[ad_1]

Hispanolistic/E+ by way of Getty Photos

Funding thesis

Our present funding thesis is:

MOD is probably going within the early levels of a major upswing, underpinned by trade tailwinds and a profitable enterprise mannequin transition. We imagine it will drive shareholder worth, following a interval of restricted distributions and unstable monetary outcomes. That is necessary as even when Administration is unable to wholly execute its strategic targets, the elemental enchancment within the enterprise is a price driver. MOD is buying and selling at an FCF yield of ~4%, whereas Administration forecasts income development of HSDs and margin enchancment by ~4ppts. When partnering this with its capital allocation technique, we see scope for an acceleration.

Firm description

Modine Manufacturing Firm (NYSE:MOD) is a world chief in thermal administration options. Headquartered in Racine, Wisconsin, the corporate makes a speciality of designing, manufacturing, and testing warmth switch merchandise for varied industries, together with automotive, industrial, and HVAC markets. With a historical past relationship again to 1916, Modine has established itself as an revolutionary and dependable supplier of thermal administration options.

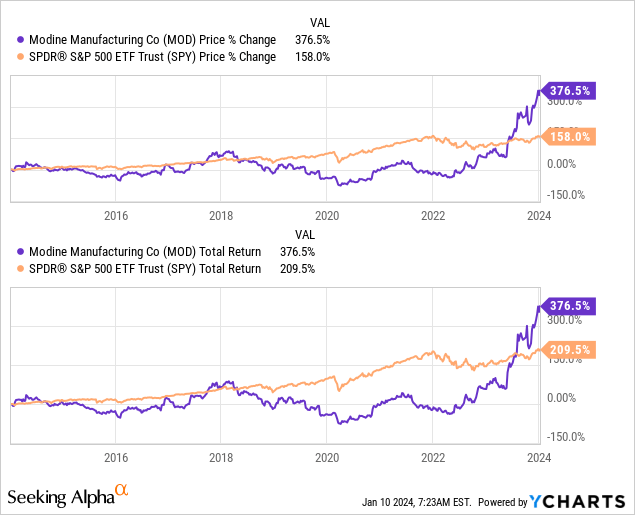

Share worth

MOD’s share worth efficiency throughout a lot of the last decade was disappointing, though a latest aggressive rally (+~177% 1Y) has contributed to returns in extra of the broader market. Modine’s inconsistent monetary efficiency has restricted its enlargement, though latest developments have pushed shareholder sentiment.

Monetary evaluation

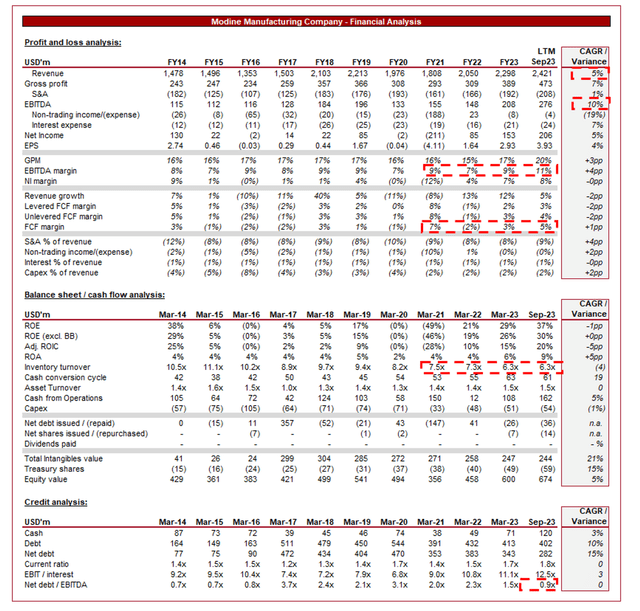

Modine financials (Capital IQ)

Introduced above are MOD’s monetary outcomes.

Income & Industrial Components

MOD’s income has grown at a CAGR of +5% over the last decade, though the annual improvement has been unstable. Impressively, EBITDA has doubled this at +10%.

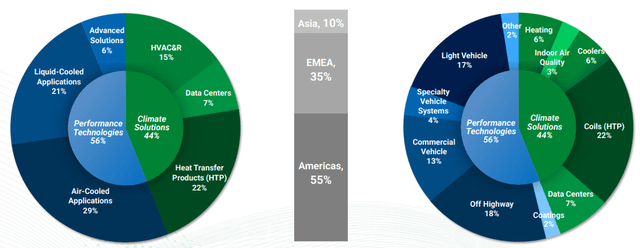

Enterprise Mannequin

Modine operates in a number of enterprise segments, together with Vehicular Thermal Options (VTS), Industrial and Industrial Options (CIS), and Constructing HVAC Techniques. These segments cater to totally different markets, offering diversified income streams whereas leveraging its core competencies and asset base.

Modine

Briefly, its providing is described as follows:

Vehicular Thermal Options (VTS) – MOD makes a speciality of offering thermal administration options for vehicular purposes. This consists of designing and manufacturing radiators, cost air coolers, and different elements for automotive, industrial car, and off-highway markets. Industrial and Industrial Options (CIS) – The CIS section focuses on thermal administration options for non-vehicular purposes. This consists of merchandise for HVAC techniques, industrial gear, energy technology, and different industrial and industrial processes. Constructing HVAC Techniques – Modine additionally engages within the design and manufacture of HVAC techniques for buildings. This consists of merchandise like unit heaters, infrared heaters, rooftop HVAC models, and air flow techniques.

MOD has a world presence, with 35 manufacturing amenities in ~13 international locations, serving clients in varied areas. This worldwide footprint permits the corporate to faucet into numerous markets and mitigate dangers related to regional financial fluctuations.

The corporate locations a powerful emphasis on innovation and know-how, underpinned by patents and deep experience, as that is the bedrock of its aggressive place. Creating superior thermal administration options that meet trade requirements but in addition improve the worth proposition for shoppers is vital to differentiating itself, notably because the demand for such merchandise will increase.

MOD gives aftermarket companies, together with alternative components and assist companies. This enhances buyer satisfaction and builds long-term relationships with purchasers and from a monetary perspective, creates higher certainty/visibility of income technology attributable to its recurring nature.

Enterprise mannequin transition

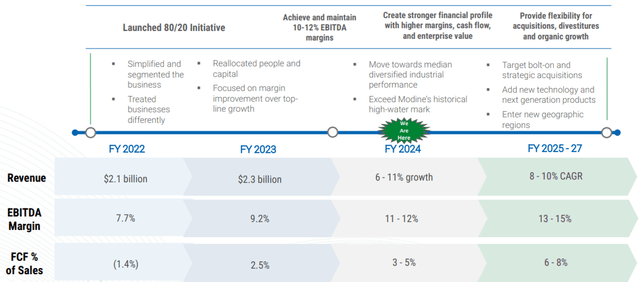

Administration initiated a multi-year revitalization effort to enhance the monetary profile of MOD, in addition to to extend returns for shareholders.

This has concerned a lot of steps, together with:

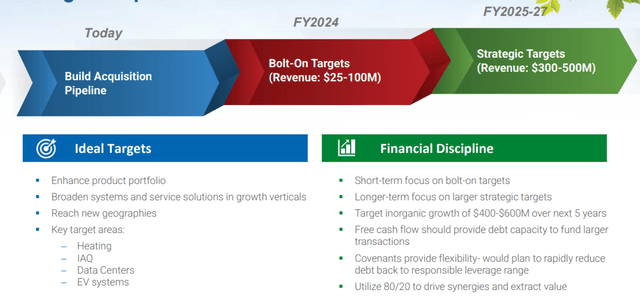

“Focus the group” – Administration has firstly sought to enhance the tradition and operational DNA of the corporate, implementing the 80/20 strategy (20% of actions generate 80% of the outcomes… so establish and deal with these) and simplifying and segmenting the corporate. Often, the announcement of tradition modifications is simply discuss however we really feel a tangible distinction being made with this swap, which Administration believes is evidenced by an enchancment in its “Local weather Options” section. “Carry out and ship” – This includes a mixture of maximizing market share in its goal markets and simplifying its operations to deal with the tip promote it cares about. For instance, efforts are being transitioned to servicing EVs and Information Facilities (amongst others however these are used as examples), each of that are inside industries experiencing long-term headwinds and thus are positioned for outsized development. The complete shift of focus positions MOD higher than lots of its friends, who would possible transfer extra defensively by preserving one eye on its current capabilities. “Speed up worthwhile development” – It is a mixture of firstly product improvement, particularly the transition from elements to techniques options, which includes deeply ingraining itself in its purchasers’ operations with extra complicated options. We imagine this to be the most important development driver and is at present being delivered efficiently. Secondly, Administration is looking for to press extra vastly on worldwide enlargement following the successes of its transition within the US, in addition to opportunistic M&A.

Modine

Thermal Administration Business

MOD faces competitors from a variety of worldwide conglomerates, in addition to specialist corporations. The consists of, however isn’t restricted to: Johnson Controls (JCI), Lennox Worldwide (LII), Honeywell Worldwide (HON), and Trane Applied sciences (TT).

These corporations compete on:

Technological developments in product choices. Pricing methods and after-sales companies. Market share and geographic attain.

We imagine MOD is positioned nicely, notably following the transition to system options, which has diversified the corporate additional.

Alternatives

We see the next components as key development drivers within the coming years:

Electrification Increase: Capitalizing on the growing development of electrical autos. Good HVAC Options: Investing in IoT-enabled merchandise for enhanced management. International Growth: Tapping into rising markets with rising infrastructure wants. Automotive and Industrial Demand: The demand for thermal administration options within the automotive and industrial sectors has been strong. Concentrate on Vitality Effectivity: MOD is specializing in growing energy-efficient HVAC options that align with market tendencies and buyer preferences.

Financial & Exterior Consideration

Present macroeconomic circumstances signify near-term headwinds for MOD, as with elevated rates of interest and inflation, shoppers are feeling a squeeze on funds. This has impacted the company surroundings, with softening spending alongside inflationary stress on its provide chain.

That is contributing to lowered capital spending as companies search to shore up their steadiness sheet. We’re not overly involved by this, contemplating it a pure cyclical swing that’s unlikely to affect the aggressive place of MOD.

Trying forward, we suspect demand shall be muted in 2024, possible declining to mid-single-digits. This stays unsure, nonetheless, as there’s a rising perception of each a recession and a step down in charges. How both or each develop will affect the demand surroundings.

Margins

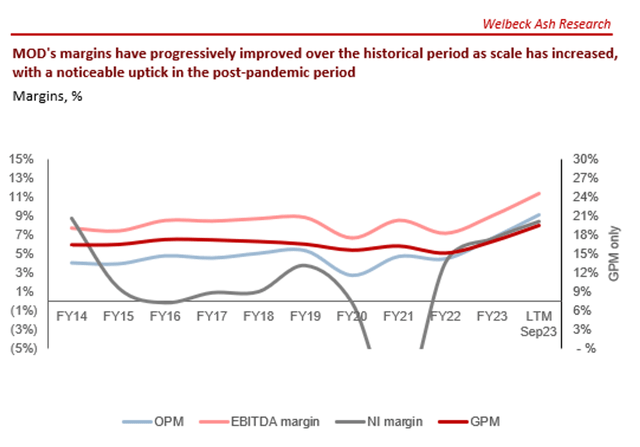

Margins (Capital IQ)

MOD’s margins have progressively improved over the last decade, notably accelerating in recent times. It is a reflection of its enterprise mannequin revitalization, with our perception that the present ranges are sustainable, but in addition that additional beneficial properties are attainable. Administration believes an EBITDA-M of ~15% could be reached by 2027, which we concur with.

Quarterly outcomes

MOD’s income uplift has softened however stays wholesome, with top-line income development of +11.5%, +7.6%, +15.0%, and +7.2%. Along with this, as now we have mentioned, margins have sequentially improved.

Stability sheet & Money Flows

MOD is conservatively financed, with an ND/EBITDA ratio of 0.9x. This has been achieved attributable to constant FCF technology, permitting for reinvestment (and extra not too long ago distributions) to be funded by means of money.

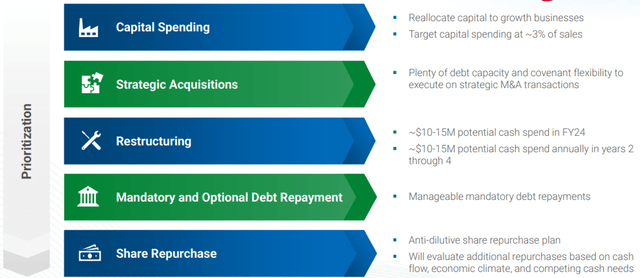

We anticipate a major transition in its capital allocation technique following its quickly enhancing monetary efficiency. Administration has introduced the next as its strategy.

Modine

We’re supportive of this strategy, noting the corporate has the optionality to boost debt to execute this as soon as charges decline. Additional, a renewed M&A method will complement the advance in monetary efficiency, accelerating its trajectory.

Modine

Outlook

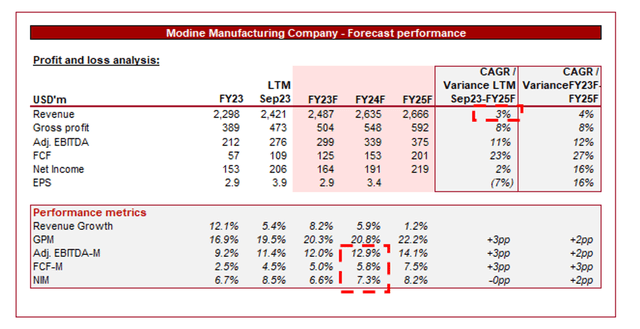

Outlook (Capital IQ)

Introduced above is Wall Avenue’s consensus view on the approaching years.

Analysts are forecasting gentle development within the coming years, with a CAGR of +3%, alongside incremental margin enchancment. From a development perspective, that is noticeably beneath Administration’s steering, implying hesitancy round execution.

We acknowledge historic underperformance, notably at first of the last decade, though its present trajectory and particularly improvement in sub-segments akin to knowledge facilities indicate MOD has upgraded itself considerably.

We suspect MOD will possible land nearer to Administration’s estimates.

Modine

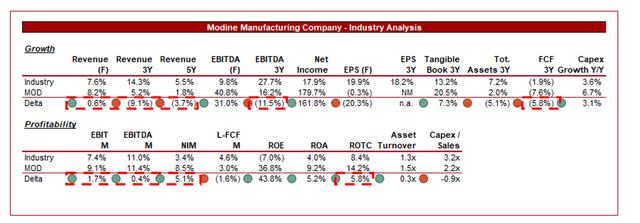

Business evaluation

Searching for Alpha

Introduced above is a comparability of MOD’s development and profitability to the typical of its trade, as outlined by Searching for Alpha (27 corporations).

MOD performs nicely relative to its friends. The corporate’s development has barely lagged behind its friends, partially attributable to its lack of M&A method and comparatively smaller measurement of its friends. We don’t take into account the delta overly regarding.

Additional, MOD’s margins are barely above common, with higher scope for enchancment within the coming years. This has allowed the corporate to boast a noticeably superior ROE/ROTC, suggesting larger long-term returns.

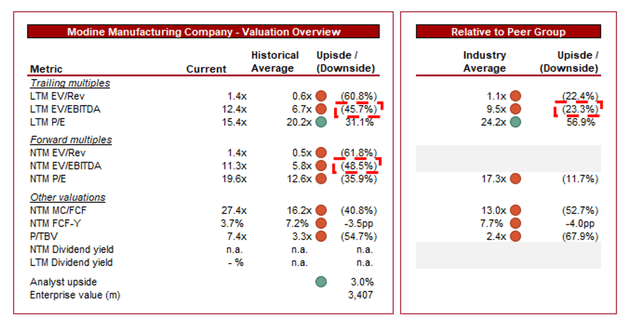

Valuation

Valuation (Capital IQ)

MOD is at present buying and selling at 12x LTM EBITDA and 11x NTM EBITDA. It is a premium to its historic common.

A premium to its historic common is warranted in our view, owing to the corporate’s robust monetary and industrial improvement throughout this era. The scale of the low cost seems excessive, and we agree, though we counter that MOD was possible undervalued for a lot of this era. MOD was buying and selling at a 7% FCF yield whereas working in a extremely enticing trade experiencing tailwinds. At a ~4% FCF yield now, we expect the corporate is enticing with out being a standout purchase (anymore).

Additional, MOD is buying and selling at a smaller premium to its friends, ~23% on an LTM EBITDA foundation and ~12% on a NTM P/E foundation. Purely from a margin foundation, that is possible a top-range justifiable premium however its ROTC implies comfortably superior returns are attainable. This shall be buffeted by investor sentiment enhancing with distributions growing.

Key dangers with our thesis

The dangers to our present thesis are:

Financial downturn impacting demand for brand new installations. Gradual adoption of revolutionary applied sciences affecting competitiveness.

Last ideas

MOD is within the strategy of being remodeled and its progress so far is extremely commendable. We’ve got seen an instantaneous enchancment in monetary efficiency, alongside a elementary shift in its enterprise mannequin that positions it completely for the longer term forward.

Though there’s execution threat within the medium time period and uncertainty within the brief time period, we see a broadly upward trajectory based mostly on the developments so far. Importantly, shareholder returns will enhance and margins nonetheless have enough room to run, implying buyers will take pleasure in extra of its ~4% FCF yield now than buyers did traditionally from its ~7% FCF yield.

[ad_2]

Source link