[ad_1]

Lea Scaddan/iStock through Getty Photographs

Welcome to a different installment of our BDC Market Weekly Evaluation, the place we talk about market exercise within the Enterprise Improvement Firm (“BDC”) sector from each the bottom-up – highlighting particular person information and occasions – in addition to the top-down – offering an outline of the broader market.

We additionally attempt to add some historic context in addition to related themes that look to be driving the market or that buyers must be conscious of. This replace covers the interval by way of the third week of November.

Market Motion

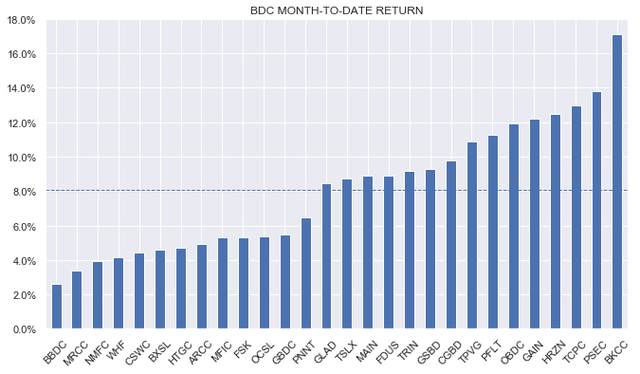

BDCs had one other good week with a complete return of round 1%. It was the best-performing sector throughout the earnings house we observe. A continued rally in shares and good Q3 outcomes are supporting BDCs.

Systematic Revenue

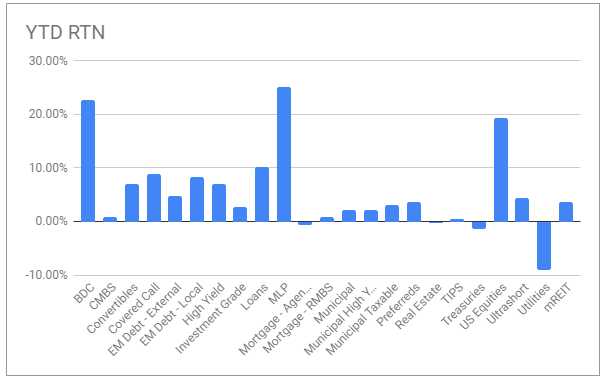

12 months-to-date, BDCs are the second-best performing sector after MLPs.

Systematic Revenue BDC Device

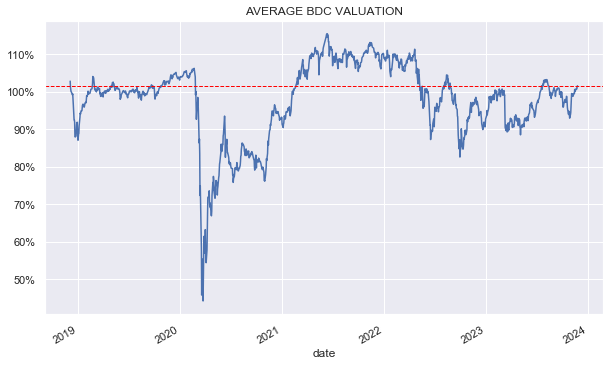

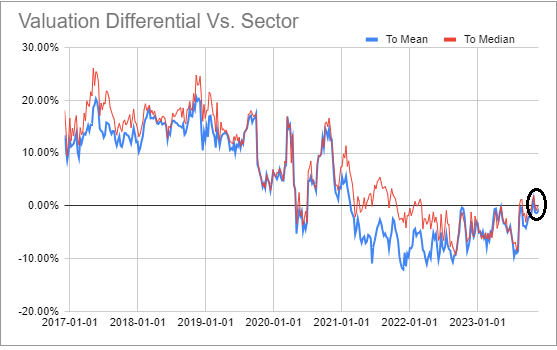

BDCs have virtually totally recovered from the valuation drop off their latest peak. The common valuation in our protection has moved up above 100%, roughly consistent with the historic common.

Systematic Revenue

Market Themes

As BDC buyers know, BDCs will not be all the identical. One of many key dimensions during which they fluctuate is the a part of the market they concentrate on. Bigger BDCs reminiscent of BXSL, OBDC, ARCC, OCSL and others concentrate on the so-called higher middle-market, or firms with EBITDA above roughly $50-100mm, whereas different BDCs reminiscent of CSWC, FDUS, PNNT and others concentrate on smaller firms with EBITDA within the $10-50m vary.

A lot of this dynamic is solely because of the measurement of the BDCs – bigger BDCs concentrate on bigger firms and smaller BDCs concentrate on smaller firms. It is because smaller debtors search for small loans and bigger debtors search for bigger loans. It would not make a lot sense for a bigger BDC to concentrate on decrease middle-market firms and vice-versa. A tiny mortgage for a big BDC requires a lot the identical due diligence as a bigger mortgage however in all probability would not transfer the needle when it comes to portfolio allocation. On the identical time a smaller BDC is unlikely to have the ability to stump up the capital to supply a sufficiently big mortgage to a bigger borrower.

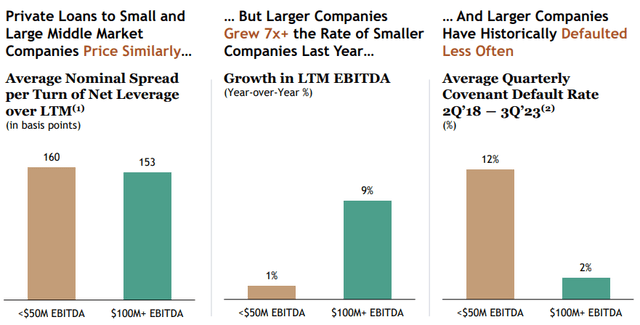

What’s fascinating, nevertheless, is that some BDCs additionally attempt to defend their space of the middle-market house. For instance, BXSL (a big BDC specializing in the higher middle-market house) has this chart of their newest quarterly presentation which reveals that bigger firms have a roughly related unfold on loans per flip of internet leverage however a a lot decrease default fee and a better degree of earnings development.

BXSL

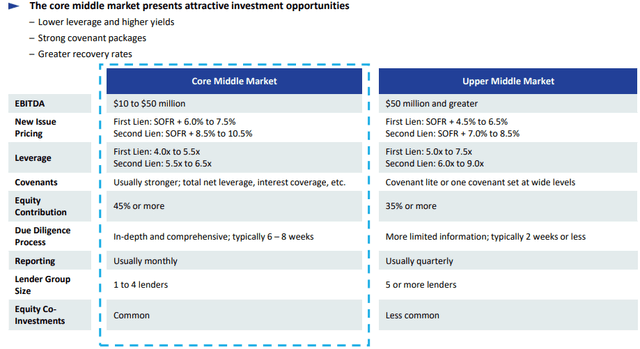

PNNT, alternatively, reveals that loans to smaller firms have a a lot greater yield on loans (1-1.5% greater on first-lien loans and extra on second-lien loans) and decrease threat within the type of decrease leverage and higher covenants.

PNNT

These sound like very totally different messages, so what is going on on? One reply is that the definitions don’t fairly line up. PNNT makes use of $50m+ because the higher middle-market whereas BXSL makes use of $100m+.

Two, PNNT makes use of information from the Nationwide Heart For the Center Market and Refinitiv whereas BXSL makes use of the Lincoln Worldwide Personal Market Database.

Three, the metrics do not line up. PNNT is targeted on yield, leverage and covenants for first-lien and second-lien individually whereas BXSL is targeted on unfold per flip of leverage and default fee for the 2 kinds of loans collectively.

All in all, the BDCs are clearly going to cherry decide the numbers that swimsuit them. A smaller BDC shouldn’t be going to be an higher middle-market lender and vice-versa even when the numbers supported that funding case. Other than the pure mechanics of lending, each components of the middle-market permit for robust returns. As an illustration, decrease and core-middle market lenders like FDUS and CSWC have put up very robust efficiency numbers as have a lot of their higher middle-market counterparts. We will additionally discover lenders in each areas that haven’t carried out nicely.

Finally, BDCs can do nicely in each components of the market so buyers should not essentially concentrate on one space simply due to what they see in a BDC presentation. It would make sense, nevertheless, to contemplate diversifying a BDC portfolio alongside this dimension simply as buyers diversify their BDC publicity throughout different dimensions reminiscent of portfolio allocation (e.g. first-lien vs. second-lien / fairness and so on.) and trade sectors.

Market Commentary

Blackstone Secured Lending (BXSL) reported good outcomes for a complete NAV return of 4% through the quarter or roughly in the course of the pack up to now this quarter. The NAV rose near 1% because of a excessive degree of retained earnings. Internet earnings did fall, nevertheless that was largely because of a large share issuance that hasn’t but been put to work. Non-accruals remained near zero. BXSL is buying and selling at a valuation of 108% which is 6% above the median BDC and is on the costly facet traditionally.

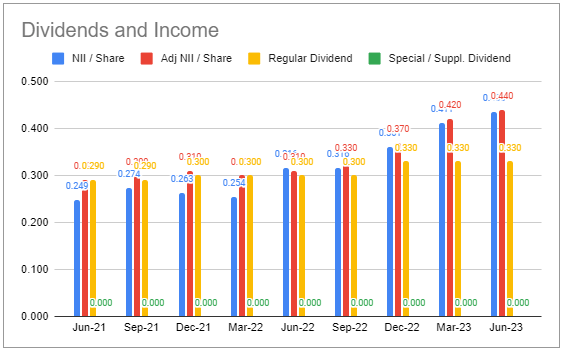

The Golub BDC (GBDC) had a superb Q3. Internet earnings rose 13% – because of a mix of upper base charges in addition to the corporate’s administration price discount to 1%.

Systematic Revenue BDC Device

A base dividend of $0.37 was declared – a 12% improve. The corporate additionally declared a $0.07 supplemental. We gained’t see equally giant dividends and internet earnings will increase going ahead because the administration price lower is non-repeatable. GBDC has now moved to commerce on par with the sector valuation which is fairly uncommon within the final couple of years and is now not a slam dunk allocation because it was again then.

Systematic Revenue BDC Device

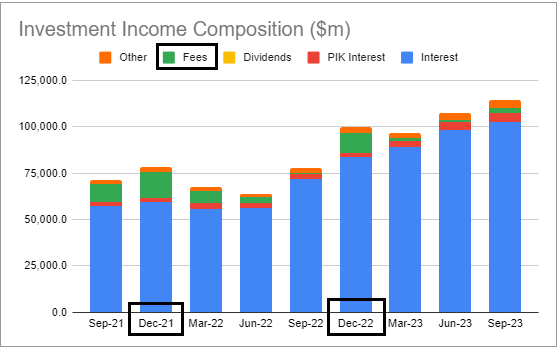

General, BDCs proceed to ship robust earnings. If threat urge for food holds up nicely, we must always see a bumper This fall as deal seasonality kicks in and results in a bump in prepayment price earnings throughout the sector. BDCs reminiscent of ARCC and TSLX (pictured beneath) could possibly be massive beneficiaries of this dynamic.

Systematic Revenue BDC Device

[ad_2]

Source link