[ad_1]

RonyZmiri/iStock by way of Getty Pictures

Johnson Outside (NASDAQ:JOUT) is a small cap firm that manufactures and sells leisure outdoor merchandise. The corporate operates in 4 segments, most notable of which is the fishing phase producing fishing motors, fish finders, downriggers and extra below the Minn Kota, Hummingbird, and Cannon manufacturers. The corporate additionally sells in diving, tenting, and watercraft recreation segments. The corporate not too long ago determined to give up its Eureka! model within the tenting phase to give attention to the extra dominant Jetboil model.

JOUT 2023 Investor Presentation

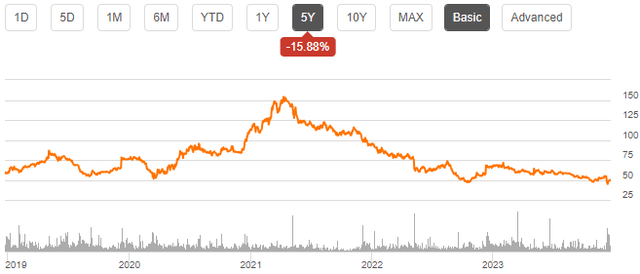

After the corporate skilled heightened gross sales through the Covid pandemic, Johnson Outside’ revenues have fallen again right into a extra sustainable stage, briefly deteriorating margins. As a result of fall, the inventory hasn’t carried out very nicely in latest instances – at the moment, Johnson Outside’ inventory solely stands at round a 3rd of the 2021 inventory peak.

5 12 months Inventory Chart (Looking for Alpha)

Revenues Are Now with the Pattern Line

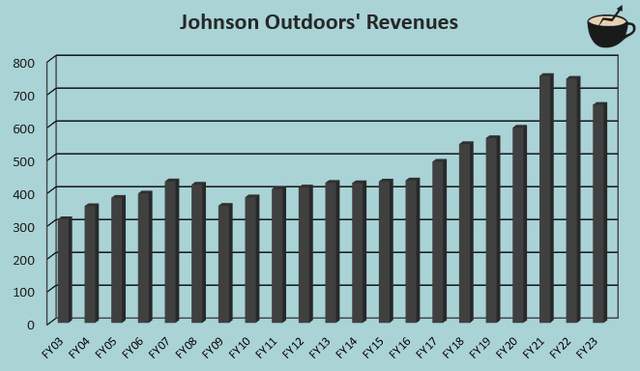

After the Covid pandemic boosted the gross sales of Johnson Outside’ merchandise, the corporate skilled a pointy improve in demand in FY2021 with a income development of 26.5%. Since, revenues have begun to fall again into the extra historic trendline. From FY2003 to FY2023, Johnson Outside has had a income CAGR of three.8%. From FY2019 to FY2023, the CAGR is 4.2% – when accounting for a better inflation within the interval, the present FY2023 revenues appear to fall throughout the long-term development line.

Creator’s Calculation Utilizing TIKR Information

FY2023 & This autumn Turmoil: A Momentary Droop

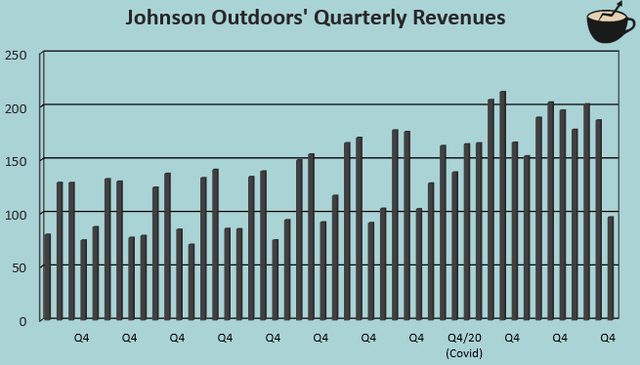

Johnson Outside reported its This autumn/FY2023 outcomes on the eighth of December. Though revenues have already beforehand had decreases again into the development line, the This autumn income droop appears extra regarding – revenues decreased by a whopping 50.9% year-over-year into $96.3 million, nicely beneath any quarterly revenues because the Covid pandemic started. With the decrease stage in revenues, the corporate’s earnings additionally decreased into destructive territory by means of pressured gross margins and destructive working leverage; in This autumn, the EBIT margin was -23.4% in comparison with a earlier yr EBIT margin of 6.8%. The margin freefall got here after already weaker margins in latest quarters. Previous to the pandemic, Johnson Outside achieved low double-digit EBIT margins, however the FY2023 margin solely stands at 1.8%.

In the course of the pandemic, as provide chains had been largely disturbed and demand was heightened, Johnson Outside’ regular seasonality sample was disturbed. Retailers largely had a list technique switch-up from “just-in-time” -inventory administration to “just-in-case” administration, holding larger ranges of stock. Johnson Outside’ seasonality was disturbed in consequence, as will be seen within the long-term quarterly revenues. With the return again right into a extra regular market atmosphere, the seasonality appears to be coming again, as CEO Helen Johnson-Leipold communicated within the This autumn earnings name. As This autumn is a really weak quarter for the corporate’s merchandise traditionally, the return to seasonality patterns had a major influence on the year-over-year income freefall with the This autumn/FY2022 not experiencing the identical seasonality.

Creator’s Calculation Utilizing TIKR Information

The administration didn’t present a transparent outlook for FY2024, however did talk within the This autumn earnings name {that a} delicate market atmosphere has continued into the primary months of the fiscal yr as retailers nonetheless have excessive inventories, and the patron spending is pressured by macroeconomic instability – I consider that the revenues are more likely to fall from a sustainable development line briefly because of the low demand. The corporate has additionally not too long ago made the choice to exit its Eureka! product line within the tenting phase, focusing extra on the Jetboil product line. The choice is estimated to have an effect on Johnson Outside’ complete revenues fairly insignificantly, with the administration anticipating a complete income impact of lower than a %.

Till Johnson Outside’ demand recovers, I count on the corporate’s margins to remain very low. Previous to the pandemic, from FY2015 to FY2019 Johnson Outside had a median gross margin of 42.5%, however the margin has fallen into 36.8% in FY2023 as the corporate appears to have compensated the decrease demand by means of a decrease pricing. The present margins don’t appear to suggest a longstanding subject in my view; I might count on the gross margin to rise again with a restoration in demand, and a better stage in gross sales to convey some working leverage, bringing Johnson Outside’ EBIT margin again near pre-pandemic ranges.

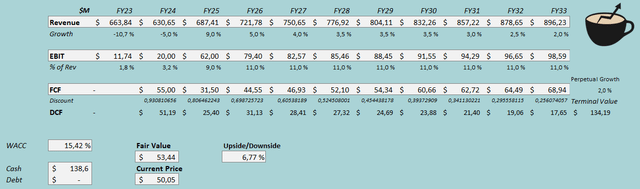

Restoration Doesn’t Have Vital Upside But

To estimate a good worth for the inventory, I constructed a reduced money move mannequin. Within the mannequin, I nonetheless estimate a weak FY2024 with the Eureka! exit and a gradual demand with a income fall of -5% and solely barely larger margins than in FY2023. Afterwards, I estimate the demand to get well with a FY2025 development of 9% that slows down right into a extra historic development price, ending up at a perpetual development of two%. With the income development, I see a margin restoration as doubtless – I estimate a FY2026 EBIT margin of 11.0%, 30 foundation factors beneath the FY2019 stage. As Johnson Outside at the moment has a really massive stock, I estimate the corporate to have good money flows in FY2024 regardless of fairly poor earnings with a shrinking stock.

The talked about estimates together with a price of capital of 15.42% craft the next DCF mannequin with a good worth estimate of $53.44, round 7% above the inventory worth on the time of writing. The inventory appears to be roughly accurately valued for a monetary restoration.

DCF Mannequin (Creator’s Calculation)

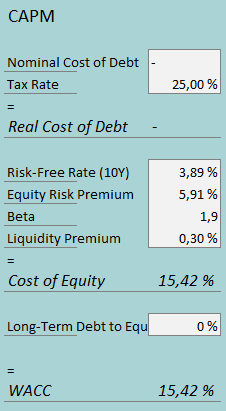

The used weighed common price of capital is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

Johnson Outside has determined to take care of a agency steadiness sheet, as the corporate doesn’t have any debt used for financing functions. I estimate the corporate’s financing technique to remain the identical, with a long-term debt-to-equity ratio of 0%. For the risk-free price on the price of fairness facet, I exploit the USA’ 10-year bond yield of three.89%. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s newest estimate for the USA, made in July.

Yahoo Finance estimates Johnson Outside’ beta at 0.82. I don’t see the low beta to be an affordable assumption within the CAPM, because the financials have proven a substantial amount of turmoil with the macroeconomic turbulence, additionally represented through the nice monetary disaster. For a extra acceptable beta, I exploit a beta of 1.90, taken from the common of three peer corporations’ betas – Solo Manufacturers’ beta of two.81, MasterCraft’s beta of 1.71, and Marine Merchandise’ beta of 1.17. Lastly, I add a small liquidity premium of 0.3%, crafting a price of fairness and WACC of 15.42%.

Takeaway

Johnson Outside is experiencing weak demand and returning seasonality after a pandemic-boosted market, pushing the corporate’s margins and revenues decrease. I’m not very involved in regards to the long-term monetary profile, however count on a collection of weak quarterly upcoming earnings. The inventory appears to be valued pretty with my monetary estimates; I’d need a barely cheaper price to contemplate the funding case very enticing. In the meanwhile, I’ve a maintain ranking.

[ad_2]

Source link