[ad_1]

Ihor Martsenyuk

Ferrexpo (OTCPK:FEEXF) is understandably engaging by some measures. Their enterprise is depressed as a result of Ukraine conflict’s affect on the power of Ferrexpo to export however they’re nonetheless worthwhile and moderately low-cost on even present run-rates. In precept, the finish of the conflict ought to imply a really substantial restoration within the inventory. In any other case, at present run-rates, there are higher options in markets that are not below this stress in any respect. Nonetheless, there’s a speculative argument for Ferrexpo, though not one which we might most likely bounce on.

Monetary and Working Scenario

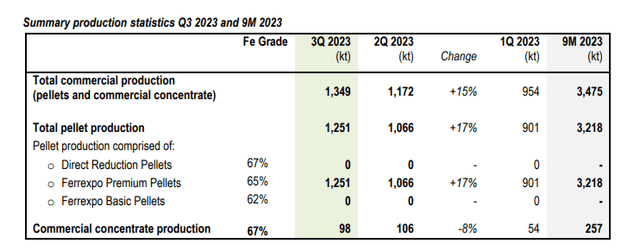

For the Q3, we truly see enhancements within the pellet manufacturing state of affairs of the corporate sequentially.

Q3 Manufacturing (Q3 Manufacturing Report)

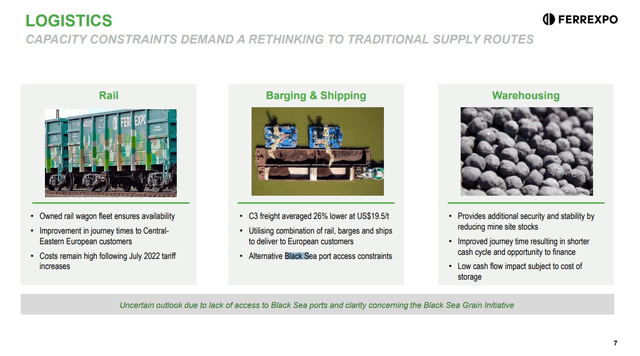

The Black Sea grain initiative has been deserted, and normally, there may be extremely restricted entry of the corporate to Ukraine’s Black Sea ports and various technique of export are being utilised, which ends up in a a lot slower turnover.

Black Sea (H1 2023 Pres)

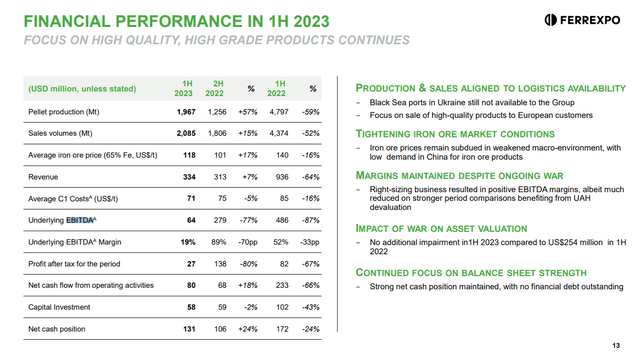

As of the H1, which is the final monetary launch, the EBITDA was $64 million. The costs of iron ore have come up meaningfully, greater than 10%, and with working leverage that ought to imply a fairly significant improve in EBITDA may very well be seen within the H2 2023. We expect round 50-60% will increase are doable, and that draw back in iron ore costs, regardless of slowdowns in main iron ore importers like China, is fairly unlikely. We estimate run-rate EBITDA to be about $200 million yearly at this level, which places the valuation at round 2x EV/EBITDA, which is in fact fairly low.

H1 2023 (Interim Outcomes Presentation)

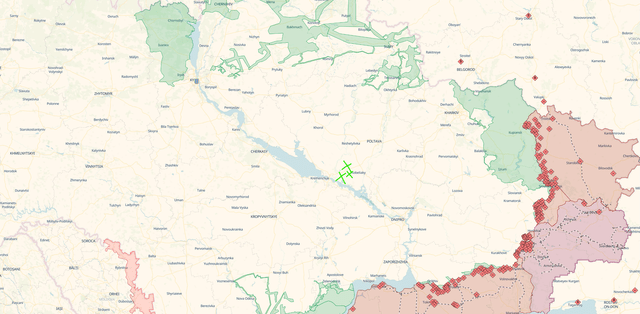

As a reminder, your entire Ferrexpo operation is positioned simply east of the Dnieper River, fortunately considerably removed from the entrance. As we perceive it the precise places are all simply southwest of Poltava metropolis, marked on the map.

Ferrexpo Operations on Battlemap (Ferrexpo Web site)

The operation contains 3 mines and pellet manufacturing services, and Ferrexpo is chargeable for about 3% of Ukraine’s whole export income, 4% in 2021.

Dangers

The dangers are tremendous apparent, which is that Ferrexpo may get blown up, particularly as it could be a strategic blow to the Ukraine economic system, however not in fact the general effort which is being funded by the West to a fantastic diploma.

Commodity dangers are iron ore costs. The worth of the pellets they produce and the truth that they’re vertically built-in into mining implies that they’re uncovered to the worth of iron ore, and below abnormal circumstances their shares would commerce correlated with the costs of iron ore. There is not an excessive amount of incremental draw back threat to iron ore, however a recession would not be nice.

Backside Line

A 2x EV/EBITDA run-rate a number of seems to be fairly good. What’s extra is that their skill to turnover merchandise has been meaningfully affected by export points as a result of the Black Sea logistics routes are unavailable and will not possible grow to be out there till after the tip of the conflict. When the open battle ends, it is extremely possible that Ferrexpo’s exports will greater than double and EBITDA will quadruple due to working leverage. The corporate, whereas primarily based in Ukraine, is run with Western capital allocation ideas they usually have paid very substantial particular dividends previously. This could occur once more, and that particular dividend may simply quantity to round 100% of the worth of Ferrexpo presently. 50% yield could be paid out from present costs on the idea of the underlying payout insurance policies if EBITDA had been to quadruple. Specials may get the determine to 100%.

The one decisive issue that may change within the coming 12 months is the election of Trump, which had been it to happen would radically improve the probability {that a} settlement is reached between Russia and Ukraine as Trump would wish to financial institution that diplomatic and financial win, on the expense of different geopolitical aims the place Republicans will sometimes take a extra isolationist view.

Our technique could be to get rid of hypothesis on hypothesis and anticipate the election to happen. If Trump wins and Ferrexpo’s value doesn’t reply to that occasion, it could be the optimum time to purchase. Proudly owning within the meantime simply exposes capital to the chance of one thing surprising and unfavourable occurring on the services.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link