[ad_1]

DigiClicks

Purple Flag

Delek Logistics Companions, LP (NYSE:DKL) seems, at first blush, to be a sexy funding alternative. The U.S. oil and fuel vitality trade is flourishing. Concomitantly, the Delek share value is down YTD and over the final 12 months. In our opinion, administration just isn’t reinvesting sufficient cash in growth for development; they’re lacking a chance to capitalize on a nationwide and world recommitment to the exploration and manufacturing of oil and fuel. An excessive amount of money is being distributed by dividend payouts primarily to different firms that personal ~80% of the excellent shares.

The share value is a good worth based mostly on P/E and earnings however momentum and development alternatives are restricted. We don’t foresee circumstances for the value to maneuver a lot larger shortly. The dangers outweigh the rewards for retail worth buyers. We price the inventory as a Promote at the moment.

Delek Logistics Companions, LP now sports activities a market cap of $1.86B. It has a P/E of 12.88. Quick curiosity is at a minimal 1.23%. But, we’re uncomfortable with retail worth buyers proudly owning a inventory with the dividend payout ratio and yield being terribly excessive. Delek Logistics’ dividend payout ratio is over 120% and the dividend yield nears 10%.

The typical dividend payout ratio of 101 firms within the oil and fuel providers and tools enterprise is 17.58% and the common dividend yield is 1.98%. Delek Logistics will get a D- Issue Grade from In search of Alpha for profitability. It seems to us that Delek Logistics’ treasure is probably being drained for functions aside from enterprise development or CAPEX plans. The corporate’s share value is already costly with a P/E GAAP of 12.82 (FWD) in comparison with the sector median of 10.49. We’ve got seen experiences of different analysts sustaining the hole is wider, 12.6x to eight.1x of friends.

Trade and Firm Profile

Delek is within the U.S. oil storage and transport enterprise. In line with CNN’s report from S&P World Commodity Insights:

(T)he United States is pumping oil at a blistering tempo and is on monitor to provide extra oil than any nation has in historical past… a world file of 13.3 million barrels per day of crude and condensate through the fourth quarter of this 12 months… America is exporting the identical quantity of crude oil, refined product and pure fuel liquids as Saudi Arabia or Russia produces, S&P mentioned.

Delek Logistics GP, LLC acts as the overall companion of the corporate. Delek Logistics Companions, LP operates by 4 segments: Gathering and Processing, Wholesale Advertising and marketing and Terminal transfers, Storage and Transportation, and Funding in Pipeline Joint Ventures. The Storage and Transportation phase is the corporate’s main supply of revenue. It operates pipelines, tanks, and offloading services of crude oil and pure fuel for processing, water disposal and recycling, storage providers, and crude oil transportation. Merchandise are bought to 3rd events and transported from terminals by pipelines in Texas, Tennessee, Arkansas, and Oklahoma.

The Storage and Transportation phase operates holding tanks, offloading services, vehicles, and ancillary property. Investments in Pipeline Joint Ventures personal a portion of three joint ventures which have constructed separate crude oil pipeline methods and associated ancillary property servicing third events primarily within the Permian Basin and Gulf Coast areas.

Delek Logistics Companions, LP was integrated a decade in the past. The corporate is linked to Delek Group Ltd. (OTCPK:DELKY), managed by Yitzhak Tshuva. His actual property and vitality conglomerate floated the IPO of Delek Logistics Companions LP, a wholly-owned subsidiary in 2012 of Delek US Holdings, Inc. (DK), on the New York Inventory Change.

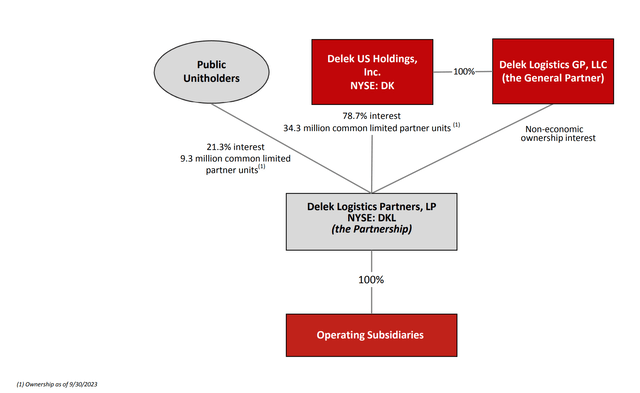

Enterprise Administration Map (Delek Logistics Slides)

Possession and Financials

A worrisome issue for us contributing to our funding evaluation is almost 80% of the shares are owned by different public firms. Insiders personal 1%. The general public owns ~9% of excellent shares. Establishments personal 11.3% of the shares. Since March ’23, company insiders bought extra shares than they purchased; they bought $17K within the final 3 months.

Highlights of the Q3 ’23 firm earnings report replicate the upturn in America’s oil and fuel manufacturing and gross sales: the corporate’s $0.80 EPS beat estimates by $0.02, income of $275.82M beat estimates by +$14M however income in Q3 ’23 was decrease than Q3 ’22. Internet revenue from all segments was $34.8M and Q3 EBITDA was a file excessive of $98.2M. Administration took explicit be aware within the transcript of the assembly launched on In search of Alpha that Q3 ’23 represents “43 consecutive quarters of distribution development with a latest improve to $1.045/unit.”

We want to see substantial reinvestment in growth and development on the a part of Delek Logistics to pump up the share value; it’s down -7% YTD and about -10% for the final 12 months. In the meantime, the SPDR® S&P Oil & Gasoline Gear & Providers ETF (XES) share value is up 13.4% YTD and +11.3% for the 12 months. The SA Quant Ranking for the ETF is Purchase. We imagine the ETF promoting at ~$85 per share, down from its 52-week excessive over $100 every, is a greater alternative for retail worth buyers than Delek Logistics at the moment.

In our opinion, Delek Logistics has been benefitting from being on the proper place on the proper time working in the correct trade. However the share value doesn’t replicate the nice instances within the oil/fuel vitality providers enterprise. And if not now, when?

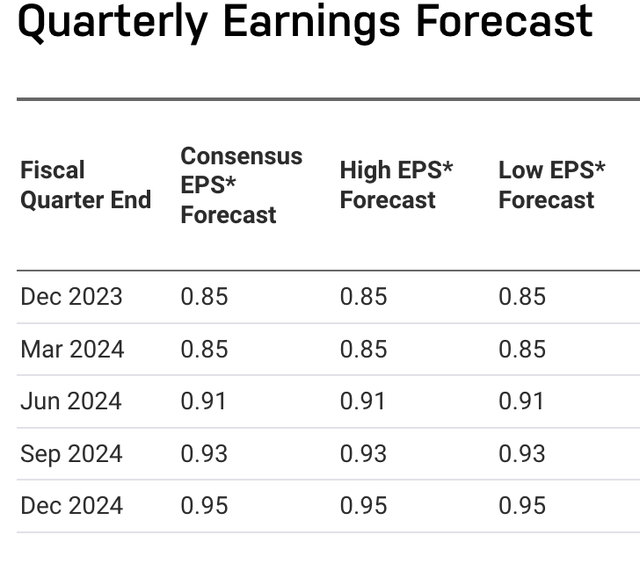

Trying ahead, the consensus reported by NASDAQ.com is, and we concur, that the EPS will slip about 9% to ~$0.91 from $0.98 Y/Y. We estimate that This fall ’23 EPS is not going to high $0.85. The corporate reported lower-than-estimated EPS in 6 of the final 9 quarters. Maybe that’s the reason insiders have been predominantly promoting shares greater than shopping for over the past 3 months; 2 of the three hedge funds that owned the inventory bought out earlier than the share value dived from $57.82 in June ’23 to $42.48 after Christmas. We anticipate the subsequent earnings report on or about February 21, 2024.

Quarterly EPS (NASDAQ.com)

Good Valuation Grade, Low Volatility, Shaky Dividend

The consensus amongst 9 Wall Road analysts In search of Alpha surveyed charges Delek a Maintain to Sturdy Purchase. 4 others lean to Promote to Sturdy Promote. Nevertheless, SA not too long ago issued a warning to buyers that the inventory is at excessive threat of performing badly as a result of “The corporate has Levered FCF Margin (TTM) of -18.89% whereas the Power sector median is 5.81%.”

Money from Operations stands at $5.3M versus the sector median of $7127.59M. The inventory will get an F Issue Grade for valuation metrics of price-to-cash stream and middling grades for price-to-sales (TTM and FWD). A main disadvantage to larger profitability is the low gross revenue margin of virtually 35% in comparison with +47% for the vitality sector median.

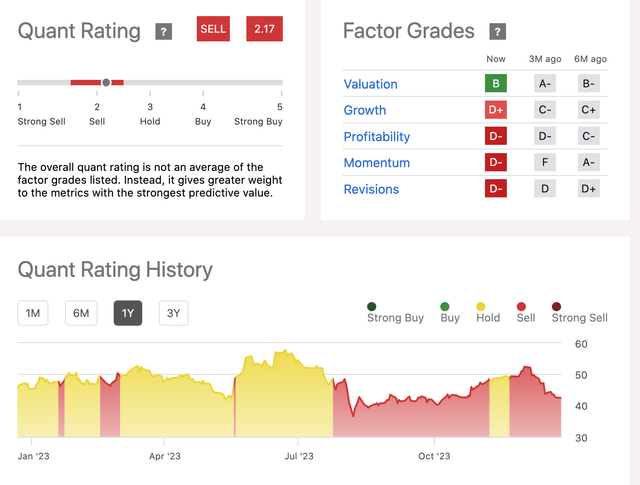

The SA Quant Ranking has not painted a reasonably image for Delek Logistics this previous 12 months:

Quant Ranking & Issue Grades (In search of Alpha)

Two constructive elements that may entice retail worth buyers are the inventory’s Levered/Unlevered Beta at 0.26, suggesting the shares are considerably much less risky than the market. Second, Delek Logistics gives an enormous dividend yield (FWD) of 9.81%.

We’re much less sure the corporate will maintain to its 122.4% dividend payout which definitely performs to the good thing about Delek U.S. Holdings. Moreover, the capital construction of Delek Logistics is shaky: complete debt is $1.76B, and money available and equivalents is a scant $4.18M. Added annual income development of +8% will come partly from the 2022 acquisition of an oil and fuel exploration firm for $625M. Earnings and money stream don’t, in our opinion, cowl the dividend yield or curiosity funds on the debt. Its debt-to-equity ratio is -1,251.5%, although short-term property of $117.64M exceed liabilities totaling $85.36M.

Takeaway

Delek Logistics holds an excessive amount of debt; its gross revenue margin is just too low, and money stream from operations is low. The dividend payout ratio and dividend yield appear unjustified to us and are maybe unsustainable. We don’t see this inventory as a constructive alternative for retail worth buyers. For the sake of transparency, we now have to share that one analyst pegs Delek’s honest value valuation at +$54 every. We don’t envision Delek Logistics as a path to compounding wealth in the long term for retail worth buyers. Danger takers can Maintain on however we price the inventory a Promote alternative whereas the oil trade is sizzling.

[ad_2]

Source link