[ad_1]

Panuwat Dangsungnoen/iStock by way of Getty Pictures

With Congress ratcheting down saber-rattling over broader healthcare reforms into 2024, Morgan Stanley has taken a extra constructive view on the managed care and retail pharmacy area, primarily as a result of biosimilar/GLP-1 alternative.

Nonetheless, the analysts led by Erin Wright highlighted the implications of rising healthcare utilization charges and cited the alternatives/ dangers associated to the upcoming superior 2025 Medicare Benefit fee discover.

Regardless of price tendencies as seen with rising utilization charges into 2024, “election cycle threat will even be entrance and heart,” MS analysts wrote, issuing their 2024 outlook for healthcare companies.

Election threat

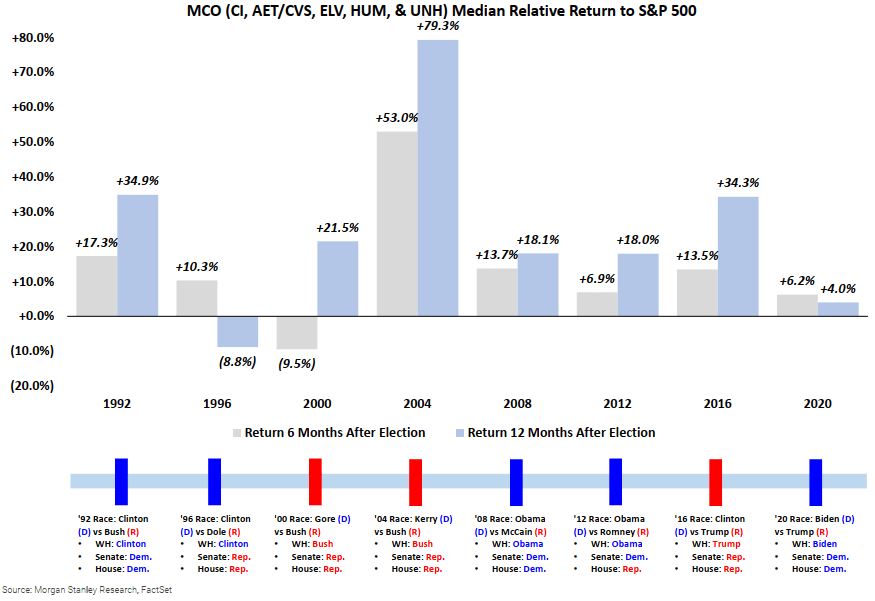

MS pointed to the sector’s underperformance this yr, noting that managed care organizations dropped 15% whereas pharmacies fell 49% YTD. In line with the agency, managed care organizations have traditionally shed a median of ~31% throughout the previous six election cycles till a mid-March trough.

Nonetheless, after the poll, managed care has traditionally outperformed the S&P 500, resulting in a median relative outperformance of ~12% and ~20% over the six and 12 months following the election day, respectively.

In comparison with earlier elections, the agency cites a scarcity of help amongst lawmakers for broader healthcare reforms, or Medicare for All. “President Biden declaring a run for reelection largely derisked Medicare for All as an overhang by retaining extra progressive Democrats on the sidelines,” MS analysts added.

“Whereas previous expertise tells us to keep away from managed care into US presidential elections, we truly view will probably be a comparatively benign cycle from a healthcare perspective,” the analysts wrote, noting that proudly owning MCO shares this yr forward of potential troughs “will not be as punitive, if in any respect.”

GLP-1/biosimilar alternative

The agency highlights Pharma Profit Managers as a key MCO theme within the sector, noting their potential to learn from the GLP-1 class of weight reduction medication and biosimilars.

Regardless of regulatory headwinds, Morgan Stanley sees worth and development prospects within the PBM area. The group performing as intermediaries between well being plans, pharmaceutical producers, and pharmacies has just lately come beneath intense congressional scrutiny over their function in rising healthcare prices.

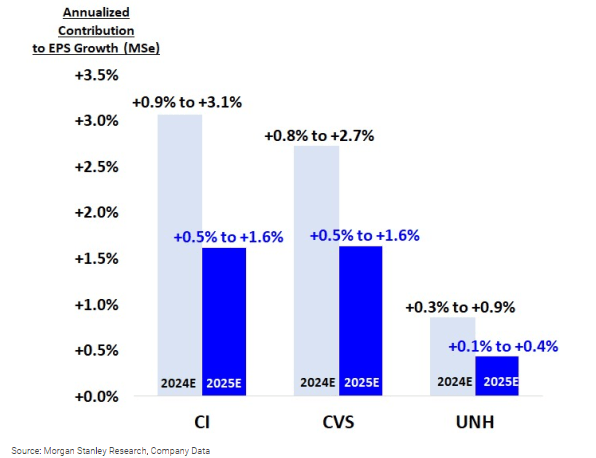

MS additionally tasks PBM’s potential to learn from GLP-1 medication, a brand new class of weight problems medication marketed by Eli Lilly (LLY) and Novo Nordisk (NVO) (OTCPK:NONOF).

In line with the agency, the rising demand for GLP-1s can enhance the 2024E and 2025E EPS of three main PBMs, particularly the Caremark unit of CVS (CVS), UnitedHealth’s (NYSE:UNH) OptumRx, and Cigna’s (NYSE:CI) Evernorth, by ~26 bps–~307 bps and ~13 bps–~163 bps, respectively.

There shall be extra alternatives from the tip of U.S. market exclusivity for AbbVie’s (ABBV) blockbuster arthritis drug Humira, given the $38B market measurement and upcoming biosimilars, together with ones with interchangeable designations.

In January, Amgen (AMGN) launched its Humira biosimilar, Amjevita, the primary of many off-patent variations launched within the U.S. in opposition to the bestselling injectable this yr.

Rising healthcare utilization

Moreover, Morgan Stanley pointed to rising price tendencies within the MCO area after UNH stated in June that the corporate’s medical care ratio, the portion of premiums spent on healthcare prices, will come beneath stress amid a post-COVID spike in medical exercise.

Whereas larger healthcare utilization, a key investor concern in 2023, “will stay elevated into 2024, it’s encouragingly not worsening, a dynamic that we are going to monitor however is appropriately embedded in expectations for MCOs,” the analysts opined.

MA superior fee discover

Commenting on the 2025 Medicare Benefit superior fee discover anticipated in late January or early February, the analysts argued that MCOs have been bracing for a post-pandemic normalization within the fee surroundings.

MS estimated that the MA superior fee discover for the 2025 calendar yr may come at +0.2%, consistent with the pre-pandemic ranges. The analysts additionally wrote that any weak spot in MCO shares following the announcement shall be a compelling shopping for alternative.

In latest historical past, 2022 and 2023 noticed the biggest hikes to Medicare Benefit closing charges earlier than the 2024 closing fee got here flat.

Medicaid redeterminations

MS thinks that the continued Medicaid eligibility critiques, which it expects to proceed till at the very least 2024, shall be among the many key MCO themes to be careful for subsequent yr.

The analysts argue that industrial insurer Cigna (CI) will change into a significant beneficiary of the continued redeterminations, which resumed in April after a pandemic-era pause previously few years.

“CI doesn’t take part in MDCD managed care applications and MDCD redeterminations represents an upside alternative for its industrial/employer sponsored plans and the alternate market which isn’t at the moment embedded into steerage,” the analysts wrote.

Scores

The Bloomfield, Connecticut-based firm is a key Chubby for MS on its biosimilar alternative and minority funding in healthcare supplier VillageMD, which is majority-owned by Walgreens (NASDAQ:WBA). Its value for CI stands at $365 per share.

Nonetheless, Walgreens (WBA) has change into a key Underweight for MS, and its value goal, adjusted to $22 from $27, displays a softer development outlook for FY24. The agency cites macro challenges, decrease COVID-19 vaccine and take a look at volumes, a weaker respiratory season, and ongoing modifications to the corporate’s retail footprint as causes for its bearish outlook.

Given its scale and diversification, UnitedHealth (UNH) was topped Morgan Stanley’s high choose within the MCO area. Citing its development prospects and diversified enterprise mannequin, the agency raised UNH’s value goal to $618 from $579 per share with an Chubby score.

Different listed MCOs embody Centene (CNC), CVS Well being (CVS), Elevance Well being (ELV), Humana (HUM), Molina Healthcare (MOH), Alignment Healthcare (ALHC), and Clover Well being Investments (CLOV).

[ad_2]

Source link