[ad_1]

The decision is in — the previous manner of doing enterprise is over. Be part of us at Inman Join New York Jan. 23-25, when collectively we’ll conquer as we speak’s market challenges and put together for tomorrow’s alternatives. Defy the market and guess large in your future.

Whereas others are downsizing, the nation’s largest mortgage lender employed 1,000 staff and remained worthwhile through the third quarter at the same time as rising rates of interest saved a lid on mortgage manufacturing.

Mat Ishbia, the chairman and CEO of UWM Holdings Corp., mentioned the Pontiac, Michigan-based wholesaler is investing in new know-how and hiring new group members to make sure UWM is ready when mortgage charges come down and enterprise booms.

Within the meantime, UWM reported $301 million in third quarter internet revenue Wednesday, a 31 p.c enhance from Q2, as income grew by 15 p.c from the earlier quarter to $677 million.

That’s even supposing at $29.7 billion, Q3 mortgage manufacturing declined 7 p.c from the earlier quarter and was down 11 p.c from a 12 months in the past.

Whereas UWM’s backside line bought a lift from a $92.9 million markup within the truthful worth of its $281.4 billion mortgage servicing portfolio, it’s additionally making an even bigger revenue on the smaller pool of loans the corporate originates. Complete acquire on sale margin hit 97 foundation factors within the third quarter, up from 88 foundation factors in Q2 and 52 foundation factors a 12 months in the past.

Shares in UWM, which within the final 12 months have traded for as little as $3.23 and as a lot as $6.98, soared greater than 13 p.c after earnings had been introduced and Ishbia briefed funding analysts Wednesday morning, sharing credit score for the corporate’s success with the mortgage brokers it does enterprise with.

Mat Ishbia

“You’re now seeing the truth of what I’ve been saying for years: When charges rise each UWM and brokers shine, whereas others wrestle,” Ishbia mentioned on a name with funding analysts. “Regardless of 25-year-high mortgage charges and low housing stock, we proceed to thrive in all facets of the enterprise — together with having considered one of our greatest buy quarters of all time.”

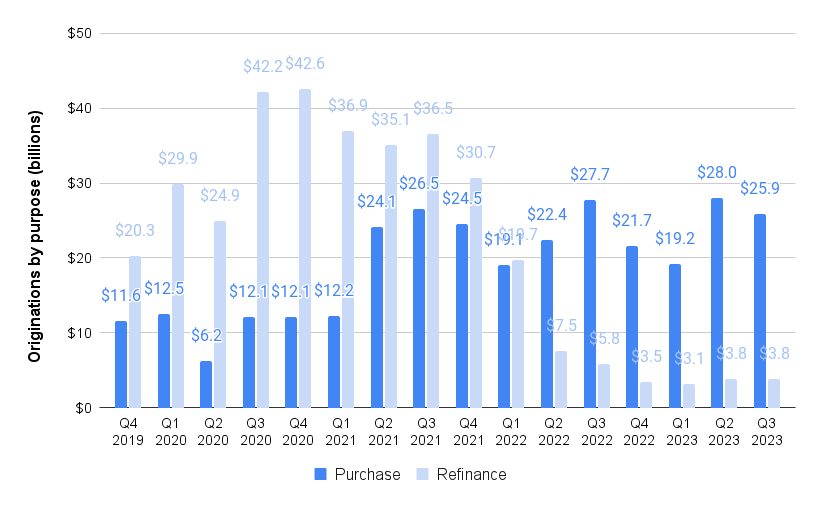

UWM mortgage originations by quarter

UWM originated $25.9 billion in buy mortgages in July, August and September — the third-best quarter in firm historical past and greater than rival Rocket Mortgage’s whole Q3 mortgage manufacturing of $22.2 billion.

UWM originated $25.9 billion in buy mortgages in July, August and September — the third-best quarter in firm historical past and greater than rival Rocket Mortgage’s whole Q3 mortgage manufacturing of $22.2 billion.

Since overtaking Rocket final 12 months because the nation’s largest supplier of dwelling loans, UWM has put much more distance between the 2 firms. Through the first 9 months of the 12 months, Rocket has originated $61.5 billion in mortgages, down 46 p.c from the $114.1 billion in mortgage manufacturing on the identical level a 12 months in the past.

To date this 12 months, UWM has managed to originate $83.9 billion in mortgages, a extra modest drop of 18 p.c in comparison with the primary 9 months of final 12 months.

“It’s no secret why UWM and the dealer neighborhood proceed to take action properly within the buy market,” Ishbia mentioned. “Buy transactions require an skilled. They require extra consideration to element. They require a better stage of service for actual property brokers, customers and brokers — all people. They usually require an environment friendly course of the place pace issues for hitting contract deadlines.”

Like different lenders, UWM has seen its refinancing quantity shrink to a trickle. Through the third quarter, the corporate refinanced $3.8 billion in mortgages — about the identical as Q2, however lower than a tenth of the refi enterprise UWM was doing in late 2020 and early 2021, when charges had been at historic lows.

“When charges flip we can be prepared as a result of we’re investing closely proper now to make sure our brokers will win greater than ever within the subsequent refi cycle,” Ishbia mentioned. “The mix of our buy enterprise and the dimensions and high quality of our servicing e-book is so robust that our enterprise can thrive in just about all markets. We embrace these cycles every time they occur and we come out stronger, and no different lender can say that.”

In its most up-to-date annual report back to traders, UWM mentioned it employed roughly 6,000 group members as of Dec. 31, 2022. In reporting second-quarter outcomes, UWM didn’t present a headcount however mentioned the variety of group members was down from a 12 months in the past. Ishbia has beforehand mentioned that UWM hasn’t laid off staff, however can downsize by way of attrition.

“Our tradition is vibrant,” Ishbia mentioned Wednesday. “We’re hiring. We’re rising, we’re investing in know-how. Within the first seven years we’ve been in enterprise we’ve by no means laid off a group member. And actually, within the third quarter, we employed over 1,000 group members and we’re gonna rent extra once more within the fourth quarter.”

Though UWM’s Q3 hiring would symbolize a 17 p.c enhance from year-end 2022 staffing ranges, the corporate didn’t instantly reply to a request for the corporate’s present headcount.

Get Inman’s Mortgage Temporary Publication delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

Electronic mail Matt Carter

[ad_2]

Source link