[ad_1]

Crossovers are an vital a part of day buying and selling the foreign exchange, crypto, commodities, and the bond market. They’re extensively used to search out entry and exit positions when each day buying and selling and investing.

Crossovers are essential amongst two widespread varieties of merchants: reversals and trend-followers. A reversal-focused dealer will usually discover alternatives when a sure crossover occurs. Equally, a trend-follower can discover a possibility when two shifting averages cross one another.

It’s potential for a dealer to be worthwhile by specializing in crossovers. For instance, within the chart under, we see that the bullish breakout was confirmed when the 50-day and 100-day shifting averages crossed one another.

What’s a crossover?

A crossover, because the identify suggests, is a interval when two or extra indicators cross one another. When these overlaps between two indicators occur, it tells you the route that the worth of the asset will transfer to.

It additionally exhibits you potential entry and exit positions for a development commerce. Importantly, a crossover can inform a dealer whether or not an present development is about to finish. In all, these conditions are vital as a result of they enable you to to establish buying and selling alternatives.

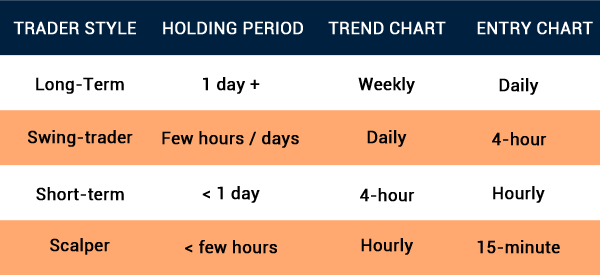

Crossovers can occur throughout all timeframes. Generally, day merchants deal with people who occur in extraordinarily short-timeframes, together with one-minute. Swing merchants intention to establish medium-term overlaps whereas traders take a look at longer-term actions.

There are two fundamental varieties of crossovers: bullish and bearish. A bullish crossover occurs at a cheaper price when the worth is about to maneuver upwards. It factors to a possible change of an asset’s value change from bearish to bullish.

A bearish crossover is the precise reverse of this. It occurs when an asset that’s in an uptrend modifications route and turns into bearish.

As you will notice under, among the finest ways in which this occurs is when two brief and lengthy shifting averages cross one another.

What crossovers imply within the inventory market

The idea of crossovers is used extensively in technical evaluation, which is the thought of analyzing charts. Generally, it’s used with shifting averages, the most well-liked technical indicators within the business.

When these conditions occur, it often signifies that an present development is about to finish and a brand new one about to occur. For instance, if two indicators cross one another when an asset is in a downtrend, it signifies that a brand new bullish one is about to occur.

In different phrases, a crossover is an idea utilized in buying and selling reversals. After a reversal occurs, a brand new development often occurs, which you’ll observe till the top.

Methods to establish a crossover

The simplest means: utilizing MAs

The most well-liked crossovers are often called the golden cross and the demise cross. The 2 occur when two shifting averages cross and are due to this fact a sign to purchase or promote.

A golden cross occurs when an extended shifting common – usually a 200 interval – and a shorter one crosses each other.

To starters, a shifting common is an indicator that tracks the general common of a value throughout a sure interval. There are a number of varieties of averages, which embrace:

amongst others.

Shifting averages are trend-based indicators. They’re used to establish when a development is about to type and when it’s about to wane. If you happen to’d wish to be taught extra about how you can establish a development early, have a look right here.

Golden cross & demise cross

Whereas there are a lot of methods of utilizing the shifting averages, crossovers are among the finest. On this case, the thought is so as to add two averages of various durations and establish after they meet one another.

Within the golden cross and demise cross, the most well-liked averages used are the 200-day and 50-day averages.

If the 2 crossover factors upwards, they’re often an indication that bulls are profitable and that the worth will hold rising. Equally, in the event that they escape decrease, it’s a signal {that a} new downward development is starting.

Whereas the 200-day and 50-day MAs are the most well-liked, most short-term merchants provide you with their most well-liked intervals. The most typical is a 14-day and 7-day shifting common.

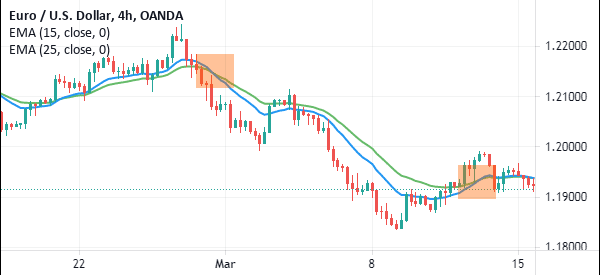

The chart under exhibits that the EUR/USD saved falling after the 2 shifting averages made a crossover.

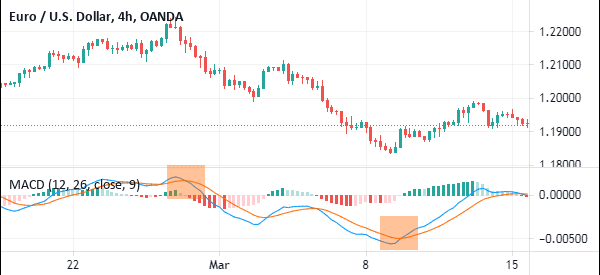

MACD

The shifting common convergence and divergence (MACD) is an oscillator created utilizing shifting averages. It was developed by Gerald Appel greater than 40 years in the past and it has grow to be one of the crucial standard indicators on the planet.

The MACD is derived by first subtracting the 12-day exponential shifting common from the 26-day EMA. The sign line of the MACD is the 9-day shifting common of the MACD line. The histogram, then again, is the MACD line minus the sign line.

Whereas the MACD can be utilized to establish overbought and oversold ranges, the most well-liked technique is to establish the place the 2 strains make a crossover.

After they cross under the impartial line, it’s often an indication that the worth is about to interrupt out larger. However, when the 2 strains make a crossover above the impartial line, it’s a signal of a bearish signal.

As talked about, the inspiration of the MACD is on the 12-day and 26-day shifting common. Nevertheless, you’ll be able to regulate these intervals to match your buying and selling technique.

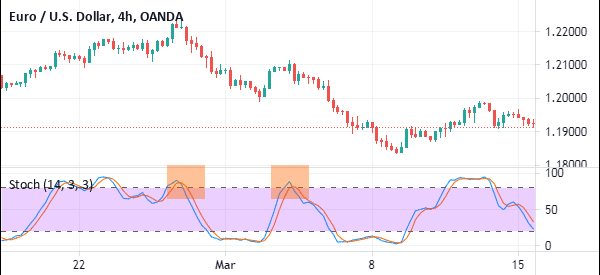

Stochastic oscillator

The Stochastic oscillator was developed by George Lane within the Fifties. It is among the best-known oscillators out there, with the others being the Relative Power Index (RSI) and the Relative Vigor Index (RVI).

The Stochastic oscillator is a comparatively troublesome indicator to calculate. For one, you first must calculate the %Ok, which is calculated by first subtracting the bottom low from the present shut after which dividing it by the bottom low and highest low and multiplying the outcome by 100.

The %D is calculated by discovering the 3-day easy shifting common of the %Ok.

Utilizing the stochastic oscillator is straightforward. Like all oscillators, it’s used to establish overbought and oversold ranges. When the 2 strains are under 25, it’s mentioned to be within the oversold zone. When they’re above 75, it’s mentioned to be within the overbought zone.

The crossover of %Ok and %D

Nonetheless, the most well-liked buying and selling technique of utilizing the stochastic oscillator is to establish the crossover of the %Ok and %D.

When it occurs on the oversold zone, it’s often an indication that the worth will rebound. Equally, when it crosses over above the overbought zone, it’s a signal that the worth will begin to drop.

The chart under exhibits a very good instance of the Stochastic oscillator.

Crossover buying and selling methods

There are a number of buying and selling methods that you need to use in day, swing, or place buying and selling when two indicators intersect one another. A few of these methods are:

Pattern following

Pattern following is a buying and selling technique that entails figuring out an present development after which following it to the top. The thought is that an present development will proceed till it meets an equal power in the other way.

It’s potential to make use of crossovers in trend-following. For instance, after a golden cross occurs, it often results in a brand new bullish development, which you’ll observe. Equally, a demise cross is adopted by a bearish development, which you’ll brief the asset.

After the crossover occurs, there are two fundamental methods of holding the commerce. First, you’ll be able to maintain it so long as it’s above the shifting common. Second, you’ll be able to keep the commerce so long as it’s above an ascending trendline. Additional, you’ll be able to maintain the commerce so long as it’s above the dots of the Parabolic SAR.

Test them in a number of timeframes

The opposite technique for utilizing crossovers is to take a look at the assorted timeframes simply to verify. Generally, it’s often really useful to make use of no less than three time frames in evaluation. For a day dealer, you need to use the four-hour, hourly, and the 15-minute chart.

Alternatively, you need to use the 1-hour, 30-minute, and the 5-minute charts. Utilizing these charts is a perfect technique that may enable you to establish crossovers.

On this case, for those who discover them within the 15-minute chart, you’ll be able to take a look at the hourly chart for affirmation.

Affirmation indicators

The opposite technique for utilizing crossovers is for affirmation indicators. If you’re utilizing value motion evaluation, there are a number of chart patterns like head and shoulders, double-top and triple-top, symmetrical triangle and wedge.

When these patterns occur, you need to use crossover patterns like golden and demise cross to verify the strikes.

Advantages of utilizing crossovers

There are a number of advantages of utilizing crossovers within the monetary market. First, they’re comparatively simple to make use of instruments out there. For one, it’s simple to mix the brief and longer-term shifting averages. Additionally, it’s simple to implement the opposite three varieties of crossovers that we’ve checked out above.

Second, this method can be utilized effectively together. For instance, a crossover of the shifting averages, stochastics, and MACD can be utilized to verify when a reversal is about to occur.

Third, you’ll be able to provide you with a customized crossover buying and selling technique. Lastly, you’ll be able to simply automate the shifting averages utilizing a robotic.

Widespread crossover errors to keep away from

Like all buying and selling methods, there are some widespread errors that may result in substantial losses. A few of these errors to keep away from are:

Over Reliance on crossovers – Whereas crossovers work effectively, it is best to mix them with different instruments and techniques.

Ignoring market context – Along with crossovers, you must also deal with different components out there like information and financial knowledge.

Not utilizing threat administration – There’s the error of not utilizing the chance administration methods talked about above when utilizing this technique.

Threat administration when utilizing crossovers

Threat administration is among the most vital components of day buying and selling. It refers back to the idea of decreasing dangers whereas maximizing returns. A few of the most vital threat administration methods to make use of are:

Utilizing a cease loss

A stop-loss is a instrument that stops your commerce mechanically when it reaches a sure level. For instance, for those who place a purchase commerce at $10, you’ll be able to place a stop-loss at $8. On this case, if the bullish commerce fails, the stop-loss shall be triggered.

Whereas a stop-loss is an effective instrument, you would possibly think about using a trailing cease, which strikes together with the asset. Within the above instance, if the worth rises to $12 after which rapidly drops to $8, your preliminary income shall be triggered.

Place sizing

The dimensions of a commerce performs an vital function within the monetary market. A better commerce dimension signifies that you’ll make more cash if the commerce goes on effectively. For instance, for those who purchase 10 shares, your revenue shall be greater than for those who purchase 5 shares.

The chance of opening large trades is that it might probably result in extra losses. Due to this fact, at all times guarantee that you’re opening reasonable trades to cut back your loss publicity.

Leverage

Leverage is a mortgage {that a} dealer offers you with the objective of maximizing your income. A better leverage will result in extra income however expose you to extra dangers.

Due to this fact, it is best to restrict this leverage problem through the use of a smaller one. Whereas the income is not going to be large, they may enable you to handle dangers out there.

Backtesting

The opposite threat administration technique to think about is called backtesting. It is a course of the place you utilize historic knowledge to gauge the efficiency of an asset. It’s principally used if you end up utilizing a robotic or an algorithmic instrument.

Most buying and selling platforms like TradingView and MT4 and MT5 have their backtesting options. You need to use these backtesting instruments if in case you have created a crossover robotic.

There are different threat administration methods to bear in mind, together with, not leaving your trades open in a single day, chopping losses early, and diversification.

Last ideas

Buying and selling crossovers is a well-liked factor amongst foreign exchange, shares, and commodity merchants. It’s a comparatively simple course of to make use of and is among the most correct. Nevertheless, to succeed, you have to to apply for some time.

Additionally, it is best to attempt it effectively utilizing your most well-liked parameters.

Exterior Helpful Assets

[ad_2]

Source link