[ad_1]

NoSystem pictures/E+ through Getty Photographs

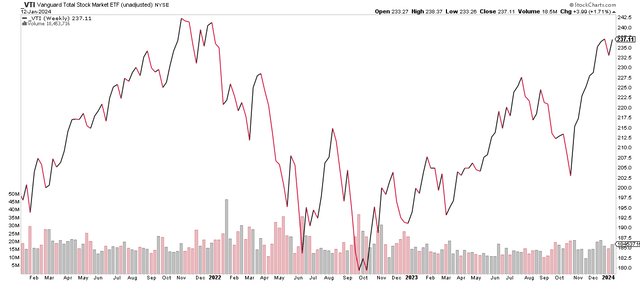

The S&P 500 is up 10 of the final 11 weeks. The Vanguard Complete Inventory Market Index Fund ETF Shares (NYSEARCA:VTI) can say the identical, although the ETF did not settle at a recent all-time weekly excessive shut, whereas the SPX did. VTI’s vital weight in home mid-cap shares, with a splice of small caps, typically harm relative efficiency to the large-cap index over the previous three-plus years. US SMID caps peaked in This autumn 2021 and have retraced solely about half of their late 2021 to October 2022 bear market.

I’m downgrading VTI from a purchase to a maintain based mostly on greater valuations, combined momentum indicators, and sketchy seasonal developments that usually ensue throughout the first half of election years. For background, VTI seeks to trace the efficiency of the CRSP US Complete Market Index. The fund holds large-, mid-, and small-cap equities diversified throughout development and worth kinds and employs a passively managed, index-sampling technique, in response to Vanguard.

VTI: Up 10 of the final 11 Weeks

StockCharts.com

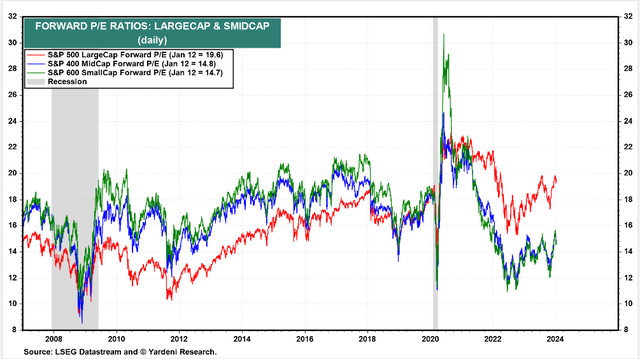

Because it stands, VTI trades at a lofty ahead non-GAAP price-to-earnings ratio near 19. That elevated valuation a number of shouldn’t be excessive, although. Think about that the high-growth and comparatively defensive Data Know-how sector includes greater than 27% of the allocation.

I.T. shares naturally command a better valuation, so massive caps’ 19.6 P/E, per Yardeni Analysis, is cheap whereas a few 15 a number of on SMIDs could also be honest based mostly on their decrease high quality and extra cyclical nature. In different phrases, shares are priced perhaps to not perfection, however they’ve actually baked in a Goldilocks financial final result.

US Inventory Market Valuations by Market Cap: P/Es off the Lows

Yardeni Analysis

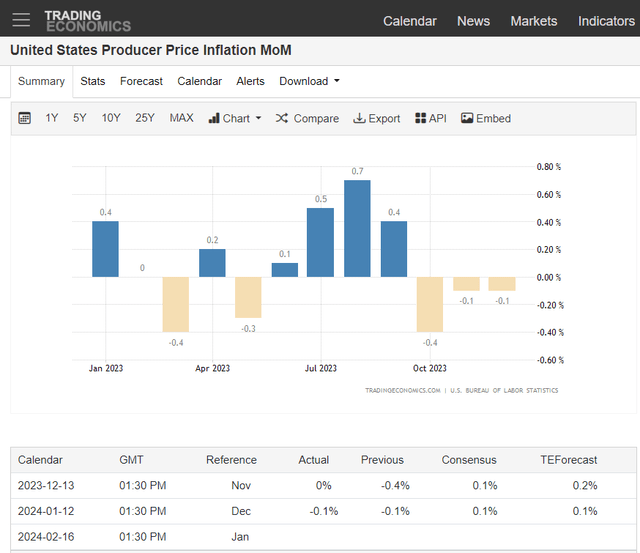

Think about that Core PCE is now below the Fed’s 2% goal on a six-month annualized foundation (Core PCE inflation is the Fed’s most popular inflation gauge). Final week, whereas CPI numbers got here in on the nice and cozy facet, PPI confirmed that wholesale costs proceed to really deflate, dropping one other 0.1 share level in December.

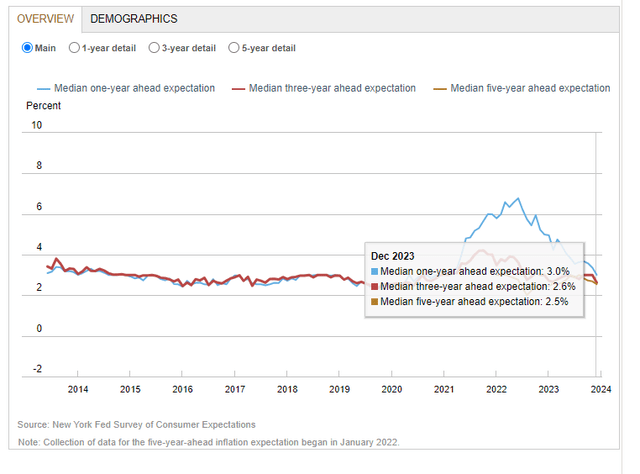

The inflation panorama was solid in a greater gentle early final week, too. The New York Fed Survey of Shopper Expectations revealed that Individuals are extra sanguine about future inflation ranges – short-term inflation expectations dropped to their lowest degree in three years.

US PPI Declines for a Third Straight Month

Buying and selling Economics

NY Fed Survey: Lowered Shopper Inflation Expectations

NY Fed

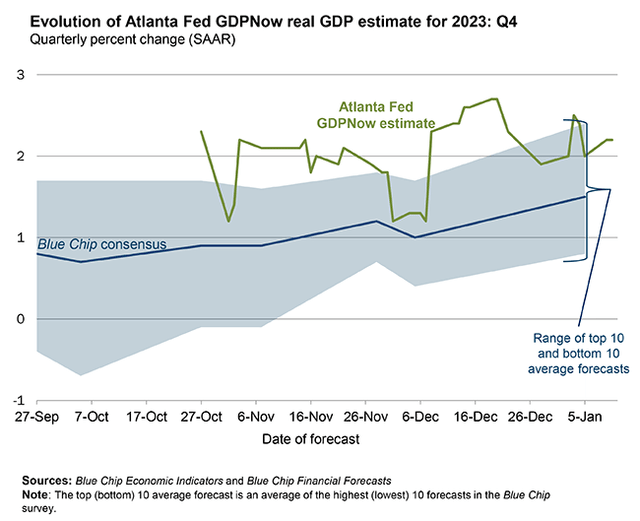

On the expansion facet of the ledger, the Atlanta Fed’s GDPNow software exhibits the US economic system buzzing alongside at a good 2.2% actual charge for This autumn. Whereas that’s down from the stellar growth tempo seen in Q3 final 12 months, there’s actually little proof of a tough touchdown and even any stretch of adverse actual GDP development within the offing.

This autumn US Actual GDP Progress Seen at +2.2%

Atlanta Fed GDPNow

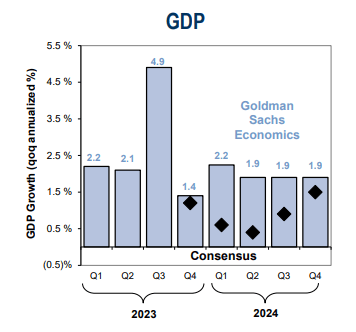

Economists at the moment count on the US actual GDP development charge to trough in Q1 and Q2 this 12 months, sidestepping a technical recession, earlier than a re-acceleration takes place within the second half of 2024. A lot will rely on how the roles state of affairs unfolds in addition to what retail gross sales appear like following a vacation procuring season that was good, not nice. Additionally, the This autumn 2023 company earnings season will make clear the well being of corporations large and small.

Consensus US Actual GDP Forecast

Goldman Sachs

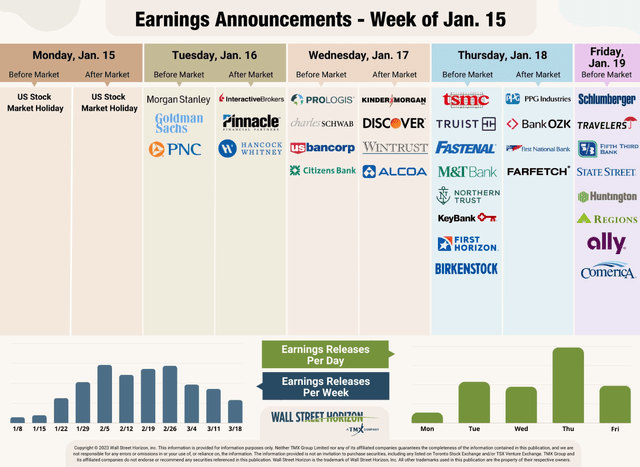

In line with FactSet, for This autumn 2023 (with 6% of S&P 500 corporations reporting precise outcomes), 76% of S&P 500 corporations have reported a constructive EPS shock and 55% of S&P 500 corporations have reported a constructive income shock, however the blended (year-over-year) earnings decline for the S&P 500 is -0.1% after a rebound in EPS development reported in Q3. Nonetheless, strategists count on per-share revenue development to have continued final quarter, and we are going to know much more within the subsequent three weeks as the majority of SPX earnings hit the tape.

Earnings on Faucet This Week

Wall Avenue Horizon

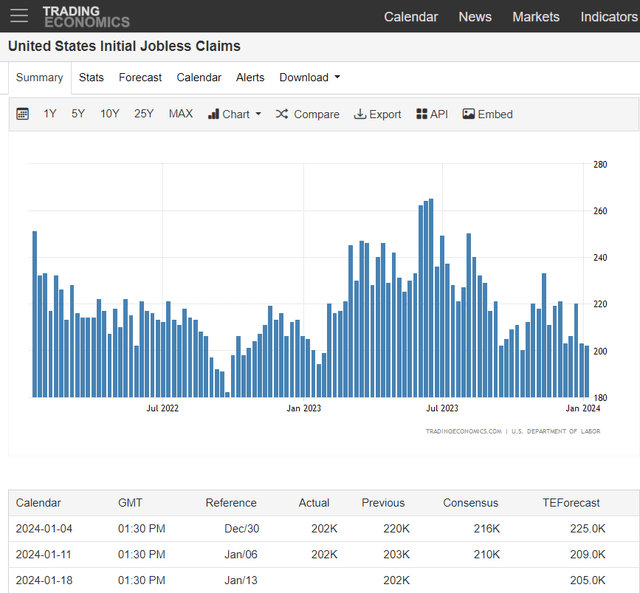

I discussed the labor market earlier. Employment development has actually ebbed over the previous few quarters, however Preliminary Jobless Claims stay exceptionally low by historic requirements, and month-to-month beneficial properties within the NFP institution payrolls report recommend hiring continues to be occurring.

What’s extra, wage development has steadied at a good 4% clip on a year-over-year foundation. Detrimental revisions to the headline jobs print and volatility within the family survey, used to calculate the unemployment charge, are issues the bears level to. Additionally regarding was a shock downtick within the ISM Providers Employment sub-index for the month of December.

Sanguine Jobless Claims Numbers

Buying and selling Economics

As for VTI and the broad US inventory market, I count on bouts of volatility right here and there all through the primary half of 2024. With the Iowa Caucuses happening on Monday, a market vacation, we at the moment are within the coronary heart of major election season.

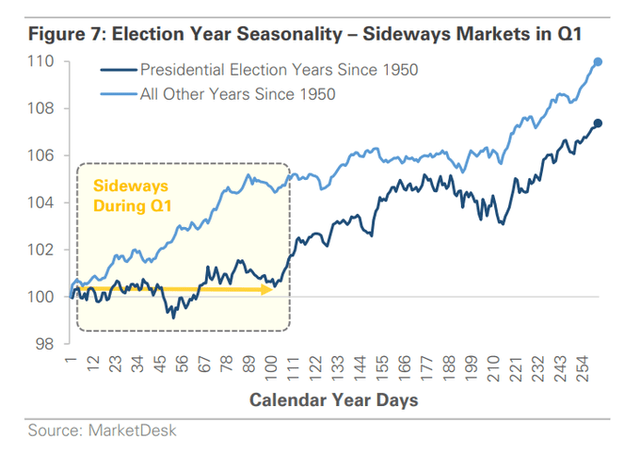

Betting markets recommend a excessive likelihood of a Trump versus Biden rematch being within the playing cards, so maybe equities is not going to be rattled fairly as a lot as they in any other case can be by excessive coverage concepts as candidates search to attraction to their respective bases. However, shares usually stumble on the state of election years, in response to information put collectively by MarketDesk.

Uneven Value Motion into Q2 of Election Years

MarketDesk

The Technical Take

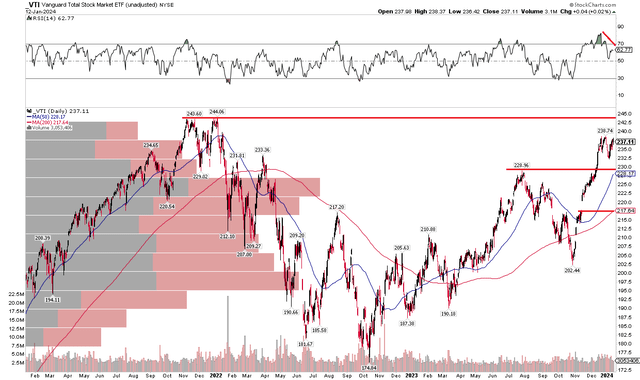

As we kind a story about VTI for the subsequent few months, let’s take a look at its momentum state of affairs. Discover within the chart under that the fund, in contrast to the S&P 500, has not peeked above its early 2022 all-time excessive. If we see VTI rise above $245 on a weekly closing foundation, perhaps we are able to get extra constructive, however I see the chance of a buying and selling vary rising on a near-term foundation. Assist is seen on the $229 mark – that was the excessive from July final 12 months and it’s also the place the rising 50-day shifting common comes into play. I see subsequent assist additional down at $218 – there is a vital worth hole there together with the rising 200-day shifting common providing technical confluence.

Additionally check out the RSI momentum gauge on the high of the graph – whereas not a technical bearish divergence, VTI’s RSI was at a a lot weaker degree to shut final week whereas the S&P 500 settled at a recent all-time weekly excessive shut. I want to see a worth thrust confirmed by sturdy momentum, in addition to with elevated quantity. For now, $244 seems to be resistance whereas $229 is near-term assist.

VTI: Stays Under the All-Time Excessive, Assist on the Summer season 2023 Peak

StockCharts.com

The Backside Line

I’m downgrading VTI from a purchase to a maintain. I used to be bullish on the US inventory market heading into the ultimate two months of the 12 months given seasonal tailwinds and excessive bearishness in October. Now, although, momentum has waned and a extra risky seasonal stretch is underway. VTI’s valuation shouldn’t be all that low-cost, both, whereas macroeconomic situations are combined as actual GDP development slows.

[ad_2]

Source link