[ad_1]

Kuzmik_A/iStock through Getty Photos

O-I Glass (NYSE:OI) produces glass bottles. The inventory has carried out very poorly prior to now ten years as acquisitions haven’t helped the corporate in attaining any development in actual phrases. The corporate’s margins are enhancing in the present 12 months as the corporate goals for price efficiencies and a greater pricing, however the efforts might show themselves as flimsy as gross sales volumes have gone down. The inventory appears to be priced for the weak financials at a ahead P/E of 5.6, although – I’ve a hold-rating for the inventory.

The Firm & Inventory

Based in 1903 in Ohio, O-I Glass produces glass packaging for alcohol producers. The corporate primarily produces glass bottles meant for beer and wine merchandise.

The inventory hasn’t been a improbable long-term funding – O-I Glass’s inventory has halved in value over the previous ten years, whereas solely paying $0.25 per share in dividends, signifying a complete yield of lower than a % with the late 2013 inventory value. Furthermore, the corporate doesn’t at the moment pay any dividends, though the corporate is contemplating a dividend.

Ten-12 months Inventory Chart (Searching for Alpha)

Financials

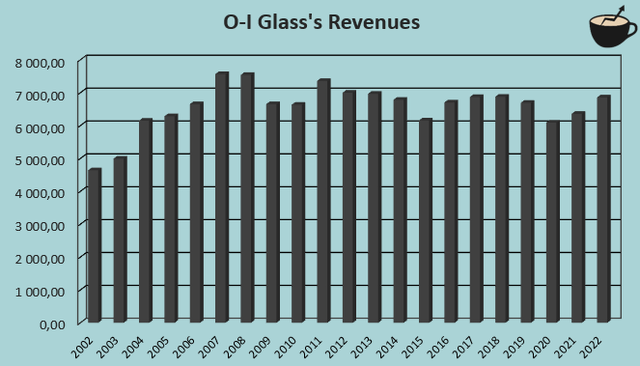

O-I Glass’ income hasn’t been superb. The corporate has achieved a compounded annual development fee of two.0% from 2002 to 2022:

Writer’s Calculation Utilizing TIKR Knowledge

At face worth, the expansion appears okay as it’s principally according to inflation. What makes the expansion unhealthy is the truth that the efficiency is a results of a number of acquisitions. For instance, in 2015 the corporate had a money acquisition value $2.4 billion, being value across the identical as O-I Glass’ present market capitalization. Different acquisitions have been smaller in measurement, however nonetheless contributed nicely into O-I Glass’ efficiency.

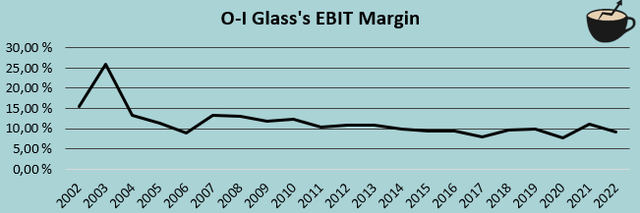

The income efficiency isn’t the one worrying monetary metric for O-I Glass’ buyers. The corporate’s EBIT margin has traditionally been on a slight decline in the long run. The corporate’s common EBIT margin from 2002 to 2022 is 11.5%, with the 2022 margin being 9.1%.

Writer’s Calculation Utilizing TIKR Knowledge

The corporate has achieved a greater degree in 2023 to this point, as the present trailing margin stands at 11.7%. O-I Glass’ administration attributes the sturdy margin into a positive pricing within the interval within the firm’s Q2 earnings name. In the identical name, the administration mentions that volumes are down by 9% in Q2; though a few of the decrease quantity might be attributed to a softer demand, it appears doable that the upper pricing has precipitated O-I Glass’ purchasers to chorus from buying within the interval. O-I Glass does have margin enlargement as a transparent goal within the firm’s technique – a part of the elevated EBIT might very nicely be sustainable.

Margin Initiatives (O-I Glass Q2 Earnings Presentation)

O-I Glass has a considerable amount of debt, a minimum of when in comparison with the corporate’s market capitalization. The corporate’s stability sheet reveals round $4.7 billion of long-term debt, of which $81 million is within the present portion. In comparison with O-I Glass’ present market capitalization of $2.4 billion, the quantity appears very extreme. The corporate must depend on secure money flows from operations to have the ability to finance the money owed as additional fairness financing to repay debt would dilute buyers’ shares massively. In comparison with the corporate’s present ranges of working revenue, the debt doesn’t appear too unreasonable but although – with trailing figures, round 32% of working revenue has gone into curiosity bills.

Upcoming Q3 Outcomes

O-I Glass is reporting its Q3 outcomes on the first of November within the post-market. Analysts at the moment count on revenues of $1.76 billion, representing a development of 4.0% year-over-year. I imagine that the estimate appears cheap, as in Q2 the corporate’s revenues grew by 6.3% – the estimated determine is roughly according to latest efficiency, though does value in a barely weaker quarter when it comes to development.

For O-I Glass’ EPS, analysts predict a normalized determine of $0.70. The estimate approximates O-I Glass’ margins to scale barely, as in Q3 of 2022 the corporate had an EPS of $0.63 – revenues are anticipated to develop by 4% and the EPS by round 11%. In Q2, the EPS grew by 21% year-over-year as O-I Glass’ margin efficiency has been good – the estimated earnings might be met with a slight optimistic shock.

Valuation

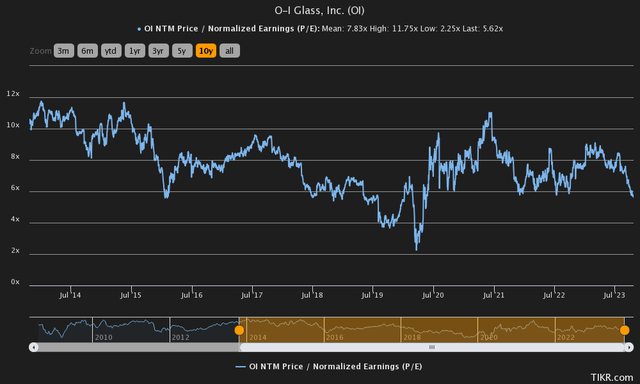

O-I Glass appears very low-cost on a price-to-earnings foundation. The corporate’s present ahead P/E stands at 5.6, beneath the corporate’s already low ten-year common of seven.8:

Historic Ahead P/E (TIKR)

The P/E ratio doesn’t inform your entire story alone. O-I Glass has had a weak long-term historical past when it comes to development and margin improvement. The corporate can be at the moment investing closely, leading to weakened money flows. On prime, O-I Glass’ terribly great amount of long-term debt poses a danger for shareholders. To additional analyse the valuation, I constructed a reduced money movement mannequin in my regular method.

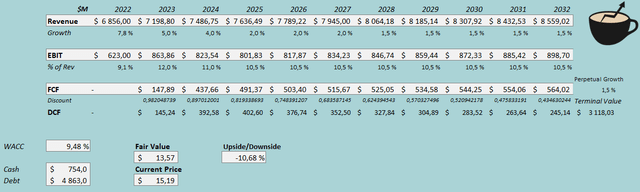

Within the mannequin, I estimate a development of 5% in 2023, signifying a barely worse H2 as in H1 revenues grew by 7.3%. After 2023, I estimate a development of 4% in 2024 because the at the moment softer demand might begin to subside. The higher quantity of development is for my part not possible to be maintained, although. For the interval from 2025 to 2027, I estimate O-I Glass’ revenues to develop by 2%. After 2027, I estimate the expansion to decelerate additional right into a tempo of 1.5%, that means very slight decreases in quantity if inflation continues at a long-term common tempo.

For the EBIT margin, I estimate a determine of 12.0% for 2023 as the corporate’s pricing improves the margin. After the 12 months, I estimate prices to catch up and pricing to return barely all the way down to sustain volumes – I estimate the margin to return down by one share level. Additional, I estimate an EBIT margin lower of half a share level in 2025 right into a determine of 10.5% that’s sustained into perpetuity. The talked about estimates together with a price of capital of 9.48% craft the next DCF mannequin with a good worth estimate of $13.57, round 11% beneath the present value:

DCF Mannequin (Writer’s Calculation)

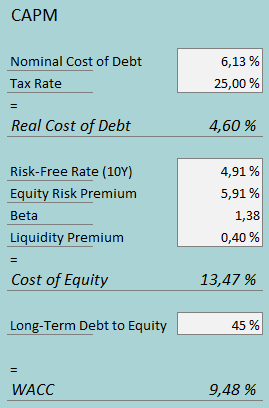

The used weighed common price of capital is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

Within the first half of 2023, O-I Glass had $149 million in curiosity bills. With the corporate’s whole quantity of interest-bearing debt, the corporate’s rate of interest comes as much as an annualized determine of 6.13%. O-I Glass holds a major quantity of debt on its stability sheet and has completed so for a protracted time period. I imagine that the technique will proceed, as I estimate a long-term debt-to-equity ratio of 45%. The corporate does plan to deleverage the stability sheet barely, however nonetheless to maintain a excessive quantity of debt as a type of financing.

For the risk-free fee on the price of fairness aspect, I exploit the USA’ 10-year bond yield of 4.91%. The fairness danger premium of 5.91% is Professor Aswath Damodaran’s estimate made in July for the US. Yahoo Finance estimates O-I Glass’ beta at a determine of 1.38. I imagine that the corporate’s operations are very defensive of their nature, however as O-I Glass has a really excessive quantity of debt, shareholders are extremely leveraged within the operations. Lastly, I add a small liquidity premium of 0.4% into the price of fairness, crafting the determine at 13.47% and the WACC at 9.48%.

Takeaway

Though the low P/E ratio looks as if an excellent alternative to purchase the inventory, I imagine that O-I Glass’ buyers must be cautious concerning the inventory. The corporate has had a principally unhealthy monetary historical past, and the corporate actively leverages a really excessive quantity of debt. O-I Glass does have initiatives that goal to information the corporate in direction of development and margin enlargement, however I imagine the makes an attempt shouldn’t be taken at face worth; a long-term monetary historical past speaks extra for my part. The present inventory value appears to agree with my thesis because the inventory appears roughly pretty valued with my DCF mannequin – in the interim, I’ve a hold-rating.

[ad_2]

Source link