[ad_1]

Editor’s notice: Searching for Alpha is proud to welcome Niccolo Braccini as a brand new contributor. It is easy to turn out to be a Searching for Alpha contributor and earn cash to your greatest funding concepts. Lively contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

OlgaMiltsova/iStock by way of Getty Photos

PepsiCo (NASDAQ:PEP) is an effective enterprise with an unbelievable financial moat pushed by its well-known manufacturers and I see it as a compelling purchase alternative at this time. It has grown at a dependable tempo within the final decade and it will probably increase additional investing in international markets. It’s a dividend king paying round 3% in dividends annually and so they can proceed rising sooner or later. Nonetheless the corporate has some points on the free money movement aspect that’s already fixing contemplating the Q3 2023 information.

I’ll rapidly make a PepsiCo inventory overview, focus on its financial moat and doable development alternatives, take a look on the doable threat elements and eventually conclude with a valuation.

Inventory overview

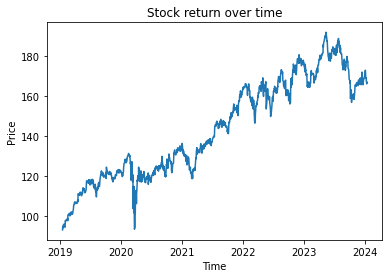

Regardless that PepsiCo inventory has seen important capital appreciation within the final decade, the value has fallen over 15% from its latest excessive, leaving many buyers to marvel if now’s the precise time to purchase.

5 years inventory citation (Creator’s Calculation)

The drop in inventory worth is primarily attributed to a particular issue: the rise in rates of interest has prompted many buyers to favor risk-free price bonds over inventory dividends. As long-term buyers, we don’t should be overly involved about macroeconomic shifts; as a substitute, we must always seize these alternatives to boost our performances.

The corporate’s moat and development alternatives

At present, PepsiCo stands as an enormous conglomerate encompassing numerous meals and beverage manufacturers which are among the many most recognizable on this planet. Examples embody Pepsi, Lays, Lipton, Cap’n Crunch, Doritos, Gatorade, and plenty of others. Every of those manufacturers boasts a various vary of merchandise worldwide. The corporate persistently invests in and innovates new merchandise inside these manufacturers, not solely to keep up freshness, but additionally to enterprise into new classes.

This in depth model portfolio offers PepsiCo a major edge within the market. Customers have developed sturdy psychological associations with these manufacturers over a long time, whether or not by means of advertising and marketing campaigns, partnerships or their embedded presence in tradition. Individuals have grown up with these brands-seeing, consuming, consuming, and listening to about them. The facility of branding acts as a formidable protection towards rivals and new entrants, creating a considerable financial moat. In reality, customers are extra inclined to decide on Lays chips or Doritos over a generic or private-label various.

The defensive nature of PepsiCo’s enterprise mannequin turns into evident in its important pricing energy. Over the past two years, during times of inflation, PepsiCo was capable of strategically increase costs to offset rising prices. Like many different corporations within the meals sector, I think about PepsiCo to be non-cyclical, capable of navigate by means of financial cycles with out worrying about shopper spending.

The inventory worth enhance within the final decade aligns intently with the expansion of earnings per share, a metric that has been accelerating lately.

Firm’s EPS (Macrotrends.web)

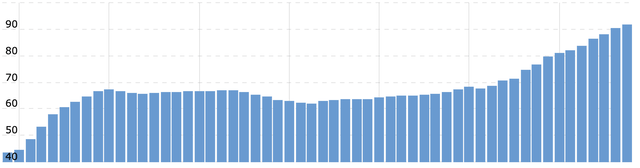

Income per share is rising at a ten years compound annual development price of three.97%, as for the EPS, the tempo of development is accelerating with a 3 years CAGR round 9%.

Income of the corporate (Macrotrends.web)

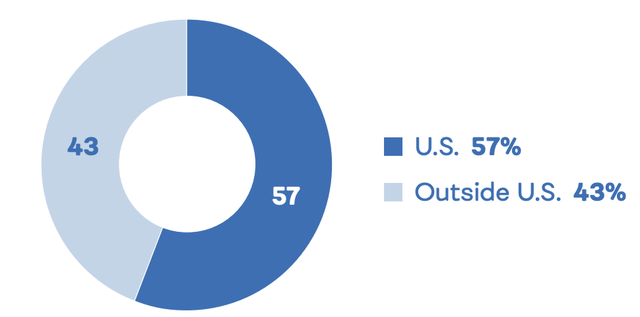

Whereas the corporate is already a large, I understand additional enlargement alternatives within the international market. In fiscal yr 2022, the corporate generated 57% of its revenues in america and 43% internationally. The international markets current a major development alternative for the corporate within the coming years, as many merchandise extensively obtainable in america have but to be launched in a number of different nations. For instance from Italy, in my native retailer, only some manufacturers corresponding to Pepsi, Gatorade, and Lays can be found. This means that the corporate has a plethora of manufacturers at its disposal which are nonetheless “American made.” Increasing the distribution of those manufacturers internationally might unlock new income streams and contribute to the corporate’s general development technique

Break up of firm revenues (Firm 10K)

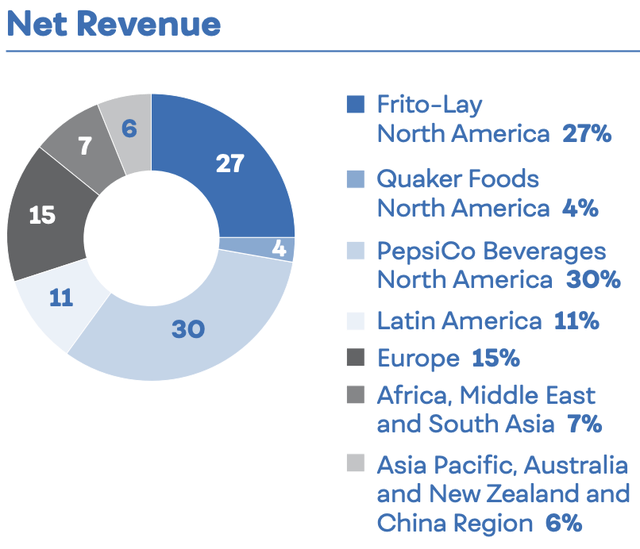

As the corporate continues to increase its attain, there may be an anticipation of elevated revenues and working income. Over the following 5 years, as an investor, I’d count on the corporate to leverage the proceeds from the U.S. market to additional increase its presence overseas. Particularly, I anticipate a give attention to Asia, which isn’t solely essentially the most populated geographical space on this planet but additionally represents a comparatively small income phase for the corporate at the moment. Over time, I’d be happy to look at an alignment between these segments, signifying profitable enlargement and a broader international market share for the corporate. This strategic transfer might result in enhanced monetary efficiency and shareholder worth.

Web income segments (Firm 10K)

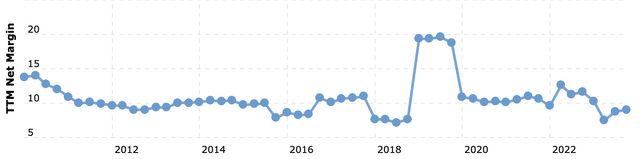

Growth certainly comes with prices, and because the firm extends its operations into new areas, I anticipate a slight lower in web margin. It is a widespread final result when getting into unfamiliar markets, as there are elevated operational prices related to establishing and managing new amenities, adapting to totally different regulatory environments, and establishing distribution networks. Whereas this non permanent discount in web margin is predicted, the long-term objective is for the corporate to capitalize on the expansion potential in these new areas, in the end resulting in a optimistic influence on general profitability. Monitoring how effectively the corporate manages these expansion-related prices and the next returns from new markets will likely be essential for buyers assessing the success of the worldwide enlargement technique.

Web margin (Macrotrends.web)

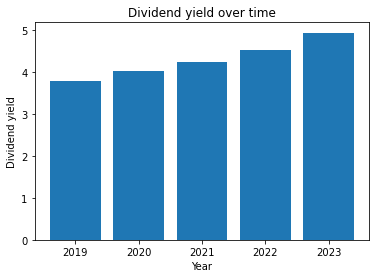

Regardless of free money movement stagnation, the corporate has continued rising its dividend fee. The ten-year CAGR of the dividend is 8.4%, and the newest enhance was a major 10%, marking the fiftieth annual dividend enhance.

Dividends over time (Creator’s Calculation)

Contemplating the overall efficiency of the corporate, the dividend is sustainable though within the brief time period the free money movement payout ratio handed from a mean of 72.4% during the last decade to an unbelievable peak of 110,1% in fiscal 2022. In different phrases, the corporate collected 4.06$ per share in FCF and paid 4.47$ in dividends. Regardless of the challenges within the free money movement payout ratio, the EPS payout ratio stays steady at round 70%.

I see PepsiCo as a really conservative firm and the latest 10% enhance in dividend fee should imply that the administration crew really feel very assured for the longer term forward. It’s probably that they’d count on their working money movement will develop and so they could reduce a number of the capital expenditures as they reported within the newest report.

PepsiCo maintains a robust stability sheet with greater than 10 billion {dollars} in money available and 39 billion {dollars} in web debt, which is lower than 4 occasions annual working money movement. For my part, debt is just not an issue for the corporate.

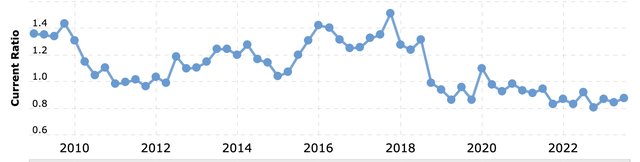

Since 2020, the corporate’s present ratio has been persistently decrease than one, indicating that present property are lower than present liabilities. Though it isn’t a major subject, it will be higher to see a reversal on this development within the subsequent years. I’d begin having some doubts each time the ratio comes decrease than the 0.75-0.8 vary however for now the state of affairs is suitable.

Present ratio development (Macrotrend.web)

Dangers

Now we deal with a major concern associated to PepsiCo. Regardless of the earnings assertion signifies a wholesome and rising firm, there are notable points on the free money movement aspect. Over the previous decade, unlevered free money movement has skilled a modest 0.84% CAGR, whereas annual capital expenditures almost doubled from $2.7 billion in 2012 to $5.2 billion in 2022, leading to a decline in free money movement.

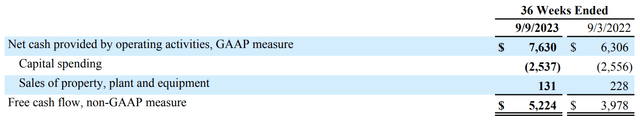

Happily, there are indicators that the administration crew is actively addressing this concern, as evident from Q3 2023 earnings information. Over the previous 36 weeks, working money movement elevated considerably to $7.64 billion, marking a 20.9% year-over-year rise. Capital expenditures barely decreased to round $2.5 billion, resulting in a notable 31.3% enchancment in free money movement, which reached $5.22 billion.

Contemplating 2022 as a difficult yr without spending a dime money movement, from a long-term investor perspective, there may be an anticipation of a reversal and constant development in free money movement annually. As PepsiCo approaches a maturity stage, it turns into essential for the corporate to rework right into a ‘money cow,’ able to producing substantial returns for shareholders by lowering capital expenditures.

If the administration crew fails to realize this minimal final result, I’ll shift from a bullish to a impartial perspective. Given the corporate’s present excessive Worth/Earnings (P/E) ratio of 27.5, investing would turn out to be too dangerous with out a clear enchancment in free money movement.

Q3 outcomes (Firm’s 10Q)

Valuation

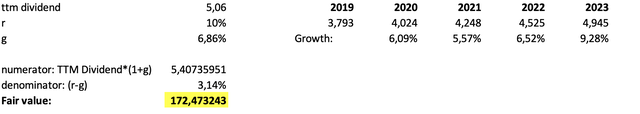

Let’s now take into consideration all of the assumptions in an effort to make a valuation of the corporate. Since PepsiCo is a Dividend king, it’s higher to judge it by means of a dividend low cost mannequin to check the truthful worth of the corporate.

PepsiCo valuation (Creator Excel sheet)

On the precise aspect of the sheet are reported the yearly dividends for the final 5 years and their respective development. On the left aspect are computed the anticipated dividends for fiscal yr 2024, 5.06$ per share, contemplating a ten% annual return for the funding (r) and the common dividend development for the final 5 years (g) which is the same as 6.86%. Making use of the system reported within the image I bought a price of 172$ per share. Provided that the present market worth is round $166, I consider this characterize a good alternative to provoke a place within the inventory and profit from future dividends.

Conclusion

PepsiCo’s sturdy model presence, resilience within the face of financial challenges, dedication to dividend development, and strategic worldwide enlargement make it an interesting prospect for buyers, providing each stability and potential for future positive aspects.

Total I view PepsiCo as a high-quality firm that may proceed to develop into the longer term at a dependable tempo. Though the corporate is superb, it does face some challenges with its free money movement and present ratio, I would favor to purchase it at a 10-15% low cost from its truthful worth

[ad_2]

Source link