[ad_1]

However that could be a check as we speak’s buyers have failed miserably, with short-term returns favored over long-term

The monetary markets are just like the marshmallow check: if you happen to delay gratification, your investments will flourish

Have you ever ever heard of the Marshmallow Take a look at?

Initially designed for a juvenile viewers, the check made its debut at Stanford College within the Eighties with a basic goal: gauging a baby’s capacity to train self-control by delaying speedy gratification for a extra important reward sooner or later.

The mechanics of the check have been simple—kids have been offered with a alternative: eat a single marshmallow instantly or look forward to quarter-hour to obtain two. These choosing on the spot consumption might ring a bell earlier than the 15-minute mark, forfeiting the second marshmallow.

Remarkably, the outcomes over time revealed that kids exhibiting endurance and forgoing short-term positive factors in favor of delayed rewards tended to realize higher school outcomes and develop increased shallowness.

How Is This Take a look at Related for Immediately’s Traders?

Making use of the Marshmallow Take a look at to the monetary markets, one wonders: how would buyers fare in an analogous situation? Sadly, many buyers resemble the kid who opts for speedy consumption, sacrificing potential long-term advantages. This analogy prompts reflection on how often buyers, lured by short-term positive factors, compromise the substantial returns provided by the inventory market.

Contemplate the cases the place buyers purchase shares, solely to promote inside 3-6 months, neglecting the deserves of an 8-10 12 months funding horizon. Such habits undermines particular person efficiency relative to the market and hinders the seize of the complete spectrum of alternatives offered by numerous asset courses.

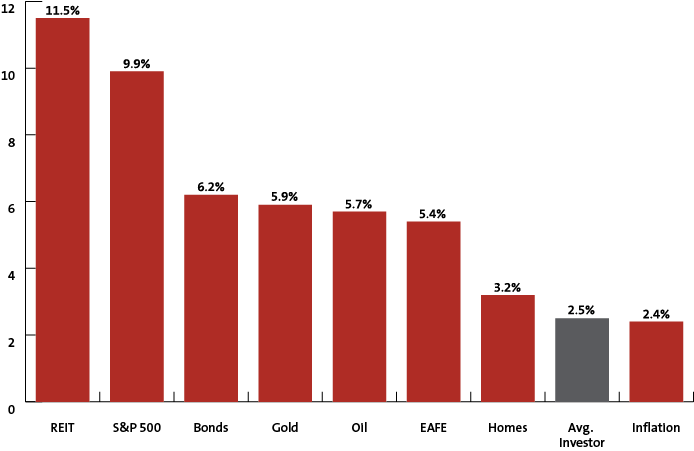

The following illustration depicts the stark distinction between market choices (depicted in pink columns) and the common investor’s returns over a 20-year interval (depicted in grey).

The frenzy of as we speak’s world has fueled our want for fast gratification, mirroring these children who cannot resist devouring the marshmallow instantly, forsaking the promise of two later. Because the market rollercoaster unfolds, buyers, pushed by a six-month horizon, are on edge, influenced by the present ebb and circulation seen in 2022 and 2023.

The pivotal question for buyers: Can they resist the attract of short-term positive factors (or losses) to safe extra substantial rewards in the long term?

No educational scores right here, however the distinction can be crystal clear over a decade or two. The affected person and self-disciplined, akin to the second group of marshmallow testers, will watch their investments flourish, whereas the impulsive starvation of the primary group will persist.

***

Discover All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to speculate as such it’s not supposed to incentivize the acquisition of property in any means. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link