[ad_1]

U.S. shares are in rally mode as we enter the ultimate weeks of 2023.

With the ultimate CPI report of the yr out of the way in which, the market’s focus is now fixated solely on the Federal Reserve assembly.

Fed Chair Powell may strike a extra hawkish tone than anticipated.

In search of a serving to hand available in the market? Members of InvestingPro get unique concepts and steerage to navigate any local weather. Be taught Extra »

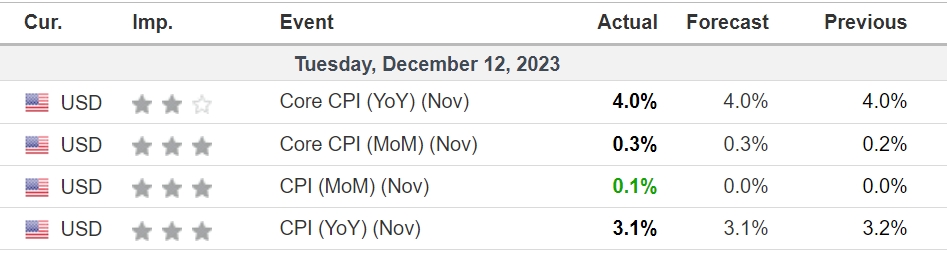

There was a little bit little bit of one thing for each the doves and hawks in Tuesday’s U.S. CPI report, which confirmed that headline inflation continues to sluggish, however core costs stay sticky.

The buyer worth index edged up final month after being unchanged in October, the Labor Division’s Bureau of Labor Statistics stated.

Within the 12 months by way of November, the annual CPI elevated , slowing from the three.2% tempo seen in October.

Economists polled by Investing.com had forecast the CPI could be unchanged for the month and rise 3.1% on a year-on-year foundation.

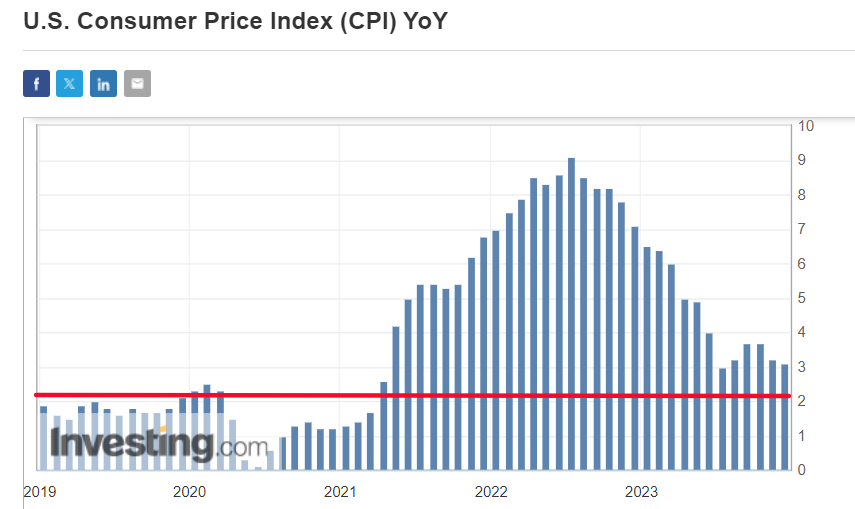

As will be seen within the chart beneath, U.S. inflation has come down considerably since June 2022, when it peaked at a 40-year excessive of 9.1%, amid the Fed’s aggressive rate-hiking cycle.

Nonetheless, whereas the speed of inflation is declining, costs are nonetheless rising much more rapidly than what the Fed would think about per its 2% goal vary.

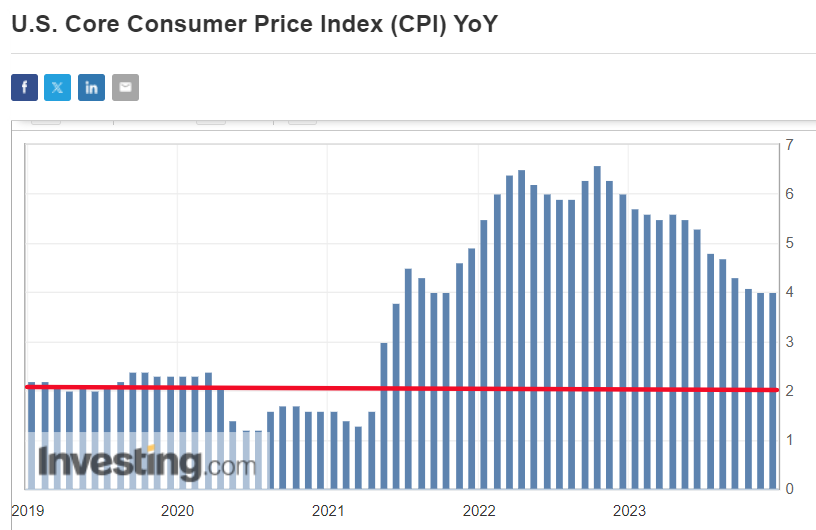

Excluding the risky meals and vitality parts, core CPI elevated in November after climbing 0.2% within the earlier month.

On an annual foundation, core CPI rose after advancing on the identical fee in October. Each readings had been in keeping with estimates.

In a worrying signal, the so-called ‘supercore inflation’, which tracks the price of providers minus vitality and housing, rose 0.44% on the month, doubling from 0.22% in October.

The ‘supercore’ determine is carefully watched by Fed officers who imagine that it offers a extra correct evaluation of the long run course of inflation.

All in all, these numbers counsel that the Fed would nonetheless have to see additional progress on a few of these underlying inflation measures earlier than policymakers are snug slicing rates of interest.

Taking that into consideration, the Fed’s inflation battle is much from over as sticky underlying core inflation persists, offering additional proof that the U.S. central financial institution was unlikely to pivot to rate of interest cuts early subsequent yr.

All Eyes Flip to the Fed, Powell

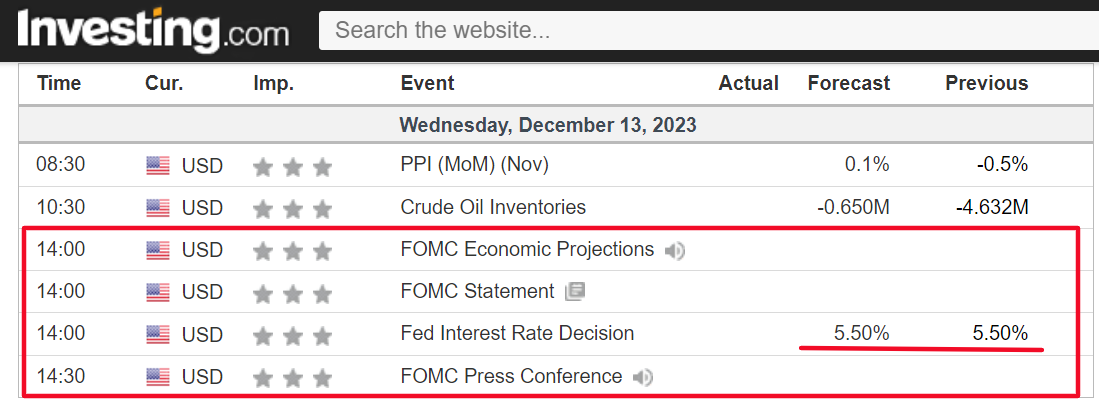

With the CPI report out of the way in which, the market’s focus is now fixated solely on the ultimate Federal Reserve assembly of the yr scheduled for later Wednesday.

The U.S. central financial institution is extensively anticipated to go away rates of interest unchanged for the third consecutive assembly as Fed officers assess latest indicators of financial softening.

After elevating borrowing prices by 525 foundation factors to the present 5.25%-5.50% vary since March 2022, many market contributors are rising extra assured that the Fed’s coverage tightening marketing campaign is all however over.

Nonetheless, I imagine there’s a danger that Fed Chair Powell may strike a extra hawkish tone than anticipated in his post-meeting information convention on condition that some underlying measures of inflation remained comparatively elevated in November.

As such, Powell is prone to reiterate that the Fed will preserve charges larger for longer as he pushes again towards market expectations for a fee minimize within the first half of 2024.

As well as, look ahead to the Fed chair to sign that he’s not but able to definitively rule out additional hikes as sticky inflation continues to meander alongside its sluggish, downward path.

It must be famous that regardless of Powell’s repeated ‘higher-for-longer’ fee warnings, buyers have largely ignored him for essentially the most half amid the idea the Fed is unlikely to boost charges any additional and have began to cost in a collection of fee cuts starting subsequent spring.

As per the Investing.com , there’s a roughly 45% likelihood of a fee minimize on the Fed’s March 2024 assembly, whereas odds for Could stand at about 75%.

I believe {that a} fee minimize would seemingly solely are available in both June or September of subsequent yr as inflation takes longer to return to the Fed’s 2% goal than many had hoped.

As such, the central financial institution may preserve coverage charges in restrictive territory for longer than markets at present anticipate.

What To Do Now

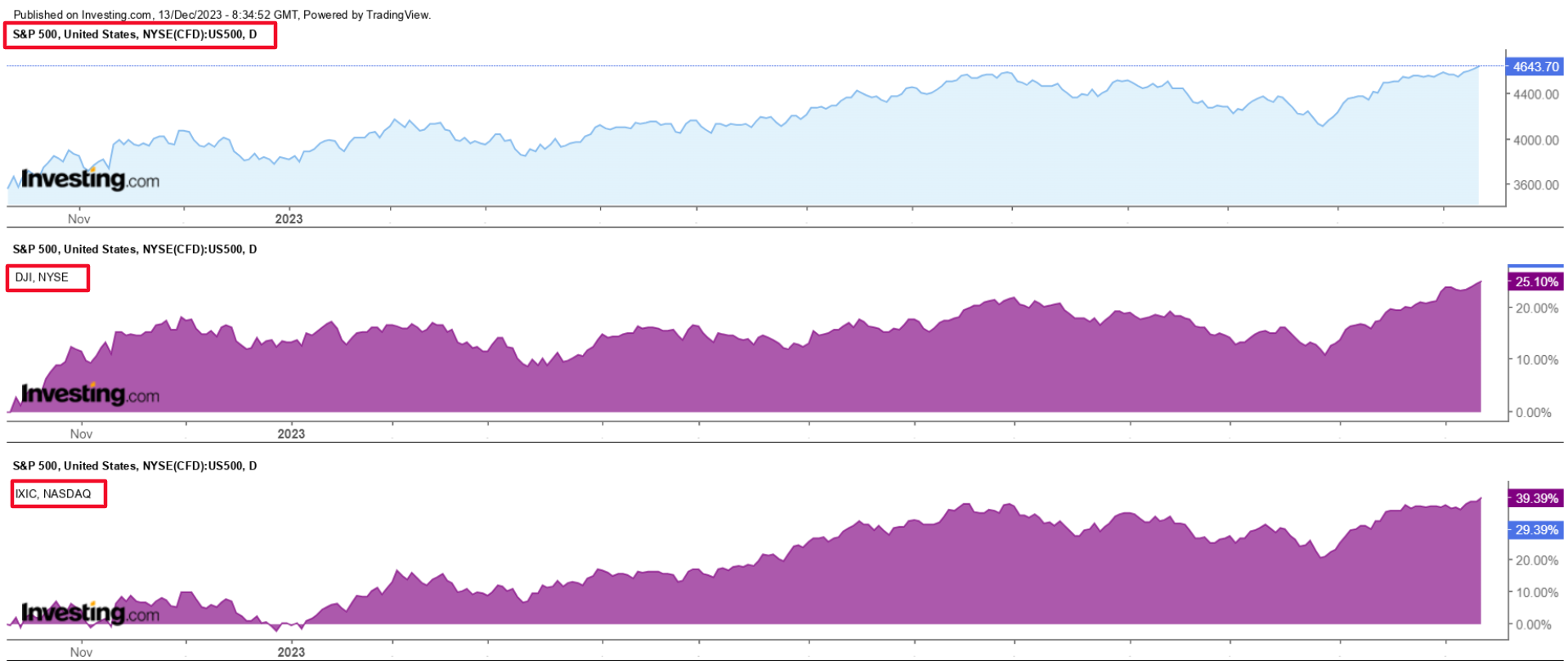

Wall Road’s main averages closed at recent highs for the yr on Tuesday, as buyers reacted to the newest inflation report whereas awaiting the Fed’s final coverage determination of 2023.

The blue-chip Common closed at its highest stage since January 4, 2022, and now stands lower than 1% away from its all-time excessive.

In the meantime, the benchmark ended at its finest stage since Jan. 14, 2022, and the tech-heavy at its highest since March 29, 2022.

Whereas I’m at present lengthy on the Dow, S&P 500, and the by way of the Dow Jones ETF (NYSE:), S&P 500 ETF (NYSE:), and the , I’ve been cautious about making new purchases on account of indicators the market is overbought.

Maybe my greatest fear is the entire lack of market concern as represented by the , or VIX. As seen within the chart beneath, the market concern gauge tumbled to its lowest stage since January 2020 on Tuesday.

When the market concern gauge will get unusually low, it is a signal of extreme bullishness or complacency. That raises the chance of a market pullback.

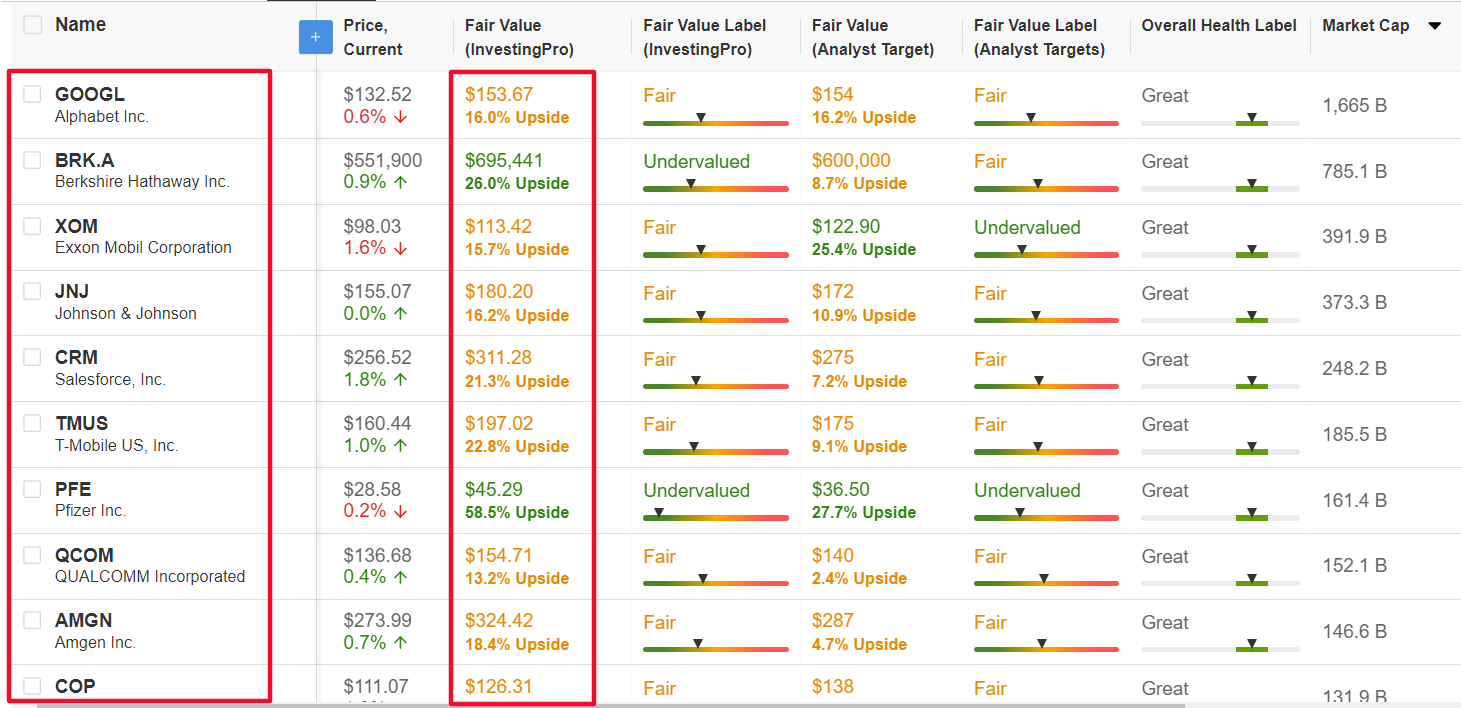

As such, I used the InvestingPro inventory screener to determine top-quality shares with robust fundamentals and extra upside forward based mostly on the Professional fashions.

Not surprisingly among the names to make the listing embrace Google-parent Alphabet (NASDAQ:), Warren Buffett’s Berkshire Hathaway (NYSE:), ExxonMobil (NYSE:), Johnson & Johnson (NYSE:), Salesforce (NYSE:), T-Cellular (NASDAQ:), Pfizer (NYSE:), Qualcomm (NASDAQ:), Amgen (NASDAQ:), and ConocoPhillips (NYSE:) to call a couple of.

Supply: InvestingPro

With InvestingPro’s inventory screener, buyers can filter by way of an unlimited universe of shares based mostly on particular standards and parameters to determine low cost shares with robust potential upside.

***

You possibly can simply decide whether or not an organization is appropriate in your danger profile by conducting an in depth basic evaluation on InvestingPro in keeping with your standards. This manner, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you’ll be able to join InvestingPro, one of the vital complete platforms available in the market for portfolio administration and basic evaluation, less expensive with the most important low cost of the yr (as much as 60%), by benefiting from our prolonged Cyber Monday deal.

Discover All of the Information you Want on InvestingPro!

Disclosure: I repeatedly rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic atmosphere and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

[ad_2]

Source link