[ad_1]

DKosig

As detailed in “XLF: The 2024 Financials Sector Outlook Is Regarding,” I imagine there’s a robust risk that we see continued deterioration in most financials shares subsequent yr. Just a few key causes for my sentiment embrace the elemental lack of solvency in most banks and a few insurers and capital markets companies if belongings are accounted for at truthful worth. Final yr, nearly all monetary establishments suffered super off-balance sheet losses on account of rising long-term rates of interest that lowered the market worth of held-to-maturity bonds and loans.

As mentioned, whole unrealized losses are almost equal to financial institution fairness, which means banks basically lack fairness within the occasion of a continued decline in whole deposits, which is probably going given the Fed’s QT program and the dwindling provide of reverse repurchase agreements (a significant “backup” liquidity supply for banks). The statistically excessive chance of a recession complicates the state of affairs by probably bettering the most important rate of interest challenges whereas including probably vital mortgage losses. In fact, if inflation stays comparatively excessive in a recession, as I think, then I imagine many at-risk banks may fail, relying on authorities intervention, which, to this point, has been minimal.

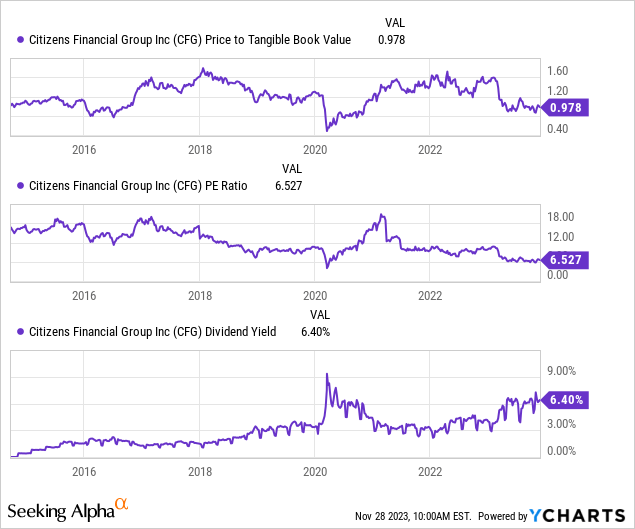

In fact, many traders are conscious of those points. The extra at-risk banks, reminiscent of Residents Monetary Group (NYSE:CFG), commerce at low valuations with a ahead “P/E” of round 6.8X and an honest dividend yield of 6.3%. Most analysts are bullish on Residents Monetary Group and imagine it to be a reduced alternative after dropping over a 3rd of its worth this yr. Certainly, whereas there are a lot of qualities of CFG that time towards undervaluation, I imagine dangers dealing with the financial institution are under-discussed by most analysts.

Worth Potential in Residents Monetary Group

On the floor, CFG seems to be a strong low cost alternative. The financial institution is at the moment buying and selling at a price-to-tangible guide worth of ~0.98X, giving it a really slight low cost on its guide worth. Traditionally, the financial institution has normally traded round 1.2X, indicating a possible 20% low cost. The financial institution additionally has substantial intangible belongings, as its price-to-book is beneath 0.60X; nevertheless, most intangibles present little core worth to banks. CFG trades at a traditionally low “P/E” of 6.5X and a traditionally excessive dividend yield. See beneath:

CFG’s valuation is about as little as it was in the course of the COVID concern crash in 2020. Its dividend yield, earnings valuation, and price-to-tangible guide are all near the degrees reached in the course of the 2020 spring crash, indicating the financial institution is at the moment priced for a steep basic correction.

In fact, we should understand that banks function basically otherwise than non-financial corporations. Banks use excessive leverage and rely on financial cycles and Federal Reserve insurance policies. Accordingly, in sure situations, a small change to macroeconomic circumstances can have vital unfavourable penalties on banks, significantly small-to-medium-sized ones like CFG. Additional, on account of excessive leverage, banks naturally have very excessive unfavourable tail danger, which implies they will lose worth a lot sooner than they achieve.

Residents Monetary Group faces dangers just like some banks that failed earlier this yr. On the finish of Q3, the financial institution’s held-to-maturity debt securities had an amortized value of $9.32B however a good worth of $8.05B, indicating an unrealized lack of $1.27B off-balance sheet. Subtracting that from its tangible guide worth, its “market worth adjusted” tangible guide could be nearer to $11.24B, erasing a lot of its theoretical price-to-book low cost. That mentioned, this isn’t a large concern for CFG as a result of most of its securities losses are in its available-for-sale section, which is counted in its steadiness sheet figures. Its total securities losses are much less vital than I’ve seen in lots of different banks.

That mentioned, many analysts are usually not contemplating unrealized off-balance sheet mortgage losses. Loans with shorter maturities are usually not a large concern as a result of the financial institution can anticipate to carry them to maturity and obtain a full cost; nevertheless, there was a pointy enhance in non-agency mortgage loans in recent times, normally being fixed-rate with 15 to 30-year maturities identical to typical company mortgages.

CFG final reported its mortgage maturity knowledge in its final annual report, with no vital adjustments in its whole mortgage guide occurring by Q3, making that knowledge extremely related. On the finish of 2022, CFG had a complete of ~$17.26B in fixed-rate residential mortgages with maturities over 15 years, most yielding round 3 to three.5%, just like mortgage charges earlier than 2022. The financial institution additionally had ~$3.19B in fixed-rate training loans with > 15-year maturities with yields within the 5% vary. It additionally had round $530M in different > 15-year fixed-rate loans of various maturities. The biggest section of its fixed-rate business actual property loans ($7.13B) had 5 to 15-year maturities, giving it some length danger on these as effectively.

What would these belongings be value in the event that they have been offered at present? It’s tough to say for certainty with out extra knowledge, however fair-value losses on fixed-rate residential loans are seemingly just like these on fixed-rate securities on account of their related yields. Most of its securities (~85% of the whole, together with AFS and HTM) are agency-backed MBS belongings, which typically have related maturities to residential loans of >15 years. The distinction between truthful worth and amortized value of all its securities (HTM and AFS MBS belongings, Treasuries, and others) is $4.4B, pointing to an ~11.75% loss ($37.5B amortized value). The full loss particularly from MBS securities, was ~$4.12B or ~13% of its prices (~$31.9B amortized value). Attributable to their larger maturities and decrease yields (or larger length danger), the numerous wrongdoer for its securities worth losses is its MBS belongings.

Assuming an identical degree of losses on its fixed-rate loans with maturities over 15 years, about $21B at amortized value, we come to a good worth estimate of virtually ~18.5B, or round $2.5B decrease (12% drawdown estimate). I’d additionally add an estimated $350M off-balance sheet loss from its 5 to fifteen-year fixed-rate loans, with a decrease loss charge on account of their shorter maturity. Importantly, these figures are tough estimates primarily based on my mortgage length estimate. Nonetheless, I imagine the whole unrealized mortgage losses dealing with CFG are seemingly round $2.9B because of the rise in long-term charges. Offsetting that, the financial institution has round $15B in fixed-rate long-term borrowed funds with maturities starting from simply over one yr to over fifteen years with a mean charge of 4.75%. It’s difficult to say the precise “truthful worth” of those liabilities. Nonetheless, I estimate that whole beneficial properties from the devaluation of liabilities for CFG ought to offset its whole unrealized off-balance sheet loss to round $2B.

Including these identified ($1.27B from HTM securities) and estimated figures ($2B internet from fixed-rate loans offset by liabilities devaluation) collectively, I arrive at a tangible internet asset worth estimate for CFG at about $9.3B. CFG’s market capitalization is at the moment $12.3B, which can be buying and selling at a ~32% premium to its tangible NAV. Whereas this exhibits how CFG is probably going, not undervalued, this determine will not be essentially a excessive premium in comparison with many banks at present, as many bigger banks could be hardly solvent if belongings have been accounted at truthful worth within the method I’ve carried out above. Nonetheless, CFG’s estimated tangible core fairness NAV-to-asset ratio is simply round 4.3%, giving it ample danger in a unfavourable market occasion.

Residents Monetary Group Earnings Compression

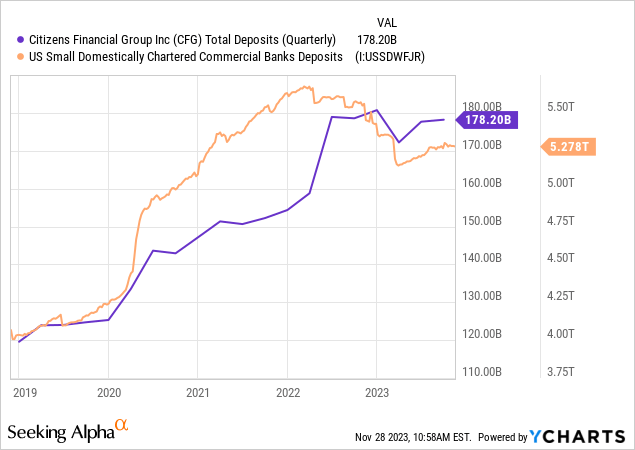

Unrealized off-balance sheet losses are solely a problem if a financial institution requires liquidity. With out liquidity wants, the financial institution may simply assume belongings might be held to maturity, through which case they’d not lose any worth. Like many small-to-medium banks, CFG faces strains in sustaining its deposit base. That mentioned, it has not seen as vital of a deposit loss as small banks. See beneath:

Total, CFG’s deposits have been steady in comparison with small banks and are extra typical of its giant financial institution friends. Residents are technically on the low finish of the “giant financial institution” spectrum however don’t essentially profit from the “sticky depositor” phenomenon within the largest banks. The biggest section of CFG’s liabilities are deposits, of which $33.5B are checking (1.49% charge in Q3), $29.5B financial savings (1.65%), $52B cash market (3.17%), and $21.6B in time period (4.3%). Importantly, in 2022, each one of these charges have been meager at <1%, indicating a larger charge sensitivity than many banks.

As we’re seeing an acceleration in financial savings account charges, indicating a rising depositor competitors, I anticipate CFG’s NIM compression will speed up over the subsequent yr. Its internet curiosity margin slipped to three.03% in Q3 from 3.24% in 2022, and I’d not be shocked to see a continued decline to ~2.5% to 2.75% by the top of 2024 as CFG continues to pay larger charges on its varied short-term liabilities. Accordingly, I anticipate its 2024 internet curiosity revenue to be nearer to $5.62B or $1.4B quarterly. The financial institution usually earns round $500M in noninterest revenue (primarily charges) with $1.3B in noninterest bills. Thus, I mission its pre-tax quarterly revenue by the top of 2024 at ~$600M, or ~$470M post-tax, and ~$450M for widespread fairness.

The Backside Line

The above estimate offers CFG an EPS outlook of ~$0.96 per quarter or $3.86 per yr. That mentioned, CFG has additionally seen a rise in projected mortgage losses because of the systemic rise in defaults, now above pre-COVID ranges in shopper credit score. Provided that, its true EPS will seemingly be solely $3.86 given regular credit score high quality circumstances, which at the moment seem unlikely. Problematically, on account of its low tangible widespread NAV estimate in comparison with its loans, it might not essentially take a substantial “shock” enhance discover defaults to hurt CFG’s worth considerably.

If not for prime recession dangers, I could also be barely bullish on CFG on account of its low ahead “P/E” valuation. Nonetheless, I’m considerably bearish on CFG at present due to my broader macro view that we’ll seemingly see a continued rise in defaults by 2025 on account of a recession. Additional, I anticipate that inflation won’t fall sufficiently over this era to permit for a reversal of Federal Reserve insurance policies, which means CFG won’t essentially profit from a decline in long-term charges. Extra info on that time will be present in my earlier two articles (1,2).

Nonetheless, in comparison with many banks I’ve analyzed, I don’t imagine Residents Monetary Group is in a really high-risk class. Certainly, its dimension place is a profit as some bigger banks have larger solvency points associated to off-balance sheet losses. As compared, the smaller banks usually have larger NIM compression on account of deposit competitors. Thus, though I’m barely bearish on CFG, I view it as safer than most banks at present. Nonetheless, Residents does have ample publicity to business actual property and different segments that can lead to unfavourable surprises, so it stays potential that CFG may underperform different banks.

[ad_2]

Source link