[ad_1]

As a 2023 bullish attracts to a detailed, buyers are already setting their sights on shares to purchase for 2024.

The market provides these 3 shares greater than +32% progress potential within the coming yr

Let’s check out these three shares intimately.

As 2023 attracts to a detailed, buyers are shifting their focus to the upcoming fiscal yr.

In at this time’s evaluation, we’ll discover three shares which have captured the market’s consideration and are poised for substantial progress of over 32% within the subsequent fiscal yr.

Moreover, we’ll delve into the underlying components driving their respective potentials, leveraging information from the InvestingPro skilled device.

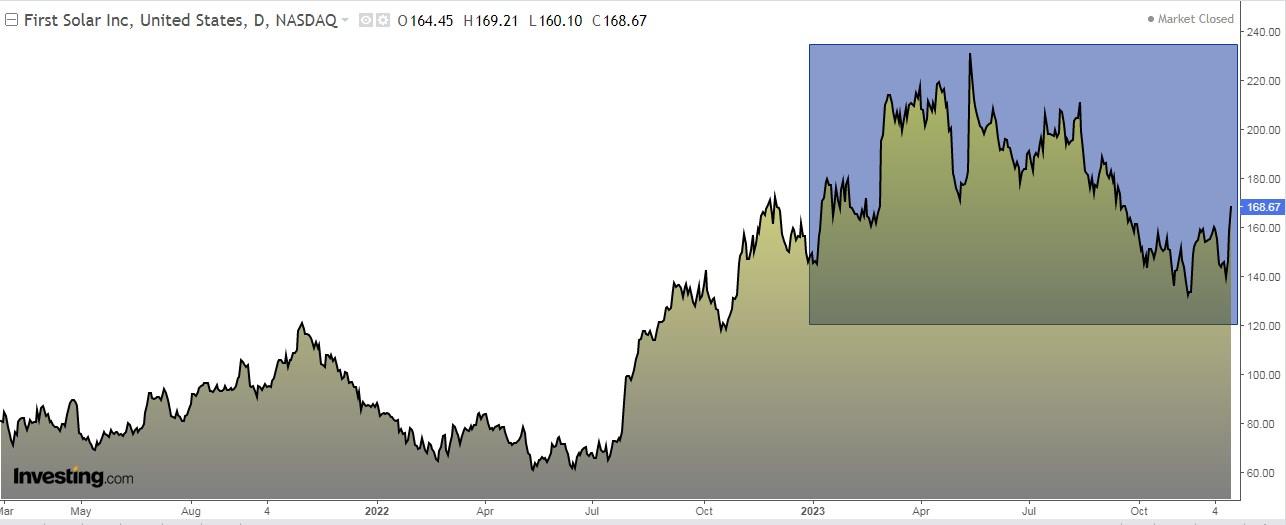

1. First Photo voltaic

First Photo voltaic (NASDAQ:) provides photo voltaic photovoltaic vitality options in the USA, Japan, France, Canada, India, and Australia.

The corporate designs manufactures and sells photo voltaic modules that convert daylight into electrical energy.

It was previously often known as First Photo voltaic Holdings and adjusted its title to First Photo voltaic in 2006.

First Photo voltaic reviews its quarterly outcomes on February 22. Its earnings per share (EPS) are anticipated to extend by +60.34% and precise revenues by +22%.

Waiting for 2024, EPS forecasts are for a rise of +63.7% and income of +31.4%.

First Photo voltaic Upcoming Earnings

Supply: InvestingPro

First Photo voltaic has develop into a outstanding participant in its sector and has attracted the eye of Wall Avenue for its strategic positioning and monetary efficiency.

Along with the promising earnings forecasts for 2024, the inventory has a number of favorable components in its nook.

These embrace a sturdy order backlog extending till 2026, a stable steadiness sheet, and an anticipated progress in gross margins from 18% in 2023 to 25% in 2025.

Supply: InvestingPro

As well as, its concentrate on utilities relatively than residential photo voltaic units it other than its opponents, insulating it from business challenges resembling weak residential demand and rate of interest volatility.

The utility-scale photo voltaic demand is ever-increasing growing within the U.S. market because the shift to carbon-neutral vitality sources takes maintain.

The corporate’s inventory is up +10.60% for the yr. The conservative aspect of the market sees a 12-month potential of +36% at $229.63. In distinction, the extra aggressive aspect believes the potential is +50-55%.

First Photo voltaic Analyst Targets

Supply: InvestingPro

2. Schlumberger

Schlumberger (NYSE:) is engaged within the provide of know-how for the vitality business worldwide. Schlumberger was based in 1926 and is headquartered in Houston, Texas.

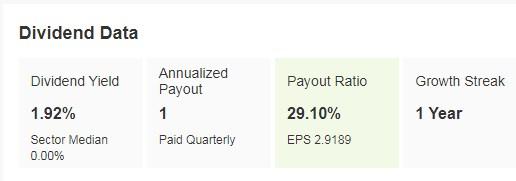

Its dividend yield is +1.92%.

Schlumberger Dividend Information

Supply: InvestingPro

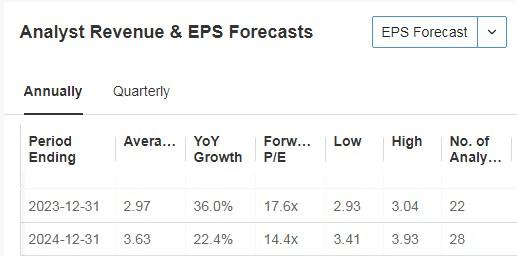

It’s going to report its numbers for the quarter on January 19 and its income may rise by nearly +4%.

The corporate’s earnings per share are anticipated to extend by +36% in 20234 and +22.4% in 2024. Concerning revenues, a rise of +17.9% this yr and +13.1% for the next fiscal yr.

Schlumberger Income and EPS Estimates

Supply: InvestingPro

Its shares are down 2% for the yr. It presents 31 rankings, of which 28 are purchase, 3 are maintain and none are promote.

Supply: InvestingPro

The market provides it a 12-month ahead potential of +32%.

Schlumberger Analyst Targets

Supply: InvestingPro

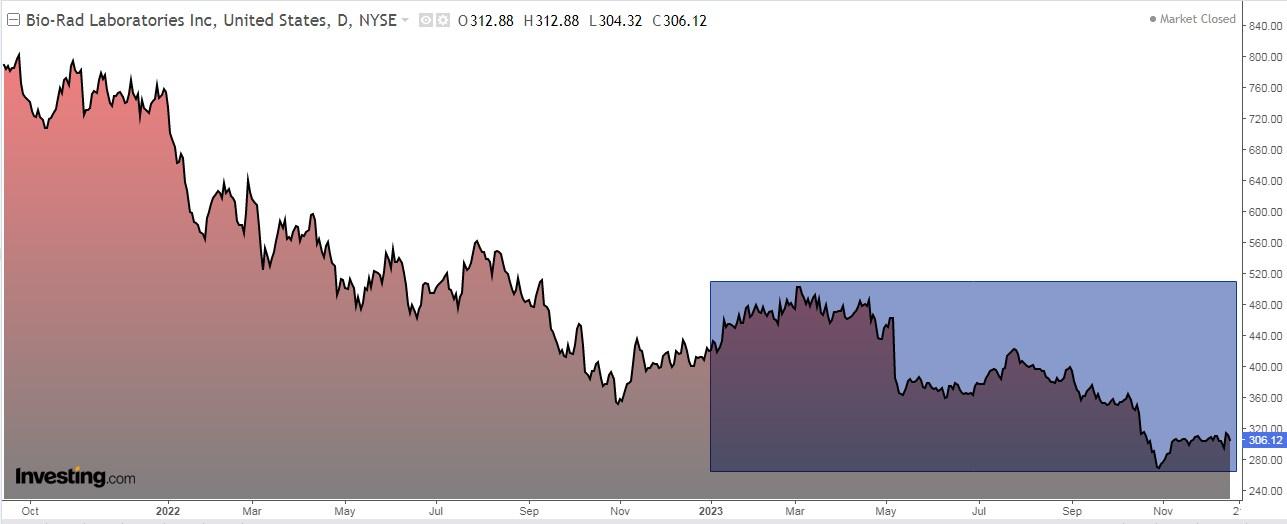

3. Bio Rad Laboratories

Bio-Rad Laboratories (NYSE:) manufactures and distributes medical diagnostic merchandise and laboratory gadgets and devices which might be utilized in analysis methods in the USA, Europe, Asia, Canada, and Latin America.

It was based in 1952 and is headquartered in Hercules, California.

On February 8 it presents its accounts for the quarter. For 2024, it forecasts a rise in earnings per share and income of +2.6% and +2.8%, respectively.

Bio Rad Laboratories Inventory Response After Earnings

Supply: InvestingPro

The corporate’s margin growth alternative is a constructive. The unfold between lagging working margins and margins on quantity progress is excessive, a truth that ought to place the corporate for a reasonably sturdy growth.

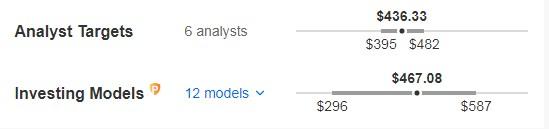

The market sees a 12-month +42.5% potential at $436.33. For his or her half, InvestingPro fashions elevate it to +52% (the $467.08).

Bio Rad Laboratories Analyst Targets

Supply: InvestingPro

Supply: InvestingPro

***

You possibly can simply decide whether or not an organization is appropriate in your danger profile by conducting an in depth basic evaluation on InvestingPro in response to your standards. This fashion, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you possibly can join InvestingPro, probably the most complete platforms available in the market for portfolio administration and basic evaluation, less expensive with the most important low cost of the yr (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost As we speak!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any approach. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related danger stays with the investor.

[ad_2]

Source link