[ad_1]

Up to date on October twenty fourth, 2023

Throughout the Nice Despair of the Thirties, the time period “widow-and-orphan inventory” was created. The sort of shares that took on this nickname have been shares that may climate turbulent financial situations, producing a gradual stream of earnings for individuals who are most weak, like widows and orphans.

These sorts of shares have been mature firms with robust market shares. Additionally they had the attribute of paying excessive dividends. These firms are usually in established industries, like utilities, client staples, or telecommunications.

A lot of these firms get pleasure from regular money movement, generate constant earnings, and have a powerful market share with little to no competitors. Due to this, they typically pay out excessive dividend yields even when markets are experiencing low progress charges.

You possibly can see the complete downloadable spreadsheet of all 51 Dividend Kings (together with essential monetary metrics equivalent to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

In at this time’s article, we’ll have a look at 10 shares that will be thought-about widow-and-orphan shares.

All of those shares are within the Shopper Staples, Utilities, and Communication Companies industries. They’ve been paying a rising dividend for greater than 19 years. Additionally they have a present dividend yield of no less than 4%.

Desk of Contents

Retirement Inventory for Revenue #1: Verizon Communications Inc. (VZ)

Verizon is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

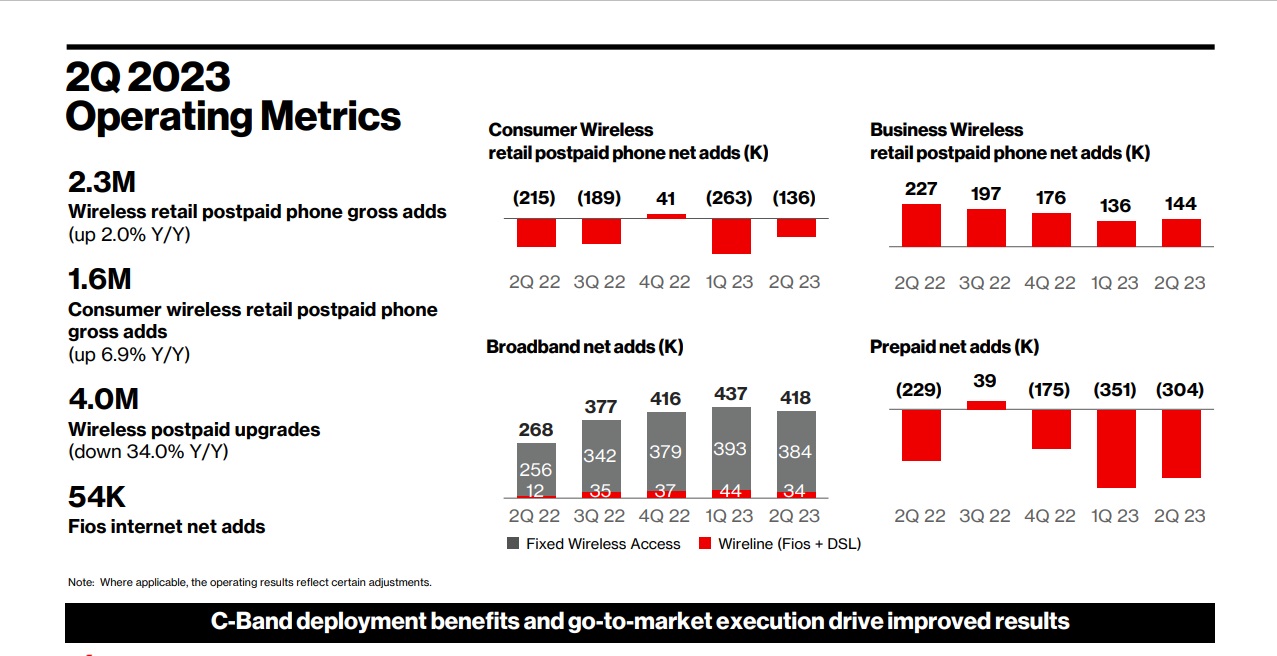

On July twenty seventh, 2023, Verizon introduced earnings outcomes for the second quarter for the interval ending June thirtieth, 2023. For the quarter, income decreased 3.6% to $32.6 billion, which was $720 million beneath estimates. Adjusted earnings per-share of $1.21 in contrast unfavorably to $1.31 within the prior 12 months, however was $0.04 larger than anticipated.

Supply: Investor Presentation

Verizon had postpaid cellphone web additions of 8,000, however retail postpaid web additions totaled 612K. Income for the Shopper section elevated 3.8% to $19.1 billion. Broadband continues to behave nicely as the corporate added 418K web new clients through the interval. This included 384K fastened wi-fi web additions, up from 256K additions within the prior 12 months. First half free money movement improved to $8 billion from $7.2 billion within the prior 12 months.

Verizon reaffirmed steering for 2023 as nicely with the corporate nonetheless anticipating adjusted earnings-per-share of $4.55 to $4.85 for the 12 months. Wi-fi service income remains to be projected to develop 2.5% to 4.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

Widow and Orphan Inventory #2: UGI Corp. (UGI)

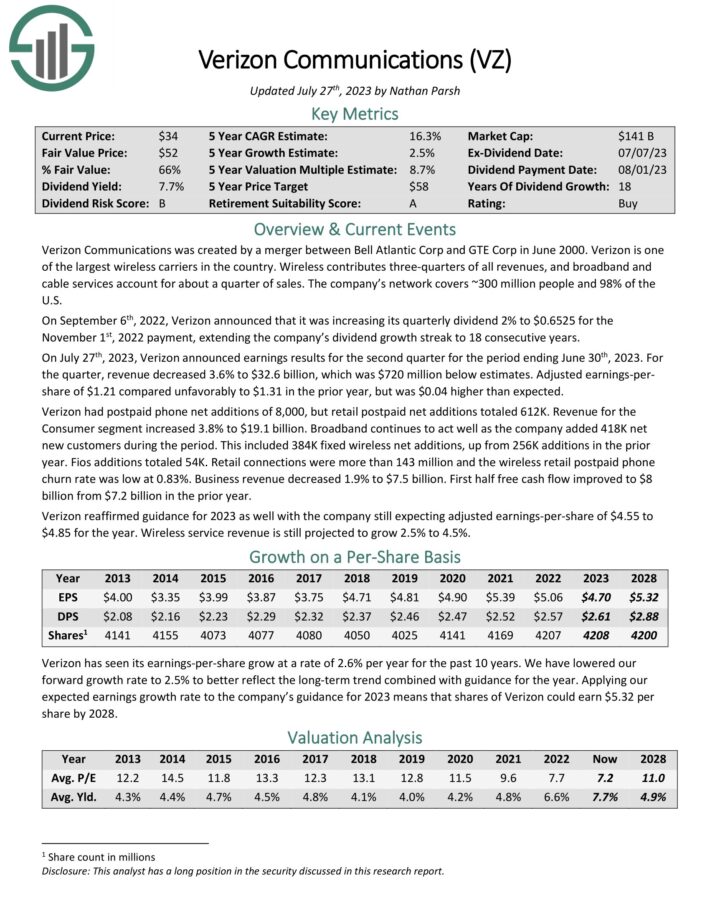

UGI Company is a gasoline and electrical utility that operates in Pennsylvania, along with a big power distribution enterprise that serves the whole US and different elements of the world. It was based in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $4.8 billion. The corporate operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Advertising and marketing, and UGI Utilities.

On August 2nd, 2023, UGI reported its Q3 outcomes. The quarter noticed GAAP diluted earnings per share of $(3.76) and adjusted diluted EPS of $0.00, contrasting with GAAP diluted EPS of $(0.03) and adjusted diluted EPS of $0.06 within the prior-year interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on UGI (preview of web page 1 of three proven beneath):

Widow and Orphan Inventory #3: Goal Company (TGT)

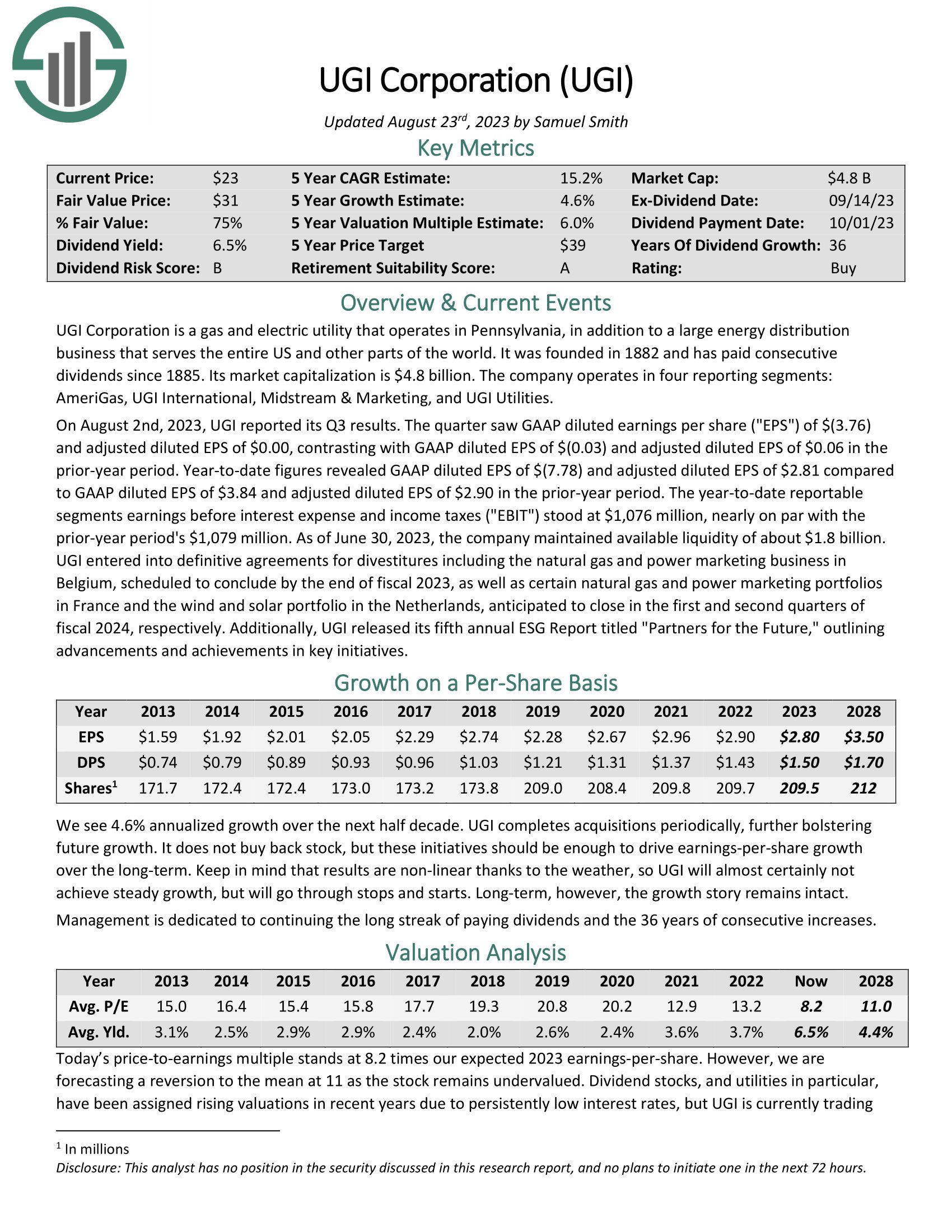

Goal is a reduction retail operations solely within the U.S. market. Its enterprise consists of about 2,000 large field shops providing normal merchandise and meals and serving as distribution factors for its burgeoning e-commerce enterprise.

Goal has invested closely in e-commerce. The rise in e-commerce initially caught many retail firms flat-footed. Goal has actually revamped its on-line choices and has seen unbelievable progress charges.

Supply: Investor Presentation

Goal posted second quarter earnings on August sixteenth, 2023, and outcomes have been considerably blended. Adjusted earnings-per-share got here in nicely forward of estimates at $1.80, which was 38 cents higher than anticipated.

Income was $24.8 billion, down 4.9% year-over-year, and lacking estimates by $460 million. The corporate additionally lowered its full-year gross sales and revenue expectations resulting from weakening gross sales, however rising margins.

Click on right here to obtain our most up-to-date Certain Evaluation report on Goal Company (preview of web page 1 of three proven beneath):

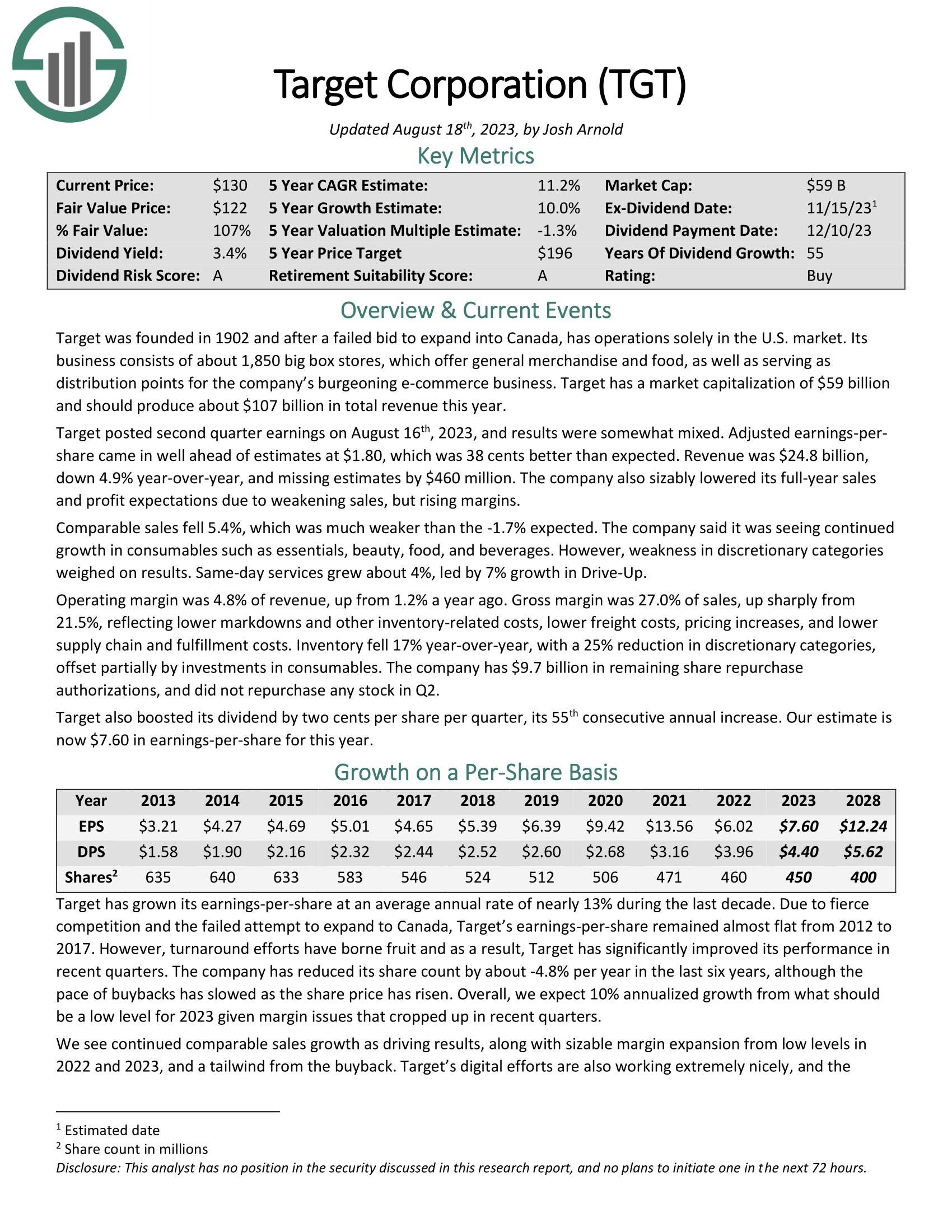

Widow and Orphan Inventory #4: Altria Group (MO)

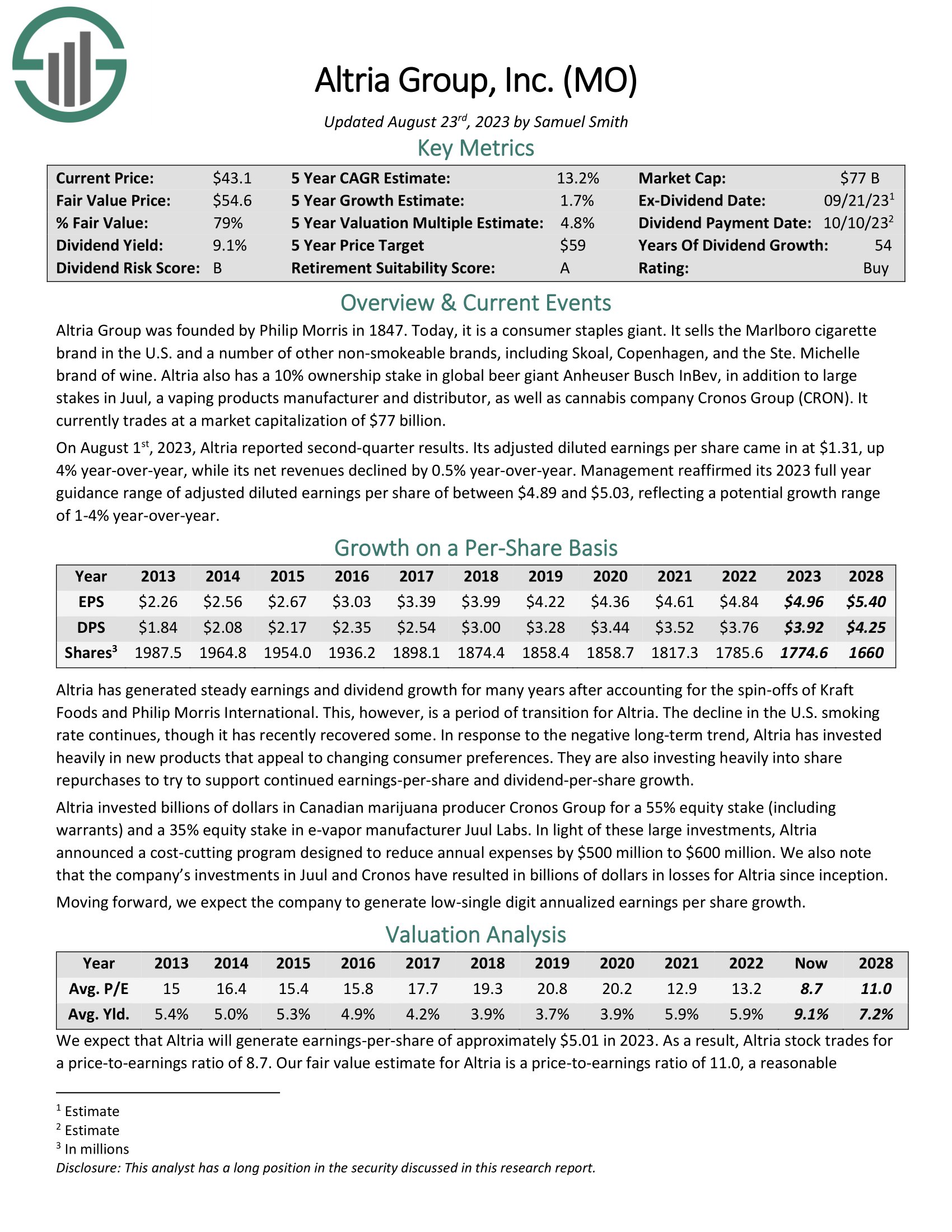

Altria Group was based by Philip Morris in 1847. As we speak, it’s a client staples large. It sells the Marlboro cigarette model within the U.S. and plenty of different non-smokeable manufacturers, together with Skoal and Copenhagen.

Altria has elevated its dividend for over 50 years, inserting it on the unique Dividend Kings checklist. This can be a uncommon enterprise longevity achievement that speaks to the endurance of the corporate’s manufacturers, even with the gradual decline in smoking within the U.S.

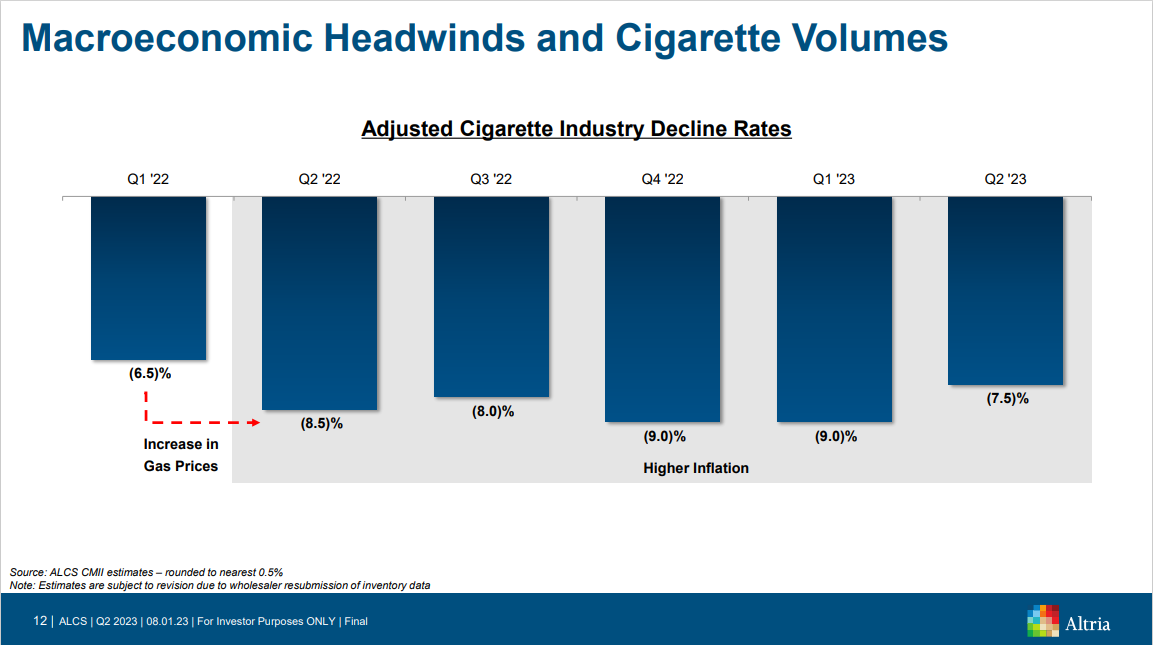

Supply: Investor Presentation

On August 1st, 2023, Altria reported second-quarter outcomes. Its adjusted diluted earnings per share got here in at $1.31, up 4% year-over-year, whereas its web revenues declined by 0.5% year-over-year.

Administration reaffirmed its 2023 full 12 months steering vary of adjusted diluted earnings per share of between $4.89 and $5.03, reflecting a possible progress vary of 1-4% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Widow and Orphan Inventory #5: Black Hills Corp. (BKH)

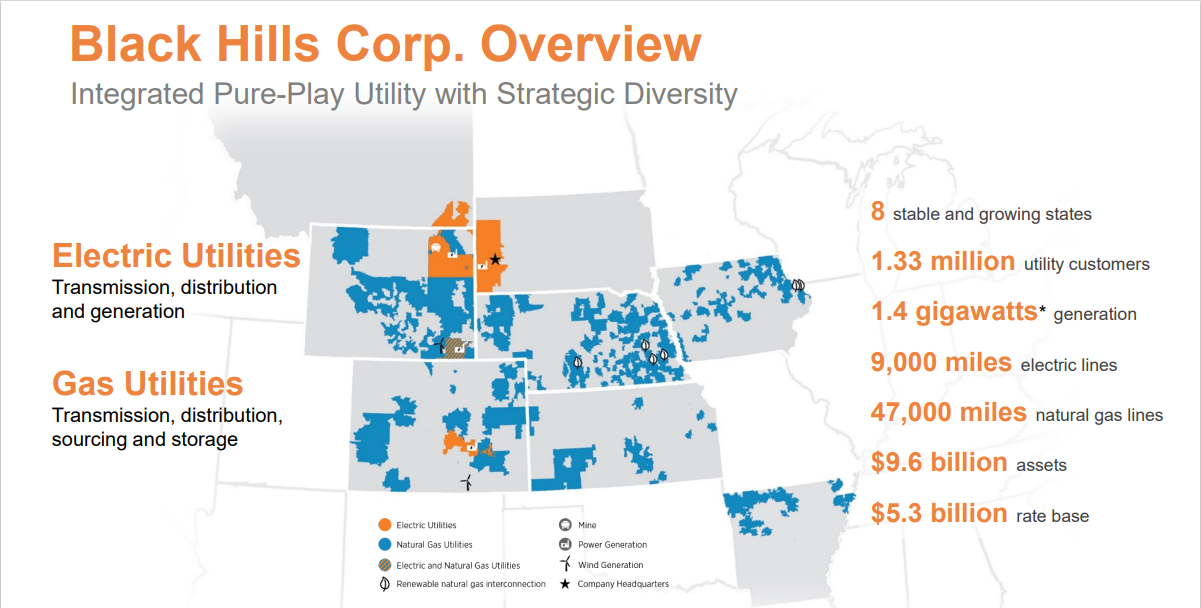

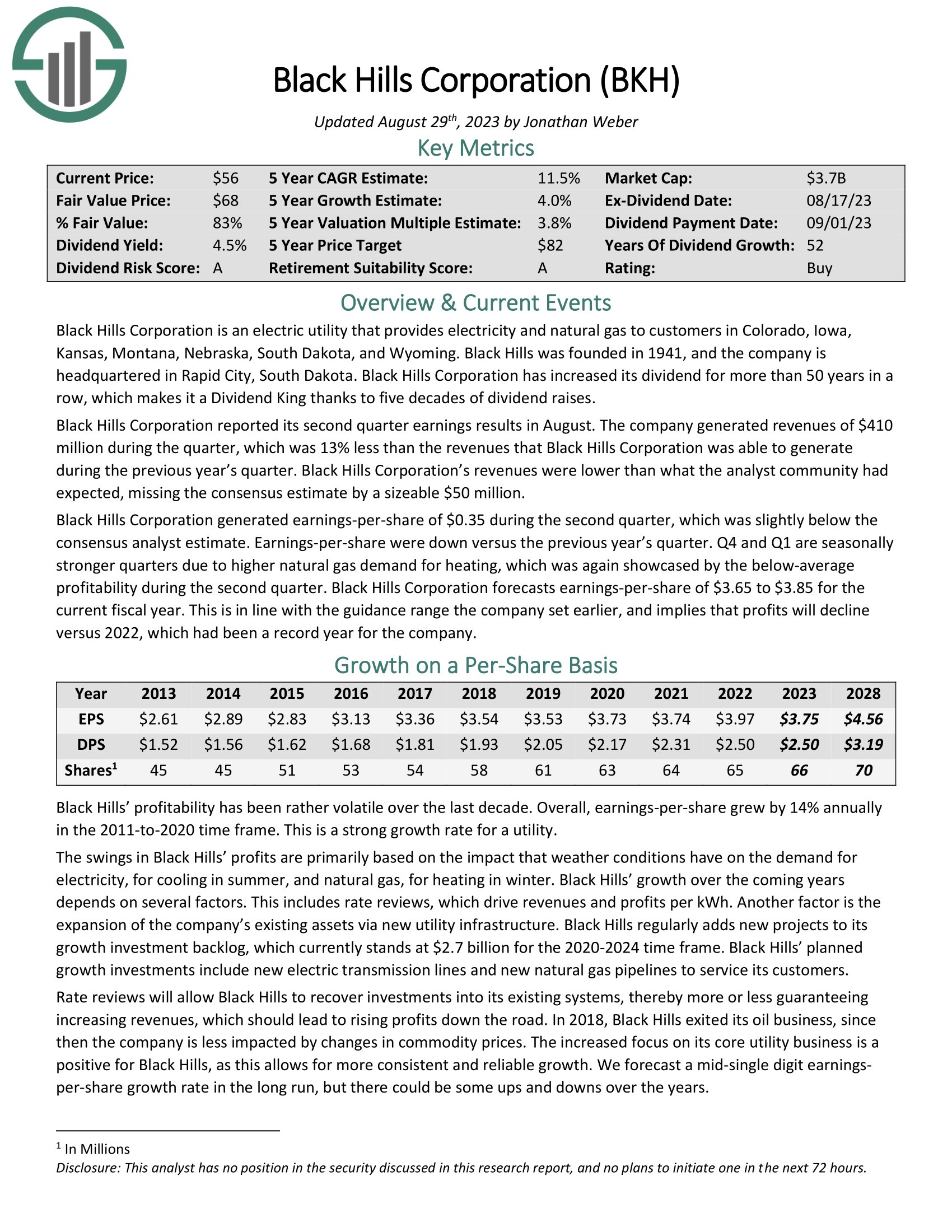

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.33 million utility clients in eight states. Its pure gasoline property embrace 47,000 miles of pure gasoline strains. Individually, it has ~9,000 miles of electrical strains and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Within the 2023 second quarter, revenues of $410 million declined 13% year-over-year and missed the consensus estimate by $50 million. Earnings-per-share of $0.35 was barely beneath the consensus analyst estimate. The utility forecasts earnings-per-share of $3.65 to $3.85 for the present fiscal 12 months.

Utilities like Black Hills are proof against recessions as demand for electrical energy and gasoline shouldn’t be very cyclical. Black Hills ought to stay worthwhile beneath most circumstances. The truth that clients have a tendency to stay with their supplier implies that Black Hills operates a comparatively secure enterprise mannequin.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

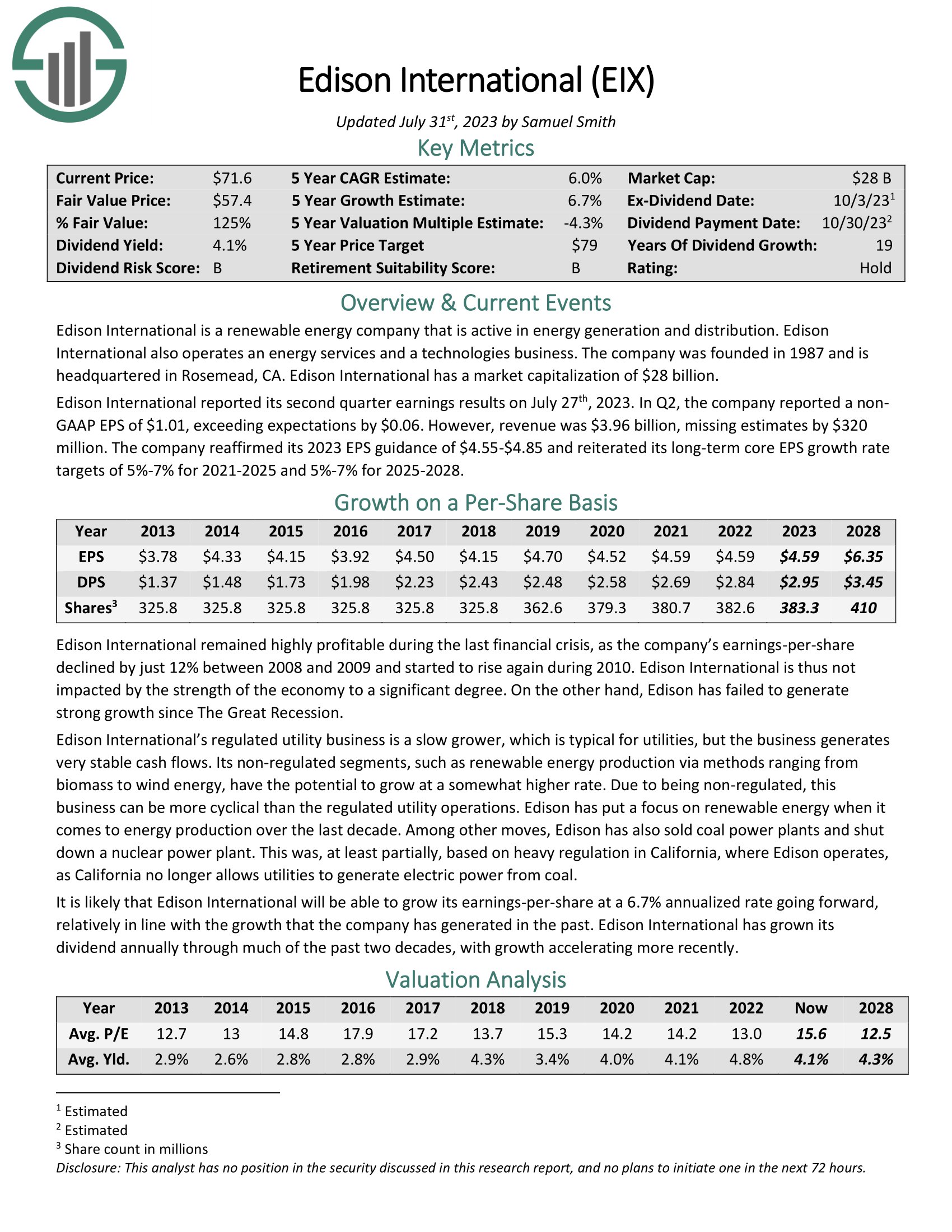

Widow and Orphan Inventory #6: Edison Worldwide (EIX)

Edison Worldwide is a renewable power firm that’s energetic in power era and distribution. Edison Worldwide additionally operates power companies and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, California. Whole income is round $22.3 billion.

Edison Worldwide reported its second quarter earnings outcomes on July twenty seventh, 2023. In Q2, the corporate reported a nonGAAP EPS of $1.01, exceeding expectations by $0.06. Nonetheless, income was $3.96 billion, lacking estimates by $320 million. The corporate reaffirmed its 2023 EPS steering of $4.55-$4.85 and reiterated its long-term core EPS progress price targets of 5%-7% for 2021-2025 and 5%-7% for 2025-2028.

Click on right here to obtain our most up-to-date Certain Evaluation report on EIX (preview of web page 1 of three proven beneath):

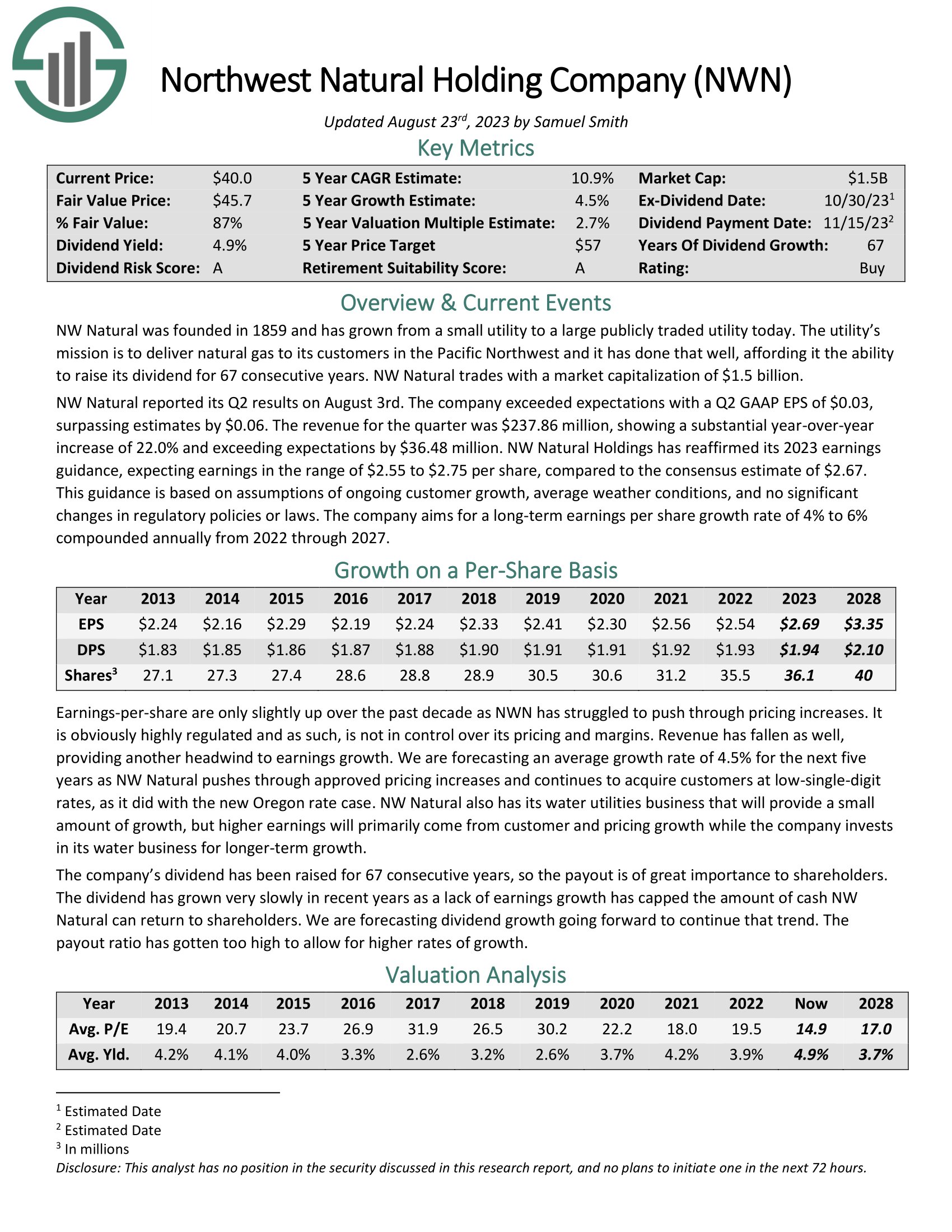

Widow and Orphan Inventory #7: Northwest Pure Holding Co. (NWN)

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 at this time. The utility’s mission is to ship pure gasoline to its clients within the Pacific Northwest, and it has completed that nicely, affording it the power to boost its dividend for 66 consecutive years.

Supply: Investor Presentation

NW Pure reported its Q2 outcomes on August third. The corporate exceeded expectations with a Q2 GAAP EPS of $0.03, surpassing estimates by $0.06. The income for the quarter was $237.86 million, exhibiting a considerable year-over-year enhance of twenty-two.0% and exceeding expectations by $36.48 million.

NW Pure Holdings has reaffirmed its 2023 earnings steering, anticipating earnings within the vary of $2.55 to $2.75 per share, in comparison with the consensus estimate of $2.67.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

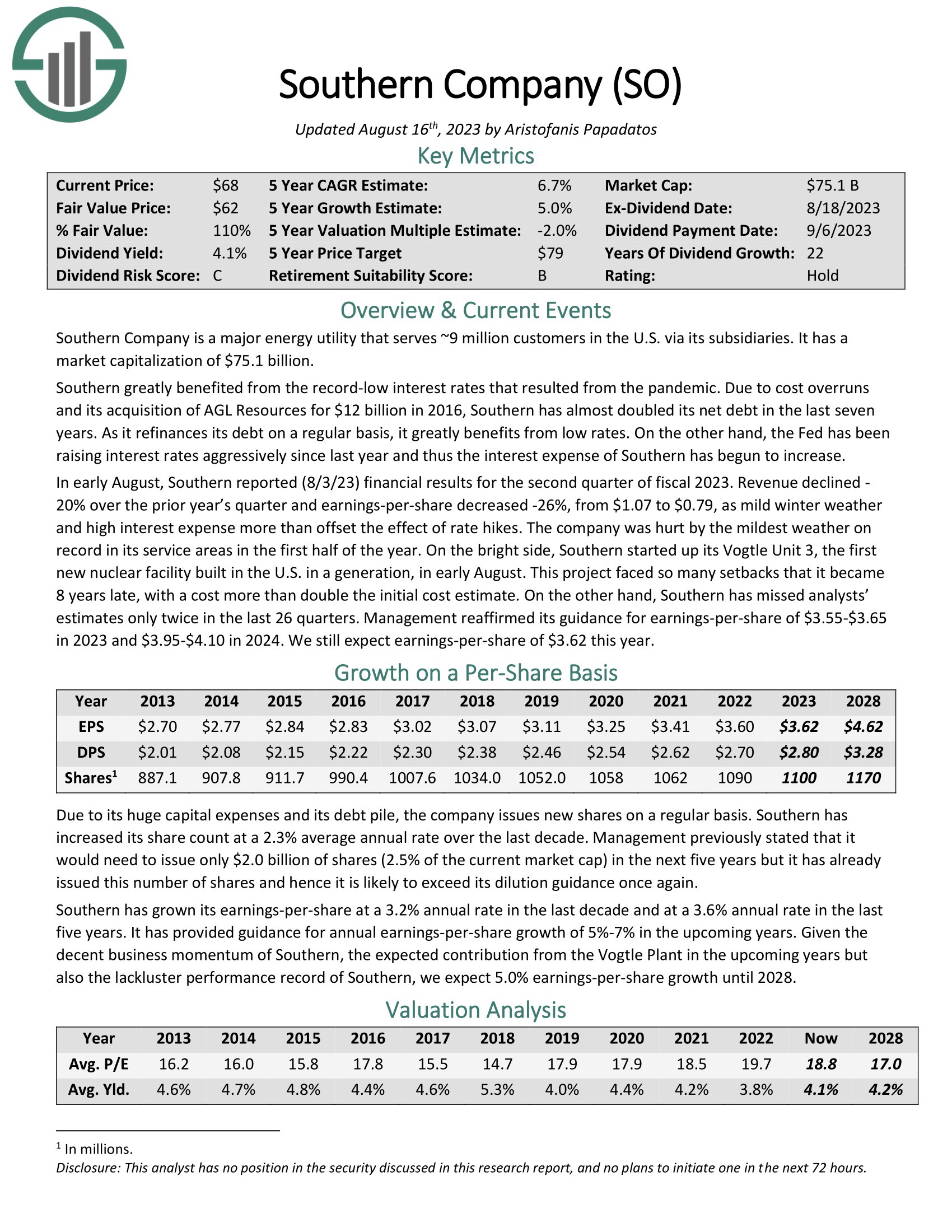

Widow and Orphan Inventory #8: Southern Firm (SO)

Southern Firm is a serious power utility that serves ~9 million clients within the U.S. by way of its subsidiaries. Southern raised its dividend by 3.0% this 12 months. It has raised its dividend for 22 consecutive years and has not lower it for 76 consecutive years.

In early August, Southern reported (8/3/23) monetary outcomes for the second quarter of fiscal 2023. Income declined –20% over the prior 12 months’s quarter and earnings-per-share decreased -26%, from $1.07 to $0.79, as gentle winter weatherand excessive curiosity expense greater than offset the impact of price hikes. The corporate was harm by the mildest climate onrecord in its service areas within the first half of the 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on SO (preview of web page 1 of three proven beneath):

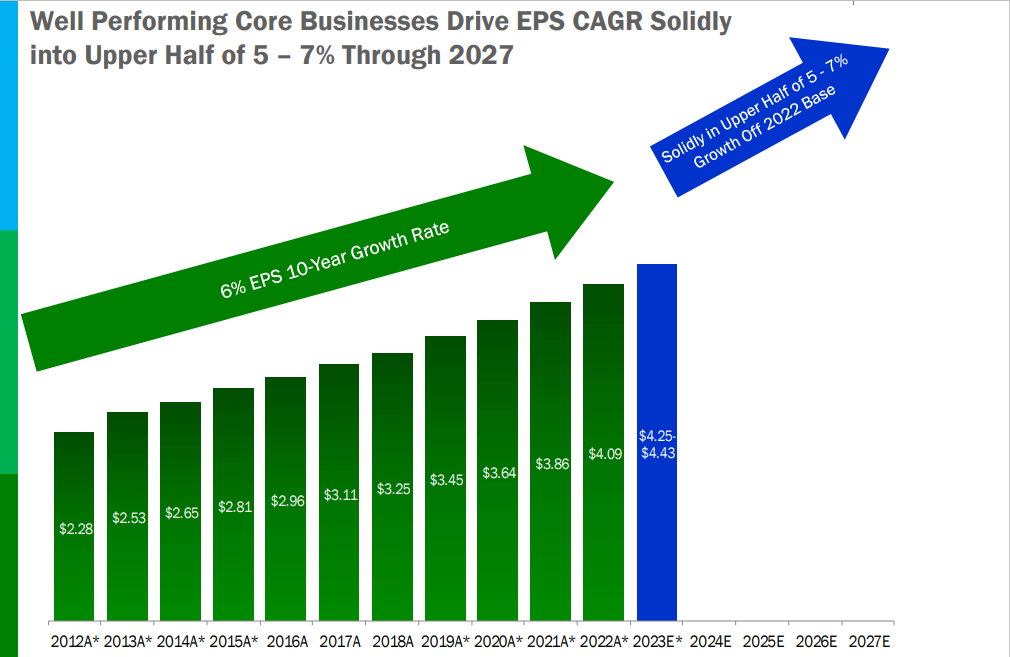

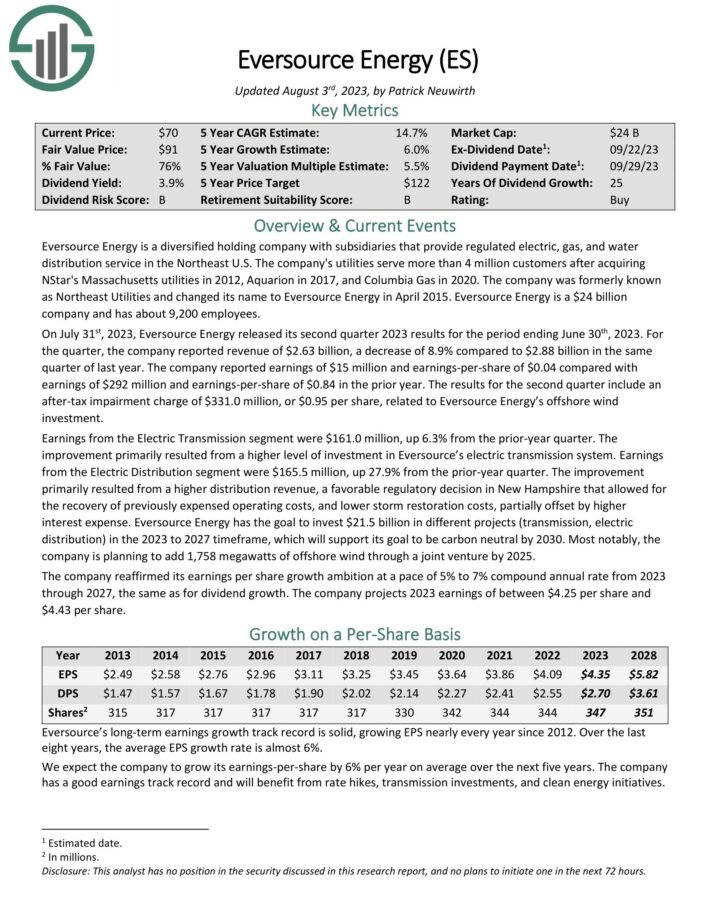

Widow and Orphan Inventory #9: Eversource Power (ES)

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S. The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has an extended historical past of producing regular progress over time.

Supply: Investor Presentation

On July thirty first, 2023, Eversource Power launched its second quarter 2023 outcomes for the interval ending June thirtieth, 2023. For the quarter, the corporate reported income of $2.63 billion, a lower of 8.9% in comparison with $2.88 billion in the identical quarter of final 12 months.

The corporate reported earnings of $15 million and earnings-per-share of $0.04 in contrast with earnings of $292 million and earnings-per-share of $0.84 within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven beneath):

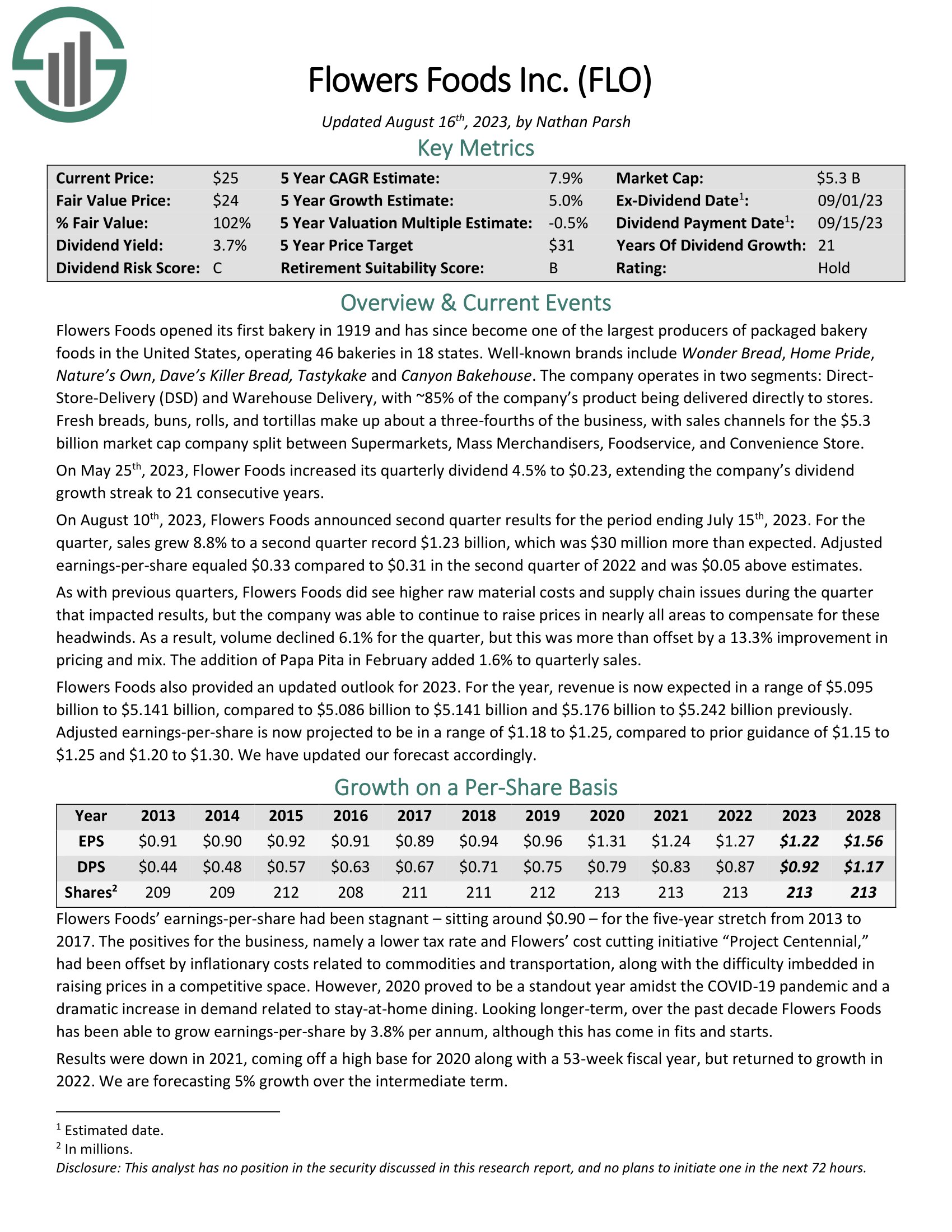

Widow and Orphan Inventory #10: Flowers Meals (FLO)

Flowers Meals opened its first bakery in 1919 and has since turn out to be one of many largest producers of packaged bakery meals in america, working 46 bakeries in 18 states. Properly-known manufacturers embrace Marvel Bread, Residence Delight, Nature’s Personal, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The corporate operates in two segments: Direct Retailer-Supply (DSD) and Warehouse Supply, with ~85% of the corporate’s product being delivered on to shops. Recent breads, buns, rolls, and tortillas make up a couple of three-fourths of the enterprise, with gross sales channels cut up between Supermarkets, Mass Merchandisers, Foodservice, and Comfort Retailer.

On Might twenty fifth, 2023, Flower Meals elevated its quarterly dividend 4.5% to $0.23, extending the corporate’s dividend progress streak to 21 consecutive years.

On August tenth, 2023, Flowers Meals introduced second quarter outcomes for the interval ending July fifteenth, 2023. For the quarter, gross sales grew 8.8% to a second quarter file $1.23 billion, which was $30 million greater than anticipated. Adjusted earnings-per-share equaled $0.33 in comparison with $0.31 within the second quarter of 2022 and was $0.05 above estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on FLO (preview of web page 1 of three proven beneath):

Remaining Ideas

The listed widow-and-orphan shares are concepts just for protected rising dividend earnings. Due diligence is required to find out if any of those shares are beneath honest worth value.

Shopping for widow-and-orphan shares ought to assist the investor sleep nicely at night time, understanding that the dividends of those firms are protected and rising. Thus, offering the earnings wanted for an appropriate retirement.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link