[ad_1]

DNY59

I’ve argued that 2024 will see a return to dividend-style investing given the Fed pivoting on charges, and assume there are a selection of excellent funds to play this. Because of this, the First Belief Rising Dividend Achievers ETF (NASDAQ:RDVY) is price a search for any investor searching for to faucet into the potential of firms with a document of persistently rising their dividend payouts. This fund has a novel method to inventory choice and portfolio administration that units it aside within the crowded discipline of dividend-focused exchange-traded funds, or ETFs.

RDVY is designed to trace the NASDAQ US Rising Dividend Achievers Index. This index goals to supply publicity to a diversified portfolio of U.S. firms with a historical past of elevating their dividends. The fund sometimes invests at the least 90% of its property in firms which might be a part of this index.

RDVY was launched in January 2014 and is managed by First Belief Advisors. It’s traded on the NASDAQ alternate and has an expense ratio of 0.50%.

RDVY ETF Holdings

The fund’s portfolio consists of fifty firms which have demonstrated a constant means to extend their dividends. The choice course of is rigorous, requiring firms to have elevated their dividend payouts for 3 consecutive years and to have constructive earnings per share development over the identical interval.

The highest holdings within the RDVY portfolio as of the latest reporting interval are Pfizer Inc., CF Industries Holdings, Inc., Uncover Monetary Companies, American Categorical Firm, and JPMorgan Chase & Co.

Pfizer Inc. stands out as a distinguished worldwide biopharmaceutical entity, boasting a big selection of prescribed drugs, vaccines, and merchandise for shopper well being care. CF Industries Holdings, Inc. positions itself as a top-tier worldwide producer and provider of nitrogen-based fertilizer merchandise. Uncover Monetary Companies operates as a complete direct banking and cost providers agency, providing an array of monetary choices together with bank cards, scholar and private loans, in addition to house fairness loans. American Categorical Firm operates on a world scale as an built-in funds company, delivering to its clients a wide range of merchandise, insights, and experiences that improve life high quality and contribute to enterprise development. JPMorgan Chase & Co. is acknowledged as a preeminent worldwide monetary providers establishment, with expansive operations spanning over 60 nations.

No holding makes up greater than 2.2% of the portfolio, which I personally like as a well-diversified combine in a world filled with top-heavy market cap weight averages.

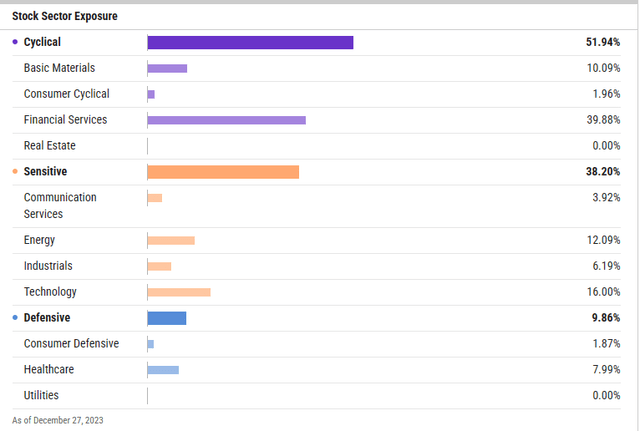

Sector Composition

The sector composition of the RDVY portfolio is numerous, which aids in threat administration and ensures broad publicity to completely different segments of the U.S. financial system. The fund has a big publicity to the Financials sector, adopted by Industrials, Primary Supplies, Power, and Know-how sectors.

ycharts.com

The fund’s sector weighting technique is dynamic and may shift primarily based on the underlying fundamentals of the businesses within the index and their means to maintain dividend development.

Peer Comparability

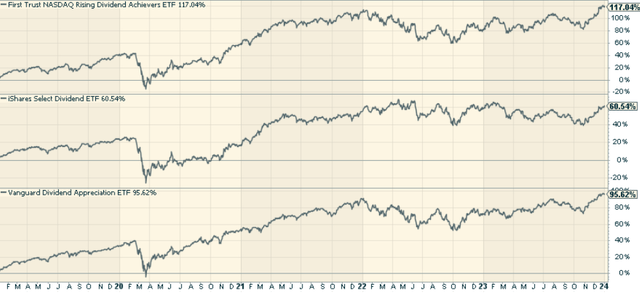

When in comparison with different comparable ETFs just like the Vanguard Dividend Appreciation ETF (VIG) and the iShares Choose Dividend ETF (DVY), RDVY holds its personal by way of efficiency and dividend yield, meaningfully outperforming each.

Whereas VIG focuses on firms which have a document of accelerating dividends over time, DVY focuses on firms with a excessive dividend yield. RDVY, then again, combines these two methods by investing in firms with a historical past of accelerating dividends and a excessive dividend yield.

stockcharts.com

Professionals and Cons

Investing in RDVY comes with its distinct benefits and potential drawbacks.

Professionals

Dividend Progress: RDVY focuses on firms with a historical past of accelerating dividends, which might present a rising earnings stream for buyers.

Diversification: The fund’s portfolio consists of fifty firms unfold throughout numerous sectors, decreasing the chance related to investing in a single sector or firm.

Efficiency: RDVY has demonstrated robust efficiency since its inception, outperforming a lot of its friends by way of whole return.

Cons

Sector Focus: The fund has important publicity to the Financials sector (40percent0, which might expose buyers to sector-specific dangers.

Expense Ratio: The fund’s expense ratio of 0.50% is larger than a lot of its friends, which might eat into returns over time.

Conclusion

Investing within the First Belief Rising Dividend Achievers ETF is usually a strategic transfer for buyers searching for a mix of earnings and development. With its deal with firms with a historical past of accelerating dividends and a diversified portfolio throughout numerous sectors, this fund appears to be like compelling as a core dividend play.

Markets aren’t as environment friendly as standard knowledge would have you ever imagine. Gaps usually seem between market alerts and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” setting.

The Lead-Lag Report can provide you an edge in studying the market so you can also make asset allocation choices primarily based on award profitable analysis. I’ll provide the signals–it’s as much as you to resolve whether or not to go on offense (i.e., add publicity to dangerous property reminiscent of shares when threat is “on”) or play protection (i.e., lean towards extra conservative property reminiscent of bonds/money when threat is “off”).

[ad_2]

Source link