[ad_1]

The S&P 500 (SP500) on Friday superior 0.77% for the week to shut at 4,594.63 factors, posting beneficial properties in three out of 5 periods. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) added 0.83% for the week.

Throughout this week, Thursday marked the top of November, a month that turned out to be historic for markets. The benchmark S&P (SP500), together with the Nasdaq Composite (COMP.IND) and the Dow (DJI), notched their greatest month-to-month advance this 12 months and one among their greatest Novembers on report.

That climb has been largely pushed by favorable financial information and feedback from Federal Reserve audio system that has led to a common consensus that the central financial institution is finished mountaineering charges and might ship a tender touchdown – an occasion the place inflation comes down with out compromising employment or progress.

An identical development contributed to this week’s beneficial properties and has led to the S&P 500 (SP500) notching its highest closing degree of the 12 months. This leaves the market poised for a powerful end to the 12 months with Friday being the primary day of December. Traders will hope that November’s momentum can prolong right into a “Santa Claus” rally.

The week began off with the retail sector in focus, after Cyber Monday adopted final week’s Black Friday in setting new data for spending. Two financial indicators grabbed many of the highlight on Wednesday and Thursday – first, the second estimate of U.S. Q3 GDP progress was revised larger. Then, Thursday’s private earnings and outlays report confirmed a M/M and Y/Y moderation within the Fed’s most well-liked inflation gauge – the private consumption expenditures worth index. Each units of knowledge enormously strengthened tender touchdown hopes.

Fed chair Jerome Powell garnered consideration on Friday with some feedback at a hearth chat at Spelman Faculty. Powell in his opening remarks tried to tamp down the market’s enthusiasm when it comes to charge cute expectations, saying that it was nonetheless too “untimely” to conclude that financial coverage was sufficiently restrictive. Nevertheless, as soon as the hearth chat began, Powell’s replies to questions have been much more optimistic and all however confirmed to merchants that the central financial institution wouldn’t hike charges anymore.

Within the lead-up to Powell, there was notable optimistic commentary from Fed Governor Christopher Waller on Tuesday and Chicago Fed President Austan Goolsbee earlier in the present day.

The continued favorable financial information additionally led to traders snapping up bonds this week, driving Treasury yields decrease and serving to equities. The longer-end 10-year yield (US10Y) has slipped 26 foundation factors whereas the shorter-end extra rate-sensitive 2-year yield (US2Y) has slid 40 foundation factors. The demand for bonds additionally acquired a detailed examination within the type of Treasury be aware auctions this week – a $54B 2-year public sale on Monday tailed whereas a $55B 5-year public sale traded by. Tuesday’s $39B 7-year public sale tailed by a big margin.

See how Treasury yields have achieved throughout the curve on the Looking for Alpha bond web page.

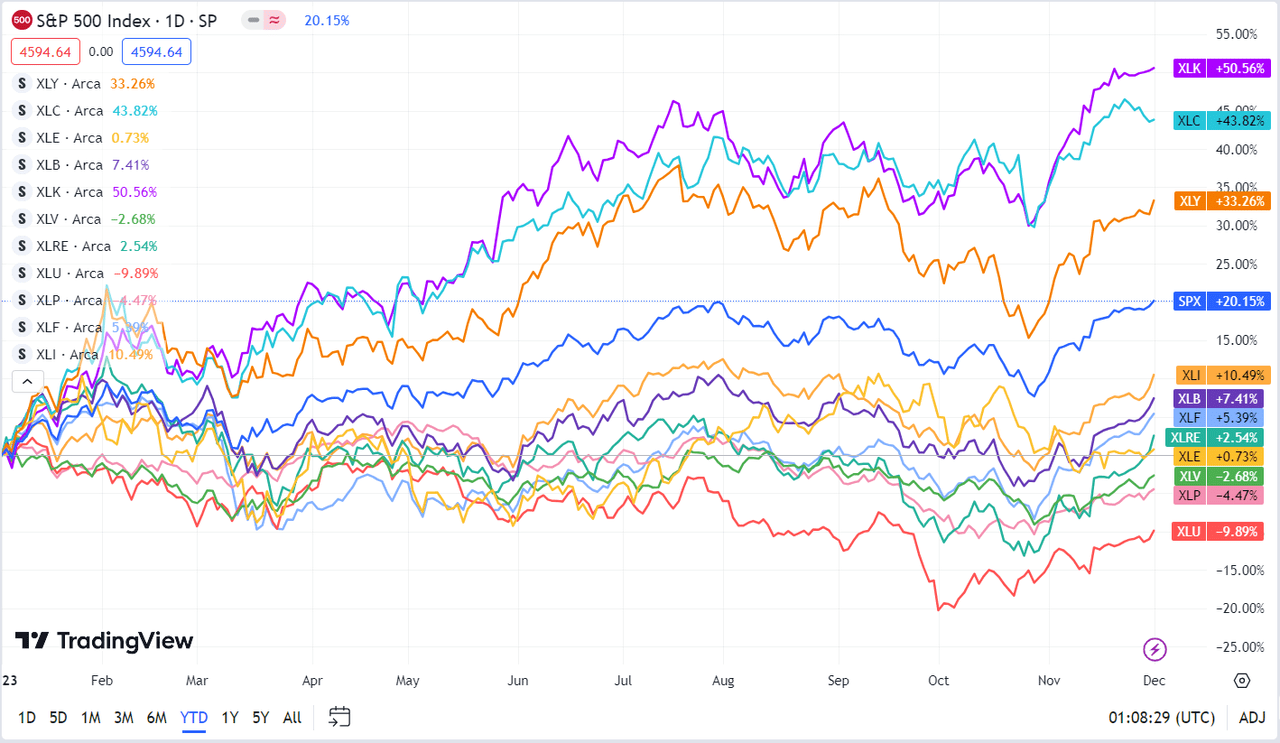

Turning to the weekly efficiency of the S&P 500 (SP500) sectors, 9 of the 11 ended within the inexperienced, led by an outsized leap of about 5% in Actual Property. Communication Companies and Power have been the highest losers. See under a breakdown of the efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from November 24 near December 1 shut:

#1: Actual Property +4.99%, and the Actual Property Choose Sector SPDR ETF (XLRE) +4.65%.

#2: Supplies +2.57%, and the Supplies Choose Sector SPDR ETF (XLB) +2.75%.

#3: Industrials +2.14%, and the Industrial Choose Sector SPDR ETF (XLI) +2.26%.

#4: Financials +2.09%, and the Monetary Choose Sector SPDR ETF (XLF) +2.23%.

#5: Shopper Discretionary +1.48%, and the Shopper Discretionary Choose Sector SPDR ETF (XLY) +1.69%.

#6: Utilities +1.27%, and the Utilities Choose Sector SPDR ETF (XLU) +1.34%.

#7: Shopper Staples +0.55%, and the Shopper Staples Choose Sector SPDR ETF (XLP) +0.77%.

#8: Well being Care +0.48%, and the Well being Care Choose Sector SPDR ETF (XLV) +0.53%.

#9: Data Expertise +0.34%, and the Expertise Choose Sector SPDR ETF (XLK) +0.63%.

#10: Power -0.11%, and the Power Choose Sector SPDR ETF (XLE) +0.11%.

#11: Communication Companies -2.49%, and the Communication Companies Choose Sector SPDR Fund (XLC) -1.48%.

Beneath is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500 (SP500). For traders trying into the way forward for what’s occurring, check out the Looking for Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.

Extra on the markets

[ad_2]

Source link