[ad_1]

cagkansayin

This text is a part of a sequence that gives an ongoing evaluation of the adjustments made to Prem Watsa’s 13F portfolio on a quarterly foundation. It’s based mostly on Watsa’s regulatory 13F Kind filed on 11/14/2023. Please go to our Monitoring Prem Watsa’s Fairfax Monetary Holdings Portfolio sequence to get an concept of his funding philosophy and our earlier replace for the fund’s strikes throughout Q2 2023.

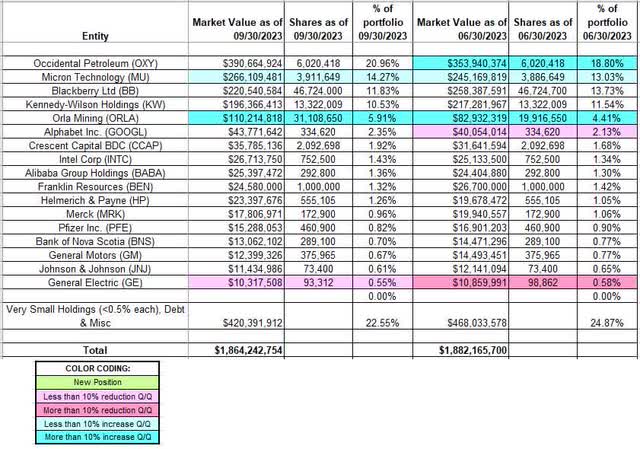

This quarter, Watsa’s 13F portfolio worth decreased marginally from $1.88B to $1.86B. There are 61 securities within the portfolio, however it’s concentrated amongst a couple of massive stakes. The main target of this text is on the bigger (better than 0.5% of the portfolio every) fairness holdings. The highest three positions are Occidental Petroleum, Micron Expertise, and Blackberry. Collectively, they account for ~46% of the complete 13F portfolio.

Observe 1: Fairfax Monetary’s (OTCPK:FRFHF) 13F holdings solely symbolize a small portion of their general funding portfolio. The entire measurement as of Q3 2023 was ~$59B of which ~$6.3B was in money and short-term positions. FRFHF presently trades at ~$880 in comparison with E-book Worth (Q3 2023) of ~$877 per share. The fairness portfolio was 100% hedged ranging from round 2003 however these have been eliminated in This fall 2016.

Observe 2: Distinguished fairness allocations not within the 13F report embody investments in Greece and India (OTCPK:FFXDF). Greek allocation primarily consists of a ~32% possession of Eurobank (OTCPK:EGFEY) (OTCPK:EGFEF). Different outstanding stakes embody ~27% of Thomas Prepare dinner India, 54% of Bangalore Worldwide Airport Restricted, and 31% of Quess Corp Restricted.

Stake Will increase:

Micron Expertise (MU): MU is presently the second largest 13F place at ~14% of the portfolio. It noticed a ~60% stake improve in Q1 2019 at costs between $31 and $44. The place was elevated by ~115% in Q1 2020 at costs between $34.50 and $60. That was adopted with a whopping ~400% stake improve throughout Q3 2022 at costs between ~$49 and ~$65. That was adopted with a ~12% additional improve throughout Q1 2023. The inventory presently trades at $81.41. There was a marginal improve within the final two quarters.

Orla Mining (ORLA): ORLA is a 5.91% of the portfolio stake bought throughout Q3 2022 at costs between ~$2.40 and ~$3.70. Q1 2023 noticed a ~45% stake improve at costs between ~$3.85 and ~$4.90. That was adopted with one other ~30% improve final quarter at costs between ~$3.90 and ~$4.85. The place was elevated by 56% this quarter at costs between ~$3.57 and ~$4.76. The inventory presently trades at $3.08.

Observe: Regulatory filings because the quarter ended present them proudly owning ~33.61M shares (10.7% of the enterprise). That is in comparison with ~31.11M shares within the 13F report.

Stake Decreases:

Blackberry Ltd (BB): BB stake is now at ~12% of the portfolio. The place was first bought in 2010 at round $50 for 2M shares. The stake was aggressively constructed as much as 46.7M shares within the following years. Their web value on a totally transformed foundation is ~$10 per share and the inventory presently trades at $4.37. There has solely been very minor exercise within the final ten years.

Observe: In This fall 2013, Fairfax co-sponsored a money infusion of $1B by means of convertible debentures ($10 conversion worth incomes 6% curiosity) – they financed $500M of that transaction, and the remaining was funded by a consortium of different funding funds. In Q3 2016, these shares have been redeemed, and new ones issued ($605M in 3.75% debentures convertible at $10 due 11/13/2020) to the identical entities in a personal placement. On 9/2/2020, these have been redeemed, and new ones issued ($330M in 1.75% debentures convertible at $6 due 11/13/2023). On 11/13/2023, these have been redeemed and new ones issued ($150M in 1.75% debentures convertible at $6 due 2/15/2024 with an non-compulsory extension potential to five/15/2024). Assuming full conversion, they’d personal ~72M shares (~12% of the enterprise).

Basic Electrical (GE): The very small 0.55% stake in GE was diminished by ~5% this quarter.

Saved Regular:

Occidental Petroleum (OXY): OXY is now the biggest 13F stake at ~21% of the portfolio. It was constructed over the last 4 quarters at costs between ~$57 and ~$67. The inventory is now at $58.56.

Kennedy-Wilson Holdings (KW): KW stake is a big (high 5) 10.53% of the 13F portfolio place first bought in 2010. This fall 2016 noticed a ~40% improve at costs between $20 and $23 and that was adopted with a ~8% improve in Q1 2018. KW presently trades at $12.69.

Observe: Additionally they have warrants that they acquired as a part of most popular fairness investments made within the final two years. Their general possession stake within the enterprise is ~20% (31.32M shares).

Alphabet Inc. (GOOGL): GOOG is a 2.35% stake bought in Q1 2020 at costs between ~$53 and ~$76. There was a ~22% stake improve in This fall 2020 at costs between ~$71 and ~$91. The final quarter noticed a marginal discount. The inventory presently trades at ~$134.

Crescent Capital BDC (CCAP): CCAP is a 1.92% of the portfolio stake bought in Q1 2020 at costs between $6.21 and $17.10 and the inventory presently trades at $17.26.

Observe: Their possession stake within the enterprise is ~6.8%.

Franklin Assets (BEN): The 1.32% BEN place was established in Q1 2020 at costs between $15.30 and $26.25 and it’s now at $29.39.

Alibaba Group Holding (BABA), Financial institution of Nova Scotia (BNS), Basic Motors (GM), Helmerich & Payne (HP), Intel Corp (INTC), Johnson & Johnson (JNJ), Merck (MRK), and Pfizer Inc. (PFE): These small (lower than ~1.5% of the portfolio every) stakes have been saved regular this quarter.

The spreadsheet beneath highlights adjustments to Watsa’s 13F inventory holdings in Q3 2023:

Prem Watsa – Fairfax Monetary Holdings Portfolio – Q3 2023 13F Report Q/Q Comparability (John Vincent (creator))

Supply: John Vincent. Information constructed from Fairfax Financials’ 13F filings for Q2 2023 and Q3 2023.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link