[ad_1]

Right here’s the highest of Porter Stansberry’s newest order type:

“EXPOSED: The Large Secret Behind AI

“Essentially the most exceptional expertise in monetary publishing reveals how you can appropriately revenue from the true winners of the AI revolution”

The “presentation” from Porter this time is just like previous displays he has given — half “massive image” argument about why everybody else is fallacious and attempting to rip-off traders, and half tease about how he’s acquired the suitable method, and has the higher investments to suggest.

The “everybody’s fallacious” half is an argument that what individuals are calling “synthetic intelligence” isn’t actual synthetic intelligence, it’s simply algorithms processing big information units and giving “enhanced intelligence” via instruments like giant language fashions (ChatGPT, and many others.), which is what he calls an “Synthetic Phantasm.” He says that traders are obsessive about the shiny playthings and are throwing cash in any respect the fallacious “AI Startup” corporations that don’t have actual income but, or in lots of circumstances even actual merchandise. And it’s not simply rubes such as you and I, after all, it’s the massive institutional traders, too — everybody’s chasing the AI story, together with the enterprise capital funds who’re daydreaming concerning the subsequent massive factor and shoveling billions of {dollars} into what they hope would be the subsequent OpenAI/ChatGPT tales.

So Porter is actually saying that he thinks the safer cash to be made is in corporations who’re utilizing a few of these “enhanced intelligence” machine studying instruments to enhance their services and products, not by betting on the subsequent massive AI platform or chip or know-how. That doesn’t sound terribly revolutionary, after all, however positive, in comparison with the dangerous AI startup concepts we’ve seen promoted all yr, I assume it’s a little bit sprint of sobriety. Both that, or it’s only a good straw man advertising method (“really feel skeptical about these scammy-sounding tech startups in AI? Me, too, and also you’re proper, they’re not actual! That’s not actual synthetic intelligence, it’s only a gradual enchancment in pc science! Now that we’re in settlement that that is simply an investing fad, take a look at my extra cheap funding concepts!”)

I simply saved you half an hour, so that you’re welcome.

What, then, does he say about his precise suggestions? He teases three picks to entice of us to subscribe to his Large Secret on Wall Avenue service ($1,000/yr, 30-day refund interval w/10% cancellation price), which is a couple of yr and a half previous now and has been targeted on Porter’s long-time effort to seek out “world class companies you can purchase and maintain without end.” (Porter additionally not too long ago returned to MarketWise (MKTW) as CEO and Chairman, that’s the corporate he constructed on high of Stansberry Analysis, his earlier publishing agency, so his consideration is definitely divided, however he says that his private writing will proceed to be via this Porter & Co. publication… even when I’d be shocked if MarketWise doesn’t find yourself shopping for Porter & Co. one among lately, too).

The essential logic behind Porter’s picks is normally fairly strong — his publishing corporations have definitely had some over-the-top advertising, and a few of his editors at Stansberry Analysis and MarketWise have been fairly far on the market on the speculative finish of the market, however the concepts he likes to put in writing about personally are normally fairly staid — he likes to speak up capital-efficient corporations which have robust manufacturers, can generate free money circulation and compound that into development of the enterprise with out a lot debt, and have some aggressive benefits of their market. He usually likes to name these “without end shares” which are environment friendly and sustainable sufficient you can maintain them in perpetuity, even when perhaps it’s a must to wait till they’re a bit overwhelmed down earlier than you possibly can safely purchase them. His previous teaser picks for this The Large Secret on Wall Avenue publication have been hit and miss up to now — his largest pushes have been for EQT and Tellurian as pure gasoline performs over the previous 18 months or so, and people haven’t performed nicely, however past that he’s had some fairly strong winners (BWX Applied sciences (BWXT) and Dream Finders Properties (DFH)) and some stinkers (Annaly Capital (NLY) and Icahn Enterprises (IEP)) over the previous yr or so.

His teases this trip are for 3 “Particular Reviews” about corporations which are buying and selling at traditionally low valuations and have robust and sustainable companies, however are additionally benefitting from AI and machine studying, even when it’s not “actual AI.” We’ll feed them to the Thinkolator one after the other… he calls these “AI Railroad” shares…

AI Railroad #1: The $1 Trillion Powerhouse

From the order type:

“On this report you’ll find out about a fintech agency that has been utilizing machine studying to lock up 40% of the market and develop its gross sales yearly regardless of any fluctuations available in the market. This “without end inventory” is likely one of the greatest investments you possibly can personal.”

He compares this one to Marqeta (MQ), which has quietly develop into a worldwide funds powerhouse as they assist big manufacturers course of funds, although I’m unsure why he likes this one a lot — they went public at a wild valuation in 2021 and have been clobbered since then, very like Adyen and lots of others within the funds house… however neither of these is the inventory he’s selecting in the present day. Extra clues…

They’ve grown symbiotically via a number of acquisitions, shopping for 26 totally different companies…. one among them grew fee volumes from nearly nothing in 2013 to $400 billion in 2022, one other acquisition grew its buyer base 3,000%, income 485% and valuation 2,975%.

They’ve 40 consecutive quarters of gross sales development

Transaction quantity was up 500% to $1,380 in 2022

Internet revenue up “a staggering 800%” since 2012

They’ve captured 40% of their market, and are “heading in the right direction to develop into a trillion-dollar enterprise by 2040” (market cap? Revenues? He doesn’t say.)

So what is that this firm that he calls a “golden goose sort of enterprise?”

That is PayPal (PYPL), which in some ways is the grandpappy of the “fintech” corporations, and stays a really giant participant, with a market cap of about $60 billion. Paypal has had various challenges as we’ve come off of the moment and dramatic change to on-line funds in 2020 and noticed e-commerce explode around the globe however they decelerate a little bit, with some company-specific points thrown in for good measure (together with a CEO change).

How are they utilizing machine studying/AI? Right here’s what Porter says:

“Rushing up product growth…

“Enhancing authorization charges…

“Stopping fraud earlier than it occurs.”

And why is PayPal at a traditionally discounted 16X earnings?

Porter says that it’s buying and selling at “one among its lowest valuations on report” as a result of, after 8 years of consecutive income development, the corporate’s gross sales slowed, just a bit bit, within the final quarter. And that “We’re fairly positive that is solely a brief dip.”

Paypal’s share worth has recovered a little bit bit from its six-year low in late October, however it’s nonetheless very low-cost relative to the place it has traded because it break up off from Ebay again in 2015. The present trailing GAAP PE ratio is about 17, and analysts suppose earnings will decide up fairly a bit subsequent yr, so the ahead adjusted PE is just about 11 (the GAAP earnings embrace stock-based compensation, the adjusted earnings don’t). And sure, earnings have come down from the heady days of 2021 — their GAAP earnings per share fell greater than 50% in 2022 (adjusted earnings fell much less), so despite the fact that that quantity did bounce again fairly properly this yr, it nonetheless appeared to scare traders and trigger them to revalue the corporate. Most folk nonetheless ignore stock-based compensation, it seems, and on that foundation PYPL is at a historic valuation low of 10-12X earnings.

The massive “hidden asset” inside PayPal lately might be Braintree, which in some ways performs a service just like Adyen or Marqeta, doing on-line fee processing for bigger corporations — that’s the acquisition that he hints at, the one which not too long ago hit $400 billion in transaction quantity. The competitors between Adyen and Braintree might be hurting their revenue margins this yr, notably within the US market, however these appear to be the 2 main gamers lately.

Will PayPal get better? In all probability. They definitely have some very highly effective manufacturers in PayPal, Venmo, Braintree, Honey and others, they usually’ve been in a position to fairly steadily develop the enterprise… even when it has gotten a giant worse up to now couple years because the e-commerce increase slowed down. They don’t seem to be with out competitors, however they’ve been round longer than anybody else, have a variety of companies which are in all probability misunderstood by traders to a point, and they’re in all probability the most affordable “fintech” chief proper now. They’re not rising very quick, and we will’t know if development will speed up from right here, however at this type of valuation you don’t actually need excessive development to justify an funding — you simply must have some confidence that their enterprise is at the very least sustainable, and extra more likely to develop than to shrink. Analysts forecast that PYPL will get again to fairly strong earnings development over the subsequent 5 years, averaging 15-20% development, and if that’s the case then shopping for now, at ~16X GAAP earnings, will very probably work out very nicely. Even when they simply develop roughly in addition to they did over the previous 5 years, roughly 10-12% per yr, this valuation is fairly straightforward to swallow.

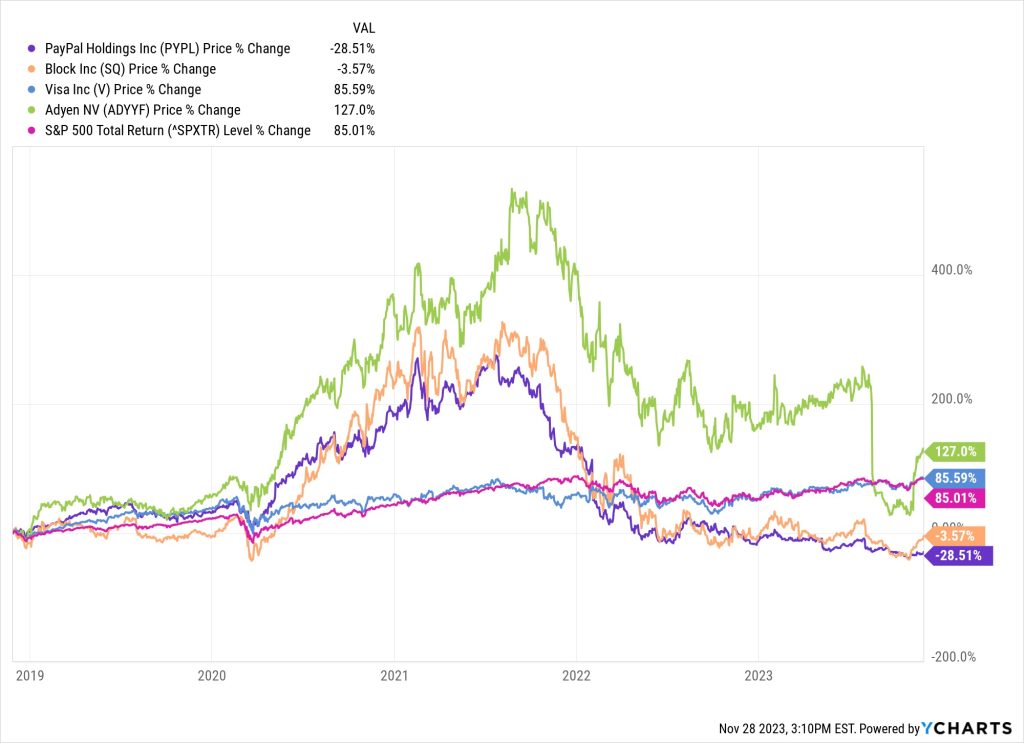

Right here’s what PayPal has appeared like over the previous 5 years, in comparison with some associated companies… that’s Adyen in inexperienced, Block in orange, and the a lot steadier oligopoly Visa in blue… Visa has just about tracked the S&P 500, however the remaining went via fairly comparable increase and bust intervals…

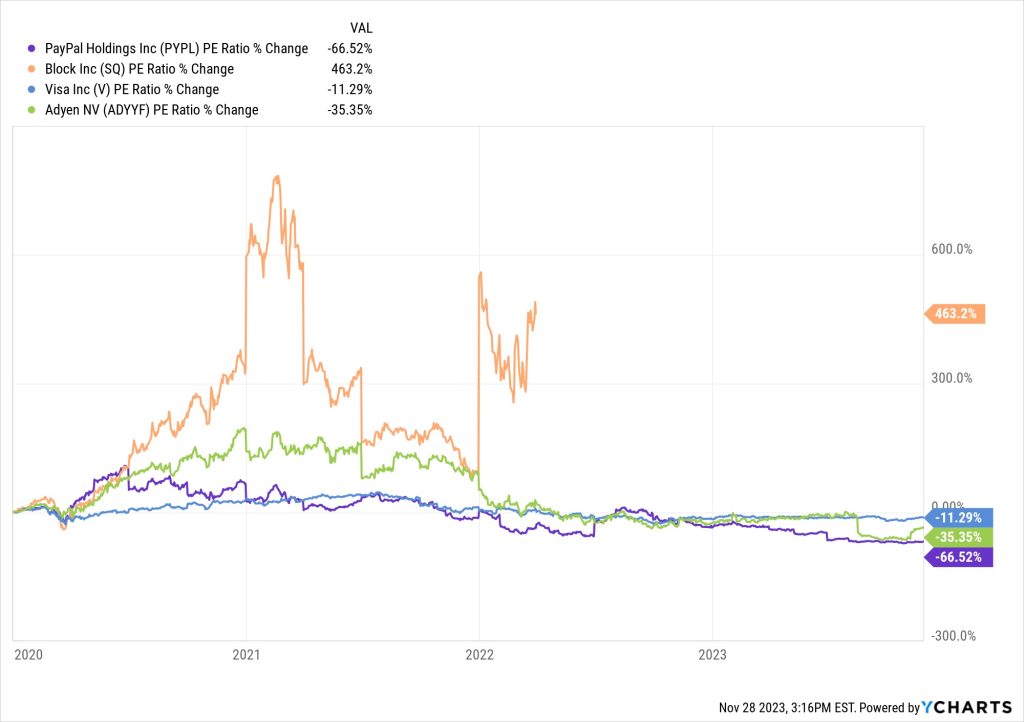

However the earnings development, gross sales development and free money circulation have been comparatively strong for these corporations, altering far much less dramatically than the share worth, so what’s actually been altering is that traders acquired too excited in 2020 and 2021, and possibly acquired too pessimistic in 2022 and 2023… right here’s how the PE ratio modified for these 4 corporations, which is a technique of claiming that what made PYPL one of many worst investments on this house wasn’t an operational shortfall, it was a sentiment shortfall, in all probability largely due to the 2022 earnings “reset” that Porter believes is a brief difficulty.

Block doesn’t have a PE ratio anymore, since they’re not GAAP worthwhile, however this chart reveals that Adyen’s PE valuation has fallen by a couple of third in 5 years, whereas PayPal’s has fallen by about 2/3. It makes much more sense to purchase a inventory after the a number of has compressed like this than earlier than, after all, despite the fact that it’s human nature to keep away from shares which are “on sale” within the inventory market… and, we’ll restate the plain, no person is aware of what the long run holds, shopping for at a low valuation provides you extra room to be fallacious, on common, however the valuation may keep low if PayPal isn’t in a position to get again to rising its earnings.

What’s subsequent?

AI Railroad #2: The Prettiest Inventory on Wall Avenue

This one is a couple of retailer…

“Bodily retail by no means died, and sure sectors had been by no means in that a lot hazard to start with — and sweetness merchandise are in all probability the obvious

“Apart from 2020, the cosmetics market has grown each single yr…. It doesn’t matter what occurs, girls are all the time going to purchase cosmetics.

“And AI is having a huge impact on the business

“One firm has found out how you can leverage machine studying to nook the wonder market and dominate its competitors.”

And we get some particular numbers, too, so the Thinkolator will admire that…

“Since 2010, this firm’s web revenue has shot up 4,000%”

“Earnings per share up 3,600%

“Free money circulation up 1,000%

“ROE up over 400%

“Prospects spend a mean of $28 per 30 days on their merchandise, over $300 a yr

“One of many best retail companies that has ever been constructed”

Porter says that this firm advantages from model loyalty, has $630 million in money and no debt, and earns a 40% gross margin, which is fairly spectacular for a retailer. What else?

Progress continues to be fairly good — in 2023, he says gross sales had been up 18%, gross income 10%, and earnings per share up 7.5%… although you’ll have already observed the issue in these numbers, if earnings had been rising slower than gross sales and gross revenue, then they had been getting much less environment friendly, which traders typically hate to see.

And certainly, that’s what Porter mentioned the issue was that introduced on the great valuation he sees in the present day — he says the inventory is “grossly undervalued” with a PE ratio of 16, and that it’s solely this low-cost as a result of the working margins “narrowed barely” by 1.5 proportion factors… however that we should always have the ability to ignore that, as a result of they’ve doubled their earnings in 5 years and he thinks they’ll maintain that up. He calls this a a “Ceaselessly Firm” that might ship 15% compounded returns.

So what’s this one? That’s, you’ll have guessed, Ulta Magnificence (ULTA). It is a firm I owned for some time, and may have held, however I acquired spooked out of the shares in the course of the early days of the pandemic in 2020 and haven’t appeared into the shares not too long ago. It seems to be just like the problem is a little bit of an earnings development slowdown of late, with earnings per share solely more likely to develop at a ~7%/yr tempo over the subsequent few years, if analysts are right, so that might be a significant slowdown from the 15-20% tempo of latest years (aside from the COVID yr), and extra like 30-40% after they had been simply constructing out their retailer footprint within the decade earlier than that. It is a highly effective model and retailer base, notably now that so many conventional shops are faltering and dropping that coveted cosmetics enterprise, and their return on fairness is exceptional for a retailer, notably one which doesn’t carry debt (although they do have significant lease obligations, that are sort of like debt).

Appears fairly cheap — I don’t know something about how they’re utilizing machine studying, however they survived COVID very nicely, girls are nonetheless spending on cosmetics (and males are spending extra, too), they usually appear to have confirmed themselves as an business chief. You would in all probability persuade me to get fascinated with Ulta once more because the valuation drops into the cheap vary right here, it’s at roughly 16X earnings nonetheless, and it’s a well-run firm that doesn’t depend on stuff like stock-based compensation, so these earnings are a bit extra “actual” than some… although it could nicely require some endurance in the event that they aren’t in a position to shock analysts with some development acceleration once more. In the event that they’re caught at ~7% earnings development, then it’s simpler to pay rather less, I’d discover it simpler to be interested in this one at 14X earnings, for a PEG ratio of two.0, however I think about that a part of the argument right here is that ULTA ought to shock analysts with their development over the subsequent decade (14X earnings proper now can be a bit over $350, simply FYI).

And yet one more…

AI Railroad #3: “Apple of Agriculture”

That is an argument that we have to use AI to feed the world…

“World meals manufacturing wants to extend by 70% to feed the anticipated rising inhabitants by 2050, and with 50% much less farm labor and fewer arable land.

“AI may enhance manufacturing and cut back waste.

“My group has recognized the one firm that we’re sure goes to play the important function on this convergence of AI and farming. They’re already utilizing machine studying to assist farmers…

“Distinguish weeds from crops, decreasing chemical use by 80%

“Analyze the standard of grain on the harvesters and make changes, decreasing meals waste”

Clues concerning the firm?

Since 2004, their dividends have grown by 1,000percentSince 2017, working margins have grown 80percentSince 2018, web gross sales up 210percentSince 2019, money flows up 100%

“Within the final quarter alone, this firm’s revenues soared by greater than 30%” (Q2, that’s)

And Porter says they…

“have essentially the most loyal consumer base in your complete business, 77% of farmers are model loyal.

“That’s why they’ve been referred to as the “Apple of Agriculture,” they make each {hardware} and software program, have lengthy buyer engagements, and are leveraging massive information and their dealership community.”

Extra? We’re instructed that 11 of the world’s greatest portfolio managers at the moment make investments on this firm… and that it’s at the moment valued at simply over 11x earnings, an especially low worth — Porter says it usually trades between 15-30x earnings

Why? Porter says it’s as a result of “Farming is cyclical.” And he says “each investor on the planet ought to personal this inventory.”

So hoodat? Thinkolator sez he’s teasing Deere (DE) once more right here, an organization he touted as his favourite “AI inventory” and “final without end inventory” again in early September.

What’s occurred since then? Not a lot — the inventory has come down about $50, to roughly $360 now, largely as a result of the estimates for 2024 earnings had been diminished by about 10% after the final earnings replace. The massive image is that analysts are nonetheless anticipating earnings to be fairly flat for the subsequent few years, at one thing near $30 per share, so it’s buying and selling at about 12X earnings lately, so all that’s actually modified is that analysts had anticipated 2-3% earnings development from 2024-2026, and now they count on 0% development, which modifications the fashions and estimates however doesn’t actually have a lot influence on the longer-term potential (and, after all, analysts can’t predict the farm economic system to that degree of precision — they will’t see what commodity costs or rates of interest will likely be in 2024 or 2025 any extra clearly than you or I can, despite the fact that their job means they need to guess). Right here’s what I wrote about Deere again in September, my considering hasn’t actually modified:

“It is a pitch for Deere as a fairly valued play on the growing use of know-how in agriculture… notably the more and more automated and autonomous “precision agriculture” push that will increase yields and reduces labor (and requires costlier tools). Deere is a really prime quality firm that has develop into rather more shareholder-focused up to now 15 years or so, and has led the best way over smaller rivals and compares favorably with Caterpillar (CAT) within the locations the place they overlap… and it’s extensively seen as being the business chief with regards to know-how, and essentially the most beneficial model, so it’s in all probability a fairly first rate guess right here at 12X earnings, even when the analysts are proper in forecasting that earnings will flatten out right here for a couple of years (after a number of years of very robust development, fueled by good commodity costs, new merchandise, and simple cash for tools upgrades). They’ve constructed up a powerful stream of recurring income as they promote software program and repair on high of the tools, and loved nice pricing (not in contrast to the auto makers) lately, although there appears to be a widely-held perception that the gravy prepare is slowing, at the very least for a little bit bit, in all probability largely due to the influence of upper rates of interest on the farm economic system and on capital tools gross sales. I confess to being a little bit extra tempted by AGCO (AGCO), one of many smaller tractor corporations that’s at a a lot decrease valuation and will get higher development out of a recovering Ukraine (sometime), however that’s largely simply the temptation of cheapness — in fact, it’s usually wiser to purchase the clear chief at a good valuation than to purchase the weaker competitor at an inexpensive valuation.”

So… fascinated with Porter’s “without end” shares that revenue from “enhanced intelligence?” Choose to search for extra direct performs on AI know-how which are a bit lustier lately? Produce other fairly valued favorites to recommend? Tell us with a remark under… and thanks for studying!

Irregulars Fast Take

Paid members get a fast abstract of the shares teased and our ideas right here.

Be part of as a Inventory Gumshoe Irregular in the present day (already a member? Log in)

[ad_2]

Source link