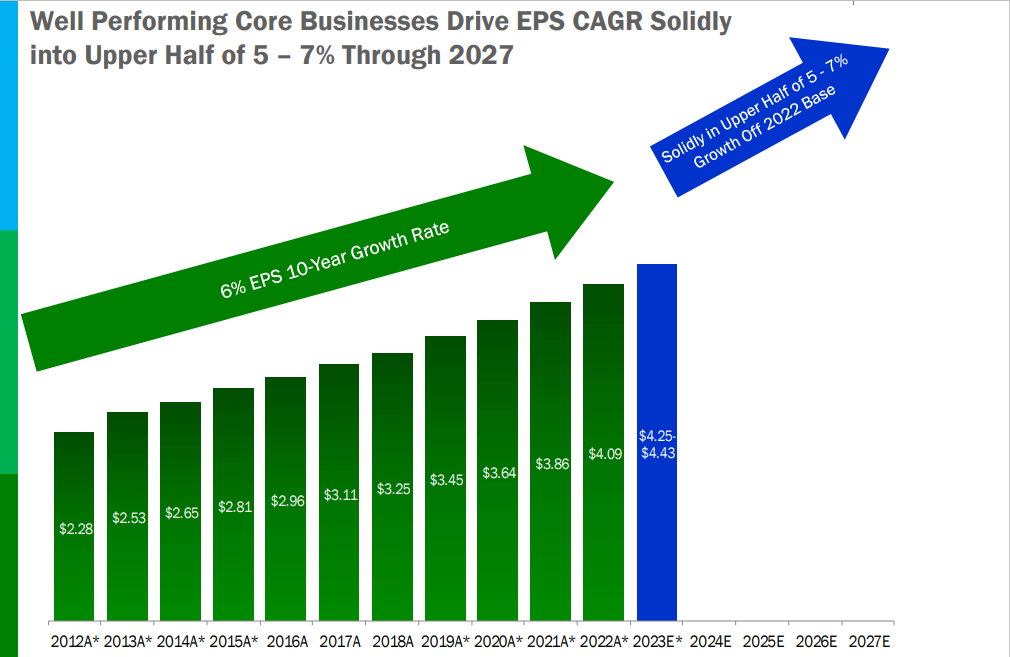

Eversource has a protracted historical past of producing regular development over time.

Supply: Investor Presentation

On July thirty first, 2023, Eversource Vitality launched its second quarter 2023 outcomes for the interval ending June thirtieth, 2023. For the quarter, the corporate reported income of $2.63 billion, a lower of 8.9% in comparison with $2.88 billion in the identical quarter of final yr.

The corporate reported earnings of $15 million and earnings-per-share of $0.04 in contrast with earnings of $292 million and earnings-per-share of $0.84 within the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven under):

Blue-Chip Inventory #3: NuSkin Enterprises (NUS)

Dividend Historical past: 23 years of consecutive will increase

Dividend Yield: 8.0%

Anticipated Whole Return: 21.9%

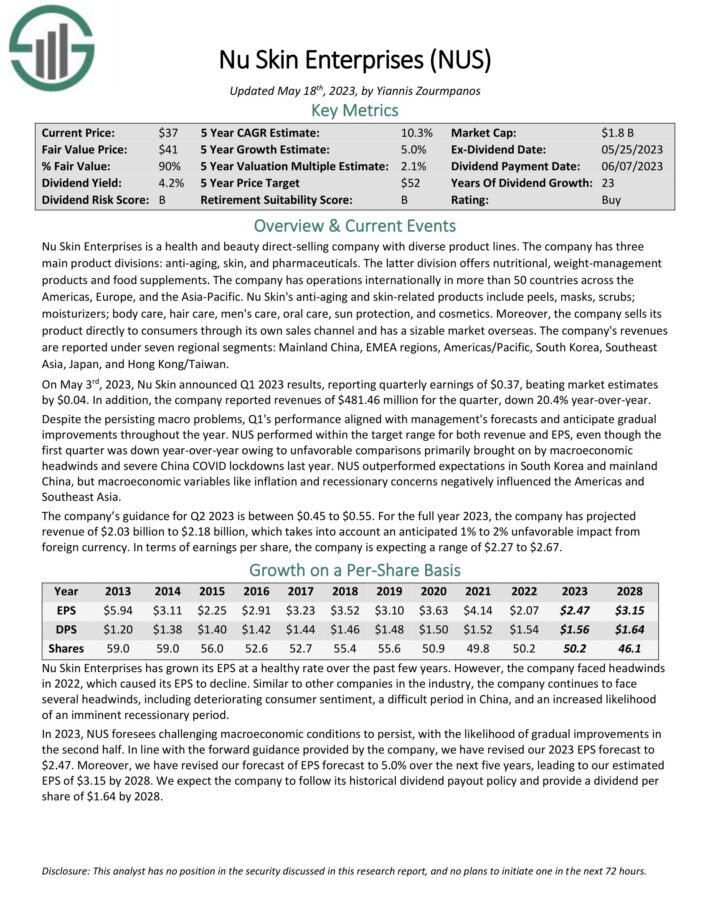

Nu Pores and skin Enterprises is a well being and sweetness direct-selling firm with various product traces. The corporate has three major product divisions: anti-aging, pores and skin, and prescribed drugs. The latter division presents dietary, weight administration merchandise and meals dietary supplements. The corporate has operations internationally in additional than 50 international locations throughout the Americas, Europe, and the Asia-Pacific.

Nu Pores and skin’s anti-aging and skin-related merchandise embody peels, masks, scrubs; moisturizers; physique care, hair care, males’s care, oral care, solar safety, and cosmetics. Furthermore, the corporate sells its product on to customers by way of its personal gross sales channel and has a large market abroad.

On Could third, 2023, Nu Pores and skin introduced Q1 2023 outcomes, reporting quarterly earnings of $0.37, beating market estimates by $0.04. As well as, the corporate reported revenues of $481.46 million for the quarter, down 20.4% year-over-year. Regardless of the persisting macro issues, Q1’s efficiency aligned with administration’s forecasts and anticipate gradual enhancements all year long.

The corporate’s steering for Q2 2023 is between $0.45 to $0.55. For the complete yr 2023, the corporate has projected income of $2.03 billion to $2.18 billion, which takes into consideration an anticipated 1% to 2% unfavorable impression from overseas forex. When it comes to earnings per share, the corporate is anticipating a variety of $2.27 to $2.67.

Click on right here to obtain our most up-to-date Certain Evaluation report on NUS (preview of web page 1 of three proven under):

Blue-Chip Inventory #2: Lincoln Nationwide Corp. (LNC)

Dividend Historical past: 11 years of consecutive will increase

Dividend Yield: 7.5%

Anticipated Whole Return: 23.8%

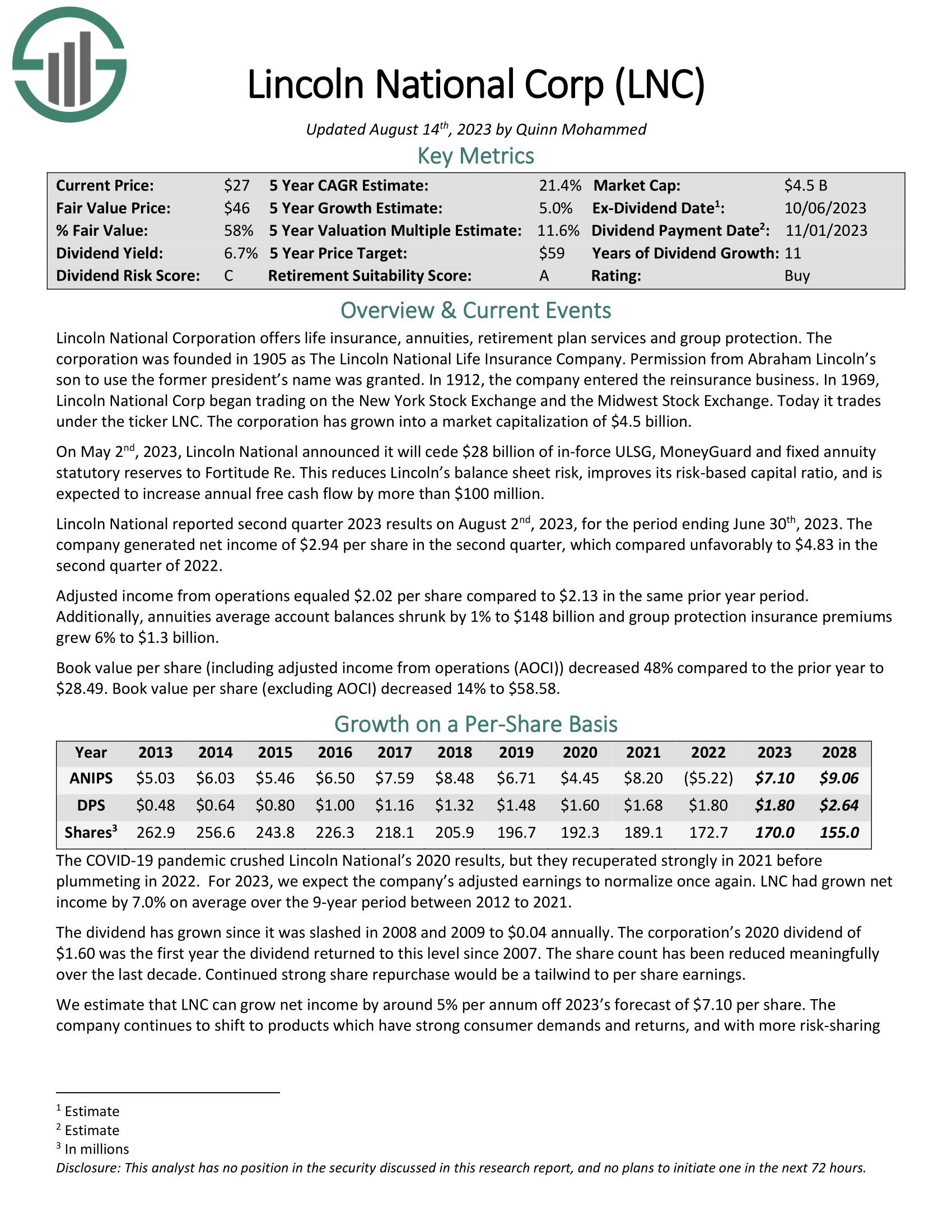

Lincoln Nationwide Company presents life insurance coverage, annuities, retirement plan companies and group safety. The company was based in 1905.

Lincoln Nationwide reported second quarter 2023 outcomes on August 2nd, 2023. The corporate generated internet earnings of $2.94 per share within the second quarter, which in contrast unfavorably to $4.83 within the second quarter of 2022. Adjusted earnings from operations equaled $2.02 per share in comparison with $2.13 in the identical prior yr interval.

Moreover, annuities common account balances shrunk by 1% to $148 billion and group safety insurance coverage premiums grew 6% to $1.3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LNC (preview of web page 1 of three proven under):

Blue-Chip Inventory #1: Albemarle Company (ALB)

Dividend Historical past: 28 years of consecutive will increase

Dividend Yield: 1.0%

Anticipated Whole Return: 33.0%

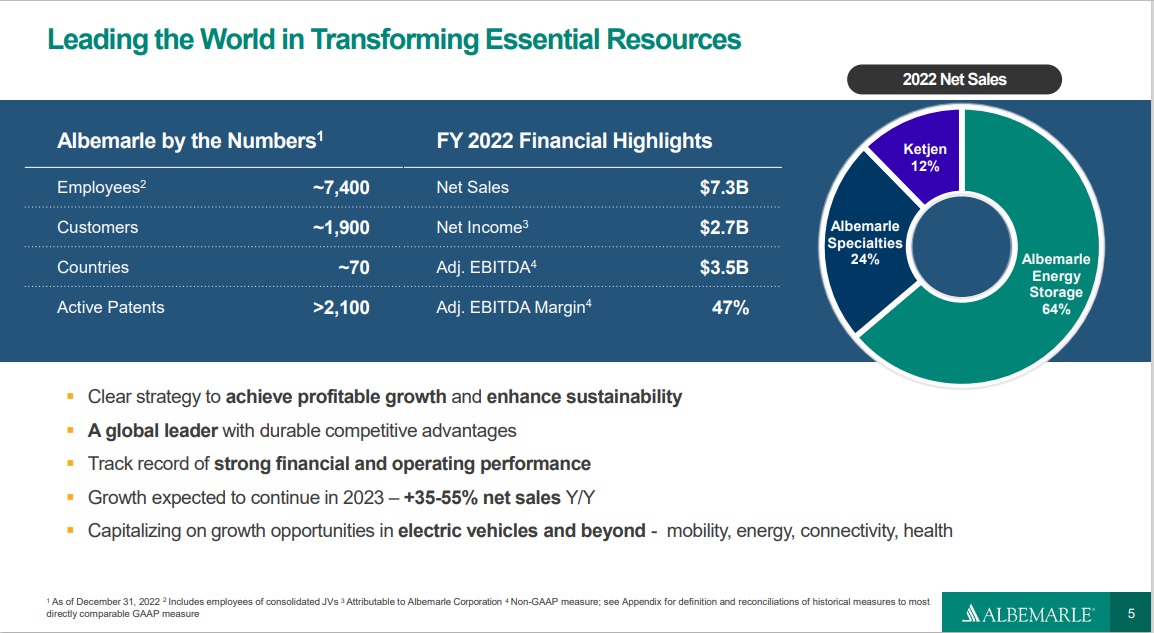

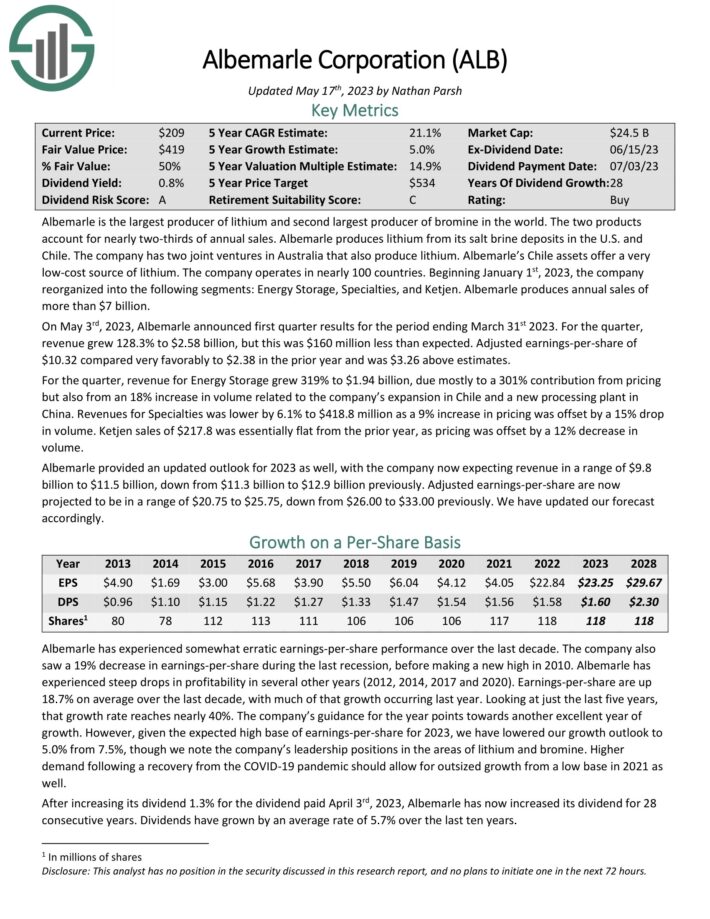

Albemarle is the biggest producer of lithium and second largest producer of bromine on the earth. The 2 merchandise account for almost two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium.

Associated: 2023 Lithium Shares Checklist

Supply: Investor Presentation

On Could third, 2023, Albemarle introduced first quarter outcomes. For the quarter, income grew 128.3% to $2.58 billion, however this was $160 million lower than anticipated. Adjusted earnings-per-share of $10.32 in contrast very favorably to $2.38 within the prior yr and was $3.26 above estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Albemarle (preview of web page 1 of three proven under):

Different Blue Chip Inventory Assets

Blue chip shares are likely to have many or the entire following traits:

Market leaders

Standard / well-known

Giant market capitalization

Lengthy historical past of paying rising dividends

Constant profitability even throughout recessions

That’s why they will make glorious investments for the long-run. And their power and reliability make them compelling investments for buyers of all expertise ranges, from novices to consultants.

This text featured a number of sources for locating compelling blue chip inventory investments:

The sources under will provide you with a greater understanding of blue chip investing, long-term investing, and dividend development investing.

Blue Chip Inventory Investing

Dividend Progress Investing

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link