[ad_1]

There are a lot of buying and selling methods utilized by merchants within the monetary market. These methods are divided into technical and basic evaluation.

In technical, merchants use a mixture of technical indicators like shifting averages and Bollinger Bands to make choices. In basic evaluation, they use the information and different financial information. The symptoms repeatedly used listed below are rates of interest, inflation, confidence numbers, and employment numbers.

Information buying and selling, right here, is without doubt one of the hottest methods within the monetary market. It’s so essential as a result of information is commonly the commonest driver of property like shares, currencies, and commodities.

Some merchants have achieved success by simply specializing in information. Others have succeeded by combining information with different methods like trend-following, reversals, and arbitrage.

This text will have a look at the idea of stories buying and selling, the way it works, why it issues, and a number of the professionals and cons.

What’s information buying and selling?

Because the title suggests, information buying and selling is a technique that includes information to find out whether or not to purchase or brief an asset. Information can vary from an organization’s earnings to CEO appointments, to financial information.

Information could be optimistic or destructive (day merchants and scalpers can profit from each). A number of the high destructive information embrace chapter filings, product flop, and an investigation by an entity just like the Securities and Trade Fee (SEC).

A number of the high optimistic information are a profitable product launch, entry of an activist investor, an acquisition, and better oil costs (for power corporations).

A information occasion can have main implications on a inventory or some other asset. In some circumstances, an organization’s shares can go up or down by greater than 50% after publishing its earnings.

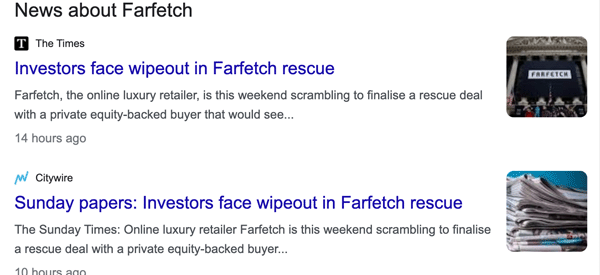

An excellent instance of all that is proven under. On this chart, we see that FarFetch shares dropped by 13.26% in a day. It was down by 86% YTD in 2023 and by 97% in 5 years.

Usually, a 13% inventory drop often occurs after an organization generates destructive information. Due to this fact, a easy search in Google Information reveals that the inventory dropped as a result of the corporate was on the snapping point.

Information is beneficial for each long-term traders and day merchants. Day merchants use information to seek out entry factors for an asset. Whereas long-term traders are ready to climate short-term volatility, others can use rising points to exit their positions.

For instance, Warren Buffett has held a place in Coca-Cola for greater than 30 years. On this interval, the corporate has had some destructive and optimistic information, which Buffet has ignored. Nonetheless, he used some information occasions to exit his shedding place in IBM.

How information impacts buying and selling choices

Information has a significant affect on an individual’s buying and selling choices. It does this by altering the sentiment of an asset amongst traders and merchants in the direction of an organization.

For instance, if an organization’s inventory has been in a downward pattern for lengthy, a optimistic earnings report will help to vary sentiment amongst traders.

Information can even have a destructive implication for a monetary asset. An excellent instance of that is when an organization publishes monetary outcomes that present falling revenues and profitability. On this case, merchants and traders can exit their positions in seek for higher alternatives.

In technical phrases, information can result in a continuation or a reversal. Continuation is a state of affairs the place a inventory in an uptrend continues rising after a significant information occasion. A reversal, however, occurs when an asset modifications course.

In different phrases, information can validate an individual’s bullish or bearish view of a monetary asset. In different intervals, information can see them change their minds concerning the property.

Easy methods to commerce the information

Broadly, there are two major methods in which you’ll commerce the information: basic evaluation solely and together with technical evaluation.

The elemental method is a state of affairs the place you concentrate on utilizing information occasions to make choices. For instance, you possibly can resolve to commerce within the course of the information occasion. This method is usually often known as hole and go.

The opposite technique is the place you utilize the present information occasion and mix it with technical evaluation. For instance, you are able to do a multi-timeframe evaluation to seek out help and resistance ranges.

Forms of information

There are a lot of forms of information within the monetary market. Information could be broadly divided into two: breaking information or scheduled information.

Breaking information are occasions that come out of nowhere, which means that they’re unscheduled. Some examples of breaking information are M&A offers, demise or sudden resignation of a CEO, an investigation by a regulator, and a product failure.

Scheduled information is already anticipated by market members. These information occasions could be present in key calendars like:

earnings

splits

financial calendars.

A number of the high scheduled information occasions are earnings, inflation, jobs, and retail gross sales information.

Financial information

One widespread kind of stories is named financial information. These numbers have implications on all property, together with shares, cryptocurrencies, and currencies.

The implication comes from their affect on central banks just like the Federal Reserve and the European Central Financial institution (ECB). You need to use the financial calendar to see a schedule of those numbers.

The preferred numbers to bear in mind are inflation, jobs, GDP, retail gross sales, and industrial manufacturing.

Company earnings

Publicly traded corporations are required by legislation to publish earnings, both quarterly, yearly, or biannually, primarily based on their nations. Within the US, they’re required to publish their outcomes each quarter.

Usually, shares are inclined to both drop sharply or rise after publishing their monetary outcomes. This occurs as a result of outcomes present traders with an summary of how the corporate is performing.

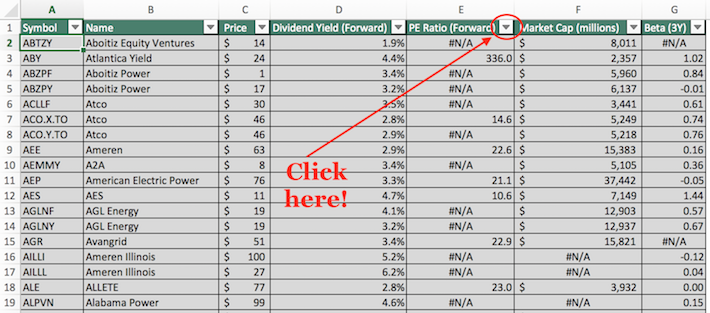

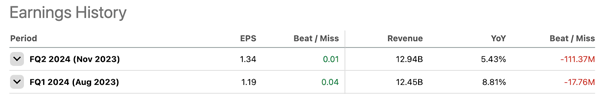

There are a number of issues to observe when an organization publishes its monetary outcomes. First, it’s the headline income and EPS figures. Merchants need to see whether or not an organization has crushed the estimates by Wall Road analysts.

Second, they have a look at the corporate’s steering of its future efficiency. Additional, they hearken to the earnings name to listen to the initiatives the administration is making.

An excellent instance of that is within the Oracle chart under. As you possibly can see, the inventory dropped sharply after publishing two consecutive outcomes.

Within the chart under, we see that the inventory crashed as a result of the corporate’s revenues got here wanting analysts’ expectations.

Geopolitical occasions

The opposite necessary information occasion that impacts monetary property is predicated on geopolitics or relations between two or extra nations. These occasions can have a significant implication on corporations, currencies, and commodities.

An excellent instance of geopolitics was Russia’s invasion of Ukraine in 2022, which led to a pointy surge of oil and pure gasoline costs. As these commodities rose, corporations that cope with them noticed strong efficiency, which lifted their share costs.

One other potential geopolitical occasion shall be China’s invasion of Taiwan. The affect shall be substantial due to the position that China performs on the worldwide economic system since it’s the largest producer and purchaser of uncooked supplies.

If the invasion occurs, likelihood is that many shares will crash as a result of China is their largest market.

Central financial institution choices

Central financial institution choices even have a significant affect on shares and different property due to their affect on cash provide. Usually, shares have a tendency to leap after the Fed (and different central banks) cuts charges and vice versa.

In 2022, shares plunged because the Fed, ECB, and Financial institution of England determined to hike rates of interest on the quickest tempo in years.

Central financial institution choices are primarily based on financial information. A number of the hottest information that have an effect on corporations are inflation, jobs, manufacturing exercise, and client confidence.

Information buying and selling methods

Separating the information – The financial calendar

This is a vital instrument utilized by merchants as a result of it supplies a schedule for the financial occasions. The calendar could be very correct and is often customizable in accordance the information and their significance.

For instance, whereas the rates of interest choice by the Federal Reserve reverberates all through the market, that of a smaller central financial institution like Ghana or Kenya has no affect within the total market.

On the identical time it will be irrelevant for a dealer specializing in American equities to have South African financial information. That is just because South Africa doesn’t have a significant affect on the American monetary market.

To make use of the calendar nicely, it is suggested that you just do a number of issues:

All the time examine the calendar earlier than the buying and selling day; this can assist you understand extra concerning the occasions that you just anticipate.

Take a look at the tendencies within the particular information. For instance, in case you are anticipating employment numbers, you need to increase the chart to point out the latest tendencies within the chart.

Clear the calendar by eradicating the pointless items of knowledge. You are able to do this by eradicating the nations that you just don’t observe and the financial information that doesn’t have main impacts.

As we speak, these calendars could be accessed very simply. There are functions that solely concentrate on the financial calendar. As well as, all the most important monetary information web sites comprise a calendar.

One other kind of calendar is the earnings calendar. That is significantly necessary for merchants concerned in equities and indices.

Nonetheless, watch out to decide on your sources correctly and depend on a small variety of them. Having an excessive amount of information, significantly if discordant, may cause you confusion.

Spikes

When a significant monetary information is launched, there may be often a whole lot of volatility out there. As an illustration, when the Federal Reserve will increase the rates of interest, the market will at all times react. This response generally is a blessing to those that have been proper of their prediction.

It is also catastrophic to merchants who missed the prediction. In truth, the interval when the information is being launched is essentially the most unstable interval for merchants.

Associated » Easy methods to Commerce with Excessive Volatility

We offer you an instance.

We have now put within the chart 4 strains (purple, white, yellow, and pink). The purple vertical line reveals the place the time when the information comes. A dealer can do the next in order that he can profit from the commerce no matter what the information is.

Set a pending order (BUY) on the yellow line.

Set a pending order (SELL) on the pink line.

The pink line ought to be the cease loss for the purchase place.

The yellow line will now be the cease loss for the brief place.

On this case, if the information is optimistic, it should take the chart excessive. This shall be a win to a dealer who positioned a purchase place. If however the information will take the chart down, the dealer will lose however he shall be lined by the pink cease loss.

Through the use of this straightforward technique, it is going to be doable for one to make an excellent return whatever the information.

One other necessary technique to make use of when main information is to wait. In truth, except one has a whole lot of expertise as a dealer, it’s often suggested to keep away from buying and selling throughout the time when information is popping out.

For fairness merchants, the earnings calendar could be an necessary instrument to take a position. As an illustration, if monetary establishments comparable to Morgan Stanley, JP Morgan, and Citi launched weak experiences, then it will be a good suggestion to take a position that Financial institution of America’s outcomes shall be weak too and brief it earlier than the earnings.

Purchase the rumor and promote the information

This is without doubt one of the hottest approaches in buying and selling the information. It often occurs when there may be an underlying rumor out there about one thing. Usually, a inventory or crypto tends to rise forward of the information occasion after which it dips after the information is confirmed.

An excellent instance of that is proven under. In it, we see that the XRP value jumped sharply after the SEC misplaced a significant case towards Ripple Labs.

In a great state of affairs, you’d anticipate the cryptocurrency to proceed rising. As a substitute, the alternative occurred because the token continued falling.

Fading the information

Usually, information occasions are inclined to have main implications on monetary property like shares and foreign exchange pairs. Nonetheless, it’s normal data that traders are inclined to exaggerate some conditions primarily based on concern and greed.

An excellent instance of that is within the chart under, which tracks the SPDR S&P Regional Banks ETF. Because the chart reveals, the ETF plunged arduous after the mini-banking disaster in 2023.

It dropped as traders feared a widespread collapse of regional banks, which didn’t occur. Due to this fact, the ETF then staged a powerful restoration throughout the 12 months.

This instance is predicated on longer-term occasions. Nonetheless, it can be used to commerce short-term actions of shares and different property. Fading is often known as a contrarian method because it makes an attempt to maneuver towards a broad pattern.

Breakouts

The opposite information buying and selling technique is named breakouts. A breakout is a state of affairs the place an asset strikes sharply above or under a sure resistance or help degree. Usually, a breakout can occur after a significant information occasion.

There are a number of approaches to commerce this breakout method. For instance, you should utilize multi-timeframe evaluation to seek out potential help and resistance ranges. Additionally, you possibly can resolve to observe the brand new pattern shaped after a breakout.

An excellent instance of that is within the chart under. As proven, the inventory discovered a powerful resistance at $10.80 in early 2023. It then made a bullish breakout in March, after the corporate revealed encouraging information.

After information buying and selling methods

Usually, you’ll miss the preliminary value motion after a significant information occasion. Due to this fact, most methods targeted on the information intention to make the most of these occasions.

A number of the high after-the-news methods are following the pattern, fading the brand new pattern, and scalping the information occasion.

Pre-market buying and selling methods

Most individuals who reach buying and selling information occasions accomplish that by specializing in the pre-market and prolonged hours as a result of that is when most of them come up. Corporations launch their earnings principally within the prolonged and pre-market.

One of many approaches to make use of in that is putting pending orders, that are executed at predetermined ranges. For instance, if a inventory is buying and selling at $10 and has earnings arising, you possibly can place a buy-stop at $11. On this case, the buy-stop commerce shall be executed if the value strikes to that degree.

Breaking Information Method

The benefit of the calendar is that it tells you about what to anticipate. Nonetheless, there are different information that you just don’t anticipate.

For instance, when there’s a main earthquake, there are often impacts to the markets (or different distinctive occasions). It’s worse as a result of nobody can precisely predict when an earthquake will happen.

Due to this fact, it is essential so that you can be among the many first folks to obtain the information. There are a number of methods to do that.

Be on Twitter/X

Twitter is the place most merchants get their info. Right here the 15 Greatest Buying and selling Accounts and 7 Greatest Day Merchants to Comply with on Twitter.

Have entry to the newest information by watching monetary media. Two of the perfect sources of stories are Bloomberg and CNBC. Should you don’t have the channels at dwelling, you possibly can stream them on-line (Bloomberg and CNBC).

Take a look at the native information

For instance, in case you are an oil dealer, you need to spend time studying native information from nations like Saudi Arabia, Nigeria, and Venezuela. Earlier than the information makes international headlines, it’s first reported by the native information businesses.

Humorous sufficient, most subtle traders not often get this information as a result of they rely upon giant information businesses like Bloomberg and Reuters.

Know how one can interpret the information

For instance, when there may be an earnings launch, most uninformed merchants are inclined to commerce utilizing the headline numbers. On this, they ignore the necessary numbers that merchants concentrate on.

For instance, the revenues and EPS of a social media firm would possibly beat the estimates but when the person progress slows, the corporate will see the inventory value falls. The identical occurs to funding banks the place merchants have a look at the buying and selling revenues.

Associated » The Greatest Information Sources for Your Buying and selling

Dangers and challenges of stories buying and selling

There are some dangers after we resolve to focus our method on information evaluation, together with

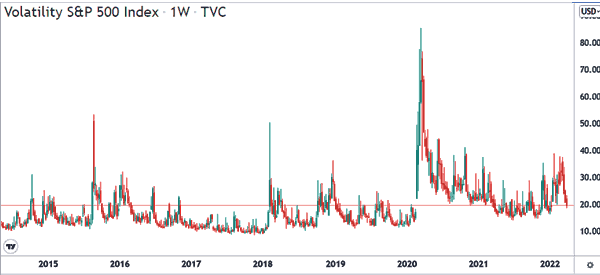

Market volatility

Monetary property are inclined to have heightened volatility after a significant occasion. Whereas volatility is an effective factor to many merchants, it could actually additionally result in main points, particularly when you’re already able.

Slippage

Slippage is a state of affairs the place a commerce is executed at a special value than the one you positioned it at. Whereas slippage occurs always, it typically happens in intervals of excessive market volatility. Because of this your earnings could be impacted.

Emotional points

Usually, information occasions can have an emotional affect on an individual, which might see them make dangerous choices.

For instance, if an organization publishes robust earnings, the primary assumption is that it’ll proceed doing nicely. Nonetheless, in actuality, the inventory can drop sharply when this occurs.

False alerts

Within the period of social media, it’s doable to make choices primarily based on false information occasions. For instance, in October 2023, Bitcoin surged after a false report famous that the SEC had authorized an ETF.

Easy methods to be efficient in information buying and selling

Like all buying and selling methods, utilizing the information shouldn’t be straightforward and it takes analysis and evaluation to do it nicely. Listed here are a number of the high methods that can make you efficient in information buying and selling within the monetary market.

Analysis earlier than you enter a place – Examine the related information and take into account all situations earlier than you begin a place.

Examine historic information – All the time examine historic information earlier than you enter a place. Multi-timeframe evaluation is without doubt one of the finest approaches to do that.

Relations between information and value motion – Additional, examine about how sure information occasions have an effect on an asset value.

Danger administration – Like with different approaches, at all times embrace danger administration methods when utilizing this technique that includes information.

FAQs

What forms of information do day merchants concentrate on?

There are a number of information varieties that day merchants concentrate on. A number of the commonest ones are earnings experiences, financial information, central financial institution choices, and administration modifications amongst others.

Is it advisable for learners to do information buying and selling?

Sure, however with some coaching and follow. This method is without doubt one of the best approaches to understand. Nonetheless, it takes a whole lot of follow and studying to do it nicely.

How can merchants educate themselves about information buying and selling?

We suggest studying about buying and selling the information in on-line literature, then watching reside buying and selling periods (Dealer TV is an effective begin), after which training it in a demo account.

What’s the distinction between surprising and scheduled information?

Sudden information is an occasion that comes from nowhere. Examples of those occasions are aircraft and practice accidents, investigation, and a CEO change. Scheduled information are these occasions out there in calendars.

How can I keep away from info overload?

The easiest way to keep away from info overload is to concentrate on sure information, utilizing particular sources, and having a scientific method to analyzing information occasions.

That are the highest sources of stories in buying and selling?

You need to use mainstream media sources like Bloomberg, CNBC, and Fox Enterprise. Additionally, you should utilize social media platforms like StockTwits, Twitter, and Reddit to seek out breaking information.

Extra Helpful Tricks to Do Information Buying and selling

[ad_2]

Source link