[ad_1]

Reversals are an vital a part of buying and selling and investing since they sign the tip of an present pattern and the beginning of a brand new one. A dealer who is ready to methodically spot a reversal is ready to obtain essentially the most success available in the market.

There are a number of approaches for recognizing a reversal in property like shares, currencies, crypto, and bonds. You should use indicators like shifting common, Relative Power Index (RSI), and the MACD.

Alternatively, you should use reversal chart patterns like the pinnacle & shoulders, double prime and double backside, rising and falling wedge, and a rounded backside. Additional, you should use candlestick patterns like hammer, doji, and morning star.

This text will have a look at the kicker sample, which is one other reversal candlestick sample you should use when each day buying and selling or investing.

What’s the kicker sample?

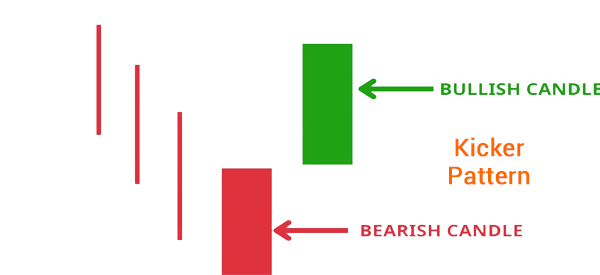

The kicker sample is a candlestick sample that’s utilized by day merchants and traders to identify a reversal. There are two varieties of kicker patterns: bullish and bearish. A bullish kicker occurs throughout a downtrend and is normally an indication that an asset will begin a brand new uptrend.

Equally, the bearish kicker occurs in an uptrend, sending a sign that the asset will begin a brand new bearish pattern. In each, these kicker patterns are characterised by a spot that occurs between candlesticks.

How is a bullish kicker sample shaped?

A bullish kicker sample occurs throughout a downtrend. It occurs when a protracted bearish candle (usually the crimson one) is adopted by a protracted bullish candle that’s separated by a spot. In a each day chart, because of this a inventory closed sharply decrease immediately adopted by an up hole with a protracted bullish candlestick.

A spot varieties when an vital occasion occurs available in the market. For instance, if a inventory closes at $10 on Monday, it may well open at $12 the next day for a number of causes. Among the most notable causes of gaps are:

company earnings

a merger and acquisition (M&A)

an FDA approval of a drug

company-specific information

The chart beneath reveals how the bullish kicker sample varieties. As proven, the asset was in a downtrend and shaped a protracted bearish candle. On the next day, it opened above the day gone by excessive and shaped a protracted bullish candle.

This sample implies that there’s a change in momentum in an asset and that bulls are beginning to are available in. As such, it sends a sign that the uptrend will proceed for some time.

How a bearish kicker sample varieties

A bearish kicker sample varieties within the precise reverse of the bullish kicker one. It occurs when an asset is in an uptrend after which it varieties a bearish reversal adopted by a protracted bearish candlestick.

The down hole may be attributable to an organization publishing weak monetary outcomes, a denial of an FDA approval, and different unfavourable issues. When it varieties, the sample is normally an indication {that a} monetary asset will begin a brand new bearish sample.

What does the kicker sample imply?

The kicker sample signifies that a monetary asset shifting in a sure pattern is about to show round and transfer in the wrong way.

Within the case of a bearish kicker, it signifies that an uptrend is shedding momentum. That is firstly indicated by the down hole after which confirmed by the scale of the following bearish candlestick. When it occurs, it’s a signal that the asset’s downtrend will proceed.

Equally, when a bullish kicker varieties, it’s a signal that the downtrend is fading and {that a} new uptrend will kind.

Tips on how to establish bullish and bearish kicker patterns

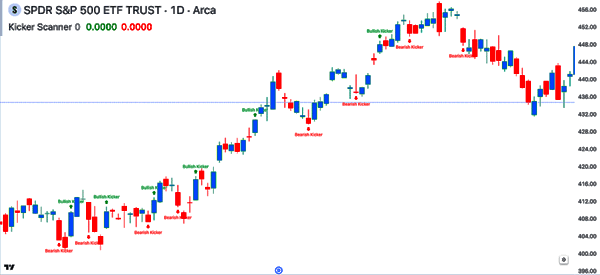

A standard query amongst many merchants is on how one can establish a bullish and bearish kicker sample. There are two primary methods of doing this. First, the best strategy is to make use of TradingView’s indicator search.

TradingView has an indicator often called Kicker Scanner, which scans a chart and identifies bullish and bearish scanners. The chart beneath reveals the kicker candlestick patterns it has recognized within the SPY ETF. Whereas this indicator is an efficient one, it’s best to at all times take its alerts with a grain of salt.

The opposite strategy of figuring out the kicker sample is to visually scan an asset. You are able to do this as a part of your multi-timeframe chart evaluation.

That is an strategy the place you have a look at a minimum of three chart timeframes earlier than you make a buying and selling determination. You may have a look at the each day chart adopted by the four-hour and the 30-minute chart.

Tips on how to use the kicker sample

There are a number of steps that we suggest when utilizing the kicker sample. First, it’s best to try the principle catalyst for the asset because it entails a spot. At all times know the principle reason for that hole! For instance, if a inventory made a down hole after publishing a robust earnings report, there’s a chance that it will likely be crammed.

Additionally, if a inventory varieties a down hole due to a serious concern in one other firm, there’s a chance that the hole shall be crammed.

Second, at all times do a multi-timeframe evaluation. We suggest taking a look at three time frames. The good thing about doing that’s that it’ll aid you to establish the important thing help and resistance ranges. It should additionally aid you to establish false alerts.

Third, await the affirmation. As a substitute of putting a reversal commerce immediately, it is smart to attend for a number of hours or days to verify the reversal.

How dependable is the kicker sample?

As with all candlestick patterns, the kicker sample is just not at all times dependable and there are occasions it gives you a false sign. Consistent with this, merchants and traders use a number of approaches to enhance the reliability of the sample.

For instance, they mix it with different chart patterns like head and shoulders and double-top and bottoms. As well as, they verify the validity of the sample through the use of technical indicators like shifting averages and Bollinger Bands.

The opposite vital method to make use of the kicker sample is to have a look at quantity. Subsequently, by itself, the kicker sample would possibly give a false sign, which suggests it’s best to at all times verify the reversal.

Kicker sample methods

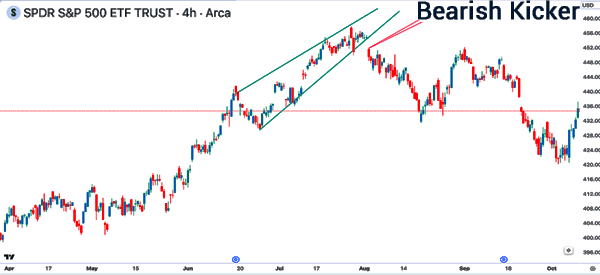

Utilizing the kicker sample with chart patterns

Among the best approaches for utilizing the kicker sample is to mix it with different chart patterns. For instance, you should use it with the rising wedge sample as proven beneath.

The chart reveals that the SPY ETF is in an uptrend and has shaped this wedge. Because it nears its finish, it varieties a down hole adopted by an enormous down candle, resulting in extra draw back.

You should use the kicker sample with different patterns like double and triple prime and backside.

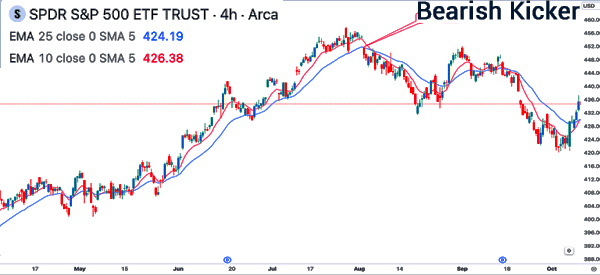

Utilizing kicker with double-moving averages

The opposite kicker buying and selling technique is to make use of a quicker and shorter shifting common. The preferred of those approaches is the loss of life and golden cross. These crosses kind when the 200-day and 50-day shifting averages. Nevertheless, most day merchants use a lot shorter shifting averages.

Within the chart beneath, we see {that a} bearish kicker sample shaped. Now, as an alternative of putting a bearish commerce at this stage, you possibly can await the 25-period and 10-period shifting averages to crossover.

Utilizing pending orders

The opposite strategy is to make use of pending orders when putting trades. A pending order is the place a dealer directs a dealer to open a commerce when an asset reaches a sure worth. It could assist to guard you from being caught in a false breakout.

For instance, in a bearish kicker candlestick, you possibly can place a sell-stop a number of factors beneath the decrease candle. In a bullish candle, you possibly can place a buy-stop above the inexperienced candle.

Kicker candle vs exhaustion hole

On this article, we’ve got checked out what the kicker candle is and how one can use it in day buying and selling. A standard query is on the distinction between the kicker candle and the exhaustion hole.

An exhaustion hole is shaped, totally on the each day or weekly chart, when an asset is shifting in an uptrend or downtrend then varieties a spot in the wrong way. This hole is characterised by rising quantity. The distinction between the 2 is that in a kicker, the hole is adopted by an extended candlestick.

FAQs

What’s the success charge of the kicker candlestick?

The precise success charge of a kicker candlestick sample has not been recognized. Like different patterns, this charge will rely in your buying and selling technique and the general market circumstances.

What are the important thing features of a kicker candlestick sample?

There are 4 primary features to recollect when utilizing the kicker candlestick sample. These are the pattern, quantity, help and resistance, and the information. At all times have a look at these features earlier than you open a commerce utilizing the kicker sample.

How usually do the bullish and bearish kicker patterns?

In contrast to different chart and candlestick patterns, the bullish and bearish candles will not be in style. They kind solely on comparatively uncommon events. In a each day chart, the sample can kind only some days per 12 months.

Exterior helpful assets

The Kicker Candlestick Sample vs. Exhaustion Hole – Tradingsim

[ad_2]

Source link