[ad_1]

Luis Alvarez

Pricey subscribers,

I have been pretty clear in the previous few months about the truth that I am going into Workplace REITs, and my three picks of Highwoods (HIW), Kilroy (KRC), and Boston Properties (BXP).

My shares had been purchased at a mixture of valuations, however one factor all of them have in frequent after the previous few days is that they are all firmly within the inexperienced. Additionally, the truth that not one of the firms talked about are any longer at what I might contemplate their “backside”.

The most recent few days of rate-related and macro-related surges have resulted in a really a lot modified upside for a lot of of those REITs.

After all, on the identical time, I’ve seen over the previous few days, in feedback and in strategies, that now is perhaps the time to spend money on these workplace REITs.

What?

This text seeks to supply strategies and a few steering, for traders who want to be taught one thing about valuation and methods that may be utilized to most traders seeking to beat the market utilizing elementary methods.

Workplace REITs – why I’ve outperformed, and why I am not promoting (but)

I’ve written at least ten articles on the aforementioned firms throughout 2023 in a mixture of singular and multi-company articles the place I’ve, time and time once more, referred to as these firms to be price shopping for. Whereas it is true that I’ve all the time been clear in regards to the dangers and can proceed to be this right here – bear in mind, we’re speaking about workplace house, the false equivalency that many traders have fallen to right here is that as a result of places of work are seeing a downturn, all workplace property firms ought to be prevented.

I’m hoping that the previous few days have proven you, for those who’ve prevented these investments like many appear to have finished, that this isn’t the case and the way a lot of the undervaluation was perceived charge threat to the businesses in query.

Is the danger over?

No, I might argue that the elemental threat to those firms is just about unchanged since my final set of articles for them. The market might consider itself to have higher visibility for 2024, however:

These firm fundamentals haven’t modified. Their credit standing has not modified. Their dividends haven’t modified Their administration has not modified.

What has modified is market notion. And as you’ve got seen over the previous few days, for those who miss out on these few up-days, you then miss out on an entire lot of progress. Lots of the workplace firms in query, the place I’ve secured yields of over 7.5% on value, are actually yielding lower than 5.5-6%.

Not solely is that this materially deteriorated from their earlier, interesting valuations throughout troughs, nevertheless it’s at a degree the place I might argue that there are firms with higher upside right here.

Let me title a fast instance.

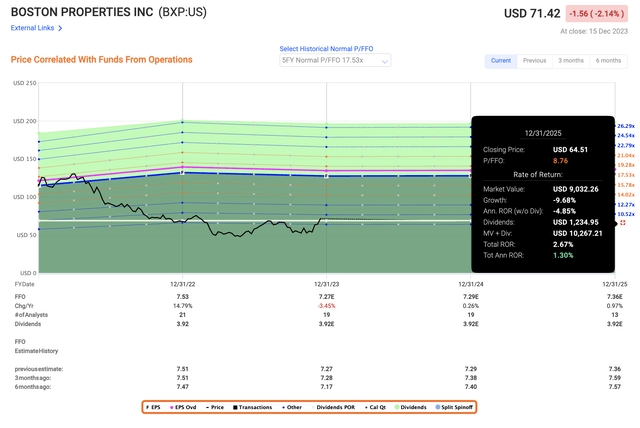

On the one hand, I’ve Boston Properties – a terrific, BBB+ rated workplace charge. On the trough, it yielded over 7% and I might see a conservative upside of 25% yearly, by which I imply an upside to lower than 8.7x P/FFO even with a progress of almost 0% till 2025E. At a 25% upside, this was a terrific potential – however now the potential to that 8.7x is like this.

F.A.S.T Graphs BXP Upside (F.A.S.T Graphs)

Whereas the corporate might go increased, we additionally have to estimate the place this firm might go, and the way excessive it might go given the expansion charge the corporate is forecasted.

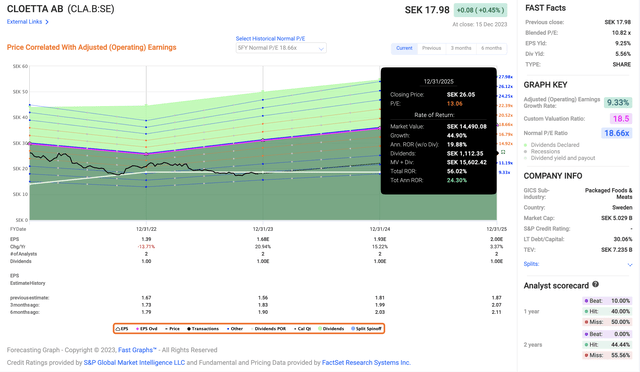

After which evaluate it to one thing like Cloetta (OTCPK:CLOEF). It is a Swedish sweet and meals firm yielding extra at 5.56%, with an upside to a conservative 13x P/E that appears like this.

F.A.S.T Graphs cloetta upside (F.A.S.T graphs)

So you may see how an organization’s enchantment on the broader market relies on a mess of things, however all issues being equal, valuation is the important thing deciding issue. So if selecting between these two firms in the present day, and if I did not have full publicity to Cloetta AB, that is what I might add to my portfolio.

The most recent few days have actually pushed all of those REITs, particularly these which were considerably undervalued, to ranges the place they may now not be that interesting if we assume {that a} zero-growth estimate leads to pressured multiples for the following few years.

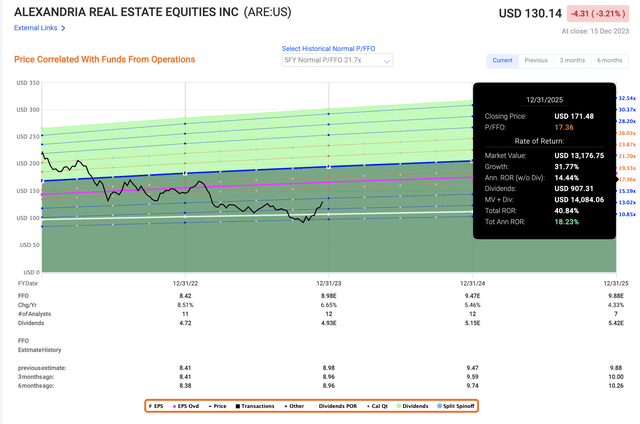

As I have been saying in my previous articles, these workplace REITs have been undervalued for a really very long time, and regardless of pressured progress charges and refinancing dangers, all of them have additionally proven continued robust demand for his or her properties – and we’re not even speaking about Alexandria (ARE) right here, the REIT that has been finished finest by far, with RoR of over 30% since my funding.

On this article, I wish to make clear the place I see the enchantment for Workplace REITs like BXP, HIW, and KRC after this latest surge.

I wish to clearly state that there’s continued enchantment in investing right here, however wish to make it equally clear that one of the best upside has now handed.

I am speaking in regards to the upside to a 7-9x P/FFO for these REITs of over 20%. So as to get these charges of return now, it’s good to really estimate these REITs buying and selling at double-digit multiples, within the case of KRC, nearly above 11x to get a 15% annualized RoR right here. (Supply: F.A.S.T graphs)

These should not outlandish calls for or projections – not when you think about that KRC for example, manages a historic premium of virtually 18x P/FFO.

However is that premium doubtless in a world of a 4-5% risk-free charge when the corporate is forecasted, with 100% accuracy, to develop earnings at unfavourable quantities for the following few years?

Whereas all the workplace REITs have seen a resurgence, and all of their quarterly experiences and releases present operational stability that might deny any form of elementary decline firmly, all the forecasts are very clear in a single matter.

Any form of FFO/AFFO progress within the subsequent few years will likely be small, if not barely unfavourable. And when you might generate double-digit returns, these returns develop into much less and fewer interesting the upper these shares go.

That is why I hold a really shut eye on high quality shares – like these workplace REITs – and as soon as they really go decrease, I purchase extra.

When Alexandria hit double digits, that is after I actually dialled up my shopping for. Alexandria represents the one largest workplace REIT in my portfolio and over 1% of my present whole, each privately and commercially for a really particular set of causes.

Take my standards for instance.

Alexandria is BBB+ rated. Alexandria’s dividend is extraordinarily well-covered. Alexandria, not like these different REITs, is estimated to develop at 4-5% FFO yearly. Alexandria has a historic 10-year 100% forecast accuracy (Supply: FactSet) Alexandria is a little more specialised when it comes to the workplace sub-sectors and is unlikely to see a big decline even in a tough market atmosphere.

The entire different workplace REITs have enchantment as properly – and are cheaper – however none are as qualitative, and I firstly deal with high quality.

Let’s take a look at what kind of shopping for appeals these REITs nonetheless have in the present day.

Valuation for KRC, HIW, BXP (And ARE).

We now enter what I view as a interval to be extra cautious. I view valuations for a lot of firms at their peak, or at report ranges. I keep a big record of firms that I cowl along with value targets, and I’ve not often seen so few price shopping for as I’m seeing in the present day. The potential for firms to “drop” again down appears increased right now.

That being mentioned, if you wish to spend money on Workplace REITs now, it isn’t “too late”, offered you reasonable your progress assumptions.

Lower than 2 weeks in the past, you can get 20%+ annualized RoR if forecasting ARE under 15x P/FFO. Right this moment it’s good to forecast it at 16-17x P/FFO to get above 15% per yr and solely a yield of three.9% as an alternative of virtually 4.5%. The present share value is not unattractive, and I nonetheless contemplate ARE to be a “BUY”, with the next sensible upside.

ARE Upside (F.A.S:T graphs)

That is the highest-quality workplace REIT upside, and I refer you to my different articles to grasp why this is not your typical workplace REIT.

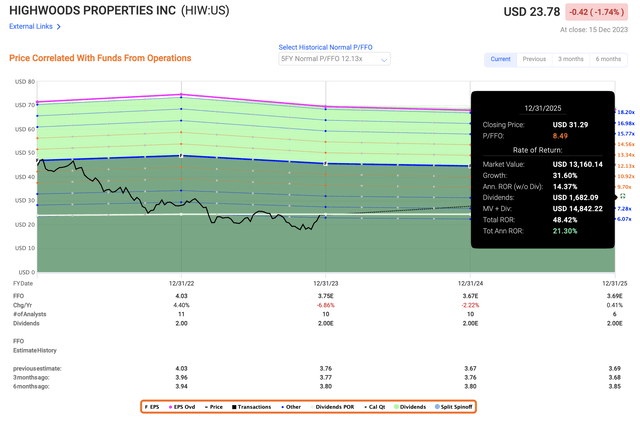

Out of the opposite REITs right here, they now commerce at a mixture of valuation multiples – often associated to fundamentals and progress prospects. Highwood is by far the most affordable of the bunch, at present nonetheless at an 8.4%+ yield, however the REIT can also be the one which’s anticipated to say no over 1% per yr, making an upside to any considerably “excessive” a number of much less doubtless than the others.

I nonetheless contemplate Highwood a “BUY” right here, however solely to a 7-8x P/FFO, at most 8.5x. And to an 8.5x, this firm nonetheless manages round 21% yearly – although once more, we’re speaking about investing in an organization that appears prone to decline, which places a query mark on any upward trajectory it may need.

HIW Upside (F.A.S.T Graphs)

The same case is true for Boston properties – although that is the one workplace REIT I cowl right here, besides Alexandria, that is anticipated to develop FFO. Even when that progress is barely 0.5% per yr. Nonetheless, consequently, the corporate is near 10x P/FFO right here in comparison with HIW, and it’s good to estimate it at 12.5x to get even 17% per yr.

My level right here is that these charges of return are fairly good, however nowhere close to pretty much as good as they as soon as had been solely 2-3 weeks again, or months again.

My level is that whole sectors or subsectors typically, irrationally, commerce down for prolonged intervals, and that is the time to spend money on them – not once they’ve already recovered over 10-18%, which is what has occurred solely prior to now 1-2 weeks.

It requires figuring out what I contemplate to be essentially sound companies. You may even see that I’ve not coated companies I contemplate riskier all that a lot, however as an alternative deal with the BBB-rated or above firms, the place any elementary decline over the long run appears fairly far off. Whereas I do personal a stake in Medical Properties Belief (MPW), for example, that stake is extraordinarily small – and whereas I do view it as a “spec” purchase, this can be a enterprise that whereas yielding 11%, can also be estimated at rising FFO unfavourable 6% or much less yearly within the subsequent few years. Couple this with some administration points, and I am clear why I’m not going as deep as within the firms that I’ve talked about right here.

My level right here is, pay attention to valuation

My level is that I’m always searching for one of the best valuation and fundamental-related upsides, and whereas Workplace REITs are nonetheless good picks right here, their threat profile has not, a minimum of to my thoughts, materially improved or declined. The market’s view on them has. Nonetheless, this latest surge has made different choices way more attention-grabbing – as I confirmed you with my instance for Cloetta. There are maybe 15-20 undervalued firms that I might say have much less of a unfavourable rate of interest threat than these REITs do, and these have all develop into rather more attention-grabbing to me after the previous few weeks.

As we’re transferring towards the tip of 2023, I feel it is essential to be sensible about what 2024 might deliver. Whereas we’d see a continuation of the constructive growth we have seen up to now, I desire to err on the facet of warning right here and count on a much more sobering expertise for the approaching funding yr.

That is why my battle cry for 2024 will likely be centered round selecting solely essentially the most qualitative however undervalued equities to spend money on – firms with excessive outperformance potential even within the case of sub-par growth.

If you happen to missed out on investing in these 4 firms at trough valuations, then I’m hoping that my articles for the rest of 2023 and going into 2024 can offer you qualitative concepts for the place one might put one’s cash for the quick, medium or longer-term.

I will proceed to supply conviction right here, within the sense that I very, very not often write about firms I’ve no “pores and skin within the recreation in”, and make it very clear the place I see the risk-reward ratio.

For now, that is what I see for the Workplace REITs that I cowl right here. I contemplate them “BUY” nonetheless, however their enchantment has materially modified from just a few weeks again.

[ad_2]

Source link