[ad_1]

taikrixel

ALLETE (NYSE:ALE) has not too long ago had a worth restoration following stable earnings. Even with this worth improve, I imagine that ALLETE is at the moment a purchase on account of its stable outperformance in regard to earnings in difficult occasions, stable acquisitions for the future, beneficiant dividend, and undervaluation assuming my DCF figures.

Enterprise Overview

ALLETE, Inc. capabilities as an power firm, working by means of distinct segments: Regulated Operations, ALLETE Clear Vitality, and Company and Different. The agency makes use of quite a lot of energy-generating methods, comparable to wind, photo voltaic, hydropower, and biomass co-fired with pure fuel, coal-fired, and hydroelectric energy. About 15,000 electrical customers, 13,000 pure fuel prospects, and 10,000 water prospects in northwest Wisconsin are served by ALLETE’s Regulated Operations utilities. It additionally offers companies to 14 non-affiliated municipal prospects and over 150,000 retail prospects in northeastern Minnesota.

Electrical transmission belongings in Illinois, Wisconsin, Michigan, Minnesota, and Minnesota are owned and operated by ALLETE. The company possesses round 1,300 megawatts of wind energy-producing services and is actively concerned within the improvement, acquisition, and administration of unpolluted and renewable power initiatives. Along with coal mining, ALLETE additionally engages in actual property investing in Florida and North Dakota. Proudly owning 162 substations with a mixed 10,116 megavolt ampere capability, ALLETE serves quite a lot of companies, comparable to pipeline, secondary wooden merchandise, paper, pulp, taconite mining, and extra.

ALLETE

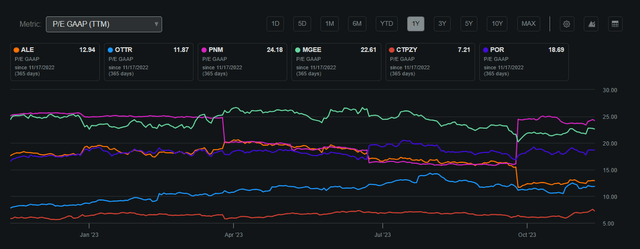

ALLETE is valued at a market capitalization of $3.2 billion and demonstrates a 3% Return on Invested Capital. Within the final 52 weeks, its inventory has fluctuated between a excessive of $67.45 and a low of $49.29. The present inventory worth stands at $55.44, accompanied by a P/E GAAP ratio of 12.94, putting ALLETE in proximity to its 50-day shifting common of $54.21. Notably, compared to its trade counterparts, the corporate’s P/E ratio is notably decrease, suggesting potential worth relative to others within the trade. This means a promising place for buyers searching for relative worth inside the sector.

ALLETE P/E GAAP In comparison with Friends (Searching for Alpha)

The agency additionally pays a dividend of 4.86%, representing a payout ratio of 62.23%. This beneficiant dividend demonstrates the constant revenue shareholders obtain to create worth. With solely a 3% ROIC, ALLETE has acknowledged that using FCF to develop is moderately unproductive, and distributing a fair proportion of FCF whereas additionally investing in progress could be the most effective plan of action. I agree with this methodology of worth creation because the agency is already properly established and might give attention to revenue buyers moderately than burn money trying to scale, particularly with the present macro headwinds.

Share Efficiency (Searching for Alpha)

Efficiency In comparison with the Broader Market

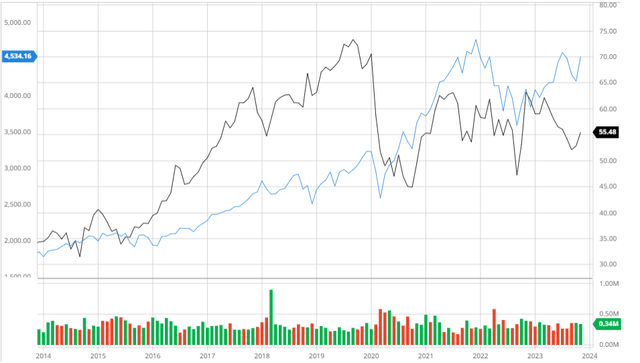

Over the previous 10 years, ALLETE has underperformed the S&P 500 when adjusting for dividends. That is because of the latest pullback in worth from excessive charges that are particularly impacting utilities on account of alternative value in comparison with bonds. I imagine that though bonds appear comparatively enticing as of now, latest worth declines have made utilities enticing from a valuation standpoint with out many operational failures in its core enterprise making a stable long-term maintain.

ALLETE In comparison with the S&P 500 10Y (Created by creator utilizing Bar Charts)

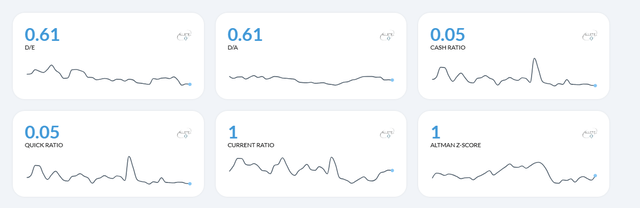

Steadiness Sheet

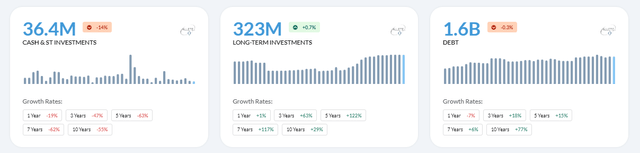

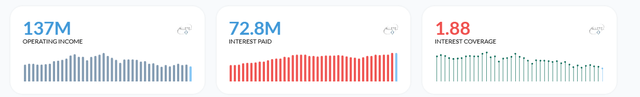

When analyzing ALLETE’s steadiness sheet, it’s evident that the agency is safely leveraged. With debt growing 18% within the final 3 years and the agency’s curiosity protection dropping to 1.88, I really feel that ALLETE ought to start to give attention to reducing debt with remaining FCF with out slicing the dividend as a way to preserve long-term revenue. This may lower curiosity funds and provides the agency extra FCF to both capitalize on growth or payout as revenue over the approaching years, which might be useful for shareholders. Lastly, with a Present Ratio of 1 and Altman-Z-Rating of 1, the agency ought to stay solvent within the quick time period.

Monetary Place (Alpha Unfold) Curiosity Protection (Alpha Unfold) Solvency Ratios (Alpha Unfold)

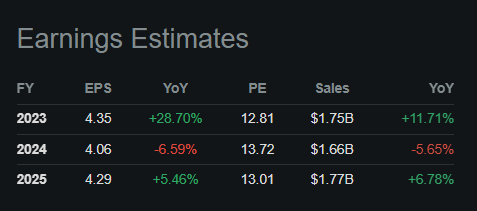

Q3 Earnings

ALLETE additionally reported stable Q3 2023 earnings with EPS surpassing estimates by $0.84 at $1.49 and lacking revenues by solely $18.45 million at $378.8 million exhibiting a -2.4% YoY decline. Though revenues barely missed, the agency raised steerage on EPS to $4.30 to $4.40 for the 12 months and has created stable revenue in occasions of macro headwinds. Steering for the upcoming years appears comparatively flat with a decline in 2024 after which a restoration in 2025. I imagine that though there could also be a slight pullback on account of excessive charges hindering growth, the corporate continues to be a wonderful long-term maintain and can retain this 12 months’s giant positive factors to create stable worth.

Earnings Estimates (Searching for Alpha)

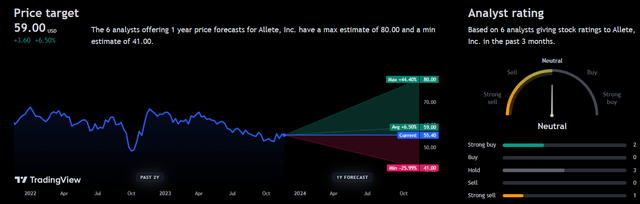

Analyst Consensus

Analysts at the moment fee ALLETE as a “maintain” with a median 1-year worth goal of $59 representing a possible 6.56% upside. This, mixed with the dividend, will create a stable upside within the quick time period if analysts are appropriate which relies upon upon rates of interest.

Analyst Consensus (TradingView)

Valuation

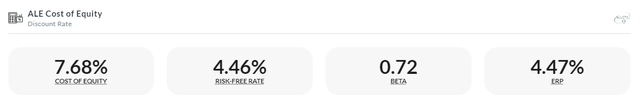

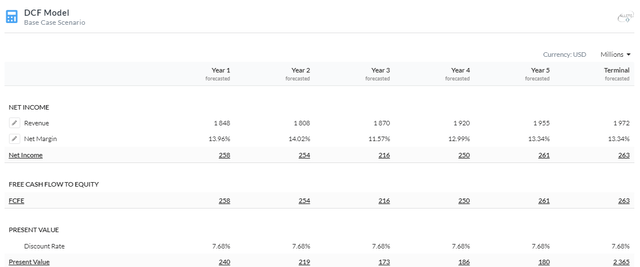

Earlier than calculating ALLETE’s truthful worth, I calculated a Price of Fairness for the agency utilizing the Capital Asset Pricing Mannequin. Utilizing a risk-free fee of 4.46% primarily based on the 10-year treasury yield and a beta of 0.72, ALLETE’s Price of Fairness is 7.68%.

Price of Fairness (Created by creator utilizing Alpha Unfold)

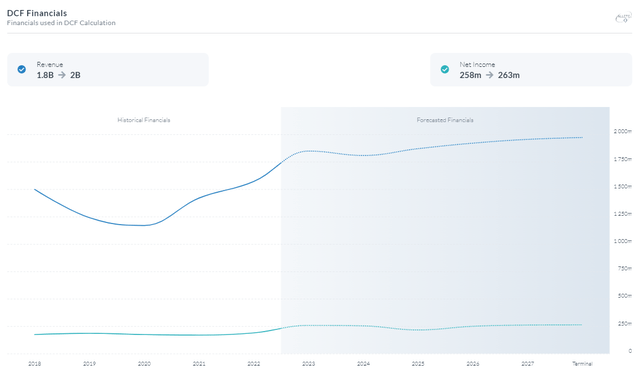

After discovering an correct low cost fee, I used a 5-year Fairness Mannequin DCF primarily based on internet revenue to discover a truthful worth for ALLETE. For this DCF, I used a reduction fee of seven.68% which is in keeping with my Price of Fairness calculations. I made a decision to not add a threat premium for my low cost as utility corporations are comparatively steady and obtain moderately undisturbed revenue all through the cycles in comparison with different industries. With reference to my income and margin estimates, I assumed in keeping with analysts which is moderately conservative when analyzing the agency’s outperformance of those metrics not too long ago. This resulted in a good worth of $58.5 presenting a 5% upside. I imagine that the slight undervaluation together with the stable dividend makes this a purchase on account of its long-term revenue alternative together with share worth appreciation.

5Y Fairness Mannequin DCF Utilizing Internet Revenue (Created by creator utilizing Alpha Unfold) Capital Construction (Created by creator utilizing Alpha Unfold) DCF Financials (Created by creator utilizing Alpha Unfold)

Strategic Acquisitions Leading to Compounding Development

To broaden its footprint and strengthen its competencies within the power trade, ALLETE Inc. has used a strategic acquisitions strategy. The Diamond Spring Wind Mission, a wind power challenge in southern Oklahoma, was bought by ALLETE Clear Vitality in 2019. ALLETE’s portfolio of renewable power now consists of 303 megawatts of wind manufacturing capability due to this good buy. ALLETE sought to reap the benefits of the rising demand for clear and sustainable power sources by growing its footprint within the wind power trade. A first-rate instance of ALLETE’s strategy to rigorously selecting belongings that complement its dedication to sustainable improvement and renewable power is the Diamond Spring Wind Mission. These purchases assist the corporate’s general growth and placement inside the ever-changing and dynamic power sector.

I imagine that these acquisitions won’t solely diversify the agency’s portfolio but additionally place it in a market that has nice long-term alternatives. This can create stable progress in regard to profitability as properly as soon as renewables grow to be mainstream which might enhance the scalability of those acquisitions and create distinctive pricing energy within the areas of operation. This will even allow ALLETE to capitalize on authorities tax credit thus making preliminary contributions minimal in comparison with different types of growth. This may enable the agency to work round its heavy debt load to spark improved money flows and thus lower its value of debt in the long term.

With EPS rising by a major margin, I imagine that when ALLETE pays off extra of its debt, the agency will proceed to make the most of these acquisitions as a way to create synergies with its core enterprise. As soon as macro headwinds subside and the price of debt declines, the agency will have the ability to successfully leverage to buy these alternatives and can enhance energy within the core enterprise.

Dangers

Regulatory Dangers: As a result of ALLETE works in a extremely regulated sector, alterations to legal guidelines, ordinances, or fee constructions might impact the corporate’s operations and monetary efficiency.

Vitality Value Volatility: The price of power commodities comparable to electrical energy impacts ALLETE’s earnings. The profitability of the agency could also be impacted by worth volatility.

Conclusion

To summarize, I imagine that ALLETE is at the moment a purchase on account of its stable outperformance in regard to earnings in difficult occasions, stable acquisitions for the long term, beneficiant dividend, and undervaluation assuming my DCF figures. I imagine that monitoring rates of interest and their influence on ALLETE’s debt load funds shall be prudent as additional fee hikes might alter my thesis on account of solvency considerations.

[ad_2]

Source link