[ad_1]

Klaus Vedfelt

An excessive amount of of any good factor turns into a not-good factor. With pure fuel (NG1:COM) (NG), an excessive amount of manufacturing, like too massive of an ice cream cone, weighs closely on the value. Throughout the previous twenty-four months or so, NG costs reached $10 for a interval, fell to below $2 for a brief interval, and now what needs to be peak utilization and due to this fact greater costs, the value continues to float below $3 suggesting additional pricing strain coming within the spring when demand falls. We selected the time period or aspect of an excessive amount of manufacturing quite than not sufficient demand as a result of the latest enhance in manufacturing primarily comes from frackers in search of a spot to get rid of their much less profitable product, pure fuel. For them, no matter value it will get, nice. So how massive is the ice cream cone? Can anybody eat it, or will it soften? Or does this dimension demise the mid-term future for costs? Let’s go discover out.

Adjustments in Manufacturing

From our personal information assortment gathered from weekly EIA stories, manufacturing jumped from 107 – 108 billion cubic ft per day in the summertime to 110 – 111 billion cubic ft per day, the newest December numbers. The rise equals roughly 2-3%. Since spring the rise is far more dramatic growing from 105 billion cubic ft per day. Including to the manufacturing will increase are three NG pipelines in West Texas coming on-line within the fall of 2023. Two of the pipelines are from Kinder Morgans and one is from MPLX. The overall capability enhance equals 6 billion cubic ft per day. This transportation enhance largely appears to fall inside the waste product class.

Storage

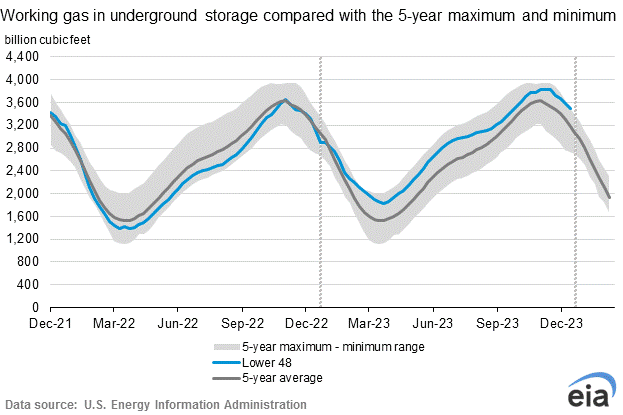

Some produce other opinions, however the actuality exists that {the marketplace} and pricing driver falls inside the path of storage. Included subsequent is a graph as soon as once more supplied by the EIA for weekly storage right this moment and in comparison with 5-year averages. The cyan line is right this moment’s outcome.

EIA

What’s necessary about this chart is deviations for pure fuel from the 5-year common, darker line. Till early January of final yr, the 2 have been monitoring at or below that 5-year quantity. Manufacturing will increase coupled with a particularly heat winter, within the northeast, a primary consumer of NG within the winter, drove storage on the opposite aspect. NG costs plummeted from document highs simply months earlier than.

Climate Predictions

So, what do the climate patterns appear like now? Up to now, this winter, that means December, has additionally been unusually heat on account of a persisting El Niño climate sample. However traders could depend on the climate service to at all times be 100% right. The Climate Channel actually coated its foundation. In its take a look at the forecast for January, the Channel gave its El Niño report, chilly within the southern U.S. and heat within the north. At nearly the identical time, it famous the robust chance for a sample change, a polar vortex. This sample permits for very chilly from the higher pole to float south into the northeast and typically at the same time as far east into northern Europe. A model of this forecast with nice particulars comes from Zero Hedge. Solely time will inform the truthful story. If the latter happens, extra pure fuel manufacturing will probably be consumed or largely thereof. Just like the used automobile salesman, by broadcasting with the forked mouth, they actually assured excellent outcomes. However this is not useful for investing.

Demand Progress

From Commodities 2024: Coming US LNG provide wave to inch nearer as new tasks close to startup:

A lot of the North American capability additions usually are not anticipated to materialize till the ultimate months of 2024 earlier than a wave of latest provide arrives in 2025. Round 8.4 million mt/yr of latest capability might be added by the tip of 2024 on high of the 84 million mt/yr of liquefaction capability in operation at the moment, based on S&P World Commodity Insights analysts.

By early 2025, additions might rise to round 18 million mt/yr past present ranges, with the enlargement anticipated to succeed in greater than 53 million mt/yr over the course of that yr.”

The most effective estimate claims a 2% enhance in LNG later in 2024 and with a lot greater will increase in 2025.

Manufacturing Losses & Climate

For the close to time period, it is about winter chilly and summer time warmth and/or manufacturing loss from reductions in drilling. Within the Haynesville area, the standard swing area, rig depend has turned detrimental, however important decreases in manufacturing have not but adopted. Reductions can take time for wells to dissipate. With forecasters talking from either side as mentioned, the allusive climate image solely stays allusive.

Danger

Pricing strain probably proceed till one thing clearly resolves the oversupply difficulty. A superb means for traders to comply with is within the EIA storage chart referenced above. Any deviation decrease begins resolving pricing pressures.

Trying ahead, one producer, one by which we maintain a comfortable purchase, Antero Sources (AR), with its very best-in-class belongings and markets, continues to overview information and advise traders that by the center of 2025, provide shortages will as soon as once more be the norm (slide 20). With full disclosure for traders, Sources is unhedged.

In actuality, the subsequent 6-12 months for pricing relies on manufacturing losses and winter chilly or summer time warmth. The brand new capability is coming from the waste product pricing mentality. These corporations will take no matter value they will get. We’re impartial with a slight detrimental seasonal slant on NG going ahead by way of 2024. However this might change in a heartbeat. The ice cream cone, for now, is simply too massive, not a great factor.

[ad_2]

Source link