[ad_1]

anyaberkut

DoubleVerify (NYSE:DV) offers promoting know-how. The corporate has achieved a steady and excessive development and has stayed worthwhile on a internet earnings foundation in the complete interval, opposite to many rising software program firms. DoubleVerify’s software program providing appears to be very aggressive within the ad-tech trade with a number of promising KPIs. Though the corporate is nice in high quality, I solely have a maintain ranking as the present value already displays the implausible prospects.

The Firm and Inventory

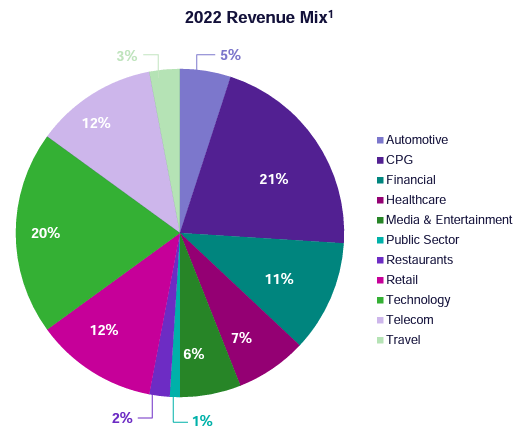

DoubleVerify presents digital promoting options that assist companies in optimizing geographical focusing on, viewability, prevention of fraud, and model security together with different functions. The providing targets to optimize clients’ promoting spend’s effectiveness. The corporate presents the answer in a number of industries – DoubleVerify’s clients are extremely diversified with industries starting from Automotive to Telecom:

DoubleVerify Q2 Earnings Presentation

DoubleVerify’s excessive buyer retention price speaks concerning the platform’s competitiveness – from 2019 to 2022, the corporate boasts a 100% buyer retention throughout the high 75 clients, whereas the common income per buyer has gone up from $1.1 million to $2.6 million per buyer in the identical interval. As well as, DoubleVerify is positioning itself for the AI revolution with the corporate’s Scibids AI platform that was launched in 2023. The corporate expects Scidibs to realize $15 million to $17 million in income in 2024, however expects a really excessive development into $100 million in revenues in 2028.

After an IPO within the first half of 2021, DoubleVerify’s inventory value has decreased by 20%. As know-how shares have seen a troublesome interval after the IPO, the lower is sort of anticipated.

Inventory Chart From IPO (Looking for Alpha)

Financials

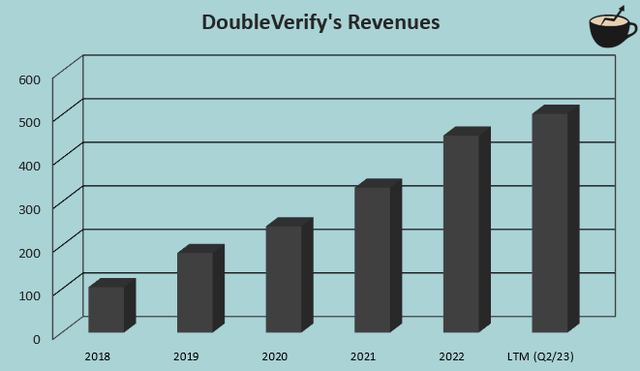

DoubleVerify’s compounded annual development price from 2018 to 2022 is 44.3%:

Creator’s Calculation Utilizing Looking for Alpha Information

The expansion has been principally natural as DoubleVerify solely has three money acquisitions within the interval that add as much as lower than 5% of the corporate’s present market capitalization. The ad-tech trade can also be rising as a market. For instance, DoubleVerify estimates a five-year CAGR of 12% for digital advert spend from 2020 to 2025 with Magna World forecast’s knowledge, as informed in DoubleVerify’s Q2 earnings presentation.

The corporate has been capable of preserve its working earnings worthwhile on a GAAP foundation in yearly of public monetary historical past. The EBIT margin has been fairly turbulent with a mean determine of 11.4% from 2018 to 2022. I imagine that DoubleVerify’s margins have a superb quantity of room to scale sooner or later – as with many SaaS platforms, variable prices are fairly steady even with rising revenues, offering vital working leverage. DoubleVerify’s additionally has a really excessive gross margin, at the moment standing at 81.6% with trailing figures.

DoubleVerify has a robust steadiness sheet. The corporate doesn’t at the moment maintain any interest-bearing debt supposed for financing functions. The steadiness sheet additionally reveals money and equivalents of $295 million – DoubleVerify has room for a strategic acquisition. I imagine that DoubleVerify ought to leverage some debt as a type of cheaper financing; the corporate already has wholesome money flows, so reasonable debt shouldn’t pose a menace for the operations.

Valuation

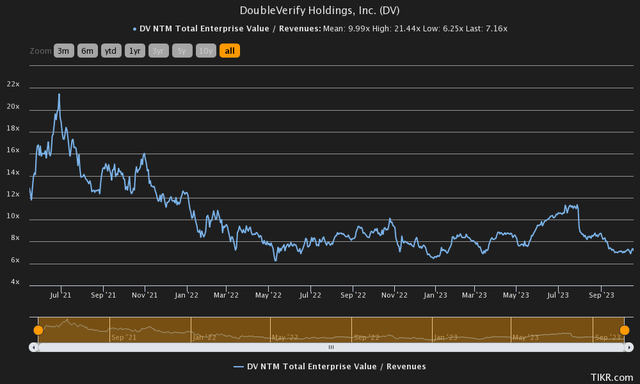

DoubleVerify’s inventory has had a reducing EV/S for many of the inventory’s historical past within the inventory market – after a excessive of a ahead EV/S of 21.4 in 2021, the ratio has come down right into a present degree of seven.2.

Historic Ahead EV/S (TIKR)

The EV/S ratio as an remoted determine doesn’t give a superb context into an organization’s valuation. Even inside SaaS firms, the honest EV/S ratio varies closely relying on the corporate’s anticipated development and achievable margins on high of different components. To additional conceptualize the valuation and to estimate a tough honest worth for the inventory, I constructed a reduced money circulate mannequin as standard.

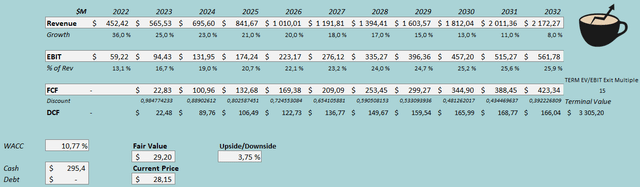

Within the mannequin, I estimate DoubleVerify’s development to proceed fairly in step with the historic development by way of greenback figures, with slight development within the development in greenback figures. Share-wise, I estimate the expansion to decelerate slowly – in 2023, I estimate a development of 25% that slows all the way down to 23% in 2024. Past 2024, I estimate comparable decreases within the development tempo right into a development off 8% in 2032. The estimated income development represents an natural CAGR of 17.0% from 2022 to 2032.

I imagine that DoubleVerify’s margins nonetheless have room to develop considerably, as defined within the financials -segment. For the present 12 months, I estimate an EBIT margin of 16.7%, 360 foundation factors above the achieved 2022 degree. After 2023, I estimate the working leverage to proceed alongside DoubleVerify’s development – I estimate the EBIT margin to develop right into a determine of 25.9% that’s achieved in 2032. The mannequin does think about a excessive quantity of margin enlargement, however with the corporate’s very excessive gross margin, I imagine the estimate is achievable.

Opposite to my standard methodology of discounting money flows with a perpetual development price within the terminal of the DCF mannequin, I imagine that an EV/EBIT exit a number of is extra applicable for DoubleVerify. Within the mannequin, I estimate the expansion to proceed at a reasonable however vital degree in 2032 – a perpetual price could be troublesome to find out. I imagine an EV/EBIT exit a number of of 15 represents the honest worth fairly effectively, as the corporate nonetheless grows within the mannequin with a high-quality product.

The talked about estimates together with a price of capital of 10.77% craft the next DCF mannequin with a good worth estimate of $29.20, round 4% above the worth on the time of writing:

DCF Mannequin (Creator’s Calculation)

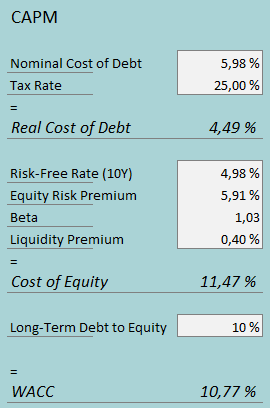

The used weighted common price of capital is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

DoubleVerify doesn’t at the moment leverage debt within the firm’s financing. I imagine that sooner or later the corporate may begin drawing some debt as a type of financing, as I imagine the corporate’s money flows to be steady. Within the CAPM, I estimate a long-term debt-to-equity ratio of 10%. For the rate of interest estimate, I exploit a determine of 5.98%. The estimate is calculated from the USA’ 10-year bond yield of 4.98%, and including in a proportion level for a margin of security.

I exploit the identical US’ 10-year bond yield because the risk-free price on the price of fairness facet. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s estimate made in July. Yahoo Finance estimates DoubleVerify’s beta at a determine of 1.03. Lastly, I add a small liquidity premium of 0.4% into the price of fairness, crafting the determine at 11.47% and the WACC at 10.77%.

Takeaway

I base my views on a inventory largely on its valuation. Though DoubleVerify’s value appears very excessive at a ahead P/E of 39, I imagine the worth pretty displays the corporate’s promising prospects. The corporate has a really excessive retention price together with new AI resolution capabilities, fueling DoubleVerify for vital development. As my DCF mannequin estimates the inventory to be valued pretty, I imagine a maintain ranking is constituted.

[ad_2]

Source link