[ad_1]

Cathie Wooden, the founder and CEO of funding administration firm Ark Make investments, is a broadly adopted investor on Wall Avenue due to her technique of shopping for shares of corporations able to disruptive innovation, which she believes may yield stable returns in the long term.

Wooden’s flagship fund, the Ark Innovation ETF, has benefited from this technique in 2023, logging spectacular positive factors of 70%. After all, the well-known investor’s philosophy of shopping for high-risk, high-reward corporations additionally implies that there shall be durations of volatility, which is clear from the large beating Wooden’s funds took in 2022. That explains why Wooden has an funding timeline of 5 years, which permits her investments to journey via durations of volatility.

The great half is that Wooden’s investments may benefit from a positive inventory market situation in 2024. A possible minimize in rates of interest by the Federal Reserve may give development shares a pleasant shot within the arm within the New 12 months, which is why buyers could need to purchase certainly one of Wooden’s high 10 holdings earlier than it jumps greater.

Shares of Twilio (NYSE: TWLO) have climbed 52% because the starting of November. Let us take a look at the explanations this tech inventory may maintain its spectacular momentum and head greater.

Twilio is sitting on a profitable enterprise alternative

Twilio is the ninth largest element of the Ark Innovation ETF, and it is price noting that Wooden and her staff have been actively shopping for shares of this cloud communications specialist in 2023. That is not stunning, as Twilio operates in a market that is anticipated to develop at a strong tempo in the long term.

Twilio’s cloud-based software program platforms enable corporations to speak with their prospects via a number of channels, equivalent to textual content, voice, e-mail, chat, and video. Customer support associates merely want a pc and the web to attach with prospects from wherever on the planet.

These cloud-based contact facilities take pleasure in a number of benefits over conventional ones. As an illustration, corporations needn’t spend on infrastructure equivalent to workplace area or on-site servers within the case of a cloud contact heart. It is simply scalable based mostly on a corporation’s necessities and likewise helps enhance the customer support expertise, as associates can attain prospects utilizing numerous channels.

Story continues

Not surprisingly, the necessity for cloud-based contact facilities is predicted to extend at a compound annual development fee (CAGR) of 26% via 2028 and hit annual income of $69 billion on the finish of the forecast interval, in response to Mordor Intelligence. That sort of efficiency ought to assist Twilio come out of its current stoop, which has been triggered by a weak buyer spending setting.

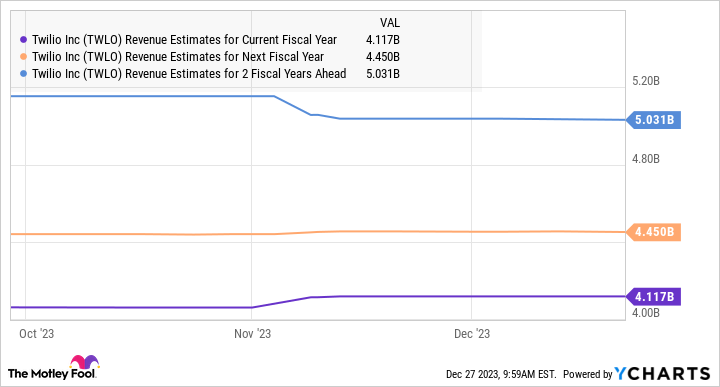

The corporate is anticipated to complete 2023 with a 7% bounce in income to $4.1 billion, adopted by an equivalent enhance subsequent 12 months. Nevertheless, as the next chart signifies, Twilio’s development is predicted to speed up from 2025.

Strong long-term upside might be on the playing cards

Members of Twilio administration identified within the firm’s investor-day presentation in November 2022 that they count on income to extend at a CAGR of 15% to 25% within the medium time period. Assuming Twilio can keep even a 15% income development fee over the three-year interval from 2026, its high line may bounce to $7.65 billion in 2028, utilizing the 2025 income estimate of $5 billion as the bottom.

Twilio has a five-year common gross sales a number of of 15. Nevertheless, it is now buying and selling at simply 3.5 occasions gross sales. Assuming it may possibly keep its present gross sales a number of after 5 years, Twilio’s market cap may bounce to virtually $27 billion, based mostly on the $7.65 billion income estimate for 2028. That might be a 94% bounce from present ranges, suggesting that this “Cathie Wooden inventory” may give buyers wholesome returns over 5 years.

And at last, Twilio’s present price-to-sales ratio is considerably decrease than the five-year common, which is why buyers ought to think about shopping for it instantly given the potential upside it may ship in the long term.

Must you make investments $1,000 in Twilio proper now?

Before you purchase inventory in Twilio, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the ten greatest shares for buyers to purchase now… and Twilio wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Twilio. The Motley Idiot has a disclosure coverage.

This Cathie Wooden Inventory Is Hovering Magnificently, and It Might Make You Wealthy Over Time was initially revealed by The Motley Idiot

[ad_2]

Source link