[ad_1]

da-kuk/E+ by way of Getty Photos

The crypto crowd is hyperventilating, as is their wont, with the prospect of 1 and certainly a number of Bitcoin (BTC-USD) ETFs getting the inexperienced gentle quickly. Even a skeptic like me, with doubts on the benign influence of establishments on property lashed to their derivatives, can’t deny the clear, sturdy bullish pattern that is creating.

The latest breakout up from near-term highs continues to provide the kind of vertical value motion we’ve got come to count on from BTC, one of many spiciest property on the block.

When information of BlackRock’s utility for an Ethereum ETF broke, up went ETH in the identical ballistic method. Whereas the cryptocurrency denizens seek for the following crypto to get the ETF remedy, I stay trying not for tokens to pre-empt the long-promised takeoff to the moon of the entire crypto ecosystem, however for an analogue I can maintain that received’t should be secured by both a painful self-custody state of affairs or an – virtually as uncomfortable – third-party relationship with some nebulous corp, enmeshed within the kind of risky emergent monetary atmosphere of shocks always featured within the blockchain media. What I would like is an instrument with a pedigree, working beneath shut regulation, which is liquid, simple to deal with and that can go lunar if Bitcoin and so forth go on the massive ‘God candle.’

It’s robust, however I feel I’ve discovered what I’m searching for: it’s an fairness. Hurrah!

I don’t usually write about single shares as a result of huge traits are what I give attention to; I let that select the shares for me, which usually go right into a portfolio the place the win/lose ratio does the work slightly than a single win from an ideal single inventory choice. Nonetheless, every now and then, up pops one thing I wish to maintain as a result of it ticks all of the containers, and it’s too fascinating to not write up.

First, I do consider that in the long run, the crypto business alongside its property will probably be even greater than it’s immediately, in all probability a lot greater. Blockchain and crypto isn’t going away. After the regulators have rounded up the cowboys what is going to stay is a panorama the place blockchain and crypto is driving a variety of revolutionary enterprise, monetary and financial methods. There’s a core sensitivity nevertheless, one thing on the coronary heart of all property and an issue that to at the present time after the passage of historical past stays unsolved: safety.

For a hope at safety, you want custody and custody is in every single place in finance. Custody is, for instance, the elemental cause banks even exist. Custody is what makes the bond and fairness markets go spherical. Custody is a kind of features ‘professionals’ obsess about, however many retail traders don’t even understand is an enormous deal.

It’s significantly an enormous subject in crypto as a result of in case you lose your crypto, by means of any of the multitude of how obtainable, it’s gone and gone for good. In case you burn a British £20 be aware, you may take the ash to the Financial institution of England and they’ll change it, however nope that’s not taking place along with your Bitcoin.

So, a inventory that may go vertical, alongside Bitcoin is the place for me. Shares are very safe to carry. The inventory in query is named Bakkt (NYSE:BKKT). I truly ran into them at this 12 months’s Bitcoin present in Miami. They aren’t ‘Bored Ape’ sorts (I hope that doesn’t offend them). They’re a spinout from ICE, the Intercontinental Alternate. The inventory has had a tough time, but it surely has been leaping within the final couple of days as a result of their newest quarterlies are out.

That is the place lots of people will need all kinds of quantity crunching info about revenue and income, P/L, ratios and so forth and I perceive that need. Whereas that’s what I do myself in a big portfolio of worth investments, for this sort of single inventory, a single concept funding, I attempt to boil it all the way down to a one flooring elevator pitch.

Crypto to the moon = NYSE-listed crypto establishment to the moon.

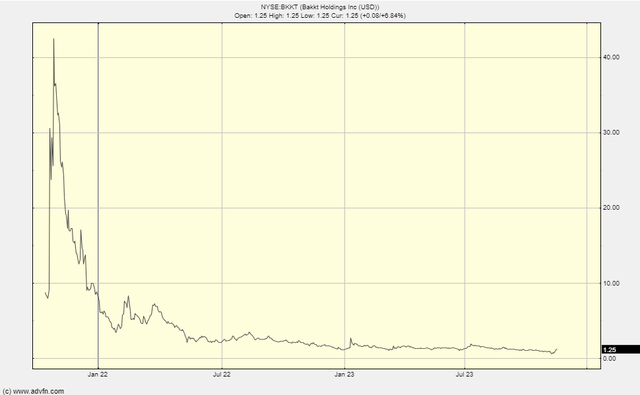

So, to bother the outsourcers, the fundamentalist quantity crunchers some extra, right here is the chart.

BKKT chart (ADVFN)

Many will discover this bizarre, however I like this chart. For a pink sheet inventory this chart sample is poison, however for a strong emergent enterprise in a deeply out-of-fashion phase it’s golden.

The corporate is anticipating to be EBITDA impartial by the tip of 2024 however care not.

If Bitcoin retains on rallying BKKT will do likewise however fairly probably with much more rocketry. If Bitcoin doesn’t do the crypto vertical factor, then it received’t.

Sure, I do personal.

[ad_2]

Source link